Cloud

The pandemic accelerates cloud adoption

2020 has redefined the way we work, collaborate, and learn on the job. Companies, both large and small and in every industry, have been under pressure to transform digitally for a long time. COVID-19 has compressed that timeframe but that’s not necessarily a bad thing.

Enterprises are required to focus on streamlining their workforce, rethink operational infrastructure and adapt to remote and blended models. Consumers who long resisted services have been compelled to try out the technology because the pandemic has limited their access to grocery stores. Doctors who thought of telemedicine as futuristic and difficult to manage are now booking video appointments with patients. And CEOs who once eschewed remote work as risky and inefficient are now finding that employees can function perfectly well without coming into the office.

As a result, there has been an increased demand for cloud computing and for cloud software to support the new normal. Companies are committing to a cloudbased infrastructure strategy that provides adaptability, resilience and security. Once this migration is done, there are many other native capabilities that these cloud platforms will provide in areas such as customer experience, employee experience, dynamic pricing, and servitisation (moving from selling products to delivering services).

Global scenario

The COVID-19 pandemic has largely proven to be an accelerator of cloud adoption and extension and will continue to drive a faster conversion to cloud-centric IT. Total worldwide spending on cloud services, the hardware and software components underpinning cloud services, and the professional and managed services opportunities around cloud services will surpass USD 1 trillion in 2024, while sustaining a double-digit CAGR of 15.7 percent, forecasts IDC.

“Cloud in all its permutations – hardware/software/services/as a service as well as public/private/hybrid/multi/edge – will play ever greater, and even dominant, roles across the IT industry for the foreseeable future,” said Richard L. Villars, group vice president, Worldwide Research at IDC. “By the end of 2021, based on lessons learned in the pandemic, most enterprises will put a mechanism in place to accelerate their shift to cloud-centric digital infrastructure and application services twice as fast as before the pandemic.”

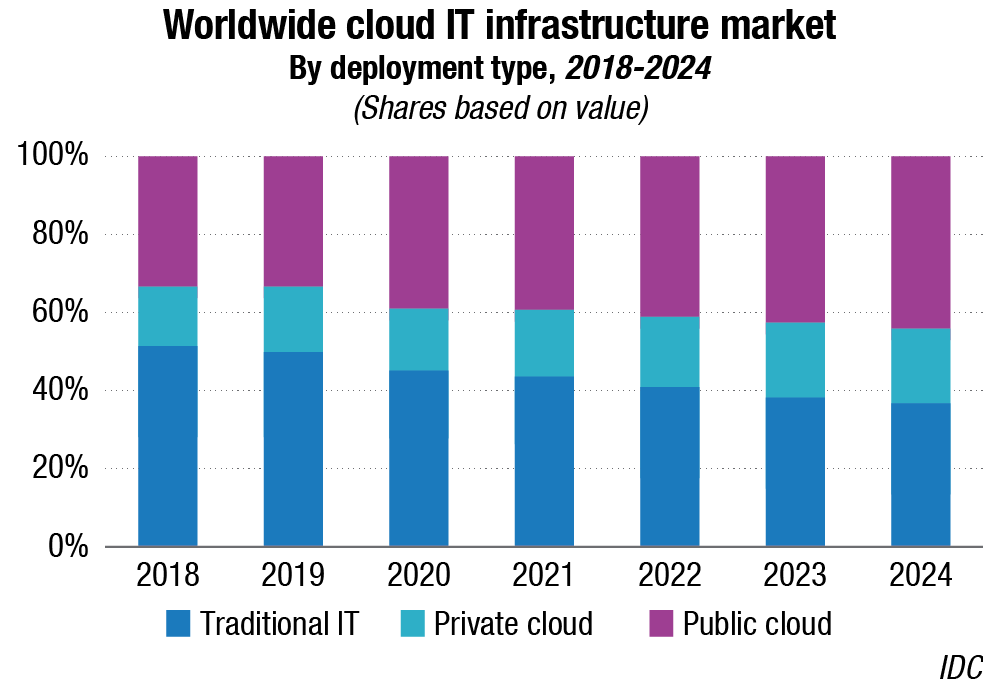

The strongest growth in cloud revenues will come in the as-a-service category – public (shared) cloud services and dedicated (private) cloud services. This category, which is also the largest category in terms of overall revenues, is forecast to deliver a five-year CAGR of 21 percent. By 2024, the as-a-service category will account for more than 60 percent of all cloud revenues worldwide. The services category, which includes cloud-related professional services and cloud-related management services, will be the second largest category in terms of revenue but will experience the slowest growth with an 8.3 percent CAGR. This is due to a variety of factors, including greater use of automation in cloud migrations. The smallest cloud category, infrastructure build, which includes hardware, software, and support for enterprise private clouds and service provider public clouds, will enjoy solid growth (11.1% CAGR) over this period.

