5G Features

The industry rises to the occasion as always!

As COVID-19 gripped India, early March 2020, and the lockdown was implemented, if it was not for the telecom services sector, it would not be an exaggeration to say that the Indian economy would have come to a halt. The telcos and their teams, now popularly referred as the corona warriors, ensured that connectivity would not be a question mark. India remained connected, with each service provider’s mobile, fixed broadband, DTH and fibre networks fully geared up to serve customers, as the scenario emerged. Networks continue to be in business continuity planning mode, fully prepared to support any exigency.

As demand surged, and challenges mounted, digital connectivity scaled many peaks. The telcos’ role and contribution was unparalleled, city by city, state by state. One estimate said, that the sector is enabling 30-35 per cent of the GDP, other than its 6 per cent direct contribution. And here, contribution to maintaining mental and emotional equilibrium is not being included. The telcos, active in the ecosystem of digital connectivity were particularly lauded for their yeoman service to the poor and underprivileged by ensuring that connectivity reaches them.

The central government as well as the state governments provided complete support to the industry, as the sector braved the conditions to keep the networks up and implemented necessary changes on-the-go to augment capacities, due to unprecedented increase in the demand for digital services.

Ravi Shankar Prasad

Ravi Shankar PrasadMinister for Communications, Electronics & IT

Today India is the second largest telecom market in the world, and it has surpassed USA and China to become the largest data consuming economy and that too at the lowest tariffs. This transformation is moving India toward becoming a knowledge society riding on the Digital Communications in true sense.In the last 25 years, the telecom sector has witnessed tremendous transformation -in connecting a billion citizens by 2G, 3G, 4G, and fiber, ushering in several disruptive technological developments, such as innovative mobile apps, mobile payments connected devices and wearables IoT, and m-governance.The clarion call for Aatmanirbhar Bharat does not mean India in isolation, but India as a robust contributor in the global supply chains. Honorable Prime Minister has also set a goal of making India a USD 5 trillion economy. Telecom sector has to play a major role in achieving that goal. Government and the industry need to work together to achieve these goals.

With timely intervention of the Department of Telecommunications and coordination with various state and local authorities, the defunct base transceiver station sites were brought down from 800 to 70, increasing the capacities substantially. “We swiftly extended all global best practices and learnings to the India telecom ecosystem by realigning the portfolio on the three principles of Secure, Scale and Stimulate, giving the operator community an immediate resolution of the challenges and linking them with the likely future requirements,” asserted Amit Marwah, Head of Marketing and Corporate Affairs for Nokia India. “While connectivity and apps are available to the consumers, device fulfilment is a challenge impacting the productivity of people directly,” cautioned Sachin Kalantri, Senior Director, Product Marketing, Qualcomm India, at a webinar held in May 2020.

Stability and commitment

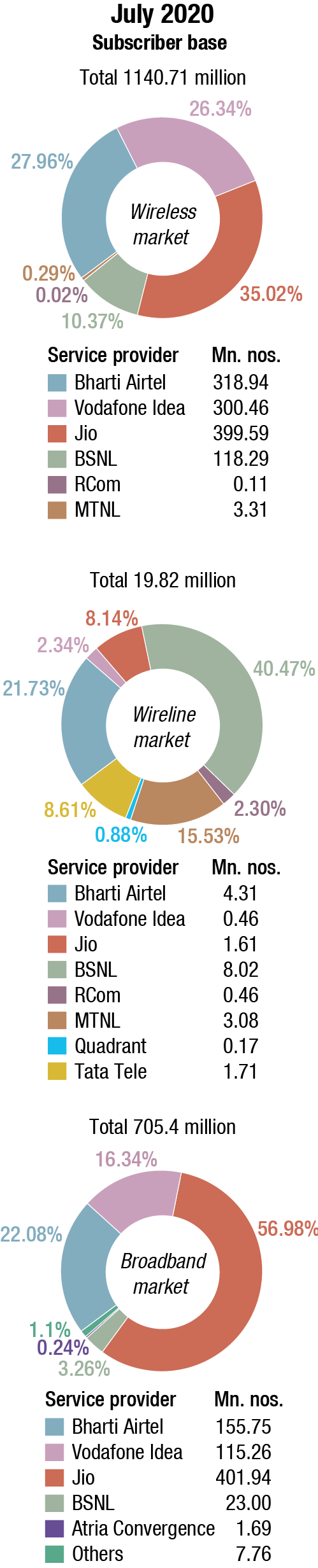

As we bid adieu to 2020, outlook for the telecom services sector seems to be relatively stable. Jio has its coffers full, its 5G plan in place and is all geared up to take on competition and gain dominance. Airtel continues to be steady and calm, as it stealthily pursues its expansion plans, handling every challenge professionally and yet passionately. Voda Idea seems to be in a better place, with the AGR issue somewhat resolved, and the international arbitration in its favour.

Anshu Prakash

Anshu PrakashSecretary-Telecom, DoT & Chairman DC

While the telecom policy has evolved from 1994, 1999, 2012, and in 2018, we now have a very futuristic national digital communications policy. Concerted efforts are a must to achieve the goals and objectives of this policy, Provision of broadband for all, enhancing contribution of digital communications in GDP and employment, increasing our ranking in the global ICT Development Index are some of the challenges that we need to address.We also need to prepare, invest and be ready for reaping the benefits of 5G technology opportunities and applications across all sectors including health, education, agriculture, disaster management, industry, commerce, etc. Enhancement of our capabilities and capacities in the core ICT sector must be a focus area.It is our belief that with active efforts of all stakeholders, the telecom sector in India will emerge stronger, and meet the expectations and aspirations of propelling India to a higher trajectory of growth with major enhancement in the quality of life of all citizens.

The brokerage and rating firms, while cautioning of turbulent times ahead, changed their tune, from it being a negative sector to being a stable one. The general consensus now is that the telcos are expected to report a stable to better set of numbers, in terms of metrics, such as ARPUs and revenues in the quarter ended September, and the losses may narrow for the sector at large.

India Ratings and Research has revised its sector outlook on the telecom sector to Stable for 2HFY21 from Negative, owing to the resolution of regulatory overhang and moderation in competitive intensity so far in FY21, compared to the past two to three years.

Motilal Oswal expects the telecom companies to continue to report losses but sees them narrowing from a year ago. Earnings would improve in 2QFY21 quarter as migrant workers’ have started returning to work with the opening up of the economy, which should increase recharges from low ARPU subscribers. The brokerage maintains that with the nationwide unlocking, business conditions are improving and some SIM consolidation, which was witnessed in the quarter ended June could have seen a reversal in the September quarter. It expects Bharti Airtel’s India wireless, Vodafone India, and Reliance Jio’s revenue to sequentially increase by 2.3 per cent, 1.3 per cent and 4.6 per cent, respectively.

Kotak Institutional Equities expects Bharti Airtel to report a net profit of ₹75.7 crore, compared with a loss of ₹23,044.9 crore a year ago, while it expects Vodafone Idea to log a net loss of ₹927 crore, compared with a loss of ₹50,921.9 crore earlier.

“We expect Indian telcos to report a stable 2Q, with all telcos showing positive QoQ growth. 2Q every year typically shows seasonal weakness led by monsoon, but every year the magnitude is declining,” said BofA Securities on October 8. ARPU is expected to see improvement for all telcos on a QoQ and year-on-year basis, due to improvement in customer mix and reversal of SIM consolidation of 4G subscribers, which should partially get offset by return of low ARPU feature phone subscribers.

“While 1QFY21 was weak owing to erosion in the subscriber base, we expect 2QFY21 to be much better operationally with an arrest in the decline thereof. ARPUs are expected to increase slightly for all industry players, as the lockdown has significantly raised the importance of telecom services over the past few months, and the trend is likely to continue,” said Edelweiss Securities.

Issues at hand

The telecom sector, with consolidation in place, COVID not being a dampener as for some others, funding not being an immediate issue, and technological support tied up, yet has many mountains to climb.

Increasing tariffs

The telcos can expect to make a turnaround only if they are able to increase tariffs. Each one is looking at Jio to make the first move. Any possibility of that happening is if it was a key element of the recent ₹1521 lakh crore fundraise at Jio Platforms. Regulatory intervention is another likelihood, although TRAI’s floor pricing exercise has not made much headway. ₹300 has been pegged as the ideal ARPU telcos to get adequate return on their capital.

2G services

Jio has been pushing to discontinue the 2G services of 300 million subscribers, contention being that they are deprived from any benefits from the data revolution. Vodafone Idea Ltd and Bharti Airtel Ltd have maintained that they do not subscribe to the idea of 2G Mukt Bharat yet. They still have many customers on it who use feature phones, for instance in UP and Bihar particularly, almost 50 percent users are on 2G, 4G services are meant for smartphone users.

The lockdown resulted in a loss of millions of 2G customers, enabling the telcos to speed up their 4G coverage by re-farming unused spectrum to better technology, reduce fixed costs and improve services. Airtel re-farmed 900 MHz spectrum, previously used for 2G services across major markets, to 4G last year, and converted most of its 3G networks to 4G. The telco also plans to add around 25,000 rural 4G sites by 2022 to ramp up its connectivity in such areas. Vodafone Idea too has re-farmed radio airwaves in the 900 MHz, 1800 MHz and 2100 MHz bands for 4G services in major markets.

