CT Stories

The enterprise networks market defies global slowdown

The Indian enterprise network market is poised to grow in single digits. Increase in adoption of emerging technologies and large investments for 5G rollouts will drive incremental revenues in the next couple of years.

India’s networking market, which includes Ethernet switches, routers, and WLAN segments is estimated at ₹7097.70 crore in the period January–September 2022. Ethernet switches constituted 55.41 percent of the market, routers 22.99 percent, and WLAN the balance 21.60 percent.

The market saw strong growth over the same nine-months period in 2021, exhibited due to vendors trying to clear backlogs as much as possible before they stepped into the next calendar year. Chip shortages continued to be an issue and the same is expected to last at least till the first half of 2023. Despite the multiple challenges that include delays in delivery, price increases, and a slowing global economy, the demand for networking equipment remains unscathed. The new normal is expected to propel more demand toward wireless, owing to hybrid work and technologies like 5G expanding the edge.

Ethernet switches

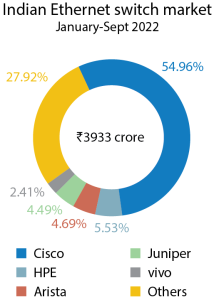

The switching market in India, during the period January–September 2022, stood at ₹3933 crore. Overall strong growth in the switching segment pushed up the growth for both DC and non-DC switching at similar levels. Key industries that contributed to the switching business include services, finance, telecom, and manufacturing.

The delivery lead times of switches continue to suffer, with vendors struggling to clear backlogs worth 2–3 quarters. IDC expects the situation to extend into 2023, and to persist at least until the first half of the year.

Cisco continued to lead the Ethernet switch market with a 54.96-percent share in the nine-month period January–September 2022, followed by Hewlett Packard Enterprise (HPE) at 5.53-percent share, Arista at 4.69-percent and Juniper at 4.49-percent share.

Sudharsan Raghunathan

Associate Research Manager, Enterprise Networking,

IDC India

“The market demand for network equipment is expected to remain strong despite the challenges the ecosystem is facing. The chip shortages are expected to remain at least till the first half of 2023. With the rising input costs, the prices of network equipment are also expected to remain volatile for the next few quarters. While 2023 certainly is expected to be a challenging year for all businesses, the demand for networking equipment would pull through, considering the growth trajectory of India and the criticality of networks to achieve the desired results.”

Routers

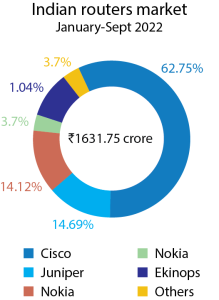

The routers market in India during the period January–September 2022 stood at ₹1631.75 crore (by vendor revenue). The market started witnessing service providers invest heavily in routers as part of upgrading to offer 5G network-supported services. More such investments are expected to come in over the next year. Enterprise router investments declined; albeit this is expected to be temporary and more enterprise investments to follow as the demand for low-end routers is set to rise due to technologies like SD-WAN.

Apart from telecommunications, the key verticals for routing include finance, government, and services.

Cisco leads the router market with a 62.75-percent share in the nine-month period January–September 2022, followed by Juniper and Nokia at 14.69-percent and 14.12-percent share respectively.

WLAN

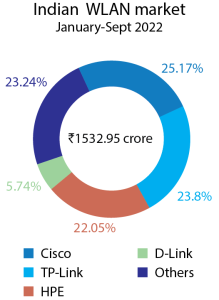

The Indian WLAN market gained traction, and is estimated at ₹1532.95 crore during the period January–September 2022. It is majorly driven by the enterprise wireless segment.

Cisco leads the WLAN market with a 25.17-percent share in the nine-month period January–September 2022, closely followed by TP-Link and Hewlett Packard Enterprise at 23.8-percent and 22.05-percent shares respectively. D-Link is also aggressive in this segment, and contributed 5.74 to the market in this nine-month period.

Cloud-managed wireless traction, especially in verticals, such as education, services, hospitality, and retail is growing at a stronger pace. The trend of choosing vendors other than the top three to be able to get quicker shipments continues. Having mentioned that, the shipment delays in the enterprise access point segment are starting to ease out. Wi-Fi 6 continues to dominate WLAN revenues.

The consumer gateway router business fell strongly; the decline was due to high demand during Q3 ’21. With offices open in most parts of the country, the demand for consumer routers is getting softer. With a broader rollout of 5G across the country, IDC expects high-end routers in the consumer segment to gain traction due to applications, such as VR/AR and cloud gaming.