| Worldwide cloud IT infrastructure market, Q2 2020

(Revenues in USD millions) |

|||||

| Company | 2Q20 revenue | 2Q20 market share |

2Q19 revenue | 2Q19 market share |

2Q20/2Q19 revenue growth |

| Dell Technologies | 2,506 | 13.2% | 2,330 | 16.5% | 7.5% |

| HPE/New H3C Group | 1,981 | 10.4% | 1,770 | 12.5% | 12.0% |

| Inspur/Inspur Power Systems | 1,917 | 10.1% | 812 | 5.7% | 136.0% |

| Lenovo | 1,087 | 5.7% | 728 | 5.1% | 49.3% |

| Cisco | 941 | 5.0% | 1,066 | 7.5% | -11.7% |

| ODM Direct | 6,656 | 35.0% | 4,069 | 28.8% | 63.6% |

| Others | 3,925 | 20.6% | 3,371 | 23.8% | 16.4% |

| Total | 19,013 | 100.0% | 14,147 | 100.0% | 34.4% |

While the impact of COVID-19 could have some negative effects on cloud adoption over the next several years, there are a number of factors that are driving the cloud market forward:

- The ecosystem of tech companies helping customers migrate to cloud environments, create new innovations in the cloud, and manage their expanding cloud environments will enable enterprises to meet their accelerated schedules for moving to cloud;

- The emergence of consumption-based IT offerings are aimed at leveraging public cloud-like capabilities in an on-premises environment that reduces the complexity and restructures the cost for enterprises that want additional security, dedicated resources, and more granular management capabilities;

- The adoption of cloud services should enable organizations to shift IT from maintenance of legacy IT to new digital transformation initiatives, which can lead to new business revenue and competitiveness as well as create new opportunities for suppliers of professional services; and

- Hybrid cloud has become central to successful digital transformation efforts by defining an IT architectural approach, an IT investment strategy, and an IT staffing model that ensures the enterprise can achieve the optimal balance across dimensions without sacrificing performance, reliability, or control.

Cloud IT Infrastructure

Spending on public cloud IT infrastructure surpassed spending on traditional IT infrastructure for the first time in the second quarter of 2020. Vendor worldwide revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, increased 34.4 percent year over year in the second quarter of 2020 (Q2 2020), according to IDC. Investments in traditional, non-cloud, IT infrastructure declined 8.7 percent year over year in Q2 2020.

Across the world, there were massive shifts to online tools in all aspects of human life, including collaboration, virtual business events, entertainment, shopping, telemedicine, and education. Cloud environments, and particularly public cloud, were a key enabler of this shift. Spending on public cloud IT infrastructure increased 47.8 percent year over year in Q2 2020, reaching USD 14.1 billion and exceeding the level of spend on non-cloud IT infrastructure for the first time. Spending on private cloud infrastructure increased 7 percent year over year in Q2 2020 to USD 5 billion with on-premises private clouds accounting for 64.1 percent of this amount.

The hardware infrastructure market has reached the tipping point and cloud environments will continue to account for an increasingly higher share of overall spending. While IDC increased its forecast for both cloud and non-cloud IT spending for the full year 2020, investments in cloud IT infrastructure are still expected to exceed spending on non-cloud infrastructure, 54.8 percent to 45.2 percent. Most of the increase in spending will be driven by public cloud IT infrastructure, which is expected to be slow in H2 2020 but increase by 16 percent year over year to USD 52.4 billion for the full year. Spending on private cloud infrastructure will also experience softness in the second half of the year and will reach USD 21.5 billion for the full year, an increase of just 0.3 percent year over year.