The telcos now have a chance to focus on bridging the 4G gap across rural markets to meet the rising demand for data from the millions who migrated from urban to rural areas due to the lockdown. Currently, 51 percent of Airtel’s customer base is on 2G network, while for Voda Idea it is 63 percent. According to GSMA, 12-13 percent of users will continue to use 2G handsets till 2025 in India.

The government has clarified that it has no intention of forcing the issue, as the choice of technology for provision of telecom services are left to the service provider as per their respective business considerations. Jio intervention with the launch of subsidised SIM-locked smartphones, priced in the ₹3,000-4,000 range, bundled with 4G data, voice, and own content services, cannot be ruled out. And then, Airtel and Vodafone Idea retaliating may be the beginning of another chapter.

3G services

Out of a total mobile customer base of 30.5 crore at the end of June, Vodafone Idea Ltd had 11.6 crore mobile broadband users on its network, of which 10.4 crore were 4G customers and rest were on 3G network. As its integration is nearing completion, and with the highest quantum of spectrum in the country and a large part of it already re-farmed for 4G, VIL is best placed and is upgrading its 3G users to high speed 4G data services in key markets. VIL has started informing its customers in the markets where re-farming is getting completed. The consolidation of Vodafone and Idea networks has substantially enhanced its 4G capacity with deployment of latest technologies through which it has been able to deploy 4G in radio waves that were earlier being used for 3G. On its Vi GIGAnet network, the telco’s enterprise customers currently using 3G based services are being upgraded to 4G and 4G based IoT applications and services, in a phased manner.

Airtel has shut down its 3G networks and the 2100 band spectrum refarmed to 4G. This spectrum helped during the lockdown with FDD spectrum giving a good indoor penetration. The process of switching off the 3G network started with Kolkata in the June 2019 quarter. By September 2019, the shutdown was affected in 6-7 more circles and between December and March 2020, the entire 3G network was shut down.

4G spectrum auctions

DoT had announced plans to sell spectrum in the 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz and 2500 MHz bands as part of the 4G auctions.

As much as over 153 MHz of spectrum, constituting around 7 per cent of the total spectrum holdings of Reliance Jio, Bharti Airtel, and Vodafone Idea will expire next year.

Jio is the only telco keen to buy spectrum. Its spectrum permits in the 800 MHz band are expiring next year in 12 circles. It also uses 37.5 MHz of Reliance Communications’ spectrum in the 800 MHz band in 14 circles, which will also expire in July 2021. Both the companies have a spectrum trading agreement.

Airtel has backup airwaves available and also some from re-farming 2G and 3G spectrum to 4G. Voda Idea having consolidated the two companies, does not face any shortage on this front. Vodafone Idea, holds 1,724 MHz of liberalised spectrum, airwaves for which market price has been paid— that can be used for deployment of any technology. Airtel and Jio have 1,536 MHz and 1,108 MHz of liberalised airwaves, respectively.

| Spectrum details | |||

| Jio | Airtel | Voda Idea | |

| Total spectrum (MHz) | 553 | 866 | 923 |

| Total investment (₹Crore) | 367500 | 264600 | 323400 |

| Spectrum expiring in 2021 (MHz) | 43.75 | 57.6 | 52.4 |

The DoT has sent its recommendations to the Union Cabinet and is awaiting approval. The dates for the auctions will be fixed after the necessary approvals come in. The process is delayed due to the nationwide lockdown and the AGR issue, which ended in September after the Supreme Court allowed Airtel and Vodafone Idea to clear outstanding AGR dues over a period of 10 years. Security clearances are pending with the Ministry of Home Affairs too, and it is unlikely that the auction will be held before March 2021.

Motilal Oswal has estimated a fund requirement of ₹49200 crore billion by the three operators in the 800 MHz band to replace the spectrum they hold, directly or through sharing. The government gets 25 per cent of the money upfront. The figure is based on the base price of spectrum for the upcoming auction fixed by the Telecom Regulatory Authority of India and on the assumption that there will be no bidding war.

Jio has objected that as per the decision of EGoM in 2012, based on recommendations of TRAI, the auction process for spectrum should start 18 months before the expiry. Even though the validity of spectrum for 39 licenses issued in 2001 is expiring in July-September, 2021, and not even eight months are left before expiry, no action has been taken so far.

Moving forward, the government has constituted a panel comprising the secretaries of home, defence, railways, telecom, I&B and department of space, with cabinet secretary Rajiv Gauba at the helm. The panel will streamline the spectrum allocation process and examine the possibility of drawing up an annual calendar for auction of airwaves, that will give telcos a clear roadmap of the quantum as well as the frequency of spectrum on offer for commercial use. It will also look into the possibility of identifying spectrum, which is likely to be released for commercial purposes.

Decision pending for the E&V bands. The panel would also take a decision on the whether the E and V bands will be delicensed or auctioned like any other spectrum.

The telcos pose a united front, that it would be legally untenable to delicense the E and V bands, and they must be auctioned. They are protecting their turf, as they fear that if this band comes free of cost, the US tech giants, Google, Microsoft, Apple and Facebook will be able to offer broadband services, leading to a non-level playing field as the telcos have paid huge sums of money to acquire access spectrum.

The Indian Broadband Forum, representing its members, including Facebook, Google and chip maker Qualcomm, is equally eloquent. Their demand is that the spectrum should be delicensed, so that millions of entrepreneurs are able to set up public Wi-Fi hotspots, and the government´s target to have over five million Wi-Fi hotspots this year, be met. In any case, the V band spectrum, albeit increases the average internet speed by 50 percent has limited coverage, and can only be used indoors to augment the existing 2.4 GHz and 5.8 GHz spectrum to enable Wi-Fi routers to connect devices.

With the demand for data, and broadband internet having recently increased exponentially, and global trend being that the bands are exempted from licensing, 70 countries have exempted these; and the flip side being that the telcos would have to collectively invest USD 3.5 billion to merely double the number of towers with a fibre backhaul; the scales seem to be tipping in favour of delicensing.

The TRAI, way back in 2014 had recommended a light licensing approach, and not auctioning for this band.

5G services

5G services

The 5G spectrum auction still seems some time away, especially as the government is still scouting for additional spectrum to the 50 MHz it has, for each of the four operators, as against the minimum 80 MHz required in the 3300-3600 MHz bands. Not that the operators are very keen to go ahead yet, as delaying the 5G spectrum auction may turn out to be advantageous for them. Apart from the nascent use-cases, limited incremental revenue potential, an inherently low ARPU structure in India, a pathetic 25 percent fiberization; the telcos will be in a more sound position financially, there may be a reduction in equipment cost and more affordable devices may become available. Also, countries that are rolling out 5G, like South Korea, Singapore, Japan, the US and China, have achieved almost 100 percent 4G penetration, which is why going 5G is their next natural step. India’s 4G penetration is much lower, and 5G services will take much longer to gain traction.

The Parliamentary Standing Committee on Information Technology has invited the representatives of Reliance Jio, Bharti Airtel and Vodafone Idea for a hearing on India’s preparedness for 5G and reasons for delay. The committee is headed by Shashi Tharoor. The two sessions are scheduled for October 27. The second session would also involve the Ministry of Communications.

Motilal Oswal Financial Services have pegged the investment in three key large components for a 5G network spectrum, sites and fiber on mid/low band spectrum with pan-India coverage at ₹1.3 lakh crore to ₹2.3 lakh crore.

The telcos are at loggerheads over 5G standards. While Jio has backed the country-specific 5G norm proposed by the Telecom Standards Development Society India, Bharti Airtel and Vodafone Idea have cautioned the government about gaps in the India-centric 5G specifications proposed by TSDSI, saying they do not mesh with global standards recommended by the 3GPP. The latter’s standards govern LTE networks operations worldwide and its suggested 5G standard has been backed by the ITU. Telcos in the US, Canada, Australia, Japan, South Korea, Germany, China, Russia and the Middle East among others are rolling out 5G services based on 3GPP’s standard. TSDSI’s 5G standard, among other things, calls for deployment of 5G services in the 3.4 GHz band and suggests mobile towers be spaced 12 km apart in villages to ensure ubiquitous 5G coverage in rural India. This is at odds with 3GPP’s 5G standard that backs 5G deployment in the 700 MHz band and wants mobile towers to be spaced 6 km apart. TSDSI has acknowledged that its 5G specifications aren’t interoperable with globally defined 3GPP standards.

At Reliance’s 43rd Annual General Meeting in July 2020, Mukesh Ambani, CEO, RIL declared that Jio has created a complete 5G solution from scratch, that will enable it to launch a world-class 5G service in India, using 100 percent home-grown technologies and solutions. Jio had made acquisitions and investments that will help them build the network, and would not be getting into manufacturing per se. Jio is integrating different components of the telecom network, building some on its own, procuring the rest—a strategy made possible by a global push towards open standards and softwarisation of telecom networks. A closer look revealed that it will take several years for the electronics and component manufacturing ecosystem to be manufactured in India.

