5G Features

Telcos prepare for the next round of disruption

The entry of big tech companies in the private 5G network space is imminent as they have unlimited potential to invest resources toward delivering connectivity as a service for enterprises

Private wireless networks are continuing to show strong growth as more companies, government sectors, hospitals, and universities are moving in this direction for a variety of reasons. This transformation wave is expected to continue. 5G private wireless will be one of the growth engines that will continue to propel the wireless industry as a whole.

The networks are proliferating, but the road is paved with challenges. Enabling 5G private network use cases for Industry 4.0 puts significant demands on network performance. Overcoming these challenges requires a solid understanding of 5G private network use cases and their requirements. Complete understanding of the underlying standards, deployment options, and key 5G features enabling these networks is needed.

Private networks present the opportunity to take wireless into places and areas where there may not be a public 5G network. In other places, where a public 5G network exists, private 5G can offer additional security, privacy, improved data sovereignty, the ability to offer application prioritization with quality of service and increased management and control.

Sectors like manufacturing, transportation, and public sector utilities are seeing maximum interest for private 5G networks. Factory automation is poised to be one of the biggest use cases for enterprises.

The Indian scenario

Just prior to the 5G auctions, the Union Cabinet announced its decision and allowed direct allocation of spectrum to private captive networks. The process and pricing guidelines are being put in place. The Indian telcos’ efforts to keep away the enterprises from the private network space, that jeopardize 40 percent of their revenue potential, for which they are investing amounts in setting up networks has come to naught.

The telecom department is identifying spectrum bands for the direct allocation of airwaves for private 5G networks. And then plan to seek recommendations from TRAI on pricing, indicating the government is unlikely to hand out airwaves administratively as was being demanded by some tech companies.

Adani group is leading the way. The company has acquired spectrum. ADNL acquired the right to use 400 MHz of spectrum in the 26 GHz millimeter wave band worth Rs 212 crore for 20 years in the recent 5G spectrum auction. Subsequently, it was granted a unified license for access services, which enables it to provide telecom services in the country. The company has indicated that it does not plan to enter the consumer mobility space but to focus on building 5G private networks for its own digital platform encompassing super apps, edge data centers, industry command, and control centers. The group is fulfilling the need for ultra-high-quality data streaming capabilities through a high-frequency and low-latency 5G network.

Infosys, Capgemini, GMR, Larsen & Toubro, Tata Communications, Tata Power, and Tejas Networks are among more than 20 companies that have applied for direct allocation of 5G spectrum to set up private communication networks.

Rakuten Symphony is looking to partner with tech majors as Microsoft, Google, and Amazon, besides Indian software companies, such as Tech Mahindra and HCL Technologies to develop private

5G networks in India.

Wipro believes clients across industries, such as automotive, manufacturing, media, and energy and utilities, will be able to leverage 5G to create differentiators in their businesses unlike the previous 3G and 4G technologies. The company has not specified whether it would apply for private 5G spectrum directly from DoT. The Bengaluru-based software services exporter is working on a flexible model, if clients seek a hybrid setting of leasing the spectrum from telecom companies or pay-per-use of the technology.

L&T Technologies seems inclined to taking the direct route for non-public captive networks, as it has applied for spectrum for its facility in Mysuru. While Tech Mahindra is pushing for spectrum to end users at zero cost, non-tech companies have been seeking non-public captive or private 5G networks to be directly allocated to them. Intel is collaborating with enterprises to deploy 5G networks at their factories. Recently, GE Healthcare in India has shown interest in a 5G innovation center.

Separately, the three telcos are also looking to offer private 5G network as a service to enterprises through the network-slicing capability offered by 5G technology.

“Think of it as a 5G LAN solution that is purpose-built for your business need. A lot of enterprises are looking at campus-based deployments,” says Arvin Singh, head of 5G and edge innovation with Verizon Business.

