5G Features

Technology spend is intact despite headwinds

Technology will continue to play central to play in business, helping to shape how to create sustained value, CTOs across the board are increasing their tech spending. There may at times be budget constraints, but over the long term, to them – tech is not so much cost as an investment that spurs productivity.

India is expected to have 500 million 5G users poised to generate revenues of USD 180 billion by 2030.

With Reliance Jio’s plan to complete pan-India 5G coverage by December 2023, Bharti Airtel’s by March 2024, and Vodafone Idea set to expedite rollout to have a presence in the geographies that matter to the telco, a 5G-ready ecosystem in place, and 10 percent of smartphones in India 5G-ready, a review is in order.

The telcos have three choices for offering 5G – dynamic spectrum sharing (DSS), 5G non-standalone (5G NSA with LTE signaling and 4G EPC), and 5G standalone (SA). Only 5G SA requires the new 5G Core, and many telcos seem content for the time being to stick with DSS and 5G NSA. At the same time, they are evaluating the option of moving 5G workloads to a public cloud, which is delaying the market uptake for 5G SA.

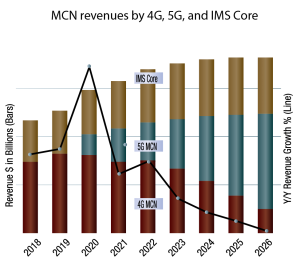

The slow uptake of 5G SA networks is decreasing the growth of the overall mobile core network (MCN), which also includes IMS Core and 4G Core (EPC). Dell’Oro Group forecasts worldwide MCN 5-year growth will be at a 3-percent compounded annual growth rate (CAGR).

The cumulative global revenue forecast for a mobile core network that includes IMS Core and 4G Core (EPC) for the period 2022 to 2026 is over USD 50 billion, at a 3-percent CAGR.

The MEC (multi-access edge computing) segment of the MCN market will have the highest CAGR, followed by the 5G MCN market and the IMS Core market. And as networks migrate to 5G SA, the 4G MCN market is expected to decline at a double-digit percentage CAGR.

5G standalone (SA) cores require more up-front costs and development, yet may provide faster and more scalable connections. However, SA can bring complexity in running multiple cores in the network. The type of 5G cores currently deployed remains dominant with about 75 percent of non-standalone (NSA) cores, using the pre-existing 4G network infrastructure.

5G core service-based architecture (SBA), a new type of core network that is emerging, will make 5G unique to delivering services for the new vertical industries, such as healthcare, public safety, the Industrial Internet of Things (IIoT), and more. In 5G SBA, all the network elements are defined, based on network functions (NFs). 5G SBA defined by Third-Generation Partnership Project (3GPP) introduces a set of NFs to provide the control and user plane functionalities. SBA utilizes the concept of network slicing within the 5G Core (5GC) to provide insights into the application scenario.

Designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks, this includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

GSA has identified 112 operators in 52 countries and territories worldwide that have been investing in public 5G SA networks in the form of trials and planned or actual deployments. This equates to almost 21.7 percent of the 515 operators known to be investing in 5G licenses, trials, or deployments of any type.

At least 32 operators in 21 countries and territories have launched public 5G SA networks, two of which have only soft-launched their 5G SA networks. In addition to these, 21 operators have been cataloged as deploying or piloting 5G SA for public networks, and 31 as planning to deploy the technology, showing that launches of 5G SA look set to continue apace. GSA has also recorded 19 operators as being involved in evaluations, tests, or trials of 5G SA.

And 955 organizations are deploying LTE or 5G private mobile networks as of December 2022. Dell’Oro identified 39 mobile network operators that have commercially launched 5G SA eMMB networks. Reliance Jio is one of the MNOs launching 5G SA eMMB networks.

GSA is totally in favor of standalone 5G. With a totally new, cloud-based, virtualized, microservices-based core infrastructure, some of the anticipated benefits of introducing 5G SA technologies include faster connection times (lower latency), support for massive numbers of devices, programmable systems enabling faster and more-agile creation of services and network slices, with improved support for management of service-level agreements within those slices, and the advent of voice-over-new-radio (VoNR) technology. The introduction of 5G SA is expected to facilitate the simplification of architectures, improve security, and reduce costs.

The technology is expected to enable customization and open up new service and revenue opportunities tailored to enterprise, industrial, and government customers.

This cloud-native technology is designed as a service-based architecture, virtualizing all software network functions using edge computing and providing the full range of 5G features. Some of these are needed in the enterprise space for advanced uses, such as smart factory automation, smart city applications, remote control of critical infrastructure, and autonomous vehicle operation.