Currently, it is possible to design locally and build components in Taiwan or Korea. And the critics are quick to point out that, since based on the telecom standards called Option 6, it will likely be a better version of 4G with higher capacity, rather than the “true 5G” the world is anticipating.

Jio has seemed to be on the prowl for some time. After four years of 1000 engineers on the project, acquisition of Radisys and amalgamation of Rancore Technologies, the operator is planning to build its own 5G software stack and is likely to embrace OpenRAN techniques or possibly even Cloud-RAN as architecture. Tareq Amin, who served as Jio’s SVP of Technology Development from 2013-18, currently working as CTO-Rakuten, that has recently got a nod to become Japan’s fourth major wireless carrier had set the tone.

This is in line with its global counterparts, that are for the first time building their own 5G virtualised networks. They are moving from the current hardware-dependent networks to ones that will be software-centric virtualised, open networks, with hardly any dependency on the underlying hardware, while also saving 40 percent in CapEx and 34 percent in OpEx.

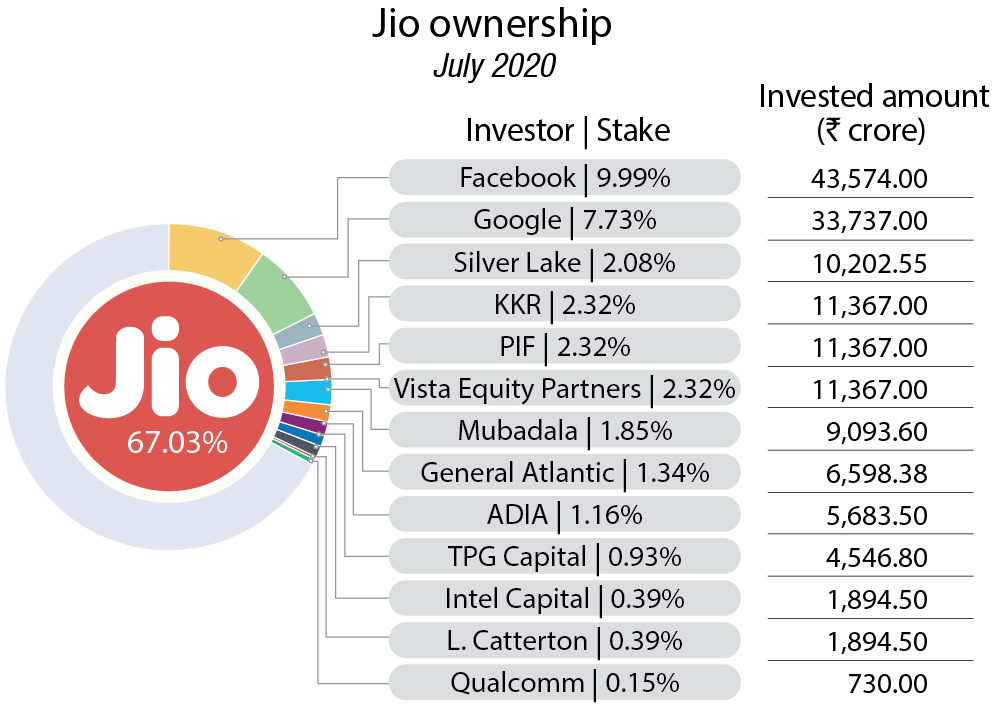

Jio is looking to acquire or form partnerships with domestic firms to develop competencies in building and manufacturing 5G products. The firm is well equipped, having secured over USD 20 billion in the last few months from the global who’s who of private equity and technology.

At the outset, it needs to address two of its weak spots, in manufacturing and radios. The Reliance Group itself certainly has manufacturing capabilities, and a partnership with ITI Limited would enhance these. But ITI suddenly moving into a new, challenging area of manufacturing will have doubters.

Moreover, Jio is missing the radio piece of the puzzle. Let’s say Jio sticks with Samsung, and doesn’t go full open RAN. Jio hasn’t committed either way, even if it is a member of the O-RAN Alliance. Samsung’s baseband supports both LTE and NR 5G with the same hardware, so it would not likely need a swap. But the radios would need an upgrade to Samsung’s Massive MIMO version, at the least. These are not manufactured in India, so it’s hard to pitch them as homegrown.

Even with a Samsung manufacturing move, Jio would not have control over the 5G solution and it’s hard to call this is a “Made in India platform.” Another possibility is that Jio is on the acquisition hunt, looking for open RAN players to fill the radio void. Altiostar and Mavenir recently announced they would work together to develop a portfolio of open RAN-compliant radios designed for the US market, produced by third party OEMs. Altiostar is likely not for sale, given its links to Telefonica and Rakuten, but Mavenir or a smaller option may be available. Short of acquisition, Jio might be content to just do as Altiostar and Mavenir are doing: draw up the specs (using Rancore) and commission a third-party OEM to manufacture.

Jio is believed to be evaluating local firms to acquire or to form partnerships. It might be looking at domestic firms in line with the Atmanirbhar push by the Indian Government. There is speculation that Jio is in dialogue with HFCL, Tejas Networks, Niral Networks, Lekha Wireless Solutions, VVDN Technologies, SignalChip, Nivetti Systems, Vihaan Networks, and Saankhya Labs!

Last week, Jio Platforms announced that Qualcomm and Jio have successfully tested 5G solutions, and clocked ultra-high speeds of 1 Gbps, in trials. The latest progress on the 5G product portfolio neatly dovetails into Jio’s overall plans to develop homegrown 5G telecom solutions.

There seems to be a change in strategy at Bharti Airtel. The telco is reported to be developing its own 5G network equipment ecosystem in the country with the help of various US and Japan-based companies. The change in strategy will allow the telecom operator to have better control over the supply chain and reduce overall network deployment costs by looking beyond traditional vendors like Nokia and Ericsson.

Airtel has tied up with global technology companies. These companies include Rakuten and NEC from Japan, Taiwanese major Sercomm, cloud player Red Hat in the US, and Texas-based Mavenir. This is in addition its existing partners Nokia and Ericsson and Altiostar. It is currently also in advanced talks with Flex, USA and Tejas Networks. The operator’s labs in Bengaluru and Manesar are designing network gear along with testing of equipment based on OpenRAN technology.

Vodafone Idea maintains that its network is 5G-ready. The telco has upgraded its capabilities to include features which are part of 5G architecture and would be able to roll out the services after auction of spectrum.

The China backlash

China has seen ostracization from some telcos in 2020, that seems to be here to stay. Amid heightened tensions on the India-China border, July 1 saw BSNL cancel its ₹9000 crore 4G tender. This was followed by Airtel and Vodafone attempting to dilute their dependence on Huawei and also filing in fresh applications for 5G trials. Airtel and Voda Idea are currently in dialogue with Ciena, Cisco and Nokia for their non-RAN networks requirement. This includes contracts for transport, packet and core networks. Reliance Jio is anyway independent of the Chinese vendors, and is in fact looking to compete with them. Huawei India is reported to have slashed its India revenue target for 2020 by 50 percent.

The two operators have sought a decision from the government on whether they will be allowed to continue to deploy Chinese infrastructure as bringing in new vendors at this stage would make a difference of 8 percent to 27 percent in cost overruns for 5G infrastructure. NITI Aayog CEO, Amitabh Kant had recently commented that no decision has been taken yet.

If they are asked to go through and cancel existing equipment contracts, another challenge would be to pay ₹6950 crore the amount owed for the supplies procured to the two vendors by Airtel and Voda Idea, combined. This does not take into consideration the penalties that may be imposed for premature cancellation of contracts, with international arbitration as an option.

BSNL also has running overdues of about ₹1400 crore. More than 44 percent mobile network equipment of BSNL is sourced from ZTE and 9 percent from Huawei. This figure is 10 percent for MTNL.

Last week, the European Competitive Telecommunications Association had denounced the move to bar Chinese suppliers. The pan-European pro-competitive trade association represents more than 100 leading challenger telecoms operators – that is not former incumbents – and digital solutions providers across Europe. Its purpose is to support the regulatory and commercial interests of telecoms operators, ISPs & equipment manufacturers in pursuit of a fair regulatory environment that allows all communications providers to compete on level terms. ECTA’s General Director Luc Hindryckx said that the statement reflected concerns of member CEOs that the adoption of a common EU approach to assessing vendor risk – known as the Toolbox – was leading more and more member countries to impose “actual or de-facto bans” on Chinese vendors. “A reduction in the number of worldwide suppliers from five to three will not only impact the telecoms sector by increasing costs, negatively impacting performance, delaying the deployment of 5G networks and constraining innovation potential,” ECTA said.

Japan too went on record and told the United States that Tokyo will not, at the moment, participate in Washington’s plan to exclude Chinese firms from telecommunications networks. While Tokyo will cooperate with the United States, Japan will take its own steps to respond in cases where there is concern over security issues.

This was in response to the US State Department’s plan called the “Clean Network” wherein it had called for telecom companies, cloud service providers and mobile apps of Chinese origin to be kept out of the United States.

