Headlines of the Day

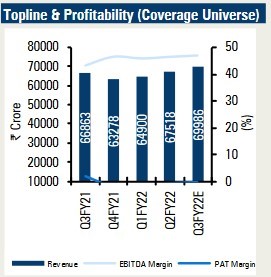

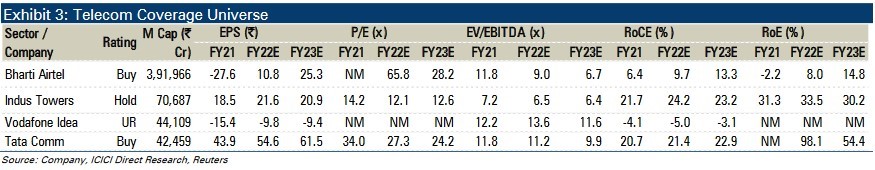

Telecom: Partial benefit of tariff hike to be seen! ICICI Securities

We expect subscriber addition momentum to moderate for the industry amid recent tariff hike. Reliance Jio (Jio) is likely to lead the subscriber addition with ~8 mn net adds mainly led by JioPhone Next launch. Bharti Airtel (Airtel), which is likely to add ~0.3 mn subscribers, with modest addition amid tariff hike led consolidation. On the other hand, Vodafone

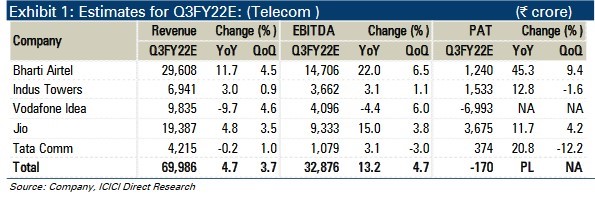

Idea (VIL) is expected to continue experiencing churn (albeit in a controlled level vis-à-vis earlier quarter) with subscriber loss of ~2 mn. ARPU growth will be seen for all telcos, led by partial benefit of tariff hike. We expect Jio, Airtel, VIL to report ARPU to be up 6%, 4%, 6% QoQ at ~₹ 149, ₹ 163, ₹ 116, respectively. The lower ARPU growth for Jio is owing to lag between tariff hike vs. peers and larger share of long duration renewals. For Jio, revenues are expected at ₹ 19,387 crore, up 3.5% QoQ. Airtel’s India wireless revenue is expected at ₹ 16,111 crore, up 6.1% QoQ. For Vodafone Idea, we expect overall revenues to grow 4.6% QoQ at ₹ 9835 crore.

Tariff hike to aid margins

Airtel India EBITDA margins are expected at 51.2%, up 160 bps, aided by tariff hike flow through. Overall consolidated margins are expected at 49.7%, up 90 bps. We expect PAT at ₹ 1240 crore for Airtel. For Jio, we expect EBITDA margins at 48.1%, up 10 bps QoQ and net profit of ₹ 3675 crore, up 4.2% QoQ. For Vodafone Idea, we expect margins at 41.6%, up 50 bps QoQ, aided by higher ARPU. The company is expected to post a net loss of ₹ 6993 crore.

Indus Towers to report stable numbers

Indus Tower is likely to report stable number during the quarter. We bake in tower and net tenancy addition of 2470 and 3500, respectively in Q3FY22. We expect rental revenues at ₹ 4290 crore, up 1% QoQ growth. Energy revenues would be up 1% QoQ at ₹ 2650 crores. Overall margins are expected at 52.8%, flattish QoQ.

TCom to witness gradual growth recovery

For Tata Communications (TCom), we expect gradual growth recovery and YoY growth in revenues after three quarters of decline, despite seasonally weak quarter wherein usage based revenues are lower due to holidays. The data revenue is expected to grow 2% QoQ (up 2.5% YoY) at ₹ 3203 crore. The voice revenues would continue to remain weak with 5% QoQ (14.7% YoY decline) decline at ₹ 575 crore. The overall revenue is expected to grow 1% QoQ at ₹ 4215 crore. Data segment margins are expected at 31% (down 240 bps QoQ as it had one-off benefits). Overall margins are expected at 25.6% (down 110 bps QoQ), as Q2FY22 had one off benefits.

CT Bureau

You must be logged in to post a comment Login