Upasana Joshi

Research Manager, Client Devices,

IDC India

“Dwindling consumer demand due to high inflation remained a challenge throughout the year despite the improved supply situation. The ASP (average selling price) hit a record USD 224, rising 18 percent YoY in 2022. The entry-level segment (sub-USD 150) shrank to 46 percent of the market, down from 54 percent a year ago. The dearth of new launches in this critical mass segment was a barrier for new smartphone users, thus limiting the overall market’s growth.”

The Indian Ethernet switches, routers, and WLAN markets are expected to grow in single digit in terms of compound annual growth rate (CAGR) for 2021–2026. Increased adoption of emerging technologies, such as cloud, IoT, mobility, etc., would drive incremental revenues. Large investments for 5G rollouts are also expected in the next couple of years.

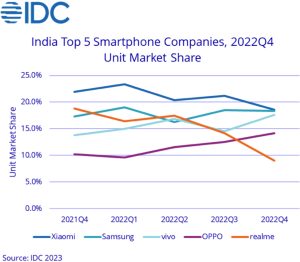

Smartphones

The India smartphone market exited 2022 with 144 million shipments (the lowest since 2019), with a 10-percent decline YoY (year-over-year). Q4 ’22 declined 27 percent YoY as shipments fell to 30 million units. Despite multiple price discounts and channel schemes, high inventory levels after Diwali restricted new shipments.

Highlights

- Shipments to online channels dropped by 6 percent YoY, though with a record-high share of 53 percent. The offline channel declined by 15 percent YoY.

- 50 million 5G smartphones were shipped during the year, with an ASP of USD 395 in 2022, down from USD 431 in 2021. With more affordable 5G launches expected in 2023, 5G devices should account for around 60 percent of shipments in 2023.

- The share of MediaTek and Qualcomm-based smartphones dropped while UNISOC’s share doubled to 14 percent, with significant volumes coming from realme and Samsung in the entry-level 4G segment.

- The mid-premium and premium price segments of USD 300–500 and USD 500+ grew 20 percent and 55 percent, respectively, while the sub-USD 300 segment declined by 15 percent. In the premium segment of USD 500+, Apple maintained its lead with a 60-percent share (iPhone 13 being the third most shipped device in 2022), followed by Samsung with a 21-percent share.

- 201 million mobile phones were shipped in 2022, clocking a 12-percent annual decline. Feature phone shipments stood at USD 57 million, a drop of 18 percent YoY. Samsung, Xiaomi, and Transsion were the leading companies in the total mobile phone market.

Global market

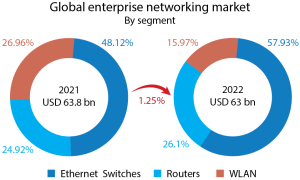

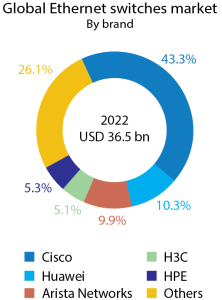

The global enterprise network market in 2022 is estimated at USD 63 billion, a 1.25-percent decline over USD 63.80 billion in 2021. Cisco continues to dominate the segment, at a 48.50-percent market share. Although in 2022, Huawei saw a degrowth in the routers and WLAN segments, it maintained its 10-percent share in Ethernet switch segment, and had an overall 10.30-percent market share. Other brands had single digit market shares, with the exception of HPE-Aruba that maintained its number-2 rank in the WLAN market, at a 14.60-percent market share.

Brad Casemore

research vice president, Cloud and Datacenter Networks,

IDC

“Strong growth in the Ethernet switch market continued in the fourth quarter of 2022, driven by a variety of trends, but the most significant factor was the continued easing of component shortages and a reduction in supply chain disruptions. Meanwhile, enterprises, service providers, and hyperscalers continue to build out Ethernet switching capacity, reinforcing the importance of connectivity and network infrastructure in today’s digital-first business world.”

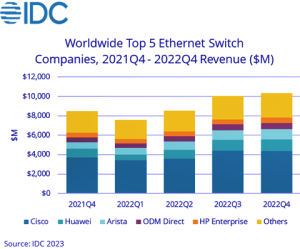

Ethernet switches

Worldwide Ethernet switch market recorded USD 36.5 billion in revenues for 2022, an increase of 18.70 percent over 2021. Annual growth builds on the market growing 9.70 percent in 2021, compared to 2020. For the full year, non-datacenter Ethernet switch revenues rose 15.70 percent while port shipments grew 12.20 percent. Datacenter Ethernet switch revenues rose 22.6 percent YoY and port shipments increased 12.20 percent.