“We have taken a position where we will support both, enterprises and telecom carriers,” says Debika Bhattacharya, senior vice president of 5G & Enterprise Solutions, Verizon Business. “In India, we can help companies with private 5G once the spectrum becomes available,” she added. The telecom company maintains partnerships with Indian telcos Jio and Airtel and with system integrators, Tata Consultancy Services (TCS) and Infosys. The US-based telecom carrier is conducting trials to demonstrate use cases following a partnership with Amazon Kuiper.

Airtel recently announced the successful trial of India’s first 5G private network at the Bosch Automotive Electronics India (RBAI) facility in Bengaluru. Airtel’s on-premise 5G captive private network was built over the trial 5G spectrum allocated by DoT. Airtel has partnered with Nokia to offer LTE private networks to enterprises. Airtel and Tech Mahindra have also announced a strategic partnership to jointly develop and market enterprise-grade digital solutions across 5G, private networks, and cloud. Capgemini is also working with the telco under a strategic partnership to develop 5G use cases for enterprises.

Vodafone Idea has partnered with Athonet, a private LTE and 5G solutions provider. L&T Smart World & Communication and Vodafone Idea have created a use case for a private 5G enterprise network in India.

Tata Consultancy Companies (TCS) plans to faucet enterprise alternatives within the personal telecom house with indigenous next-gen know-how after its profitable 4G trials and anticipated business rollout for BSNL. “The chance (within the personal sector) is there to qualify the stack for different telecom operators, which is a pure development of rising the enterprise,” said N Ganapathy Subramaniam, chief working officer, TCS.

The telcos will always have a role and some contribution to make in this, irrespective of whether they own the spectrum, or the spectrum is with the industry. The adoption of 5G for industries is an ecosystem play.

Issues remain between the telcos and the enterprise. Arguing that private enterprises from non-telecom backgrounds would not have the financial and technical know-how to set up private 5G networks, the telcos believe a new category of pseudo-TSPs may come up. They would provide wet leasing of installation and maintenance of private network service. If enterprises take private 5G from the TSPs, a dedicated network slice can be provided. They will also get quality-edge computing, radio segmentation, spectrum, 5G Core, network and device lifecycle planning, based on their ecosystem. TSPs could also establish private networks for enterprises using spectrum that they have acquired. Or, they can lease out spectrum to enterprises that can then establish their own networks.

Telcos are taking action and brokering important, relevant partnerships that can help them secure and retain lucrative enterprise business and not miss out on the business growth opportunities that are emerging in the enterprise services sector.

They are forming partnerships with the hyperscalers, such as Amazon Web Services, and Microsoft Azure, and also developing offerings that deliver scalability to businesses, have a global footprint, which include cloud- and edge-computing capabilities, and incorporate data analytics applications. Google is the latest major technology company to jump into the private wireless networking market.

Indeed, a veritable battle royale of competition is shaping up as big wireless network operators, such as Verizon and AT&T, compete with cloud computing companies like Microsoft, AWS, and now Google; startups like Celona and Betacom; systems integrators like Dell and HPE; cellular equipment vendors like Ericsson and Nokia; industrial equipment providers like Siemens and Honeywell; and traditional enterprise networking vendors like Cisco and Motorola Solutions.

As well as teaming up with industry experts to help enterprises on their digital transformation journeys, telcos are seeking out key partners to help boost their security services capabilities. For example, Telefónica’s digital business division, Telefónica Tech, has partnered with Constella, a US provider of digital-risk protection and identity-threat intelligence, to offer improved digital-threat protection for consumers, and small and medium enterprises (SMEs).

The lines between all the competitors are decidedly unclear. For example, network operators have often partnered with cloud computing companies to offer private wireless networking products and services to enterprises. Similarly, small software startups frequently partner with large hardware suppliers to round out their own private wireless networking offerings. Executives in the space often argue that a certain amount of cooperation will be required to fully cash in on the private wireless networking opportunity, given that few companies offer the entire range of necessary products and services.