As of 2019, the dominance of cloud IT environments over non-cloud already existed for compute platforms and Ethernet switches, while the majority of newly shipped storage platforms were still residing in non-cloud environments. Starting in 2020, with increased investments from public cloud providers on storage platforms, this shift remained persistent across all three technology domains. Within cloud deployment environments in 2020, compute platforms remained the largest segment (50.9%) of spending at USD 37.7 billion while storage platforms the fastest growing segment with spending increasing 21.2 percent to USD 27.8 billion, and the Ethernet switch segment grew 3.9 percent year over year to USD 8.5 billion.

At the vendor level, the results were mixed. Inspur more than doubled its revenue from sales to cloud environments, climbing into a tie for the second position in the vendor rankings between HPE and Inspur while the group of original design manufacturers (ODM Direct) grew 63.6 percent year over year. Lenovo’s revenue exceeded USD 1 billion, growing at 49.3 percent year over year.

Bridging telco public cloud adoption to enterprise needs

As communications service providers construct their next-gen network infrastructure, IDC believes that the telco cloud will develop in parallel with cloud hyperscalers, operations support systems or business support systems vendors, application providers, system integrators, open source groups, and industry bodies.

“Even though telcos have been slow in partnering with public cloud hyperscalers, several strategic partnerships have been announced in the Asia/Pacific region. Telcos are keen on aligning their external partner-centric digital transformation approach (via public cloud adoption) with their internal digital transformation initiatives such as SD-WAN. Moving forward, public cloud adoption not only defends telco connectivity revenues, but also pivots telcos to a managed service provider or cloud-broker for enterprises,” says Yash Jethani, Research Manager for Telecommunications at IDC Asia/Pacific.

The provision of this multi-cloud ecosystem with end-to-end orchestration, seamless life-cycle services, and secured and automated billing systems is the need of the hour for any enterprise. In the long term, this positions telcos to lay the foundation to become ubiquitous cloud network providers and provide an exchange of cloud interconnect services on their platform.

Cloud infrastructure services market

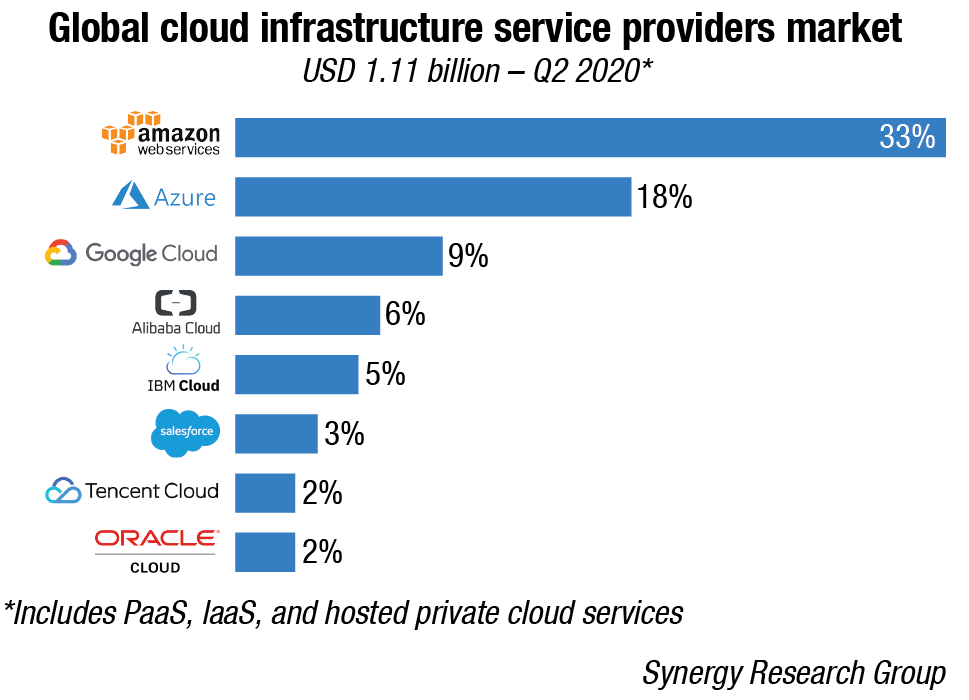

To get a sense of the Amazon Web Services (AWS) versus Azure versus Google Cloud market share breakdown, let’s take a look at what each cloud provider’s reports shared.