This will be a potential source of new revenue for service providers, as digital transformation – with 5G standalone as a cornerstone – will enable them to deliver reliable low-latency communications and massive Internet of things (IoT) connectivity to customers in different industry sectors. The low latency and much higher capacity needed by those emerging service areas will only be feasible with standalone 5G and packet core network architecture.

In addition, the service-based architecture opens up the ability to slice the 5G network into customized virtual pieces that can be tailored to the needs of individual enterprises, while maximizing the network’s operational efficiency. Advanced uses for 5G NR are not backward-compatible with LTE infrastructure, so all operators will eventually need to get to standalone 5G.

In the transition to 5G, both NB-IoT and LTE-M play a role in enabling use cases that demand speed and are frequently crucial. Compared to LTE-M, NB-IoT is less suitable for situations where very low network latency is required. In situations where near-real-time data could be necessary, where LTE-M is a better fit, it will therefore be less common.

Not all of this depends on the communication standard that is selected. For fixed or mobile devices, NB-IoT was created as a pure data transfer method. It cannot seamlessly switch between cells and cannot serve applications that need low latency. In deep coverage, NB-IoT dramatically increases spectrum efficiency, system capacity, and user device power consumption.

“The coming migration to 5G standalone core networks is expected to allow for increased device density, reliability, and latency, opening the door to advanced enterprise applications,” according to several analysts from Deloitte’s Technology, Media & Telecommunications industry group.

5G SA’s big attractions for MNOs are the new service and revenue opportunities it creates. Along with near-zero latency and massive device density, 5G SA enables MNOs to provide customers – specifically enterprise customers – access at scale to fiber-like speeds, mission-critical reliability, precise location services, and tailored network slices with guaranteed service levels.

Deloitte expects the number of mobile network operators investing in 5G SA networks – with trials, planned deployments, or rollouts – to double from more than 100 operators in 2022 to at least 200 by the end of 2023.

Technologies most needed for optimized 5G systems include more focus on cloud-native architectures, improvements for massive Internet of Things (IoT) delivery, reduced power consumption and emissions, support for extended reality and the metaverse, enhanced AI/ML functionality, open-RAN alignment and support, and integration with non-terrestrial network.

Bharti Airtel and Reliance Jio have chosen two different approaches to deploy 5G technology. Airtel is going for a non-standalone approach, while Jio is opting for the standalone approach.

In Airtel’s non-standalone (NSA) approach, a telecom operator delivers the 5G radio signal over the existing 4G network infrastructure. A standalone (SA) 5G network, on the other hand, runs on entirely new network infrastructure (say new radio towers), which requires higher capital investments.

Jio will develop this new infrastructure in-house and leverage its partnership with Qualcomm. SA structure offers ultra-low latency, which basically means minimal time lag in data transfer.

However, the challenge here is that the ecosystem for this structure is not yet developed. Very few mobile phones can actually support a 5G SA structure.

To enable the new structure, Jio acquired 700MHz frequency waves along with the 3.3GHz waves in the 5G spectrum auction. This may not give Jio much of an advantage. According to Nokia, the 700MHz band does offer better area coverage, but the speed is only a little bit better than 4G. The same sentiments were echoed by Gopal Vittal in an earnings call. The difference in these approaches explains why Airtel will roll out 5G services at half the CapEx cost of Reliance Jio.

With 5G, the fiberization in the country will need to increase by about three-fold to 60 million fiber kilometers (km) annually, driven by the tower and small-cell fiberization. The low level of fiberization at present will necessitate network CapEx of ₹1.5–2.5 lakh crore in the next 2–3 years, according to a recent Crisil Research finding.

Currently, out of 2,307,068 base transceiver stations (BTS), only 793,551 BTS are connected to fiber, accounting for a total of 34.4 percent in the country. Some of the large states, including Delhi, Uttar Pradesh, Bihar, and Gujarat are merely 30 percent fiber connected, way far behind the set target of 70 percent, and a few states like Himachal Pradesh are not even 30 percent fiber connected presently. The CapEx requirement would be around ₹45,000 crores to reach 70 percent tower fiberization by 2024.

While the current capacity per tower site is about 200 Mbps for 2G/3G/4G services, for 5G service, the capacity needed for each site will increase to 1–5 Gbps, which will require fiberized backhaul. Larger towers, network densification, translating to 1000 base stations every square kilometer, backhaul radios, antennas, and tower street furniture, 500 small cell deployments every square kilometer, and increased fiberization of towers are some big ticket expenditure planned.

