CT Stories

Test and measurement industry is on a strong wicket

The leading test and measurement equipment players reported strong second-quarter revenues and earnings globally.

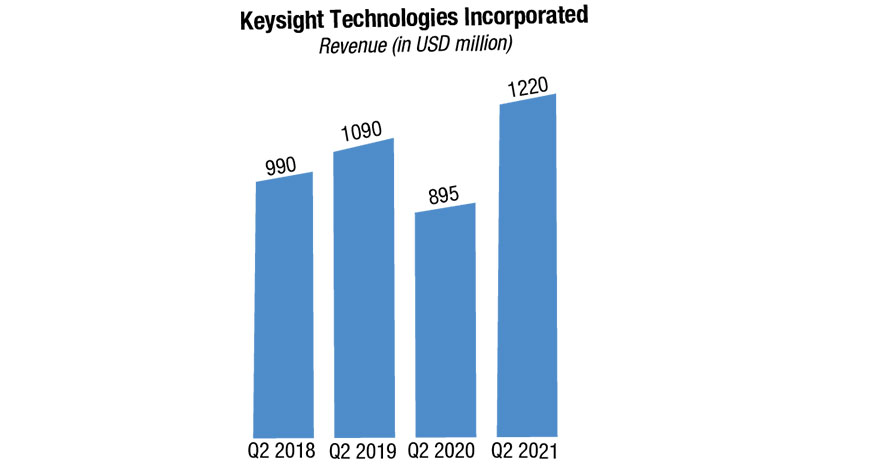

Keysight Technologies Incorporated’s orders grew 22 percent from USD 1.09 billion last quarter to USD 1.33 billion for the quarter ending April 30, 2021. Revenue grew 36 percent from USD 895 million last year to USD 1.22 billion this year. The company’s GAAP net income was USD 186 million while non-GAAP net income was USD 270 million. Cash flow from operations was USD 402 million.

“Keysight delivered an exceptional quarter and achieved record orders, revenue, and free cash flow. Our second-quarter results are indicative of our leadership position across a diverse set of markets. As an enabler of leading-edge disruptive innovation, Keysight is well-positioned to capitalize on multiple waves of technology that are fuelling our growth for the long term,” said Ron Nersesian, Chairman, President and CEO, Keysight Technologies Incorporated.

EXFO Incorporated reported sales of USD 69.3 million. Its bookings attained USD 79.3 million, up 8.9 percent year-over-year for the quarter ending February 28, 2021. “EXFO delivered another solid performance in the second quarter of 2021, marked by a robust book-to-bill ratio of 1.15 and healthy cash flows from operations of USD 14.7 million,” said Philippe Morin, CEO, EXFO Incorporated.

For the quarter ending June 30, 2021, National Instruments Corporation announced 2Q21 revenue of USD 347 million, up 15 percent year-over-year. 2Q21 was a record quarter for the company in terms of revenue. The company enjoyed record 2Q orders, which were up 33 percent year-over-year. It had a strong GAAP operating income of USD 25 million, which was up 50 percent year-over-year. It posted a record non-GAAP operating income for the second quarter of USD 60 million, up 38 percent year-over-year. “We were very pleased with the strong results in the second quarter with revenue exceeding the high end of guidance. Momentum in customer demand continued with the total value of orders for 2Q up 33 percent year-over-year. This represents record orders for a second quarter and double-digit growth year-over-year across all industries and all regions. We believe these results are proof that our strategy is working, and our continued market focus is paying off,” said Erik Starkloff, President and CEO, National Instruments Corporation.

For the quarter ending July 4, 2021, Teledyne Technologies Incorporated reported record sales of USD 1121 million, which is an increase of 50.8 percent compared to last year. “The second quarter was truly a record for Teledyne with sales, operating margin, and earnings, excluding acquisition-related costs, significantly greater than any prior period. We achieved double-digit organic growth with such sales from digital imaging, environmental and electronic test and measurement instrumentation increasing from 17 percent to nearly 25 percent year-over-year,” said Robert Mehrabian, Executive Chairman, Teledyne Technologies Incorporated.

Multiple acquisitions of quantum computing companies. Quantum systems use quantum bits or qubits to process data. However, performance-limiting errors in qubit hardware present a key challenge to large-scale quantum computing. Keysight and Rohde & Schwarz made acquisitions in this space.

Keysight Technologies Incorporated acquired Quantum Benchmark Incorporated, which specialises in performance validation, error diagnostics, and error suppression software used in quantum computing.

The acquired, venture-backed Canadian company, has worked with several companies including Google LLC, IBM Corporation, and Fujitsu Laboratories Limited to support various quantum-computing initiatives.

Quantum Benchmark Incorporated is Keysight Technologies Incorporated’s third quantum-computing acquisition in the past few years.

The company says the purchase of Quantum Benchmark Incorporated supports its goal to “deliver a comprehensive quantum portfolio addressing customer needs across the physical, protocol and application layers.”