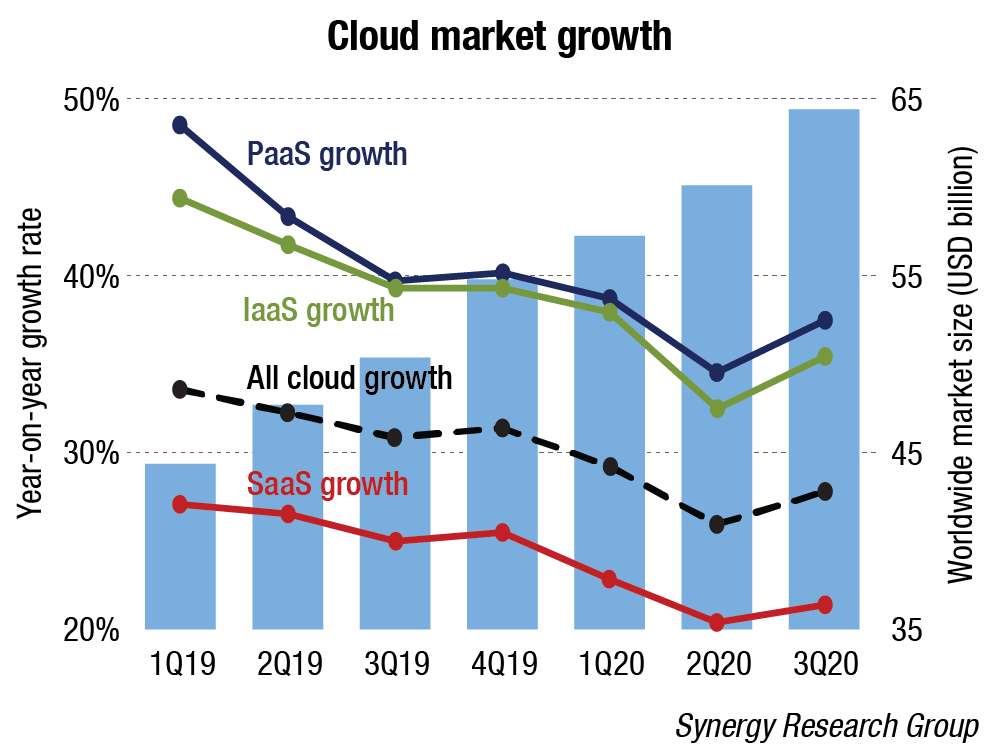

Amazon reported AWS revenue of USD 11.6 billion for Q3 2020, compared to USD 8.9 billion for Q3 2019. AWS revenue grew 29 percent in the quarter. The corresponding revenue figures for Q2 2020 were USD 10.8 billion compared to USD 8.3 billion for Q2 2019.

Microsoft only reports on Azure’s growth rate. That number is 48 percent revenue growth for Q3 2020 over the previous quarter. Here are the revenue numbers Microsoft does report. Azure is under the “Intelligent Cloud” business, which grew 20 percent to USD 13 billion in Q3 2020 and 17 percent to USD 13.4 billion in Q2 2020. The operating group also includes server products and cloud services (22% growth in Q3 2020 and 19 percent growth in Q2 2020).

This quarter, Q3 2020, Google Cloud, which includes Google Compute Engine and G Suite, generated USD 3.44 billion in revenue, a growth of 45 percent year-over-year; and generated USD 3 billion in revenue, a growth of 43 percent year-over-year in Q2 2020.

