Headlines of the Day

Telecom: Industry revenue growth remains strong, ICICI Securities

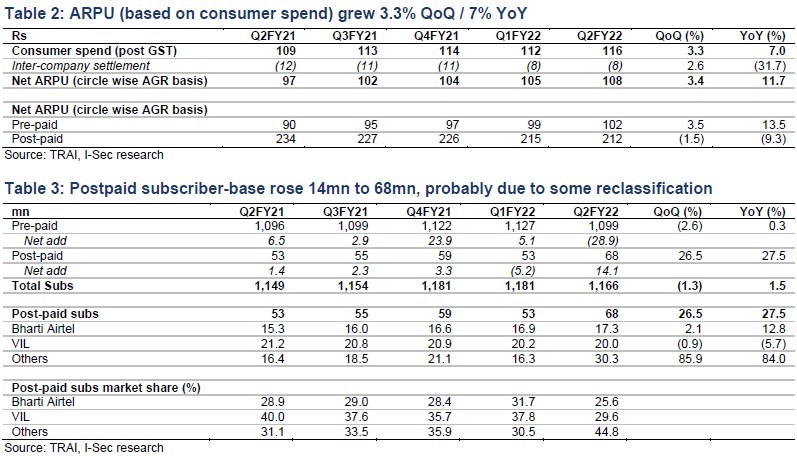

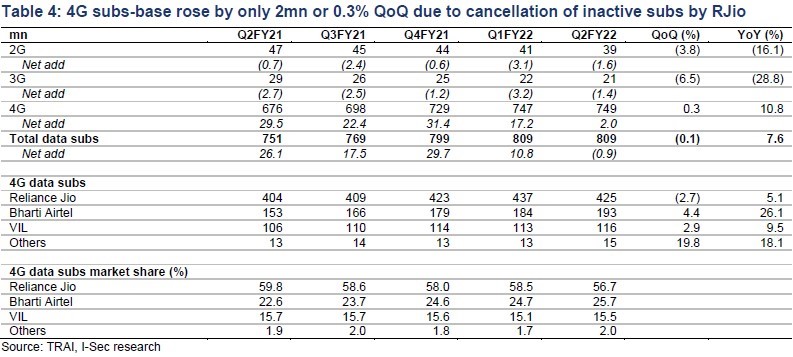

In Q2FY22, consumer spend on mobile services (post GST) rose 2.7% QoQ / 9.7% YoY to Rs409bn, aided by tariff rise in 2G base pack and shift from 2G to 4G. Postpaid net revenue rose 6.4% QoQ / 4.9% YoY on rising subscriber (sub) base. Prepaid net revenue grew 2.3% QoQ / 15.7% YoY and ARPU rose 3.5 QoQ / 13.5% YoY to Rs102. 4G sub addition slowed to 0.3% QoQ (net add: 2mn) to 749mn on cancellation of inactive subs by RJio. RJio’s 4G sub market share dipped 170bps QoQ (down 310bps YoY) to 56.7% while that for Bharti Airtel improved to 25.7%, up 100bps QoQ / 310bps YoY. FBB sub growth remains strong at 48% YoY for Bharti Airtel and 159% for RJio.

The Telecom Regulatory Authority of India (Trai) has released the sector’s performance indicator report for Q2FY22. Highlights:

• Consumer spend on mobile services (post-GST) rose 2.7% QoQ / 9.7% YoY to Rs409bn in Q2FY22 and net revenue (deducting inter-company settlements) rose 2.7% QoQ / 14.5% YoY to Rs381bn. ARPU (based on consumer spend) rose 3.3% QoQ / 7% YoY to Rs116 (Rs142 including GST) benefiting from base price hike in 2G and sub-base decline. Postpaid net revenue grew 6.4% QoQ / 4.9% YoY to Rs38.5bn in Q2FY22. Prepaid net revenue rose 2.3% QoQ (15.7% YoY) to Rs342bn. Postpaid ARPU (based on net revenue) dipped 1.5% QoQ (fell 9.3% YoY) to Rs212 and prepaid ARPU was up 3.5% QoQ (13.5% YoY) to Rs102. Prepaid revenue benefited on shift from 2G to 4G and decline in sub-base.

• 4G sub-base grew 0.3% QoQ (2mn net add) to 749mn and RJio’s 4G sub market share fell 170bps QoQ to 56.7% while Bharti Airtel’s improved 100bps to 25.7%. VIL’s sub market share rose 40bps QoQ to 15.5%. Industry-wide, 3G subs continued to decline fast and were down 1.4mn QoQ to 21mn.