Towercos are getting ready to invest over ₹6 lakh crore by 2025. The telecom tower industry, apart from BSNL, is dominated by three players, Indus Towers, which has merged with Bharti Infratel; the American Tower Corporation; and the Brookfield-Reliance combine. The two telcos, Airtel and Jio, have deployed about 3500 telecom towers for 5G services so far.

At Business 20, the official G20 dialogue forum with the global business community, Ashwini Vaishnaw, Minister for Communications, Electronics & Information Technology, has committed that indigenously-developed 5G and 4G telecom technology stack will be rolled out in the country this year, and the platform will be offered to the world from next year. “In this entire 2023, we will be rolling it out on about 50,000 to 70,000, towers, sites and then in 2024 will be offering it to the world.”

Only five countries in the world have end-to-end 4G-5G telecom technology stack but now with the public-private partnership, India has developed its own technology, which has been tested to handle 10 million simultaneous calls.

The growing opposition to Chinese telecom equipment worldwide may offer an opportunity for India-made 5G products, with the Tata Group and Reliance Jio leading the pack of suppliers. And the US may pitch in and help India, which can use the opportunity to develop locally produced equipment faster.

Recently, C-DoT unveiled its 5G core for the non-standalone (NSA) mode. The government-owned Telecommunications Technology Development Center is also working closely with Indian companies to locally develop 5G antennae, and is planning to come up with a 5G standalone (SA) mode by 2023. Jio has also developed its own 5G core indigenously that complies with global third-generation partnership project (3GPP) standards. With domestically designed and developed next-generation technology, the telco is eyeing making 5G services affordable and accessible. The Indian industry is gearing up to have ready a local 5G network solution targeting the addressable USD 500-billion international telecom equipment market.

BSNL is set to deploy homegrown 4G gear to be supplied by Tata Consultancy Services, which bought a majority stake in Tejas Networks. C-DoT has also developed interoperable 4G core equipment for BSNL’s 4G network deployment.

As we approach the 6G era of 2030, the research on the next generation of mobile networks is well underway. With 3GPP estimated to begin the specification of 6G standards in 2025, the window for pre-standardization telco alignment of 6G is right now.

Europe has always been the leader in developing standards for mobile communications, and 6G is no exception. In the first phase of the 6G journey, the 6G flagship research project Hexa-X, funded by the EU Framework Program for Research and Innovation Horizon 2020, has laid the foundation for future mobile networks, framing the 6G research questions and performing explorative research on key technological enablers. Now, Hexa-X-II will pick up the mantle as the flagship 6G research project for the second phase of the 6G journey – focused on systemization and pre-standardization.

The Hexa-X-II consortium gathers a wide range of world-leading industrial and academic partners gearing up the partner list from Hexa-X’s 25 partners to 44, with Nokia and Ericsson again jointly leading the venture as overall project lead and technical manager, respectively. The expansion strengthens the consortium with several devices and chipset vendors, additional prestigious research institutes and universities, a wider range of telecom operators, as well as the inclusion of dedicated small and medium enterprises (SMEs), focused on use cases relevant to the 2030s. This wide participation is key for the holistic approach of the project – we must understand the future needs and applications and master the entire chain of technology from chipsets to hardware to software implementation in order to succeed.

The Hexa-X-II project commenced in January 2023 and continues until June 2025. In the meantime, the Hexa-X pilot project will finalize in June 2023, providing a six-month overlap of the two flagship projects, which will ensure a smooth transition from exploratory research to systemization. This second phase of the 6G journey, which focuses on systemization and pre-standardization, will hand over to the global standardization and harmonization phase when finalized.

In the meantime, Huawei has far better technological capabilities than it did when 5G was under development. The Chinese telecoms company has boasted that its 6G will “continue the transformation from connected people and things to connected intelligence.”

We face two versions and executions of tomorrow’s mobile telephony. That matters, because despite Huawei’s 5G setbacks in western countries, the company is a behemoth that dominates countless developing markets, not to mention the Chinese one. And because today’s revenues underwrite tomorrow’s innovation, Huawei has a mighty war chest – and the intellectual heft of China’s research institutes at its disposal. In comparison, the research by Ericsson and its western competitors is bound to be more limited and fragmented by market rivalry.

If western countries do not collaborate, however, they face a very real risk of having to accept Huawei’s 6G. That would make the painful battle over 5G infrastructure look like a minor scuffle!

You must be logged in to post a comment Login