Quantum Benchmark Incorporated’s technology improves the quality of qubits across quantum hardware platforms, which helps quantum hardware makers design better qubits.

Rohde & Schwarz GmbH & Co KG acquired Zurich Instruments Limited to position its test solutions for a quantum-computing world. Zurich Instruments Limited provides advanced test and measurement systems for scientific and industrial research. The company also has a strong network and extensive experience in academic physics research. R&S plans to run the company as an independent subsidiary.

Rohde & Schwarz GmbH & Co. KG expects quantum technologies to significantly shape the high-tech industry in the coming decades. The company believes that quantum computing’s potential for industry and research is enormous. It believes quantum computing is a future trend that involved billions in government subsidies and industrial investment. To operate and maintain a large-scale quantum computer, multiple highly specific test and measurement solutions are needed. Rohde & Schwarz GmbH & Co. KG and Zurich Instruments Limited will be able to provide these holistic solutions.

The Viavi-EXFO tussle. EXFO Incorporated’s founder, Executive Chairman, and majority shareholder, Germain Lamonde, offered to take his company private by offering USD 6 per share.

In EXFO’s special meeting of its shareholders on August 13, a significant majority of shareholders voted in favour of the special resolution (the Arrangement Resolution) approving the previously announced plan of arrangement under Section 192 of the Canada Business Corporations Act pursuant to which 11172239 Canada Inc. will acquire all the issued and outstanding subordinate voting shares of EXFO, other than the subordinate voting shares held by Germain Lamonde, G. Lamonde Investissements Inc., 9356-8988 Québec Inc., and Philippe Morin (the Excluded Shares) for USD 6.25 per subordinate voting share in cash (the Arrangement).

Backgrounder. Viavi Solutions Incorporated had made a public offer to EXFO of USD 8 per share, valuing the company at USD 460 million. However, Germain Lamonde had quashed Viavi Solutions Incorporated’s offer. Last November, Viavi Solutions Incorporated had made two unsolicited offers to acquire EXFO Incorporated, first at USD 4.75 per share and then at USD 5.25 per share.

Lamonde said that Viavi Solutions Incorporated’s pursuit strategy is “a bit aggressive” and “a conscientious decision to try to create noise on the line during the offer that’s on the table” and frustrate EXFO Incorporated’s minority shareholders.

Lamonde reiterated that on August 13, “the only thing that’s on the table is whether to see EXFO remain public or return to going private,” Lamonde says. “I’m absolutely fine with both options. But there is no option for EXFO to be acquired.”

In response, Viavi Solutions Incorporated retorted, “Viavi is making our binding proposal of USD 8.00/share for EXFO to demonstrate our deep belief in a superior valuation for not only that company but also for the entire test and measurement sector, which is poised to benefit from the evolution of 5G, fiber, high-speed optical, and hyperscale for years to come. Lamonde’s offer of USD 6 is not only inferior to the Viavi proposal, but it also belies the promise of EXFO’s own future success, as reflected in the company’s recently announced fiscal third-quarter 2021 financial results, including an increase in bookings of 47.2 percent year-on-year to USD 87 million, with a book-to-bill ratio at 1.20. The strength of the combined teams and technology – including retention of EXFO’s presence in Quebec as a center of excellence – combined with significantly greater scale and financial resources, would enable strong investment in growth while achieving greater operating leverage than either company could do alone.”

Germain says he has been contacted by EXFO Incorporated’s customers – many of whom dual-source, using both EXFO Incorporated and Viavi Solutions Incorporated’s solutions. They have expressed the concern that if EXFO Incorporated is acquired, the market will become less competitive and the price of T&M equipment will increase.

Lamonde says, “To me, what’s very important is that I want to keep EXFO as a strong voice in the market. EXFO is an innovation engine that is pushing the industry and competitors forward as they face new challenges in deploying and assuring ever faster wired and wireless network technologies.”

A recent acquisition by Motwane Manufacturing Company Private Limited. An Indian engineering company, with a strong focus on R&D and IoT, Motwane, acquired Telemetrics Equipments Private Limited, a market leader that provides a range of highly specialised underground cable fault-locating equipment. With this acquisition, Motwane further expanded into providing smart test and measurement solutions.

Underground cable fault location is a definite growth area as urbanization and distributed renewable energy generation are increasingly leading to power cables being laid underground.

“Telemetrics is a very well-run company and a trusted brand. We are pleased to welcome it to the Motwane Group. The two companies will add value to each other’s offerings, and help create an Indian champion in the test and measurement space that can compete with the best globally” said, Gautam Khandelwal, Chairman, Motwane Group.

The Indian Electronic System Designing and Manufacturing sector too has seen steady growth over the past few years. This is the result of a shift in the country from pure-play systems or product designs to product development, and original design manufacturing. The growing complexity of products has spurred demand for precision testing at every stage of a product’s lifecycle. Hence, the growth of the Indian electronics industry goes hand in hand with the growth of the domestic T&M industry.

