Company News

Tata Communications-Clarity on growth path ahead, ICICI Securities

Clarity on growth path ahead!

Tata Communication (TCom) in its investor day revisited (and revised some of) its strategic growth path. The core growth path remained same with steps like deeper engagement with key clients (along with dedicated team for remaining clients), revamped operating structure, transformation from product to platform and Focus on Fixed + Usage model for digital platforms. On the medium term financial targets, there were few upgrades with a) RoCE target of 25-30% (vs. 20% target earlier), b) EBITDA margin of 23-25% (earlier guidance: 22-25%), c) maintaining optimal debt (vs. debt reduction guidance earlier) and d) double digit data revenues target (same as before) with incremental margin buffer/cash being reinvested to drive growth.

Revamped operating structure; to expand offering…

TCom revamped its operating structure with three business segments names voice, data and others (subsidiaries for transformation services, white label ATM, rental arm) (details on page 2, 3). Also, traditional/growth segments within data has been renamed as Core Connectivity/ Digital Platforms and Services, respectively. Growth strategy will be driven by six platforms viz. a) cloud, edge & security b) net generation connectivity c) NetFoundry d) MOVE & IoT e) collaborations and f) voice. One key positive takeaway from the guidance bit has been explicit focus on driving revenue growth (the only muted piece in equation so far) with increased opex/capex into infra/ innovation as well as inorganic route to expand overall solutions offerings.

To reinvest incremental cashflows/margin buffer for growth

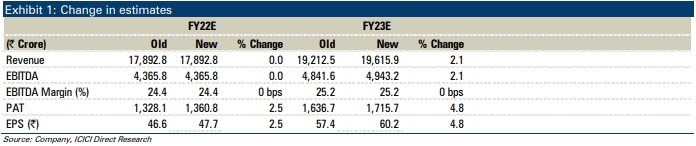

TCOM opted for narrower margin guidance of 23-25% with clear intention of utilising the margin growth buffer and incremental cash flows for investments into R&D/technology/ to drive the overall future growth. We now bake in 10.6% revenue CAGR in FY21-23E (vs. 9.3% earlier) in the overall data (including others) segment, driven by likely acceleration in growth from H2FY22 onwards. We expect overall margins to be muted at 25.2% in FY23 vs. 24.9% in FY21, in line with guidance.

Valuation & Outlook

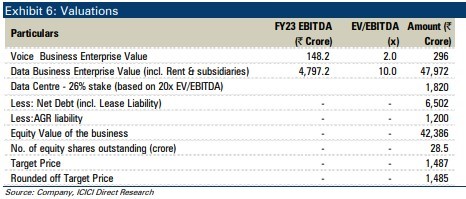

The company’s strategic growth plan, focused approach and structural improvement in data segment margins has driven multiple re-rating. While deal closures delays/some segmental impact due to Covid could have near term weakness in revenues, the demand outlook is robust with the company clearly focusing on reinvesting for growth and even outlining inorganic growth intentions. Furthermore, improved cash flow generation and improved return ratios bode well for TCom. Thus, we maintain BUY with a revised SoTP target price of ₹ 1485/share (earlier ₹ 1290/share), as we raise our data segment target multiple to 10x EV/EBITDA vs. 9x earlier.

Change in operating structure

The company undertook the change in reporting structure with an intention to simplify the same. Product level revenue segmentation has been discontinued and segmentation is now on the basis of customer proposition.

Key highlights were

• Three business segments now vs. two earlier: Data, voice and others (subsidiaries for transformation services, white label ATM and rental arm which was under data segment)

• Under Data segment, traditional services would be renamed as Core Connectivity and growth services will be renamed as Digital Platforms and Services. Product grouping remains same except Content Delivery Network (CDN), which moves from Core Connectivity to Digital Platforms

• MOVE, IoT and Netfoundry would form a third sub-segment under Data viz. Incubation (vs. innovation earlier)

Other highlights:

• The company had earlier guided for 22-25% EBITDA margin range. TCom indicated that though FY21 reported margins were 24.9%, it includes benefit of various Covid related cost savings such as travelling, rentals costs, etc. Adjusted margins would have been lower by 100 bps. The management indicated that once things normalise, costs would rise. The company has narrowed their guidance range to 23-25% now. Incremental margin buffer will be spent on opex for R&D/technologies to drive growth ahead

• The company indicated that to attain double digit growth in data revenues, they would increase their investments from the current level to support that growth in the segment. The company thus guided for higher capex (yet range bound) from the normal run rate of US$225-250 million on a yearly basis.

Valuations

Financial story in charts

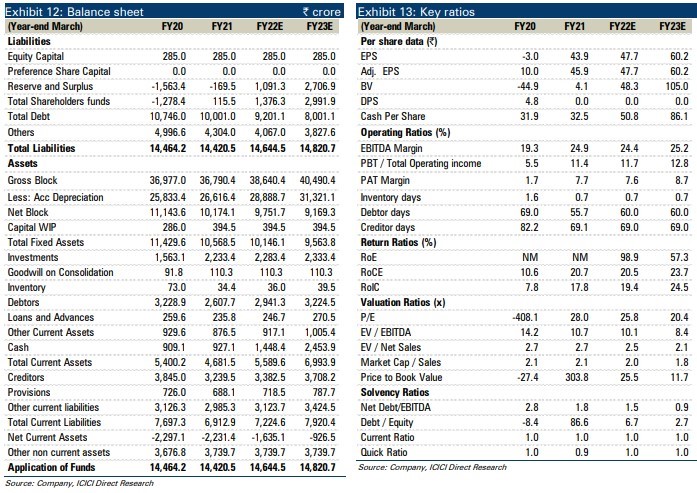

Financial summary

CT Bureau

You must be logged in to post a comment Login