Meanwhile the US Agency for International Development has offered loans and other financings, potentially worth billions of dollars in total, to countries to buy hardware from suppliers in democratic countries rather than from China. The USAID, which is known for providing food assistance than technology, will dispatch staff to meet politicians in the developing countries with an aim to persuade them that using telecom equipment from two Chinese giants, Huawei Technologies Co. and ZTE Corp is a bad idea. From the last two years, the US has lobbied allies to join the US in banning Chinese-made equipment for networks using 5G wireless technology, which promises superfast speeds to enable driverless vehicles, more efficient factories and other innovations.

The US campaign initially focused on 5G deployments in Europe, where it has had some success, including in Britain and Poland. Other countries, most notably Germany, are still debating whether to restrict or ban Chinese-made equipment. FCC, USA has officially declared both companies, Huawei and ZTE national security threats. UK and Australia too have been unambiguous in their stand against them.

Worldwide, IDC expects the total 5G and LTE router/gateway market to grow from approximately USD 979.3 million in 2019 to just under USD 3 billion in 2024 at a compound annual growth rate (CAGR) of 21.2 percent.

Fund availability may be in jeopardy for telcos?

The banks have DoT to blame for the ₹41650 crore mess created as an aftermath of the consolidation. Bickering among Indian government ministries and a deferred top court decision on the sale of bankrupt telecom companies’ rights to use mobile phone spectrum has derailed the resolution of the industry’s biggest bankruptcies, leaving banks waiting for USD 5.7 billion in payments.

The case is a stark example of how government branches are delaying bankruptcy settlements in a country whose banks suffer the world’s worst bad debt ratios. Any uncertainty about lenders’ rights over the key assets of operators could also discourage lending or bank guarantees to Bharti Airtel Ltd. and Vodafone Idea Ltd.

The bankruptcy tribunal had approved a plan to sell the assets of Aircel Ltd. group companies to help banks recover about ₹19000 crore of debt. Another proposal to sell the assets of Reliance Communications Ltd. to reclaim about ₹23000 crore is pending.

The banks were seeking larger amounts. A group of mostly state-owned lenders claimed about ₹58700 crore from Aircel firms and ₹1.2 lakh crore from Reliance companies, which used to be controlled by Anil Ambani. The telecom department claimed another ₹12000 crore from Aircel and ₹25000 crore from RCom in fees for airwave permits.

The telecom department challenged any sale before its dues are cleared, a view opposed by the corporate affairs ministry. Lenders contested the telecom ministry’s petition in court, saying without sale of airwaves rights the bankruptcy resolution would fail.

Decision pending for the E&V bands.

Airtel

Bharti Airtel as on July 31, 2020 had 324.21 million subscribers, of which 4.3 million were wireline and 319.91 million were wireless subscribers. Of the wireless subscribers, 97 percent, i.e. 310.31 million were active subscribers. These are the latest figures available.

Riding on broadband service, direct-to-home (DTH) service, digital payments bank (Airtel Payments), and Airtel Business, among others, Bharti Airtel is leaving no stone unturned to transition to a digital service provider. With its slew of digital products, the service provider has become much more than just a mobile operator.

The company’s product offerings include 2G, 3G, and 4G wireless services, mobile commerce, fixed line services, high-speed home broadband, DTH, and enterprise services. Bharti Airtel has global presence in Sri Lanka, Bangladesh, and Africa. It had made its overseas debut in January 1998 with the launch of operations in the island nation of Seychelles. Today, Airtel has fortified its presence across 18 countries in two continents, reaching out to a whopping two billion people around the world.

The company also deploys and manages passive infrastructure pertaining to telecom operations through its subsidiary, Bharti Infratel Limited, which also owns 42 percent of Indus Towers Limited. Together, Bharti Infratel and Indus Towers are the largest passive infrastructure service providers in India.

Financial review- FY 2019-20

Bharti Airtel’s consolidated revenues stood at ₹87,539 crore for the year ended March 31, 2020 as compared to ₹80,780.2 crore in the same period previous year, an increase of 8 percent. The revenues for India and South Asia (₹64,359.8 crore) represented a growth of 7 percent compared to that of previous year. The revenues across 14 countries of Africa, in constant currency terms, grew by 14 percent.

The company incurred operating expenditure of ₹31,467 crore, representing a decrease of 16 percent over the previous year. Consolidated EBITDA at ₹37,105.3 crore increased by 41 percent over the previous year. The company’s EBITDA margin for the year increased to 42.4 percent as compared to 32.5 percent in the previous year. Depreciation and amortization costs for the year were higher by 29.7 percent to ₹27,689.3 crore.

Consequently, EBIT for the year at ₹9244.7 crore, increased by 94.1 percent resulting in margin of 10.6 percent vis-à-vis 5.9 percent in the previous year. The cash profits from operations was ₹25,495.1 crore vis-à-vis ₹16,777.7 crore in the previous year. Net finance costs at ₹12,381.9 crore were higher by ₹2792.6 crore compared to previous year.

The consolidated net loss for the year was ₹32,183.2 crore as compared to net income of ₹409.5 crore in the previous year. The CapEx was ₹25,358.6 crore as compared to ₹28,742.7 crore in the previous year (a decrease of 11.8%).

Sunil Bharti Mittal

Sunil Bharti MittalChairman, Bharti Entreprises

Digital India is a vision that the country holds very dearly. What we are looking forward to, in the next 25 years is IoT connectivity, low latency connectivity, a full 5G-enabled network across the country. It is also time for the government to now ensure that this industry, which has had its ups and downs is given due attention in the area of levies and taxes.Taxes have generally been very high on this industry. It is important that this is reviewed thoroughly and telecommunication resources like spectrum and levies not become a source for the exchequer, but become a force multiplier in ensuring that the economic momentum becomes faster and gets accelerated, so the government earns its dues from other industries, who are riding on the back of this wonderful industry. I also feel the time has come for India to take a lead in the area of local manufacturing. Prime Minister’s vision of Aatmnirbhar is giving us all a clarion call to ensure that more and more value added is done in mobile devices and accelerated software abilities.I am delighted and glad that Airtel, which founded this industry 25 years back is still holding strong and will continue to serve the needs of the Indian mobile industry.

RoCE declined to (negative) 9.8 percent from 5.2 percent in the previous year.

Liquidity and funding. The company had cash and cash equivalents of ₹13,550.7 crore and short-term investments of ₹13,767.9 crore. During the year the company generated operating free cash flow of ₹11,746.6 crore. Consolidated net debt for the company including the impact of leases stands at ₹1,18,859 crore.

The year witnessed massive fund raise initiatives totaling to more than USD 8 billion. The year started with one of India’s biggest rights issue where the company raised ₹24,939 crore by issuing approximately 113.4 crore fully paid up equity shares and utilizing the proceeds materially toward deleveraging the balance sheet. In June 2019, the company concluded the IPO of Airtel Africa and raised net proceed of USD 674 million. In October 2019, company’s wholly owned subsidiary, Network i2i Limited raised USD 750 million. In January 2020, the company raised USD 3 billion through a combination of QIP (USD 2 billion) and FCCB (USD 1 billion).

Segment-wise performance–mobile services (India). Operations pertaining to optical fiber were transferred from the company to its wholly-owned subsidiary Telesonic Networks Limited with effect from August 01, 2019. Airtel continued to re-farm its 3G spectrum for 4G and modernize it. As on March 31, 2020, the company had 283.7 million customers in India. The churn decreased to 2.5 percent for the current year, compared to 3.3 percent during the previous year. The company had 148.6 billion data customers, of which 136.3 million were mobile 4G customers. The increased penetration through bundles with high inbuilt data has also led to the total MBs on the network grew by 79 percent to 21,020 billion MBs.

The company continues to expand its reach within the digital space. App Annie ranked Wynk Music crossed 170 million installs, and Airtel Xstream, formerly known as Airtel TV, crossed 138 million installs. During the year, revenues increased by 11 percent to ₹45,966.3 crore as compared to ₹41,554.1 crore in the previous year. The company had 194,409 network towers, compared to 181,079 network towers in the last year. Out of the total number of towers, 192,068 are mobile broadband towers. Mobile broadband (MBB) base stations were at 503,883 the end of the year, compared to 417,613 at the end of last year.

Key highlights strategic alliances and partnerships. Airtel continues to forge business partnerships with an aim to provide seamless customer experience with greater value proposition to end users. Airtel strengthened its strategic partnership with ZEE5, Faridabad Smart City Limited (FSCL), Bharti AXA Life Insurance, and Lionsgate. Airtel designed and implemented a future ready state wide area network (SWAN) for the state government called UPSWAN 2.0. Airtel announced the induction of Vahan into its Start-up Accelerator Program. Airtel and OYO Hotels & Homes collaborated to launch OYO Store on airtelThanks App. Airtel joined hands with HDFC Life Insurance.

