CSPs

The age of the empowered customer

Telecommunications industry leaders are faced with shrinking revenues and profitability, as well as the effects of regulatory pricing intervention and consolidation. After a punishing tariff war sparked by the entry of Reliance Jio in late 2016 in the Indian market, revenues have fallen about Rs 400 billion (USD 5.76 billion) in the last two years, according to a recent report from Crisil. But things may be looking up.

Telecommunications industry leaders are faced with shrinking revenues and profitability, as well as the effects of regulatory pricing intervention and consolidation. After a punishing tariff war sparked by the entry of Reliance Jio in late 2016 in the Indian market, revenues have fallen about Rs 400 billion (USD 5.76 billion) in the last two years, according to a recent report from Crisil. But things may be looking up.

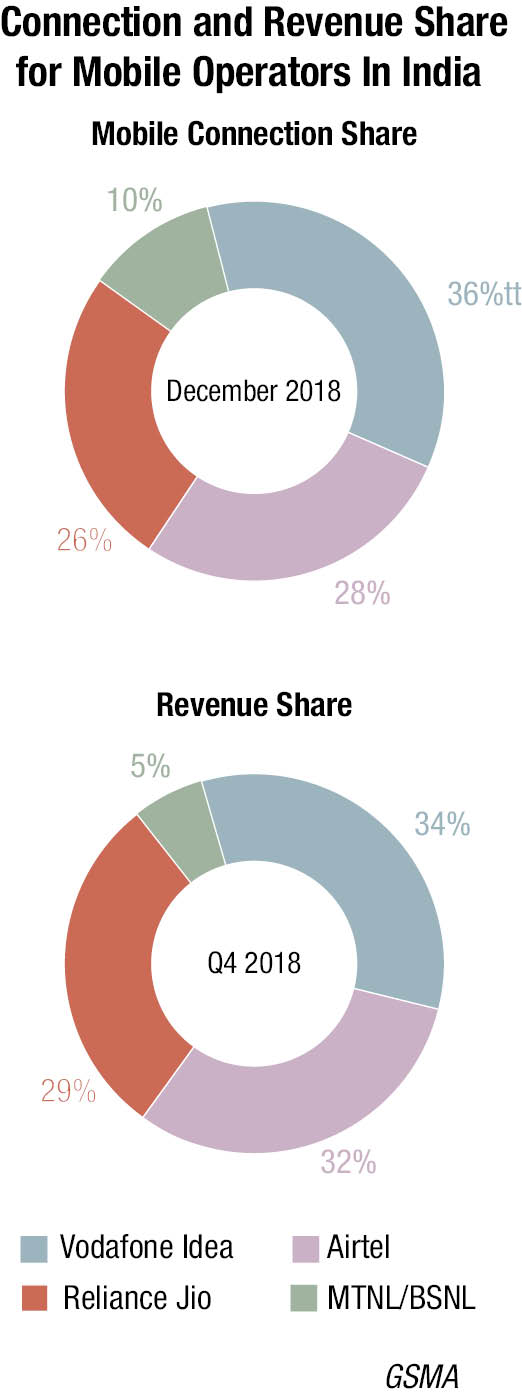

After a round of consolidation and the disappearance of two big players – Tata Teleservices and Reliance Communication – the three key private companies are now on a similar footing, as far as market share is concerned. Their focus, accordingly, is on improving the average revenue per user (ARPU).

And ARPU has at last shown signs of improvement. Vodafone-Idea reported ARPU of Rs 89 in the December-ending quarter, up from Rs 88 in the previous three-month period. Airtel saw its ARPU improve by 4 percent to Rs 104, while ARPU at Reliance Jio continued to fall over this period, dropping from Rs 132 to Rs 130. For the first three months of this year, it registered a further decline, to Rs 126.

The recovery may be attributed to higher data usage, the introduction of minimum recharge plans, and less aggressive pricing as the gap in market share between the remaining players shrinks. A conscious effort to weed out low-spending customers with minimum ARPU plans yielded results. Moving forward, the customers can expect a price increase, with telcos attempting to improve profitability.

