Headlines of the Day

Supply-side margin headwinds continue, ICICI Securities

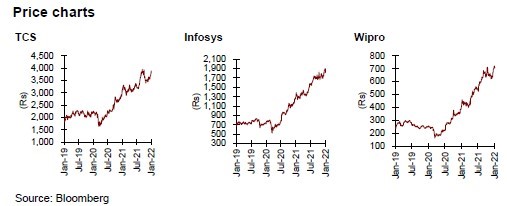

Despite Q3FY22 being a seasonally weak quarter, Infosys and TCS surprised while Wipro was below street expectations (though within guidance range). Robust growth in Europe and optimism around the retail segment for TCS / Infosys were key positives. Growth in verticals such as financial services and manufacturing further aided company performance. Supply-side cost pressures and drop in utilisations led to margin contractions (10-60bps) in all three companies. This was partly offset by higher offshore effort mix and other cost optimisation initiatives. Attrition increased sharply, by 220-540bps QoQ (LTM), with Infosys / Wipro being the most / least impacted. This is guided to stay elevated for at least another 1-2 quarters, and gradually flatten out thereafter. In light of the robust demand environment, Infosys increased its FY22 revenue guidance to 19.5-20% YoY CC (earlier 16.5-17.5%). Further, in line with its capital return commitment, TCS announced a buyback of Rs180bn at Rs4,500/share.

During the quarter, supply-side challenges continued as a result of which fresher intake has considerably increased across all three companies. While TCS achieved its H2FY22 fresher target during the quarter itself and plans to add further in the coming quarter; Infosys increased its annual recruiting target to 55k freshers from 45k earlier. Companies are making considerable investments in organic talent development. Further, to fulfil client commitments, sub-con costs across the board have considerably increased. These supply-side pressures in conjunction with impending cost headwinds like travel / office resumption should translate into largely lower than pre-covid margins. While deal pipeline commentary continues to be strong, expectations of multi-year upcycle / durable demand (base case expectation of consensus) call for higher share of longer duration / large-sized deals, in our view. Barring a few exceptions (e.g. Infosys, LTI, Mphasis), we expect growth rate of the industry to revert to pre-covid levels as the base effect normalises.

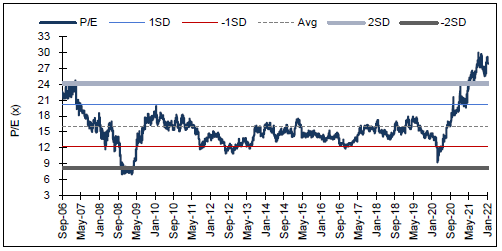

Overheated and lifetime high valuations of many stocks more than capture the near-term strength / predictability in earnings. TCS is now trading at 33x (+67% vs pre-covid long-term average of 1-year forward P/E). However, due to the recent buyback announcement and beat in Q3FY22, we expect the momentum to continue in the near term. Even as Infosys too rerated significantly (now at 32x vs historical average of 17x), we believe this is more sustainable given the growth leadership position the company regained and relatively more durable demand. Infosys remains our TOP BUY. Further, Wipro is now trading at 28x vs pre-covid long-term average of 15x. We remain cautious as we see current multiples to be at risk as disappointments on company performance continue.

TCS 1-year forward P/E

Infosys 1-year forward P/E

Wipro 1-year forward P/E

CT Bureau

You must be logged in to post a comment Login