The higher-speed segments of the Ethernet switch market continue to see strong growth, driven by hyperscalers and cloud providers building out datacenter network capacity. Market revenues for 200/400 GbE switches rose more than 300 percent, 100GbE revenues increased 22 percent, and 25/50 GbE revenues increased 29.80 percent for the full year.

Lower-speed switches, which are typically deployed in enterprise campuses and branch locations, showed strength too. Revenues for 1GbE switches grew 12.60 percent, 10GbE switches were flat at 0.40 percent, and 2.5/5GbE switch revenue – also known as multi-gigabit Ethernet switches displayed 122.10 percent YoY in Q4 ’22, with 53.10-percent sequential growth from Q3 ’22 to Q4 ’22.

From a geographic perspective, the Ethernet switch market saw growth in most regions in 2022. In the Asia-Pacific region (excluding Japan and China), the market grew 17.50 percent for the full year, in the People’s Republic of China, rose 9.20 percent for the full year and in Japan the market was down 8.60 percent for the full year. In the United States, the market rose 26.20 percent, Canada’s market increased 17 percent, the Latin America market increased 39.60 percent, in Western Europe 19.70 percent, and in the Middle East & Africa region rose 19.90 percent. In Central and Eastern Europe, the market declined 2.80 percent, compared to 2021.

Brandon Butler

research manager, Enterprise Networks,

IDC

“The enterprise segment of the WLAN market continued its rapid growth in the final quarter of 2022, driven by the continued easing of component shortages and supply chain disruptions, combined with enterprises investing in the newest Wi-Fi standards. The strong performance of the enterprise WLAN industry shows the importance of wireless technology in the network and digital transformation goals of organizations across the globe.”

Vendor highlights

Cisco’s Ethernet switch revenues rose 13.40 percent for the full year, giving the company a market share of 43.30 percent to end 2022.

Huawei’s Ethernet switch revenue rose 20 percent on the full year, giving the company market share of 10.30 percent to end 2022.

Arista Networks saw Ethernet switch revenues rise 55.40 percent for the full year, giving the company 9.90-percent market share to end 2022.

H3C’s Ethernet switch revenue rose 5.10 percent for the full year, giving the company a market share of 5.40 percent to end the year.

HPE’s Ethernet switch revenue rose 5.30 percent for the full year, resulting in a market share of 5.40 percent in 2022.

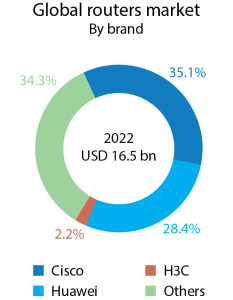

Routers

The worldwide router market recorded USD 16.50 billion in revenues, a 3.90 percent increase compared to 2021. The service provider segment of the market finished the full year with 1.30 percent. Revenues in the enterprise segment accounted for the remaining share of the market and rose 12.90 percent for the full year.

The service provider segment, which includes both communications SPs and cloud SPs, accounted for 73.70 percent of the market’s total revenues. The service provider segment of the market finished the full year up 1.30 percent. Revenues in the enterprise segment accounted for the remaining share of the market and increased 12.90 percent for the full year.

From a regional perspective, the combined service provider and enterprise router market in the US was up 17 percent for the full year. In Canada, the router market increased 1.40 percent for the full year, while in Latin America the market was up 16.70 percent. In the Asia-Pacific region (excluding Japan and China), the market fell 3.90 percent, Japan’s market saw a 0.30 percent increase, the People’s Republic of China market decreased 6.70 percent, in Western Europe it rose 5.20 percent while the Central and Eastern Europe market was down 21.20 percent for the full year. The Middle East & Africa region was up 3.70 percent for the full year.

Vendor Highlights

Cisco’s combined service provider and enterprise router revenue rose 5.50 percent for 2022, giving the company a market share of 35.10 percent to end the year.

Huawei’s combined SP and enterprise router revenue declined 3.40 percent for 2022, giving the company a market share of 28.40 percent to end the year.

H3C’s combined service provider and enterprise router revenues were flat at 0.40 percent growth for the year, resulting in market share of 2.20 percent for 2022.