Total sub-base contracted 1.3% QoQ (net loss: 15mn) to 1,166mn on RJio’s cancellation of inactive subs. Postpaid subs rose 26.5% QoQ (net add: 14mn, probably on some reclassification) to 68mn. Bharti’s postpaid sub market share dipped to 25.6% and VIL’s at 29.6%. Sequential market shares are not comparable.

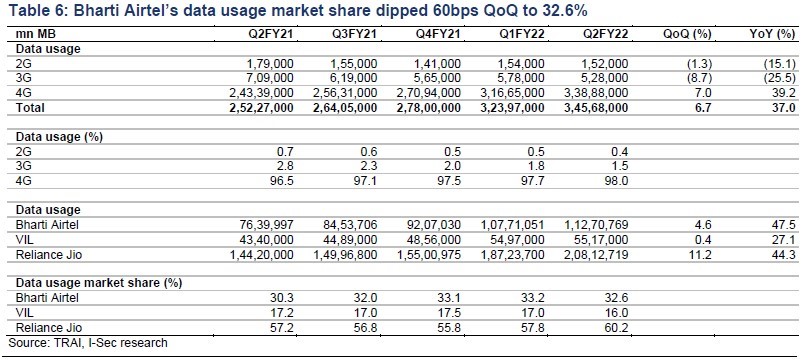

• Data usage market share fell 60bps QoQ for Bharti Airtel. Data usage grew 6.7% QoQ to 34,568-bn MB led by 4G segment growth of 7% QoQ to 33,888-bn MB (and contributed 98% to total data usage). 2G data volume dipped 1.3% QoQ and 3G data volume was down 8.7% QoQ. Bharti Airtel and VIL’s data usage market shares were 32.6% (down 60bps QoQ) and 16% (down 100bps QoQ) respectively.

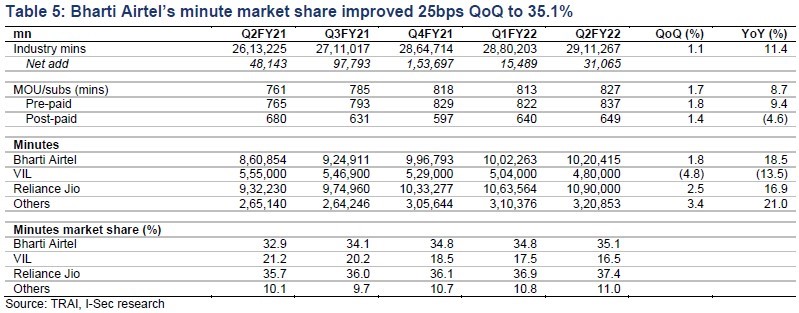

Industry minutes rose 1.1% QoQ to 2,911bn. Bharti Airtel’s minute market share improved to 35.1% (up 25bps QoQ) while VIL’s stood at 16.5% (down 100bps QoQ). RJio’s minute market share rose 50bps QoQ to 37.4%.

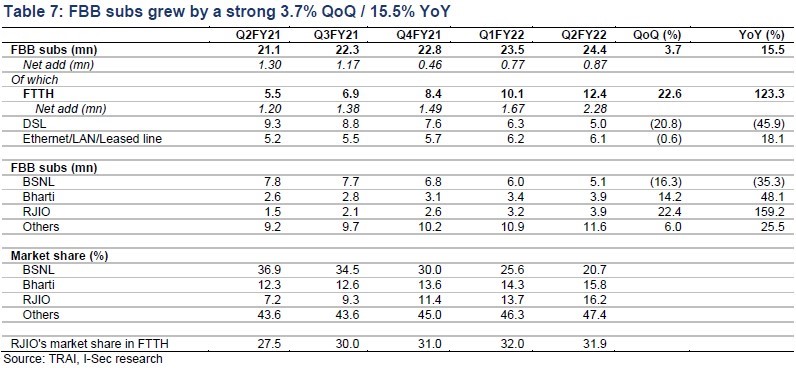

• Fixed broadband subs rose by a strong 3.7% QoQ (15.5% YoY; net add: 0.87mn) to 24.4mn. This was led by 22.6% QoQ / 123% YoY growth in FTTH subs to 12.4mn, while DSL continued to decline (down 20.8% QoQ / 45.9% YoY to 5mn). RJio’s market share inched up to 16.2% of total FBB subs while its share of FTTH subs was 31.9%. Bharti Airtel’s market share in FBB was up 150bps to 15.8% despite RJio’s aggression. BSNL’s market share dipped 490bps QoQ to 20.7%.

CT Bureau

You must be logged in to post a comment Login