Company News

Tata Communications: EBITDA declines 4% QoQ on weak data margin

FCF and dividend yield remain healthy.

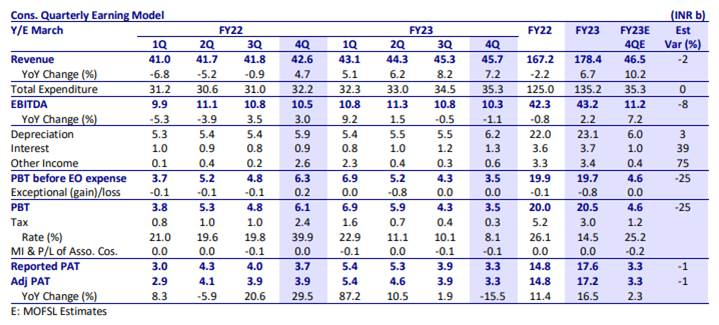

Consolidated revenue grew 1% QoQ to INR45.7b (in line), led by 2% QoQ improvement in the data segment.

- The voice segment witnessed a 9% QoQ decline, while other revenue grew 1% QoQ.

EBITDA declined 4% QoQ to INR10.3b (8% miss), led by a 7% QoQ fall in data segment EBITDA (down 6% in 3QFY23; contributes 85% of consol. EBITDA). Accordingly, consol. EBITDA margin declined by 120bp QoQ to 22.6% (150bp miss), slightly lower than the company’s guidance of 23-25%.

As a result of interest rate hikes globally, interest costs increased by 8% QoQ to INR1.3b, pushing up the average cost of borrowing to 5.88% in 4QFY23 from 5.08% in 3QFY23.

PAT after minority declined 17% QoQ to INR3.3b (in line), supported by less effective tax and high other income.

Revenue/EBITDA/PAT grew by 7%/2%/23% YoY in FY23.

TCOM recommended a dividend of INR21 per share (2% dividend yield).

Committed capex increased 36% QoQ to INR5.3b in 4QFY23 v/s INR3.9b in 3QFY23. It has remained near INR4b every quarter. Ø Annual committed capex for FY23 was INR16.9b v/s INR16.1b in FY22. Ø Core connectivity accounted for the highest capex proportion at 60%, followed by DPS and incubation at 30% and the rest in voice and other capex.

Net debt/gross debt declined 9%/2% QoQ (INR5.6b/INR1.3b) to INR57.1b/ INR75.3b.

- Net debt/gross debt declined by INR10.3b/INR9b YoY.

- Net debt-to-EBITDA improved to 1.3x in FY23 v/s 1.6x in FY22.

FCF increased 16% YoY to INR25.4b in FY23 from INR21.8b in FY22 due to a 10% YoY reduction in cash capex (v/s company guidance of increase in capex) and a 5% increase in OCF.

- FCF yields stood at 7% for FY23.

TECOM reported RoCE of 28.3% in FY23 v/s 25.4% in FY22.

Segmental details

Data revenue, the key driver of revenue growth (contributes 80%/85% of consol. revenue/EBITDA), grew 2% QoQ to INR36.7b (in line). However, growth decelerated from 5%/3% QoQ in 2QFY23/3QFY23.

- EBITDA declined by 7% QoQ to INR8.8b, taking EBITDA margin down by 260bp to 24%.

- Within data revenue, DPS grew by 2% QoQ to INR10.8b (contributing 29%/24% of data/consol. revenue).

- Core services (contributing 67%/54% of Data/consol. revenue) grew 2% QoQ to INR24.6b

The voice segment (contributing 10% of consol. revenue) decreased 9% QoQ to INR4.6b.

- Revenue fell due to a reduction in ILD+NLD to 2.5b minutes (9% reduction QoQ).

- EBITDA, however, increased by 4% QoQ to INR910m, leading to margin improvement by 250bp QoQ to 19.6%.

- Others segment (contributing 10%/6% of consol. revenue/EBITDA) grew 1% QoQ to INR4.4b and EBITDA increased by 44% QoQ to INR611m, leading to a 330bp margin expansion to 14%.

CT Bureau

You must be logged in to post a comment Login