Randeep Sekhon

Randeep SekhonCTO, Bharti Airtel

Airtel is preparing its networks on the core and transport side for automated deployment and automated readiness; and on infra side, especially RAN and MIMO, working with our partners to deliver these technologies such that they are less power-guzzling, occupy less space, and are more and more efficient, when delivered, through a partner ecosystem, comprising supplier partners, infra partners, and the telcos.Apart from the challenge of delivering, it presents a big opportunity of bringing in a Make in India story and keeping our promise. We can ensure that all these technologies are Made in India, not only for Indian consumption, but also for the global market. Since Nokia, Ericsson and Ciena have manufacturing facilities in India, it will also ensure that we are not too heavy on CapEx.I have to give the best customer experience to my customers. And introduce new services to our customers, improve home coverage through mesh solutions, besides providing a better low latency kind of service. We are now focused on giving customers indoor suburban or rural coverage where they can seamlessly avail connectivity for these purposes. Great customer experience is my mission.

Financial Performance FY 2019-2020 |

|

| Operating Highlights (000s) | Mar 2020 |

| Total Customer Base | 423287.0 |

| India | 309754.0 |

| South Asia | 2929.0 |

| Africa | 110604.0 |

| Consolidated Financials (₹ Crore) | |

| Total Revenues | 87539.0 |

| EBITDA | 37105.3 |

| Cash Profit | 25495.1 |

| Earnings Before Tax | (42846.6) |

| Net Profit | (32183.2) |

| Shareholder’s Equity | 77144.8 |

| Net Debt | 118859.0 |

| Capital Employed | 196003.8 |

| Key Ratios (%) | |

| CapEx Productivity | 41.90 |

| OpEx Productivity | 35.95 |

| EBITDA Margin | 42.39 |

| EBIT Margin | 10.56 |

| Return On Shareholder’s Equity | (35.47) |

| Return On Capital employed | (9.75) |

| Net Debt To EBITDA | 3.20 |

| Interest Coverage Ratio | 3.41 |

| Book Value Per Equity Share | 141.40 |

| Net Debt To Shareholders’ Equity | 1.54 |

| Earnings Per Share (Basic) | (63.41) |

Performance by Service 2019-20 (₹Crore) |

||

| B2C Service | Gross Rev. | EBIT |

| Mobile Services–India | 45966.3 | (3185.3) |

| Homes Services | 2245.1 | 512.9 |

| Digital TV Services | 2923.8 | 1133.0 |

| B2B Service | ||

| Airtel Business | 13233.1 | 3175.4 |

| Passive Tower Infra. | 6742.3 | 2372.4 |

Mergers and acquisitions. Airtel and Hughes Communications India Ltd. (HCIL), entered into an agreement to combine their VSAT operations in India. On July 1, 2019, Airtel completed the acquisition of the consumer mobile business of Tata Teleservices (Maharashtra) Limited (TTML) and Tata Teleservices Limited (TTSL) with Bharti Airtel Limited and Bharti Hexacom Limited. Airtel acquired a strategic stake in Spectacom Global Pvt Ltd.

Network expansion and transformation. As part of its strategy to offer high speed 4G across the country, the company has moved forward on its plan to phase out its 3G services. Airtel has deployed L900 technology in the 900 MHz band to complement its 4G services in the 2300 MHz and 1800 MHz bands. Bharti Airtel launched high speed 4G along with 2G services in 26 villages in Ladakh. Airtel deployed LTE 2100 MHz spectrum band across Delhi-NCR, Haryana, Himachal Pradesh, and Jammu & Kashmir. The company renewed and enhanced its on-going relationship with Nokia to boost its network capacity and customer experience, in particular 4G. The rollout will also lay foundation for providing 5G connectivity in the future, with approximately 300,000 radio units deployed across several spectrum bands, including 900 MHz, 1800 MHz, 2100 MHz, and 2300 MHz. Airtel launched 4G services in Lakshadweep Islands. It collaborated with Cisco to launch India’s 5G-ready, 100G IP, and optical integrated network. Airtel Wi-Fi crossed five million users in March 2020.

Homes services. The company provides fixed-line telephone and broadband services for homes in 111 cities across India. The company continued to increase its coverage by rolling out new fiber network across major cities. Further, overhauling of network from copper to FTTH continued during the year. The homes business had 2.4 million customers as on March 31, 2020. Revenues from homes services stood at ₹2245.1 crore, as compared to ₹2239.1 crore in the previous year, increase of 0.3 percent.

In line with the high speed and high value acquisition strategy, the company unveiled a new brand identity Airtel Xstream Fiber for the home broadband services. As of March 2020, operations have been launched in 11 cities and ~180,000 homes have been wired.

Digital TV services. Airtel Digital TV launched the Airtel Xstream 4K Android Box during the year. With operations in 639 districts across the country, the customer base crossed the 16 million mark during the year. It has 16.6 million customers on its DTH platform. Reported revenues for the year stood at ₹2923.8 crore as compared to ₹4100.1 crore in the previous year, a decrease of 29 percent. Airtel announced a partnership with CuriosityStream, collaborated with Sony to bundle Airtel Xstream Stick, and collaborated with TV panel makers – Samsung and Mi, to bundle TV and DTH sales.

B2B services. Airtel Business spans across India, USA, Europe, Africa, the Middle East, Asia-Pacific, and other SAARC countries. Airtel Business serves over 1200 global customers, 2000 large, and 500,000 medium/small businesses across India. Revenues in this segment comprise of enterprise and corporate fixed line, data, and voice businesses; and global business, which includes wholesale voice and data. Airtel Business launched Enterprise Hub offering self-care services to its enterprise and SMB customers.

Airtel and Nokia partnered to offer private LTE based Industry 4.0 solution to enterprises.

1QFY21

Bharti Airtel reported a consolidated loss of ₹15,933.1 crore for the quarter-ended June, which widened considerably from ₹5237 crore in March quarter and ₹2866 crore in 1QFY20. The net loss stood at ₹436 crore. Consolidated revenue from operations grew 0.9 percent sequentially to ₹23,938.7 crore. Overall customer base stood at around 420 million across 16 countries at the end of June quarter, declining 0.8 percent compared to the March quarter. The company reported EBITDA at ₹10,639 crore, up 3 percent QoQ. India revenue for Q1 FY21 stood at ₹17,589 crore, up 14.6 percent YoY on a reported basis.

Mobile revenues have witnessed a YoY growth of 18.5 percent. ARPU for the quarter is at ₹157 as compared to ₹129 in 1QFY20. 4G data customers have increased by 45.3 percent to 138.3 million from 95.2 million in the corresponding quarter last year while traffic has increased to 74.09 PB/day vs 42.90 PB/day in the corresponding quarter last year.

Airtel Business continues to accelerate its revenue growth momentum with a 9.2 percent YoY growth. Digital TV revenue witnessed a growth of 9.3 percent YoY, on the back of strong customer additions growth of 5.1 percent to 16.8 million from 16 million in the corresponding quarter last year. Homes business segment continues to remain steady and witnessed a revenue growth of 1.4 percent YoY.

Airtel’s journey as a digital business continues to grow strongly in 1QFY21. There are over 1.1 million retailers transacting and making payments every day on Mitra App. Verizon and Airtel have partnered to bring secure Enterprise-Grade BlueJeans Video Conferencing service to India. During the quarter Airtel and Carlyle entered into an agreement whereby Carlyle will acquire approximately 25 percent stake in Airtel’s Data Center business at a valuation of USD 1.2 billion, subject to customary approvals.

Consolidated EBITDA witnessed an increase of 25.3 percent YoY to ₹10,639 crore in 1QFY21. Consolidated EBIT increased by 107.4percent YoY to ₹3328 crore. The consolidated net loss after exceptional items for the quarter stands at ₹15,933 crore. The net debt-EBITDA ratio (annualized) and including the impact of leases as on June 30, 2020 is at 2.74 times as compared to 3.43 times as on June 30, 2019.

Supreme Court ruling on AGR matter: The Group provided for ₹368,322 million for the periods up to March 31, 2020. The Supreme Court on June 11, 2020 directed the telecom operators to file their proposals, as to the time frame required by them to make the payment and what kind of securities, undertakings and guarantees should be furnished to ensure that the AGR dues are paid. On June 18, 2020, the Supreme Court inter alia considered the affidavit filed by the telecom operators and directed all the telecom operators to file certain documents and also make payments of reasonable amounts to show their bonafides before the next date of hearing. The matter was listed for hearing on July 20, 2020 wherein the Supreme Court, after hearing all parties, observed that the amounts of AGR dues given by DoT is to be treated as final and there can be no scope of re-assessment or recalculation. Further, the Supreme Court reserved its order on the issue of period over which such payments could be made and terms thereof. Consequently, during the quarter ended June 30, 2020, the Group has further recorded an incremental provision of ₹107,444 million to give effect of the differential amount between DoT Demand along with provision for subsequent periods for which demands have not been received, computed based on the terms of the License Agreement, Court Judgment and the guidelines/clarifications and AGR Provision, which has been presented as exceptional item.