Just how the market will play out, however, is still up in the air. Telephones are no longer just for making calls, as the market now encompasses a vast palette of data-related services. Will this mean telcos become supporting players as mere network providers, while the OTT players such as Google, Apple, and Facebook hold sway over network-related services and digital? Or can operators compete as primary providers of add-on services, such as messaging, video calls, and music downloads? Will they successfully make the leap to packaging digital services for their customers?

Old business models are already on the way out. Changes in customer preferences are driving out old business models in favor of those introduced by OTT players. These include iTunes-like pricing and hybrid pre- and post-paid models.

Data is now the fastest-growing business for telecom operators, yet it is doubtful that it can fully compensate for losses from voice operations. While some integrated players believe they can profit from content rights sold via their networks, players in many countries are skeptical about the ability to earn money from proprietary digital services. The possibility of partnering with OTT players is a more realistic option.

Transforming into digital services providers

Transforming into digital services providers

Digital transformation has further raised the need for change of the telco business model. The traditional connectivity-centric business model will work only for few telcos with a low-cost base. The biggest challenge facing the other telcos is to remain relevant to customers. The classic telco position is eroding due to competition from alternative connectivity providers, IT services firms, and over-the-top providers.

More than ever before, telcos are embracing new technologies and experimenting with new business concepts. This, in turn, offers opportunities for enterprise customers to work with telcos as partners for their digital transformation. Forrester in its report, The Future of Telecoms: Strategies to Transform Telcos in Digital Services Providers, analyzes the extent to which telcos could move beyond their traditional role of network infrastructure and connectivity provider – and what needs to be done to get there.

Three major network-related trends are affecting enterprise CIOs’ own digital transformation efforts: cloud-based on-demand service delivery is complementing on-premises IT systems; programable network infrastructure aimed at supporting specific use-case scenarios is partially replacing passive networks; and network data-driven systems of insights are complementing systems of record. It is against this demand scenario that telcos have an opportunity to emerge as credible digital services providers.

Telcos are not the primary choice of digital transformation partner by enterprise customers today. Customer-obsessed businesses like Amazon, Google, Salesforce, Tencent/WeChat, or Alibaba are top of mind as digital services providers for both CIOs and consumers. Still, telcos can develop new offerings as digital services providers in several areas. To get there, telcos must first recognize and accept their own limitations – and be prepared to transform radically. In essence, telcos must first transform fundamentally internally before they can become reliable external digital services providers.

Keep it simple, while digital

Telcos are losing touch with the evolving needs of their busy, demanding, and digitally oriented customers, asserts Bain & Company. Customer priorities are changing. Time has become the new price. Customers want services that are simple to explore, use, and pay for. They are looking for a digital-first experience that allows them to navigate seamlessly between online and offline channels, as well as personalized service that is suited to their specific needs. Digital companies such as Amazon, Netflix, and Uber have set a new standard for personalized, simple, and digital experiences, and customers expect the same from their telecom providers.

Yet, while customers crave simplicity, telcos have become mired in complexity. In their zeal to provide individual customer experiences to millions, telcos have fragmented their marketing and sales efforts, effectively creating products so targeted that they serve a segment of one. As they devise new price plans and services, they retain old ones, along with the channels and IT systems needed to sustain them, which leads to a cycle of ever-increasing complexity.

Many telcos now find themselves burdened by a commercial engine that is complex to manage, customer journeys, and service models that are challenging to execute, and an underlying IT operation that is balky and unwieldy. Not surprisingly, when that happens, customer experiences deteriorate, and employee motivation falls. As telcos struggle to overcome these obstacles, they face pressure from a new breed of radically simple and digital-first insurgents that are not weighed down by legacy products, journeys, and channels.

To address these challenges, forward-looking telcos are investing in providing personalized, simple, and digital-first customer experiences.