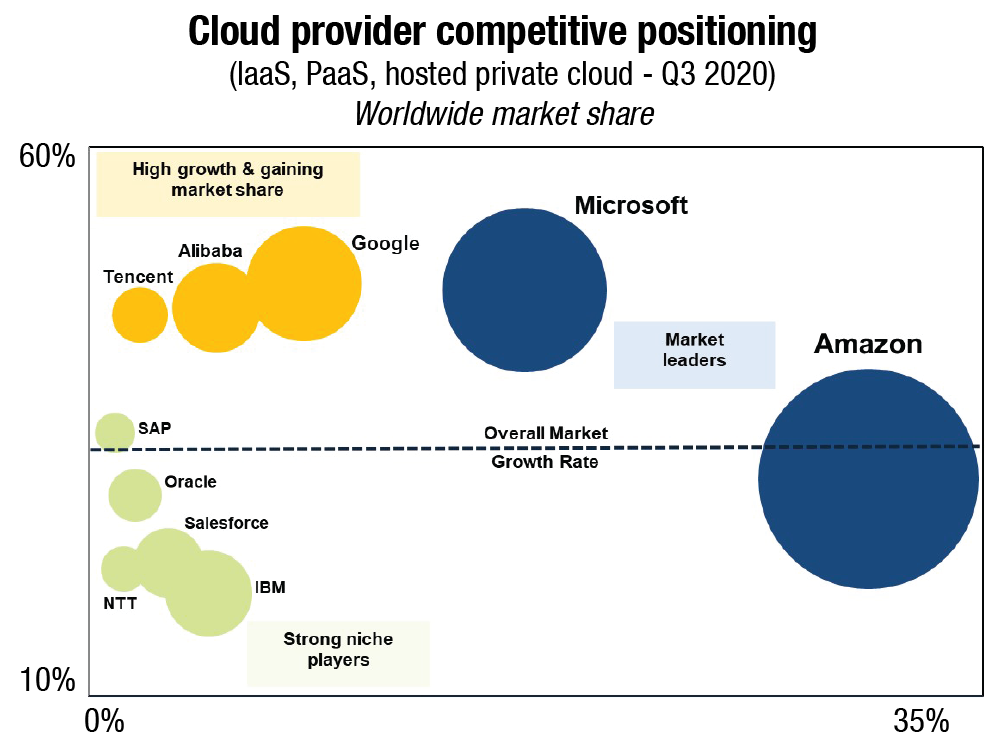

Amazon’s share of the cloud infrastructure services market has remained steady at around a third of the total market since at least 2017. In Q2 2020, Azure share in Q2 is estimated at 18 percent and Google Cloud’s 9 percent. It seems clear that in the case of AWS vs Azure vs Google Cloud market share – AWS still has the lead. However, their overall share of the market is slowly shrinking, while Azure grows.

Alibaba, IBM, SalesForce, Tencent, and Oracle are the other five large players in this segment, each with a market share ranging from 2 percent to 6 percent.

Infrastructure as a Service (IaaS) or cloud infrastructure services form one of the three core service models of the cloud computing market, along with platform as a service (PaaS) and Software as a Service (SaaS). Within Infrastructure as a Service, a third party provides and maintains infrastructure components on behalf of its customers.