Consolidated Statement of Income ₹Crore |

|||

| Particulars | 1QFY20 | 1QFY21 | YoY Growth % |

| Total Revenues | 20737.9 | 23939.0 | 15.4 |

| EBITDA | 8492.6 | 10639.0 | 25.3 |

| EBITDA/Total Revenues | 41% | 44.44% | 3.5% |

| EBIT | 1604.6 | 3328.0 | 107.4 |

| EBIT/Total Revenues | 7.7% | 13.9% | 6.2% |

| Profit Before Tax | (1529.8) | 372.0 | 124.3 |

| Net Income | (2866) | (15933) | (455.9) |

Customer Base 000s |

|||||

| Particulars | Jun-20 (000s) | Mar-20 (000s) | QoQ Growth (%) |

Jun-19 (000s) | YoY Growth (%) |

| India | 305689 | 309754 | (1.3) | 301451 | 1.4 |

| South Africa | 2847 | 2929 | (2.8) | 2573 | 10.6 |

| Africa | 111461 | 110604 | 0.8 | 99670 | 11.8 |

| Total | 419996 | 423287 | (0.8) | 403695 | 4 |

Reliance Jio

Reliance Jio, as on July 31, 2020 had 402.41 million subscribers, of which 1.61 million were wireline and 400.8 million were wireless subscribers. Of the wireless subscribers, 78.09 percent, i.e. 312.98 million were active subscribers. These are the latest figures available.

After changing the rules of the game for the telecom industry, some marquee partnerships ruled the book for Reliance Jio. During FY 2019-20, Reliance executed on the next phase of its growth journey, forging transformative partnerships across businesses.

Financial review- FY 2019-20

The business recorded revenues of ₹68,462 crore for the year ended March 31, 2020, as against ₹48,660 crore in previous year, with year-end subscribers’ base at 387.5 million. Segment EBITDA was at ₹22,517 crore for the year, as against ₹15,341 crore in previous year. Reliance Jio’s gross debt stand at ₹23,242 crore. On combined basis, retail and digital services business EBITDA has increased by 49 percent compared to previous year.

Jio’s services span across connectivity and cloud, media, digital commerce, financial services, gaming, education, healthcare, agriculture, Government to Citizen (G2C), smart cities and manufacturing.

Jio continues to transform the Indian telecom industry with key performance indicators as follows:

- ARPU of ₹130.6 per month during the quarter ended March 2020.

- Average data consumption of 11.3 GB per user per month during the quarter ended March 2020.

- Average voice consumption at 771 VoLTE minutes per user per month during the quarter ended March 2020.

- Total wireless data consumption of 1284 crore GBs (12.8 Exabytes) during the quarter ended March 2020 (one of the world’s largest mobile data networks).

- High user engagement with ~5 hours spent by each subscriber per day on the Jio ecosystem.

Data growth. Jio with affordable data plans has been the primary driver of data boom in India over the past three years. The Jio network carries over 4.5 Exabytes per month. Jio with its 4G coverage provide mobile data services to almost 250 million citizens of the country

FTTH. Jio had connected approximately one million homes with JioFiber services until March 2020.

Passive infra. Jio’s passive infrastructure, which includes 175,000 towers and 1.1 million rkm for fiber in full scope, has been transferred through a scheme as of March 31, 2019, held through two separate Infrastructure Investment Trusts (InvIT). Reliance has signed a binding agreement with Brookfield Infrastructure Partners LP and its institutional partners for investment in the units to be issued by the Tower InvIT. Brookfield and affiliates will invest ₹25,215 crore in Tower InvIT.

Mukesh Ambani

Mukesh AmbaniCMD, RIL

In the past 25 years, mobile telephony itself has undergone many disruptive and transformational changes. I can count four fundamental ways in which mobile telephony has changed, and has in turn changed, India.First, mobility has become affordable beyond all expectations. Second, it has also became democratic, and ceased to be a rich man’s monopoly. Third, from uni-functional, cellphones have become multi-functional because of the mobile internet. The combination of the connectivity revolution and the computation revolution has opened the floodgates of human creativity. Fourth, and most important, mobile telephony has become a catalyst for enrichment, and empowerment of common Indians in ways that was unthinkable a couple of decades ago.I am both humbled and happy to mention the significant contribution that Jio has made. In less than four years since its inception, Jio has become the trailblazer in affordability, quality and functional versatility. The time has come for India to be ahead of the rest of the world in key areas of technology. Let’s all work together to realize this vision and mission.

Spectrum. The entire 1108 MHz of pan-India spectrum holding across the three bands (800 MHz, 1800 MHz, and 2300 MHz) is deployed toward 4G-LTE.

VOLTE to VOWI-FI. Jio’s VoLTE network carries 9 billion minutes per day.

Undersea cable. Jio has been actively creating a multi terabit capacity international fiber network. Jio, with its partners, is a part of two undersea cable network consortiums: BBG (Bay of Bengal Gateway), a state-of-the-art 8100 km undersea cable system providing direct connectivity to South East Asia and Middle East, then onward to Europe, Africa and Far East. This facility has a landing facility in Chennai; AAE-1 (Asia Africa Europe) stretches over 25,000 km from Marseille, France to Hong Kong. This is the longest 100 Gbps undersea cable system with 21 landing stations across Europe and Asia. In India, it has a landing station in Mumbai.

Innovation across networks. Till date, Jio has filed 134 patents for the pioneering initiatives it has undertaken, of which 29 have been granted. In FY2019-20, Jio filed for 31 patents and was granted 10. These patents span across devices, network, cloud, digital media, branding and customer experience. Jio’s patents cover areas of cutting-edge technology, including IoT, 5G, video bots, Blockchain, NFV, and Evolved Multimedia Broadcast Multicast Services (eMBMS).

Suite of digital apps. Jio’s rich suite of digital applications include JioTV (680+ channels of live and catch-up TV, across 15 languages and 10 genres), JioCinema (video on demand, 10,000+ movies, 1,20,000+ episodes, 60,000+ music videos), JioMoney, JioNews (190+ live channels, 800+ magazines, 10+ languages, JioSaavn (India #1 OTT music app with 55+ million tracks across 16 languages, unique Artist Originals Program), JioChat, JioHealthHub, among others. MyJio is a cornerstone of Jio’s digital proposition for its customers.

Investments. Jio had as of March 2020 raised over ₹168,818 crore through investments by global tech investors into Jio Platforms of ₹115,694 crore and the Rights Issue of ₹53,124 crore. Jio’s Total Solutions Approach have been validated by investments from leading global partners. Meanwhile, Jio has made investments in excess of USD 50 billion since inception to create digital and connectivity ecosystem in India, with a rich bouquet of successful apps and platforms. New growth areas in NarrowBand (NB) IoT, IaaS/PaaS, mixed reality, Reliance Jio Infocomm Limited investments/acquisitions: MyJio, JioTV, JioTV+, JioNews, JioCloud, JioCall, JioChat, JioSecurity, JioSwitch, JioBrowser, JioGames, Jio Platforms Limited, JioHealthHub, JioAdvertising, JioPrime, enterprise and SMB, broadband home, broadband wireless, broadband Netradyne, JioEstonia, OU gaming, education, healthcare, agriculture, and manufacturing have been identified. As a part of restructuring of the digital businesses that Jio undertook during the year, a single platform company named Jio Platforms Limited has been created. This has been done to bring together digital assets of Reliance spanning across connectivity and technology investments under a single wholly-owned subsidiary.

Shyam Mardikar

Shyam MardikarCTO, Reliance Jio Infocomm

Going digital is bringing in an unprecedented increase in both complexity as well as scale. With 5G, it is the entire product suite, the entire portfolio that has become so orthogonal, that the various service sets are totally independent of each other. Multiple vectors come into play-of latency, bandwidth, type of content being used, frequency of transaction, and security, to name a few. At the design stage, the ability to understand the scope and span of each of these service sets, and then design the network, one that delivers near optimum level, not only from an efficiency and utilization perspective but also from the topology, architecture, and management perspective that kind of drives it, becomes very important.In the digital, 5G-plus world, an entire ecosystem is being launched, wherein the concept of first mile and last mile, the very hierarchy of the old networks is collapsing. And once this network cements itself in the ecosystem, where every piece of connectivity is just a single hop, from the core to the device, it will automatically try and create an economic value, which makes it so much more worthwhile to go digital, and to service billions of customers, and hundreds and thousands of service suites.

Regulatory development. Among the key regulatory developments with respect to the digital services business, was TRAI’s decision to push back the transition to Bill and Keep (BAK) regime by 12 months. The interconnect usage charge (IUC) would now be reduced to zero with effect from January 1, 2021. Accordingly, Jio introduced a charge of 6 paise/minute on all off-net outgoing voice minutes to pass through the impact of change in regulatory stance on IUC in October 2019. This has led to a significant improvement in voice traffic mix as misusers of free voice services have left the network and Jio is now a net receiver of IUC. Jio continues to believe that transition to the BAK regime will hasten the adoption of more efficient technologies like VoLTE, which has a negligible cost for carrying and servicing essential voice services. During the year, TRAI has also initiated consultation process on feasibility of establishing a floor price for mobility services in the country. Market dynamics have improved in the recent past, as reflected by tariff hikes effective December, 2019, wherein all the operators revised their tariff plans upward by up to 40 percent. In addition, the Supreme Court of India had, in its verdict related to the pending AGR matter, directed operators to pay the outstanding dues before January 24, 2020. In compliance with this judgement, Jio had self-assessed AGR related levy and deposited ₹195 crore with the Department of Telecom within the stipulated timeframe. The government has also expressed its intentions of conducting the next round of spectrum auctions during the fiscal year 2020-21. Jio with its 5G-ready network and extensive fiber assets, would play a key role in the development of the 5G ecosystem in India, based on market dynamics.