Bain & Company analysis of more than 150 telcos in 12 markets shows that telcos that have embraced an approach to products and processes that are simple and digital outperform their peers in customer loyalty and both top- and bottom-line growth. In addition, simple and digital superstars experienced annual revenue growth that was 1.3 percentage points higher than that of the laggards and annual margin growth that was 10.4 percentage points higher.

The analysis also points to opportunities for laggards to gain ground. Telcos that are lagging their peers can substantially boost their results through simplification and digitization of their core commercial engines, namely, products, services, customer episodes, and channels.

Consumers now expect to be able to research and buy almost anything with a few touches on their smartphones. Customers want clear and simple choices, not a large selection of complicated options. And they want simple and digital interactions. Telcos have done so much to enable the digital revolution across industries, but they have yet to fully embrace and capture the benefits of digitization themselves.

A key part of creating simple and digital experiences for customers is devising a digital-first omnichannel strategy. That involves defining a vision that puts the telco’s digital footprint (websites, microsites, apps, voice assistants, and bots) at the center of everyday marketing, sales, and service transactions. Telcos aim to establish digital experiences that are so smooth and simple that customers discover that it is quicker, easier, and more satisfying than doing the same thing offline. Companies nudge customers toward digital channels with a well-thought-through communication strategy and carefully crafted incentives.

That does not mean physical channels should be neglected. Customers who do want to use other channels should find the experience seamless as they move back and forth between web, app, social networks, stores, and contact centers. As the company’s digital-first strategy unfolds, it will be able to optimize its investments in stores and contact centers.

To make this digital-first vision a reality, telcos need to invest in underlying analytical and technology platforms. They also need to reorient their marketing from a traditional push model that often relies on human outreach to a pull approach that is more suited to digital channels.

Telcos that take these steps can dramatically reduce volumes of calls that come into contact centers by 50 percent or more. Telcos can also significantly cut costs by shrinking their physical store footprint and pulling back on sales through third-party retailers. Leading players strive to have more than half of their sales transactions and more than 80 percent of their service transactions take place in digital channels.

Telcos are unlikely to achieve customer-centric simplification and digitization until they tackle the issues of legacy IT and organizational complexity. Companies that successfully transform their commercial engine reboot their IT systems, embrace the importance of data and artificial intelligence (AI), and significantly overhaul their operating models.

Telcos need to invest heavily in building data, advanced analytics (AA), and machine-learning capabilities. While telcos have vast amounts of customer data, most of it is fragmented and underutilized. By more effectively harnessing that data, telcos can glean sharper insights into customer needs and behaviors. Using AI and AA to monitor interactions through multiple touchpoints – including websites, apps, social media, contact centers, and chats – telcos can gain a 360-degree view of their customers. Using machine learning, companies can offer personalized products to discrete segments of customers. As companies and their customers become more digitally adept, more transactions will be handled by voice and chat bots, saving time for the customer and reducing costs for the company.

Fixing IT and understanding data are essential, but there is also a third critical element: the operating model. Simple and digital leaders revamp their operating model so that marketing, products, operations, and IT act in unison. This requires a customer-centric organization in which there is clear end-to-end ownership of customer journeys and agile ways of working to bring products and services to the market quickly. Commercial and technical roadmaps must be in sync, meaning chief marketing officers need to think like chief information officers, and vice versa.

Complexity that has accumulated over years, even decades, takes time and effort to unravel. Telcos have different starting points, but each company has the potential to improve its competitive position by becoming simple and digital.

These simple and digital transformations require a leadership team committed to challenging established thinking. Companies form handpicked, cross-functional teams that adopt a customer-centric, agile way of working. On the agenda is nothing less than an overhaul of the entire commercial engine. Telcos that take these steps see substantial benefits in terms of cost, revenue, margins, and customer loyalty. These results give them the confidence to push their efforts even further – thus replacing the endless loop of complexity and despair with a cycle of simplicity, growth, and success, concludes the Bain report.

You must be logged in to post a comment Login