Currently, the size of the T&M market within the domestic ESDM sector is between USD 150 to USD 200 million and is expected to grow rapidly. Frost and Sullivan, expects demand for T&M equipment in India to touch USD 300 million by 2022.

The Indian T&M is driven by both domestic and global demand. The growth of end-user segments including automotive, aerospace, defence, and electronic design are driving growth. New opportunities will also emerge with the implementation of government initiatives like 100 smart cities, Digital India, and the push toward manufacturing defence equipment in India.

Within the automotive industry, the shift toward developing autonomous vehicles is increasing demand.

Also, as increasing numbers of vehicles are fitted with electronics components that are used in infotainment systems, and with components needed to provide adequate safety and connectivity, and as green mobility gains greater acceptance in the form of e-vehicles, the domestic T&M sector will grow even further. In addition, greater R&D across the electronics industry value chain will also spur demand.

There is a vast potential for telecommunications and mobile manufacturing in India. Already, the Make in India initiative is creating waves of optimism and opportunities, which are expected to give the domestic mobile manufacturing sector a further boost. Experts predict burgeoning opportunities in mobile handset manufacturing and allied verticals like cable TV, broadcasting, and mobile services.

The rapidly growing power sector too needs testing; demand for electricity in India is expected to continue growing swiftly over the next few years. To meet this demand, power generation, transmission, and distribution companies need to invest in accurate, reliable, and efficient equipment to protect their assets from failing.

Greater demand for green energy, especially solar power, is also expected to propel demand for T&M instruments. Over the next five years, nearly 100 GW of solar power is expected to be added in India.

Behind the high demand are factors like new technological developments, expanding end-user applications, and a growing need to validate the performance of equipment. In addition, factors like more stringent quality, safety, and environmental standards in manufacturing, maintaining, and using equipment are providing the requiste impetus.

Several additional trends are leading to the expansion of the sector. Manufacturers are becoming more aware of predictive maintenance, which is driving growth. Also, customers are demanding that manufacturers address complex process issues and as a result, T&M companies are innovating continuously. Such innovation is leading to the development of high-end devices that have unique features.

Maintenance department’s decision-makers are demanding multi-functional testing kits. Engineers have realised that instead of having many different testing kits for individual applications, it is better to use one kit that has multifunctional testing capabilities. Such tools have multi-domain applications as well.

Ensuring quality at increasingly lower costs is a challenge for testing managers and engineers. To test smart devices, organisations are transitioning from closed turnkey ATE systems and the status-quo of rack-and-stack box instruments to smarter test systems that have connectivity and problem-solving capabilities.

A focus on customised test equipment is also driving the market. Consequently, most low-end T&M equipment is now available with control options.

There is now a global need for a connected and safer world that will emerge, thanks to advances in the internet of things (IoT), machine-to-machine interaction (M2M), 5G, and millimetre.

Already, the proliferation of smart devices has started influencing the design and use of T&M equipment. Each smart device has to undergo a specific set of processes to ensure that it functions and is usable as intended. Behind each step are design, manufacturing, and testing procedures.

To meet this demand, T&M equipment will evolve accordingly. There will continue to be demand for embedded/portable T&M solutions, IoT test solutions that offer remote troubleshooting capabilities, and solutions that support the latest protocols and interfaces.

Shortly, the time to market for new devices will tighten. Manufacturers will strive to make higher-quality products with the result that products will become more complex.

End users, however, will not sense the impact of these developments. To ensure that smart device developers and manufacturers can reduce time to market and quickly manufacture quality products in high volumes, test techniques and solutions will continue to evolve.

The renting and leasing market too is seeing traction. These include the increasing adoption of consumer electronic devices, 5G rollouts in different regions, technological advances in networking and telecommunications, growing applications in material analysis, manufacturing analysis, research institutes, electronics, laboratories, commercialization of IoT services globally, the growing demand for high-performance and power-efficient electronic devices, and the rising penetration of modular instrumentation. The market may touch USD 9.43 billion

by 2026.

However, factors like the high price sensitivity of T&M equipment, absence of standards and protocols, lack of skilled workers, and the growing penetration of existing rental and leasing services may limit the industry’s growth.

Touchscreen technologies will revolutionize the T&M space. Equipment with the right hardware and a touch user interface will be more efficient and easier to use. However, merely adding a touch screen to an existing UI would not be enough.

The telecom market is being shaped by trends like consumers leading connected lifestyles, demanding more data than ever, and by the falling cost of smartphones. Consumer demand for high-speed connectivity will lead to providers increasing network capacity.

5G-related R&D in the telecom sector will create additional opportunities for the T&M sector, as being the best in 5G will depend upon tools that let providers explore new signals, topologies, and scenarios.

Just over the horizon lie a host of new technologies that hold the promise to reshape society. Innovative T&M solutions will be crucial to ensuring that these technologies realise their potential. The T&M industry, in India and across the globe, is poised for growth this decade and beyond.

You must be logged in to post a comment Login