1QFY21

Reliance Jio reported a net profit of ₹2520 crore for the June quarter 2020 against a profit of ₹891 crore in same quarter of last year, registering a growth of 183 percent. The ARPU grew 7.4 percent sequentially to ₹140.3 per subscriber per month. Revenue for the June quarter was at ₹16,557 crore, increasing 33.7 percent compared to ₹12,383 crore in same period last year.

There has been strong wireless gross addition of 15.1 million during the quarter despite COVID related restrictions across the country. Monthly churn rate for wireless subscribers at only 0.46 percent during the quarter.

Operational highlights (In ₹crore) |

|||

| Financials | 1Q FY21 | 1Q FY20 | % Change |

| Value of services | 19513 | 14,593 | 33.7% |

| Revenue from operations | 16557 | 12383 | 33.7% |

| EBITDA | 7281 | 4686 | 55.4% |

| EBITDA margin* | 44.0% | 37.8% | 613bps |

| Net profit | 2520 | 891 | 182.8% |

| *EBITDA margin is calculated on revenue from operations | |||

Customer engagement has increased during the quarter with national lockdown driving average wireless data consumption per user per month to 12.1 GB and average voice consumption to 756 minutes per user per month. Jio Platforms have rolled out the cloud-based video-conferencing app, JioMeet during the quarter.

The process of converting initial test users of Jio Fiber to paid-plans is largely complete with more than one million home users connected with Jio FTTH services. Average usage across the user base has witnessed a significant increase due to work from home and learn from home.

Strategic transactions. Jio Platform Limited, by July 2020, had raised ₹152,056 crore across 13 investors, which include Facebook, Google, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, Public Investment Fund of Saudi Arabia, Intel Capital and Qualcomm. Reliance Industries, post completion of these investments, would hold 66.48 percent equity stake in Jio Platform on a fully diluted basis. Of the total investment, Jio Platform Limited has already received ₹115,694 crore as subscription amount from 10 investors. ₹22,981 crore will be retained at Jio Platform to drive future growth.

Reliance Retail. Reliance Retail clocked significant revenues of ₹31,633 crore and EBITDA of ₹1083 crore in the quarter.

Vodafone Idea

Vodafone Idea as on July 31, 2020 had 301.83 million subscribers, of which 0.46 million were wireline and 301.37 million were wireless subscribers. Of the wireless subscribers, 89.33 percent, i.e. 269.21 million were active subscribers. These are the latest figures available.

Vodafone Idea offers voice, data, enterprise services and other value-added services (VAS), including short messaging services, digital services, and IoT.

As of March 31, 2020, the subscriber base of the company stands at 293.7 million. The company provides voice and data services on 2G, 3G, and 4G technologies across all 22 service areas and has strong spectrum portfolio and network footprint. It has the largest spectrum holding amongst all Indian telecom operators comprising 1846 MHz spectrum across 22 circles, of which 1723.6 MHz is liberalized spectrum which can be used toward deployment of any technology. Its mobile telecommunication services cover more than 1.2 billion Indians.

As of March 31, 2020, it had over 436,000 broadband (3G+4G) sites and all of the 4G sites are VoLTE-enabled, creating a better customer experience. The broadband network is spread over 325,000 towns and villages and covers more than a billion Indians. Vodafone Idea has started deployment of Dynamic Spectrum Re-farming (DSR), Massive MIMO and small cells to maximize spectrum efficiency. Additionally, the company has started deploying LTE on TDD band of 2300 MHz and 2500 MHz spectrum band to expand the capacity and on 900 MHz band to improve customer experience in dense areas.

Vodafone Idea also derives revenue from carrying India inbound ILD traffic through arrangements with other mobile telecommunications companies and long-distance carriers operating outside India. It has a portfolio of ~361,000 km of optical fiber cable (OFC), including own built and Indefeasible Right of Use (IRU) OFC.

Financial review-FY 2019-20

On a consolidated basis, the revenue of the company stood at ₹44,957.5 crore, an increase of 21.2 percent over the previous year. The EBITDA at ₹15,951.8 crore reflects increase of 228.6 percent as compared to the previous year. The consolidated net loss stood at ₹73,887.1 crore vis-à-vis ₹14,571.1 crore for the previous year.

Following the merger of Vodafone and Idea, the company had embarked on the challenging phase of integration. Below is the update on various strategic initiatives, which are underway to improve the company’s revenue and profitability as well as to strengthen its overall position in the market:

-

- The company has made significant progress in integration since merger and is now in final stages of completion. It has consolidated spectrum and radio access network in 18 out of the 22 service areas and 92 percent of total districts have been consolidated. It has fully realized the guided OpEx synergy of ₹8400 crore.While the integration progressed well in FY 2019-20, due to the nationwide COVID-19 induced lockdown, remaining consolidation is expected to take longer than initially expected.

- Vodafone Idea continues to focus on expanding 4G coverage and data capacity, especially in its major markets. The integration along with other network initiatives such as spectrum

- consolidation and refarming, deployment of TDD sites, small cells and massive MIMO have delivered a significant capacity uplift. Its overall capacity has more than doubled since merger.

- After several years of pricing pressure due to intense competition, the company as well as all the operators increased the tariffs across all price plans. While the prices are still unsustainably low, this initiative provides much needed ARPU improvement. The company also continues to focus on driving UL/4G penetration to increase ARPU. It has also started to consolidate its postpaid services under single brand of Vodafone RED. It had also launched REDX postpaid plan for postpaid customers.

- Vodafone Idea Business Services (VIBS) continues to maintain leadership in IoT offerings which is an emerging segment and has potential to grow multi-fold in the near future amid government’s push toward and . The tie-ups with e-commerce platforms, handset manufacturers, financial institutions, and NBFCs will drive value not only for the customers, but also for the company and its partners.

- Vodafone Idea successfully concluded the Rights Issue of ₹25000 crore. Further, it has the option to monetize its 11.15 percent stake in Indus, on the completion of Indus-Infratel merger.

Ravinder Takkar

Ravinder TakkarMD & CEO, Vodafone Idea Limited

The company started this journey with two extremely popular and loved brands and today we come to the final stage of integration as we announce one unified brand. In their various avatars, since the mid-90s, Vodafone and Idea steered the growth of the sector for over decades separately. Both Vodafone and Idea have set new benchmarks in network experience, rural connectivity, customer service, enterprise mobility solutions and many more.

The idea behind one common brand is integration, while cost-saving may be there. The two independent brands will be phased out, but the legacy of the two companies will reflect in the common brand.

As the integration of two businesses is now complete, it’s time for a fresh start. That’s why we believe that now is the perfect time to launch Vi, one company which provides the strength of Vodafone India and Idea.

We are not shy to raise prices, everyone today is selling below cost. A new tariff will help improve our ARPU which is at ₹114 compared to rival Airtel and Jio’s at ₹157 and ₹140.

Financial Highlights – Profit & loss account (₹Cr) |

||

| Particulars | 2019-20 | 2018-19 |

| Income from sale of good & services | 44916.7 | 37005.6 |

| Other operating income | 40.8 | 86.9 |

| Other income | 1039.3 | 731.1 |

| Total revenue | 45996.8 | 37823.6 |

| Operating expenses | 30045.0 | 32969.8 |

| EBITDA | 15951.8 | 4853.8 |

| Depreciation and amortisation | 24356.4 | 14535.6 |

| EBIT | (8404.6) | (9681.8) |

| Interest and finance charges | 15392.0 | 9542.5 |

| EBT | (23796.6) | (19224.3) |

| Exceptional items (net) | (38355.7) | 852.1 |

| Share of JV/Associates | 355.3 | 196.8 |

| Taxes | 12081.1 | (3571.5) |

| Loss after tax | (73878.1) | (14603.9) |

| Other comprehensive income, net of tax | (9.0) | 32.8 |

| Total comprehensive income | (73887.1) | (14571.1) |

On a standalone basis, the company had cash and cash equivalents of ₹322.3 crore, fixed deposits with banks having maturity of 3-12 months of ₹1650 crore and short-term investments of ₹454.8 crore as on March 31, 2020. The company’s net debt decreased by ₹5864.4 crore to ₹1,12,690.4 crore as compared to ₹1,18,554.8 crore last year. All scheduled loan repayments and deferred spectrum fee instalments to the DoT were made on respective due dates. However, term loans amounting to ₹187.5 crore that were due during the year were repaid prior to their due dates as agreed with the lenders. In addition, ₹5 crore NCDs were prepaid during the year. Further, the company has opted for moratorium on interest amounting to ₹86.6 crore falling due on March 2020 pursuant to the notification dated March 27, 2020 issued by the Reserve Bank of India permitting inter-alia, banks to grant a moratorium of three months to each borrower with respect to instalments (including interest) falling due between March 1, 2020 and May 31, 2020.