It is also clear, though, that some players will come out ahead, while others will come up short. Thus, tracking the companies working to supply services directly to enterprises – like Google – is important since they are hoping to be the primary connection between enterprise customers and other vendors.

How the private wireless networking space shakes out is anyone’s guess. But in these early days, it is clear that the market is up for grabs, and every player is hoping to snatch a piece of the pie.

Worldwide, 55 countries have deployed private networks, based on LTE/5G or been assigned 5G-suitable private network spectrum licenses. In addition, there are private mobile network installations in various offshore locations serving the oil and gas industries, as well as on ships. According to Global Mobile Suppliers Association, 794 customers have deployed private networks, out of which 37 percent (297) are powered by 5G. Around 75 of these 297 are used in manufacturing. Twenty-five countries already have dedicated private networks, or are considering it.

Germany has reserved 100 MHz in the 3.7–3.8GHz band for private companies and opened up the 26GHz band last year. Until mid-March 2022, the German regulator BNetza had awarded 201 spectrum licenses for private 5G networks in the 3.7–3.8GHz band and 10 in the 26GHz band. Spain too has approved a plan to set aside 20 MHz in the 2300–2400MHz range for enterprise private networks.

Several countries including the US, UK, Germany, Japan, and South Korea allocate spectrum for private networking, and CSPs have spectrum that can be extended for private use as well. In the US, private network solution partners can also utilize our spectrum access system (SAS) to leverage the Citizens Broadband Radio Service (CBRS).

In the Netherlands, ports are already making private use of the 3.7 GHz spectrum released in the 3.5GHz band through auction in the year 2020. Earlier, there was relatively little traction around 5G demand from the industries and enterprise segments, but we see CBRS as a catalyst for private networks in the US market. Organizations, such as Utah Inland Port Authority (UIPA), Chicago O’Hare International Airport (ORD), etc., have deployed private networks using CBRS spectrum, plus there are several network trials running on CBRS.

Similarly, there are several other markets to set aside spectrum for private licensing. There are hundreds of enterprises from manufacturing, mining, ports, education, public sector, and various other verticals to have deployed or testing private networks, according to Counterpoint Research.

These networks are typically deployed by entities other than MNOs, such as network equipment manufacturers, tower companies, and Wi-Fi gear providers to name a few, Examples include:

Bosch setting up private 5G networks in about 250 of its locations in partnership with Nokia; and Volkswagen constructing its own 5G island in its manufacturing plant in Dresden, Germany.

KUKA and Lufthansa Technik too have set up their own private networks by acquiring licenses directly from the regulator and without any auction.

There is a strong case for enterprises to construct their own private networks, which include increased security, lower latency and congestion, greater network control, leveraging existing campus infrastructure, such as indoor Wi-Fi networks, and so on. Such networks are possible in 5G due to the increased availability of high-performance, low-cost network equipment with software that assists self-configuration.

These private networks can also be shared for public use either within the campus itself or in adjacent outdoor areas. This complementarity of a private network for public use has enabled the formation of neutral hosts. A neutral host company provides wholesale infrastructure-sharing services through a digital platform to the downstream markets, enabling customers take advantage of economies of scale and scope of local networks.

Further, the radio network slicing and network function virtualization as part of the 5G network architecture, enable the neutral hosts to apportion bandwidth across public and private networks with associated quality of service requirements. This is a paradigm shift from what we have been witnessing prior to 5G. For example, until now, the MNOs have been sharing their network elements partially or fully with the mobile virtual network operators (MVNOs) to provide service.

In landline, local loop unbundling (LLU) is the methodology for sharing the network elements ranging from passive copper wire/optic fiber to bandwidth by the MNOs to other internet service providers. Unfortunately, both MVNOs and LLUs have not been successful in many countries due to various economic reasons.