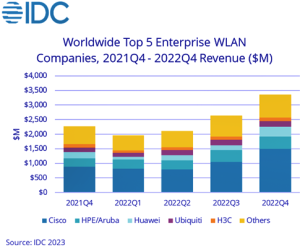

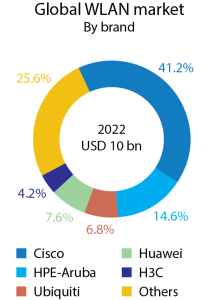

WLAN

In 2022, the enterprise segment of the worldwide wireless local area network (WLAN) market grew 31.40 percent YoY for 2021, with revenues reaching USD 10 billion.

Wi-Fi 6 and Wi-Fi 6E, the newest standards in the WLAN industry, continue to drive growth in the enterprise segment of the market. Wi-Fi 6 dependent access points (APs) grew 36.80 percent sequentially from Q3 ’22 to Q4 ’22, and in the fourth quarter of the year made up 82.80 percent of dependent AP revenues. Meanwhile, Wi-Fi 6E, which expands Wi-Fi’s use to the 6GHz band of spectrum, saw continued rapid adoption, with revenues almost doubling from Q3 ’22 to Q4 ’22 to reach USD 209 million with Wi-Fi 6E making up 7.20 percent of Dependent AP sales in Q4 ’22.

The consumer segment of the WLAN market grew 0.20 percent in 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too – in Q4 ’22, Wi-Fi 6 made up 49.30 percent of the market segment’s revenues.

The enterprise WLAN market had generally strong results across the globe. In the United States, the market increased 31.40 percent, in Canada 17.50 percent, in Latin America it rose 45.60 percent, and in Western Europe it rose 52.80 percent. In Central and Eastern Europe., the market declined 4.90 percent in 2022. In the Middle East & Africa, the market grew 42 percent, in the Asia-Pacific region (excluding Japan and China) it grew 34.20 percent, and in the People’s Republic of China it increased 16 percent for the full year. Japan’s market declined 6.10 percent in Q4 ’22, but rose 1.90 percent for the full year.

Anthony Scarsella

research director,

IDC’s

“We continue to witness consumer demand dwindle as refresh rates climb past 40 months in most major markets. With 2022 declining more than 11 percent for the year, 2023 is set up to be a year of caution as vendors will rethink their portfolio of devices while channels will think twice before taking on excess inventory. However, on a positive note, consumers may find even more generous trade-in offers and promotions continuing well into 2023 as the market will think of new methods to drive upgrades and sell more devices, specifically high-end models.”

Vendor highlights

Cisco’s enterprise WLAN revenues increased 33.80 percent for the full year. Cisco ended 2022 having 41.20-percent market share, with 40.82 percent decline compared to 2021.

HPE-Aruba enterprise WLAN revenues increased 50.90 percent in 2022, with 14.60 percent market share.

Huawei enterprise WLAN revenues increased 33.60 percent in 2022, giving the company 7.60 percent market share.

Ubiquiti enterprise WLAN revenues increased 11.40 percent in 2022, giving the company 6.80-percent market share.

H3C enterprise WLAN revenues increased 14.40 percent in 2022, giving the company a 4.20 percent share.

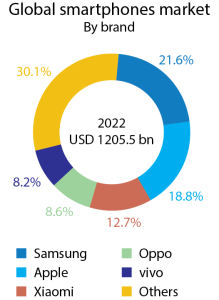

Smartphones

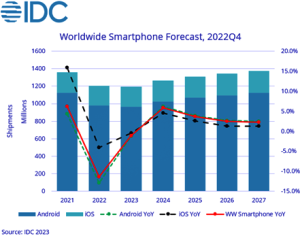

2022 ended the worldwide smartphone shipments of 1.20 billion units, which represents the lowest annual shipment total since 2013 due to significantly dampened consumer demand, inflation, and economic uncertainties. This tough close to the year puts the 2.80-percent recovery expected for 2023 in serious jeopardy with heavy downward risk to the forecast.

Weakened demand and high inventory caused vendors to cut back drastically on shipments. Heavy sales and promotions helped deplete existing inventory rather than drive shipment growth. Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability. Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. In the holiday quarter of Oct–Nov–Dec. rising inflation and growing macro concerns continued to stunt consumer spending even more than expected, and push out any possible recovery to the very end of 2023.