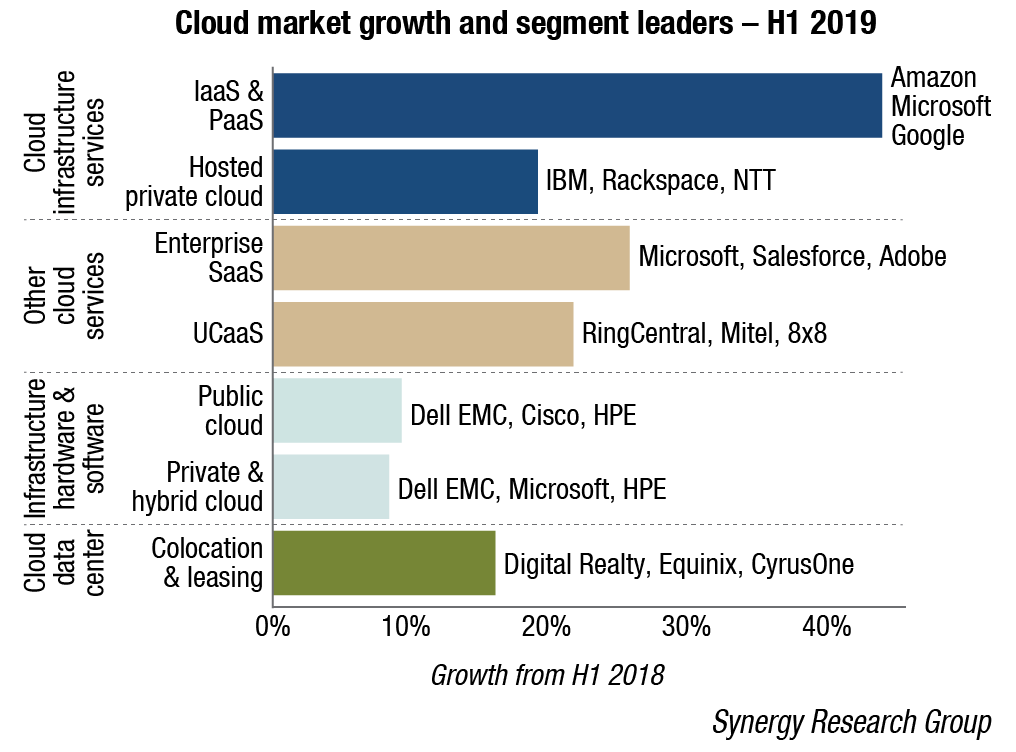

Currently, cloud infrastructure services form the fastest growing sector of the cloud computing market, although Software as a Service is – and is expected to remain – the largest segment overall.

Betting on outer space. Leading cloud computing service providers have begun flexing their muscles in space too. Ground Stations have been launched by the leading companies to allow its customers to control their satellite communications, process data, and scale operations without having to build or manage their own ground station infrastructure. It helps customers to communicate with, and analyse data from, their satellites or spacecrafts.

While the cost of the satellite itself is falling, building and running ground stations can cost up to USD 1 million or more. Complex data processing also requires a lot of computing power, and the huge data storage requirements only add to the cost. Leading cloud computing service providers are now starting to offer satellite operators the option to use these ground stations on a pay-per-use or subscription basis, thus, helping the latter save on capital expenditure costs by employing an operating expenditure model.

AWS has a headstart in space. Around two years ago, Amazon.com had launched the AWS Ground Station and on June 30, 2020, AWS announced it was establishing a new space unit, the Aerospace and Satellite Solutions. IBM has announced a beta of its Cloud Satellite service too. And on September 22, Microsoft announced the preview of Azure Orbital at Microsoft Ignite 2020 in New Orleans, its Ground Station as a Service (GSaaS).

While Microsoft and IBM are testing their services, AWS Ground Station already has customers such as NASA’s Jet Propulsion Laboratory and satellite operators Iridium Communications and Spire Global. It also has private sector customers such as Lockheed Martin, Maxar Technologies, and Capella Space.

AWS launched its first cloud infrastructure in Mumbai in June 2016 for the Indian customers to save costs, increase speed-to-market of new products. The company has now finalized an investment of ₹20,760 crore to set up its second cloud infrastructure region in Hyderabad. In addition there are currently seventeen CloudFront edge locations in India: four in Hyderabad, another four in New Delhi, three in Bangalore, three in Mumbai, two in Chennai, and one in Kolkata.

Security

Cloud providers put a lot of effort into building state-of-the-art data centres and the most sophisticated security systems and processes. More organisations are considering public cloud for its security capabilities. In fact these organisations are realising that the economies of scale allow cloud providers to invest more in people and processes to help deliver a secure infrastructure.

Organisations can build a robust security posture by leveraging security capabilities that are available natively on their cloud platform of choice and building their own security processes on top of it to make sure that they offer the best security for their customers. It’s very important to understand the shared responsibility model that’s offered by cloud providers. While these providers offer state of the art security for the underlying infrastructure that their customers are using, it’s the customer’s responsibility to use security features and best practices offered by their cloud providers to secure their data.

For instance, cloud providers offer identity and access management capabilities as well as multi-factor on their infrastructure and allow their customers to control who has access to what, but if the customer doesn’t use these capabilities they might put their data at risk.

When using public cloud for mission critical business applications, a robust infrastructure gives great benefit and reliable SLAs that boost the performance. When it comes to security, it is imperative that data must be encrypted all the time, at rest when the data is stored on the disks, and in transit when data is transferred.

As more business applications are hosted in the cloud, it’s very important to shift access controls from the network perimeter to individual users and devices using the zero-trust security model.

Indian market

As building digital IT infrastructure supporting resilient operations and pervasive experiences becomes a key priority, organizations in India are re-strategizing their IT spending plans.

Accelerating investment in an agile cloud infrastructure is seen as a part of the solution to the challenges arising from the spread of the pandemic COVID-19. More than 60 percent of Indian organizations plan to leverage cloud platforms for digital innovation based on IDC COVID-19 impact survey.

India public cloud services (PCS) market is projected to touch USD 7.1 billion by 2024 growing at a CAGR of 20.3 percent between 2019-2024. Although most organizations in India have adopted cloud at some stage, the current pandemic situation has now enabled organizations to spend more on public cloud infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) solutions, and software-as-a-service (SaaS).