The CapEx incurred was ₹9338 crore. The company also incurred ₹488.1 crore and ₹252 crore toward bandwidth and spectrum respectively. These amounts exclude amounts capitalized and charged off toward One Time Spectrum Charges amounting to ₹3887.1 crore.

The Board of Directors of the company had approved for transfer of Fibre Infrastructure Undertaking from the company to Vodafone Idea Telecom Infrastructure Limited (formerly Vodafone Towers Limited) (VITIL), a wholly-owned subsidiary. As part of streamlining the corporate structure of the company, the Board of Directors on May 13, 2019 had approved amalgamation of Vodafone India Digital Limited (VIDL) and Idea Telesystems Limited (ITL) and consequently VIDL and ITL have been amalgamated with the company. The Supreme Court delivered its judgment on October 24, 2019 in relation to a long outstanding industry-wide case upholding the view considered by DoT in respect of the definition of AGR. The Supreme Court in a supplementary order of the same date had allowed a period of 3 months to the affected parties to pay amounts due to DoT. This AGR Judgment has significant financial implications on the company. The company along with other telecom operators filed a Review Petition against the aforesaid AGR Judgment, which was rejected by the Supreme Court in January 2020. Thereafter, the company and telecom operators filed an application for modification of the supplementary order before the Supreme Court of India, wherein the Supreme Court, inter-alia, directed immediate payment of the AGR dues and directed issuance of show cause notice to the managing directors/directors of TSPs as to why contempt proceedings should not be initiated against them for violating the order passed for not depositing the amounts due, on the next date of hearing. Subsequent to the AGR Judgment, DoT had issued letters dated November 13, 2019 and February 3, 2020 to the company to carry out self-assessment of the liability and afforded certain guidelines/clarifications to compute the amounts payable based on the AGR Judgment. Accordingly, during February 2020 and March 2020, the company based on its interpretation of the guidelines/clarifications, and the principles laid down in the AGR Judgment and self-assessment, made payments aggregating ₹6854.4 crore to DoT, toward the principal amount of its AGR liability. On March 16, 2020, the DoT had filed an application before the Supreme Court with respect to giving reasonable time to the affected parties (a period of 20 years with 8 percent interest on unpaid amounts to duly protect the net present value) and to cease the currently applicable interest after a particular date. The Supreme Court, in a hearing on March 18, 2020, ordered that no exercise of self-assessment/re-assessment is to be done and the dues which were placed before the court have to be paid including interest and penalty. At the same hearing, the Supreme Court stated that the DoT application would be considered on the next date of hearing. Subsequently, on June 11, 2020 and June 18, 2020, Supreme Court has heard the matter for staggered payments and requested telecom operators for payment of reasonable amounts and file financial information for last 10 years; and further adjourned the hearing until third week of July 2020. The company has already made payments of ₹6854.4 crore in three instalments. In respect of levy of one time spectrum charge (OTSC), the DoT has raised demand on the company and erstwhile Vodafone India Limited (VInl) and Vodafone Mobile Services Limited (VMSL) in January 2013 for spectrum beyond 6.2 MHz in respective service areas for retrospective period from July 1, 2008 to December 31, 2012 and for spectrum beyond 4.4 MHz in respective service areas effective January 1, 2013 till expiry of the period as per respective licenses. In the opinion of the company, the above demand amounts to alteration of financial terms of the licenses issued in the past and, therefore, the company filed a petition in the High Court of Bombay.

The company, as part of its strategic program, partnered with an NBFC–Home Credit India Ltd and with Amazon India, to build a unique Shop-in-Shop model at the company-owned stores that generated a turnover of ₹485 crore. During the year, the company expanded its footprint from 100 stores to 250 stores. The company also partnered with leading OEMs – Samsung and Vivo–for the launch of their flagship products with joint advertising.

1QFY21

Vodafone Idea’s net sales stood at ₹10,659.30 crore in June 2020, down 5.42 percent from ₹11,269.90 crore in June 2019. Quarterly net loss at ₹25,460 crore in June 2020, down 422.37 percent from ₹4873.90 crore in June 2019. EBITDA stands at ₹4153.70 crore in June 2020, up 5.7 percent from ₹3929.60 crore in June 2019.

Subscriber churn reduced to an all-time low of 2 percent (3.3% in 4QFY20), as net disconnections were lower during the quarter. However, the gross additions were severely impacted by closure of retail stores during the nationwide COVID lockdown, resulting in subscriber base decline to 279.8 million in 1QFY21 from 291.1 million in 4QFY20.

ARPU for 1QFY21 was ₹114 vs ₹121 in 4QFY20. The company continues to invest in 4G to increase coverage and capacity, however the hardware deployment during the quarter was impacted by the lockdown. Vi added ~13,000 4G FDD sites primarily through refarming of 2G/3G spectrum to expand 4G capacity. Vi’s 4G population coverage is now around 1 billion compared to 916 million a year ago. We also made progress in implementing LTE 900 in select locations. The company has deployed ~59,800 TDD sites in addition to deployment of ~12,100 massive MIMO sites and ~11,700 small cells till date. The overall broadband site count stood at 446,131 as of 1QFY21 compared to 436,006 in 4QFY20.

At the end of the quarter, the 4G subscriber base was 104.6 million. Total data volumes grew by 10.6 percent (40.4% YoY), to 4523 billion MB compared to the last quarter, being the highest growth in the last six quarters. Total minutes on the network declined by 6 percent during the quarter.

The services to the customers continued without any material disruption during the lockdown. However, the customer’s ability to recharge, availability of physical recharge, acquisition of new customers as well as physical network rollout were significantly impacted during the quarter. Revenue for the quarter was ₹10660 crore, a decline of 9.3 percent QoQ on account of large-scale lockdown and disruption of economic activities. On reported basis, EBITDA for the quarter declined to ₹4100 crore, a QoQ decline of 6.4 percent. Post adoption of IndAS 116, the accounting for operating lease expenses has changed from rentals to depreciation on the right-of-use asset and finance cost for interest accrued on lease liability. Accordingly, this has an impact of ₹2210 crore and ₹60 crore on network expenses and other expenses respectively. Despite a sharp revenue decline, EBITDA excluding IndAS 116 impact declined by ₹180 crore to ₹1540 crore, after adjusting for one-off of ₹300 crore vs ₹1710 crore in 4QFY20 as impact of lower revenue was largely offset by reduction in subscriber acquisition costs due to lower gross additions during the quarter, marketing costs and other expenses as well as other cost optimization initiatives. The one-off credit of ₹300 crore during the quarter were related to network costs and LF and SUC charges. The EBITDA margin, excluding IndAS 116 impact and adjusted for one-offs, stands at 14.4 percent vs 14.6 percent in 4QFY20. Gross debt was ₹118940 crore, including deferred spectrum payment obligations due to the government of ₹92270 crore. Cash and cash equivalents, excluding margin deposits, were ₹3450 crore and net debt stood at ₹115500 crore. CapEx spend in Q1FY21 of ₹600 crore was lower compared to ₹18.20 crore in 4QFY20, as the rollout in 1Q was impacted by COVID-19 with disruptions to equipment supply and logistics following the nationwide lockdown.

The integration of erstwhile Vodafone India and Idea Cellular is now nearly complete, with Vodafone Idea realizing its targeted annualized OpEx synergies of ₹8400 crore well ahead of the original timeline. Having successfully achieved these synergies, the company has rolled out a further cost optimization plan across the company in line with the evolving industry structure and business model. Through this exercise, VI plans to achieve ₹4000 crore of annualized cost savings over next 18 months. As a step in that direction, the company is in the process of organization wide restructuring, which will transform the company into a lean and agile fit for future workplace.

Indus-Bharti Infratel merger update. The merger of Indus Towers and Bharti Infratel has received FDI approval.

P Balaji

P BalajiChief Regulatory and Corporate Affairs Officer, Vodafone Idea Limited

The NDCP is a fantastic document. It has three pillars, Connect, Propel and Secure India. A lot of work has started on the Connect India side. Likewise on the Propel India part, initiatives need to be taken. If USD 100 billion investment into the digital economy is required to be made, a robust and a financially strong industry is a must. Steps must be taken in that direction, whether it is unblocking the GST input credit, or reducing the amount of bank guarantees that need to be given, or reducing taxes and levies, so that more money is available in the hands of the industry to continue to invest in the network. Once that is done, there will be a multiplier effect on the economy, and it will give a huge impetus to growth in India and revenues to the government.This has to be with a light-touch regulatory framework, which allows for lower taxation than we have currently. To have the lowest tariffs in the world, maximum consumption in the world, needing to bring another USD 100 billion investment, and having the highest taxation, that aspect is understood, needs to be implemented step by step, in order to ensure that the industry continues to invest to achieve the digital vision of the prime minister of India.

Financial Highlights – Profit & loss account (₹Cr) |

|||||

| Particulars | 1QFY20 | 2QFY20 | 3QFY20 | 4QFY20 | 1QFY21 |

| Gross revenue | 11269.9 | 10844.0 | 11089.4 | 11754.2 | 10659.3 |

| OpEx | 7553.6 | 7448.4 | 7668.9 | 7374.1 | 6560.9 |