By brands, in 2022, Samsung dominated the global market with 21.60-percent share at 260.90 million units. Apple was close at 18.80-percent share, with 226.40 million units. Xiaomi contributed 12.70 percent with 153.10 million units, OPPO at 8.60 percent with 103.30 million units, and vivo at 8.20 percent with 99 million units. Other brands constituted the balance 30.10 percent of the 1.205-billion-unit market.

The latest IDC forecast is that the smartphones market will decline 1.10 percent in 2023 to 1.19 billion units, as it continues to suffer from weak demand and ongoing macroeconomic challenges. Real market recovery is not expected to occur until 2024, when IDC expects 5.90 percent YoY growth, followed by low single-digit growth leading to a five-year compound annual growth rate (CAGR) of 2.60 percent.

5G continues to grow and will account for 62 percent of smartphones shipped worldwide in 2023, rising to 83 percent by 2027. Market momentum also continues to build around foldable phones as the segment is expected to grow to nearly 21.40 million units this year – a 50-percent increase over the 14.20 million units shipped in 2022, while the overall market contracts. Foldable phone shipments will reach 48.10 million units in 2027, with a compound annual growth rate (CAGR) of 27.6 percent from 2022 to 2027. This segment will continue to grow as costs decrease and more OEMs launch this form factor. However, foldables remain in the premium price segments in all regional markets. Despite the expected drop in ASP (−6.8% in 2023), IDC has witnessed vast improvements in durability and build, while the overall user experience has been elevated with advancements in software and hardware across all vendors. More models from both new and current vendors are expected to bring further improvements and enhancements to the category to help drive continued adoption.

Finally, smartphone average selling price (ASP) that saw rapid growth over the last few years (from USD 334 in 2019 to USD 415 in 2022) will begin to decline starting in 2023 and is expected to reach USD 376 by end-2027. In 2022, smartphones contributed 98.80 percent, with foldable phones a miniscule 1.20-percent share.

For the fifth consecutive month, on April 5, 2023, IDC has lowered its 2023 forecast for worldwide IT spending as technology investments continue to show the impact of a weakening economy. For worldwide IT spending growth, IDC projects overall growth this year in constant currency of 4.40 percent to USD 3.25 trillion. This is slightly down from 4.50 percent in the previous month’s forecast and represents a swing from a 6-percent growth forecast in October 2022.

“Since the fourth quarter of last year, we have seen clear and measurable signs of a moderate pullback in some areas of IT spending,” said Stephen Minton, vice president in IDC’s Data & Analytics research group. “Tech spending remains resilient, compared to historical economic downturns and other types of business spending, but rising interest rates are now impacting capital spending.”

After reductions to PC forecasts a month ago, IDC has now scaled back its expectations for some additional hardware categories, including servers, wearable devices, and peripherals. Forecasts have been reduced for on-premise infrastructure investments by enterprise buyers, while cloud and service provider deployments remain more resilient overall.

Service provider spending is still weakening from last year’s highs as the industry adjusts to slower post-Covid growth, but planned investments by cloud and hyperscale providers have broadly held up since last month. Strong demand for cloud services continues to drive growth despite inflationary pressures but non-cloud spending is set to decline.

“The most significant impact remains concentrated in consumer markets, with consumer IT spending now forecast to decline by 2 percent this year,” said Minton. “This will be a second consecutive year of declining consumer tech spending, a huge change in fortunes from consumer growth of 18 percent in 2021. On the other hand, enterprise demand for cloud and digital transformation remains strong despite economic headwinds.”

Nabila Popal

research director, Mobility and Consumer Devices,

IDC

“With increasing costs and ongoing challenges in consumer demand, OEMs are quite cautious about 2023. While there is finally some good news coming out of China with the recent reopening, there is still a lot of uncertainty and lack of trust, which results in a cautious outlook. However, we remain convinced the global market will return to growth in 2024 once we are past these short-term challenges as there is a significant pent up refresh cycle in developed markets as well as room for smartphone penetration in emerging markets to fuel stable long-term growth.”

Channel splits trends indicate that while direct IT spending is expected to grow by 6.40 percent overall in 2023, indirect spending through channel providers will increase by just 2.50 percent as credit tightening affects smaller businesses and consumers in their ability to fund technology investments.

“Resellers that still derive much of their revenue from on-premise infrastructure and PCs are facing difficult market conditions this year,” said Minton. “Meanwhile, cloud infrastructure, software, and services are growing more slowly than a year ago but continue to account for a larger share of total IT spending and are reinforcing the general sense of resilience, which the industry still enjoys.”

The article is based on market research regularly released by IDC.

You must be logged in to post a comment Login