Trends

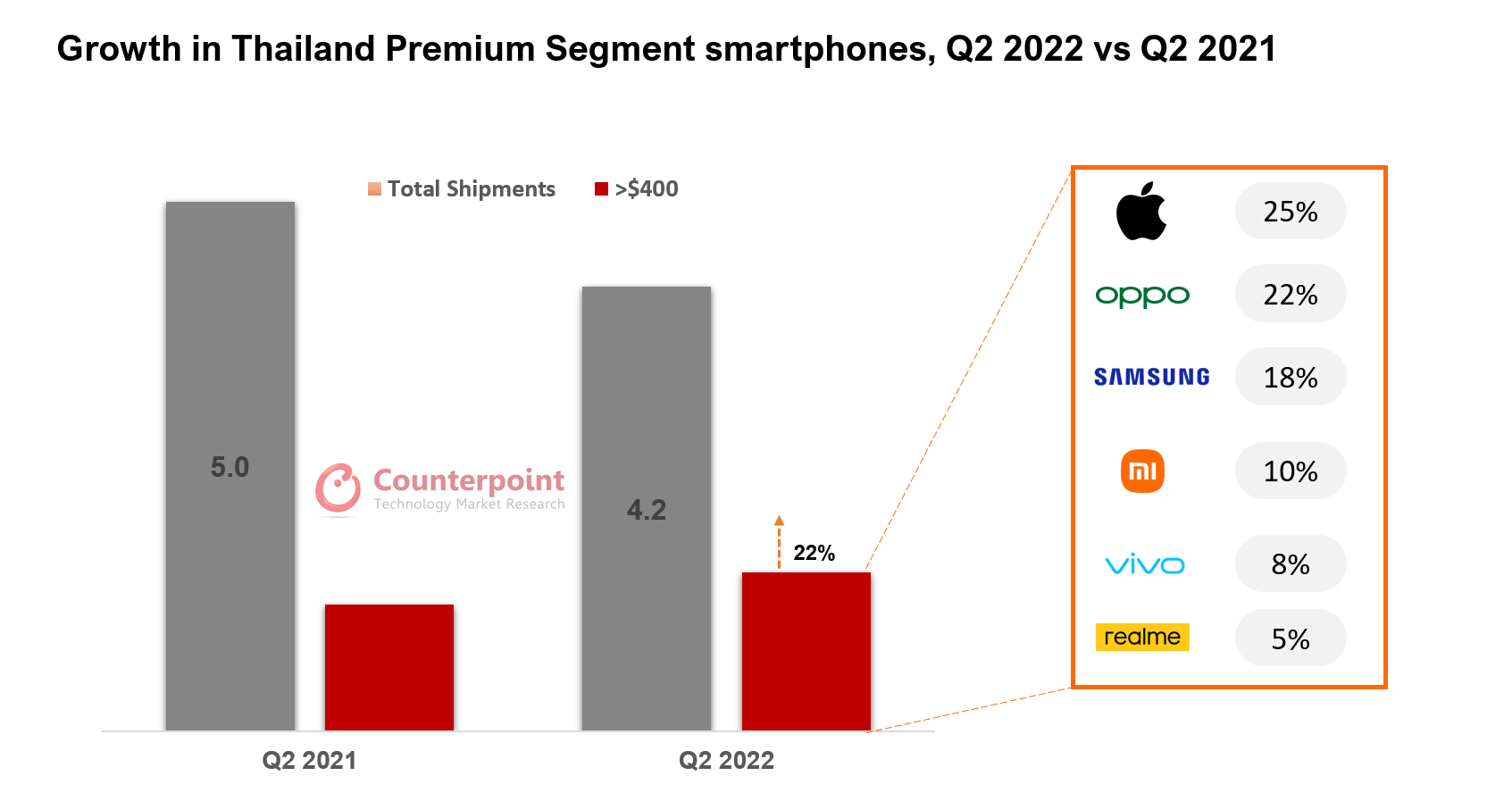

Thailand premium smartphone market grew 22% YoY in Q2 2022

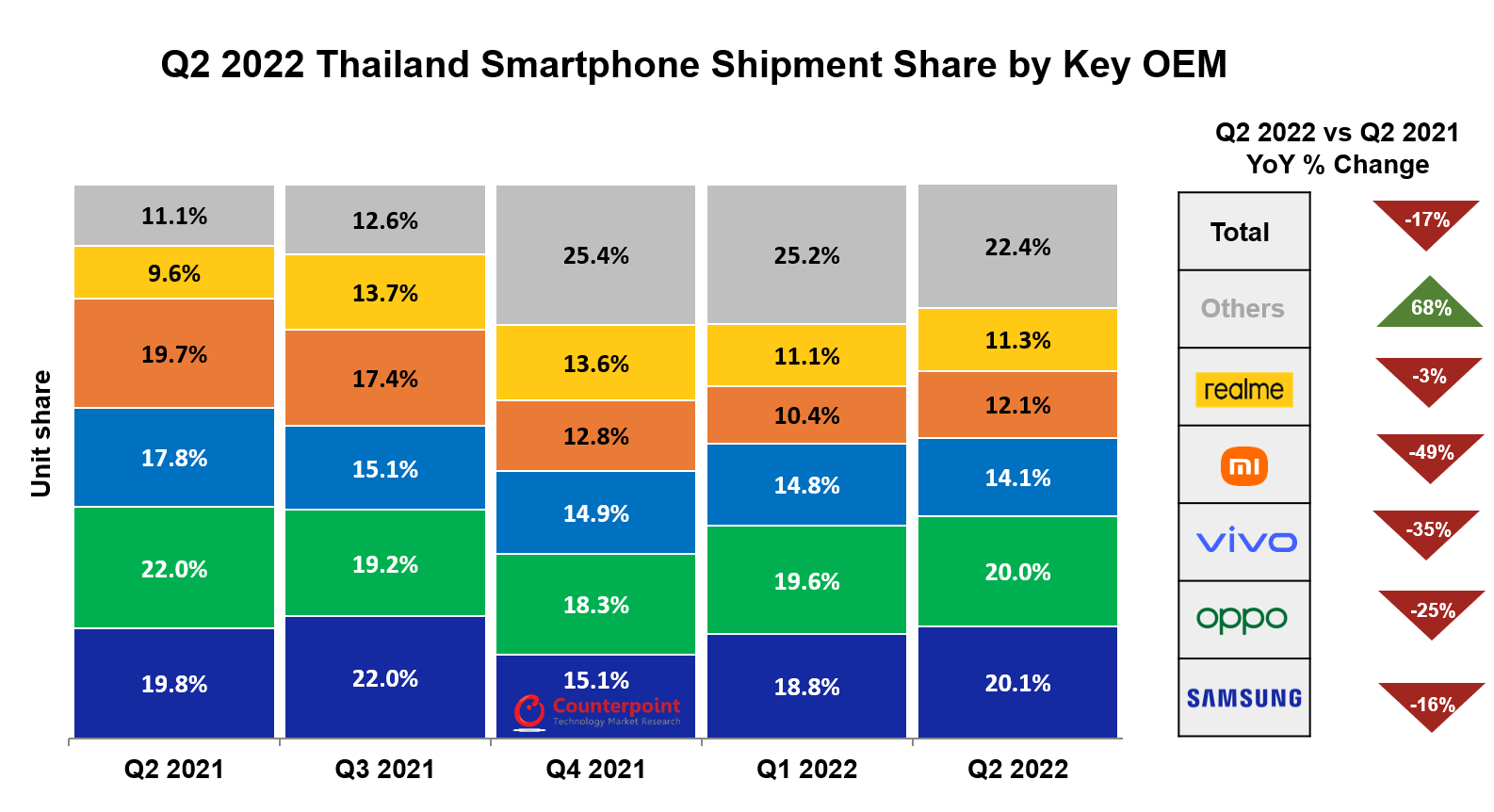

Thailand’s smartphone shipments fell 17% YoY in Q2 2022 due to continued volatility in the macroeconomic situation, according to Counterpoint’s latest Monthly Thailand Smartphone Channel Share Tracker. The macroeconomic turbulence has impacted Thailand more than its neighbors like Indonesia and Philippines, which is evident from the reduced consumer demand over the last two quarters. The inflation rate rose to 7.66% in June, the highest in 14 years. However, premium smartphone shipments (>$400) managed to buck the trend and grew 22% YoY in Q2 2022.

Discussing the factors that affected the shipments in Q2 2022, Senior Analyst Glen Cardoza said, “Thailand has a decent share of consumers who can maintain a good financial standing during this economic slowdown. It is this type of consumer who looks to purchase at least a mid-tier smartphone even in such an economic scenario. With food and related categories being hit the hardest by inflation, consumers who would consider buying a low-tier smartphone are not taking that decision right now. This has resulted in a 23% YoY drop in shipments for smartphones priced less than $250.”

While low-tier smartphones are facing the macroeconomic heat, the higher tiers are balancing the demand in Thailand. Smartphones priced more than $400 have increased their sales substantially in the country over the last two years. In Q2 2022 itself, premium models of brands like Samsung, OPPO, vivo and realme saw an increased demand with every new launch in this category. Apple is always sought after in Thailand, but it has mostly covered the ultra-premium segment. Top Chinese brands have branched out from low- and mid-tiers to the higher price brackets, providing consumers with a much-needed variety in the post-COVID-19 economy. Gaming is another aspect that these brands are promoting better than Apple.