From a segment perspective, SaaS forms the largest component of the overall public cloud services market in India, followed by IaaS and PaaS. With the changing strategy, over 56 percent of the Indian organizations plan to increase their spend on SaaS services, as a result of COVID-19. In 2019, the top two providers in the SaaS segment accounted for nearly 52 percent of the total SaaS market. In the IaaS segment, the top two providers accounted for over 78 percent in 2019.

FY22 will be the time by when the hype translates into investment

It should come as no surprise that companies that had already committed to and had made investments in cloud technology have fared better during the crisis than those that were either still on the fence, or had not prioritized cloud adoption.

In enterprises that have been slow to adopt a cloud strategy, employees have often resorted to using tools like consumer Gmail or consumer Dropbox for file sharing — solutions outside of the security infrastructure of their organization without authentication and encryption. Now, of course, that has accelerated. The message to leaders is clear: When you don’t have a cloud strategy and don’t provide the necessary tools, you make yourself vulnerable to major security risks, you won’t survive in a down market, and you will get eaten up by the competition.

While the evolution of cloud as a technology is not in dispute, acceleration led by the Covid-19 outbreak on cloud services providers and IT firms is uncertain for now. In fact, cloud-related revenues are only expected to grow gradually by financial year 2022 rather than in the second half of the ongoing fiscal year. Rather than reporting a major spurt, incremental sales booked by AWS and Microsoft ICS, post-Covid-19 (results) has been weak. This does not reconcile with the hype around cloud being the backbone for the business continuity during the lockdown.

Cloud technology has effectively captured the market for development of new platforms and applications. However, cloud providers are looking to tap the larger opportunity, of clients seeking to convert their legacy IT infrastructure to the cloud. For that, they would need the help of IT services firms, and though this would be a long drawn out process. The conversion is a much more difficult thing to accomplish as Legacy IT is well entrenched and both expensive and risky to move. Initially there was an increase in activity during Covid-19 of legacy conversion, but this died down as firms faced the significant challenges of expense and risk. Enterprises’ IT budgets are not increasing, so they will have to generate savings from their legacy operations to invest in cloud. Cloud migration will be the most sought-after market for IT services providers but will be a gradual four- to five-year process.

- The global public cloud computing market is set to exceed USD 330 billion in 2020.

- 90 percent of companies are on the cloud.

- 60 percent of workloads are running on a hosted cloud service in 2019.

- AWS accounts for 13 percent of Amazon’s total sales.

- Cloud data centers will process 94 percent of workloads in 2021.

- The US is the most significant public cloud market with projected spending of USD 124.6 billion in 2019. Its market is larger than that of the next four combined. The countries that spent the most on cloud computing technologies in 2019:

- The US – USD 124.6 billion

- China – USD 10.5 billion

- The UK – USD 10 billion

- Germany – USD 9.5 billion

- Japan – USD 7.4 billion.

- The global cloud computing market is expected to reach USD 623.3 billion by 2023.

- There are three primary cloud types: Public cloud – this refers to the model with which the services are delivered across the internet. Private cloud – it’s designed for internal use by a single organization. Hybrid cloud – this is when a company uses both a public and a private cloud. Basically, the only difference is who owns the infrastructure. Otherwise, it’s the same thing.

- Different types of cloud services:

- Software as a Service (SaaS) – Applications which are accessible by the clients via either a web browser or some lightweight applications. Google’s apps (like Gmail, Google Drive, and Google Play) are a perfect example of SaaS and so are popular website builders like WiX and Squarespace.

- Platform as a Service (PaaS) – A place for application development and testing. Think of it as a closed-environment laboratory for app developers.

- Infrastructure as a Service (IaaS) – A vast array of computing resources in a virtual environment. IaaS includes data storage, virtualization, servers, and networking.

- 89 percent of companies use SaaS and the revenue from SaaS was expected to reach USD 85.1 billion in 2019.

- IaaS is the fastest-growing cloud spending service with a five-year CAGR of 33.7 percent.

- Hybrid cloud adoption is 58 percent.

- Professional services account for 12.2 percent of the global cloud spending.

- Privacy and security are the two main roadblocks for cloud adoption.