However, in the case of neutral hosts, the local infrastructure built by non-MNOs can possibly be shared with the MNOs to provide services. The earlier form of neutral hosts was tower companies, such as American Tower Corporation or Indus Towers that leased their passive tower infrastructure to multiple MNOs.

However, in 5G, the sharing of the network elements by the neutral hosts to MNOs can range from passive infrastructure to network slicing, and even spectrum sharing. The MNOs, on the other hand, also benefit without substantial sunk cost in infrastructure deployment in local areas.

The sector remains in its infancy, and it will need to show some real traction in order to gain steam. Also, is a very good chance that traditional, incumbent telecom companies – the Verizons and Ericssons of the world – will not be able to cash in on the obvious advantages they have.

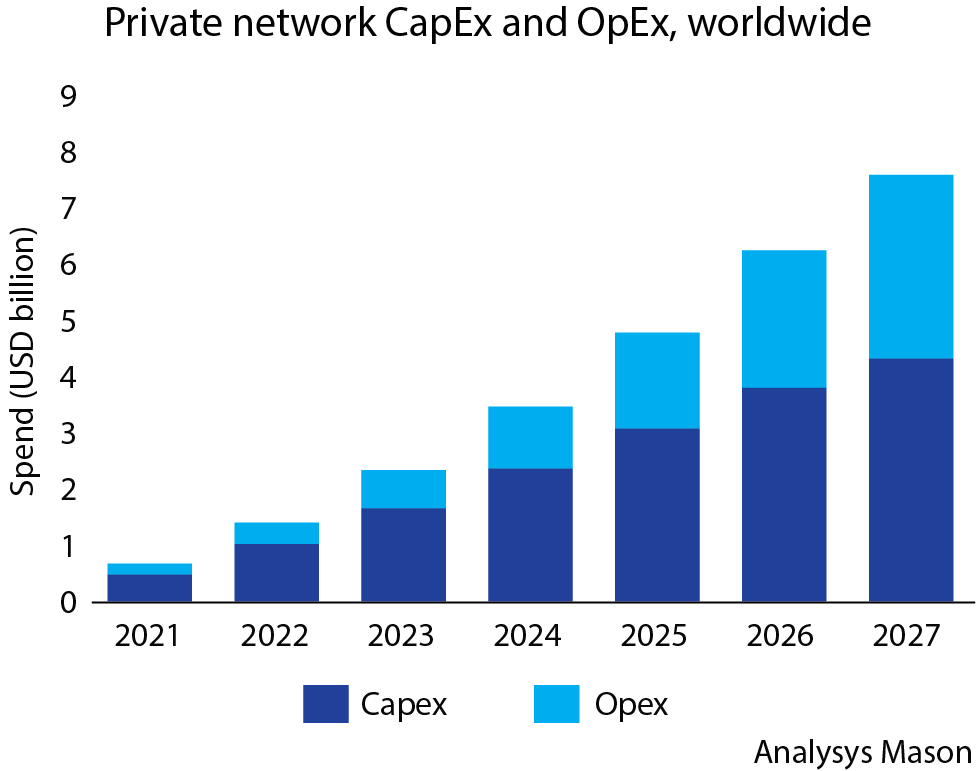

The number of private network deployments worldwide is growing rapidly. Analysys Mason forecasts that the number of networks will grow at a CAGR of 65 percent between 2021 and 2027 to reach 39,000. Spending on these networks will rise to USD 7.7 billion during the same period; this is a large figure in isolation but appears small when compared to the spending on public network infrastructure. However, private networks could act as an important new revenue stream for the mobile industry in the longer term and will also be an important bellwether of the success of 5G in the industrial sector.

What all this means for telecom’s pursuit of the private wireless networking opportunity is unclear. Ultimately, network operators remain the gatekeepers to commercial mobile networks and most licensed spectrum resources – a key position in the private networking industry. But preventing access to something is not a way to make money from it.

You must be logged in to post a comment Login