On the operators’ side, 5G smartphones are increasingly finding a place in their packages. Despite a YoY decline in overall shipments in Q2 2022, 5G volumes increased 20% YoY. Samsung and OPPO led this increase with their 5G models.

Operators like Dtac are offering free SIM cards to tourists entering the country as part of unlimited package deals. Dtac has also started trade-ins and e-waste collection at its locations. AIS and others are building a better broadband system with AI-powered smart routers especially targeted at consumers who work and learn online, along with the growing number of gaming aficionados in the country. All these developments are boosting smartphone appeal despite the tumultuous economic situation.

While the Thai Baht is at its weakest, there are factors that are helping the smartphone market to rebound:

- Improving tourism

- Increasing domestic production

- Growing exports

- Government initiatives to control inflation

The country’s commerce ministry has warned that price pressures will move into Q3 2022. But it is quite possible that the smartphone market will start seeing a recovery towards the end of Q3 2022 itself. The coming months should see an uptick in pent-up demand. The online share of smartphone shipments saw a YoY rise of around 3% in Q2 2022 to 22%. The coming months will see this share increasing due to focused online marketing by e-commerce players and OEMs. Q4 is likely to be the key quarter in Thailand’s smartphone market revival in 2022.

CT Bureau

You must be logged in to post a comment Login