Company News

Tata Communications: 3QFY22 results update, Motilal Oswal

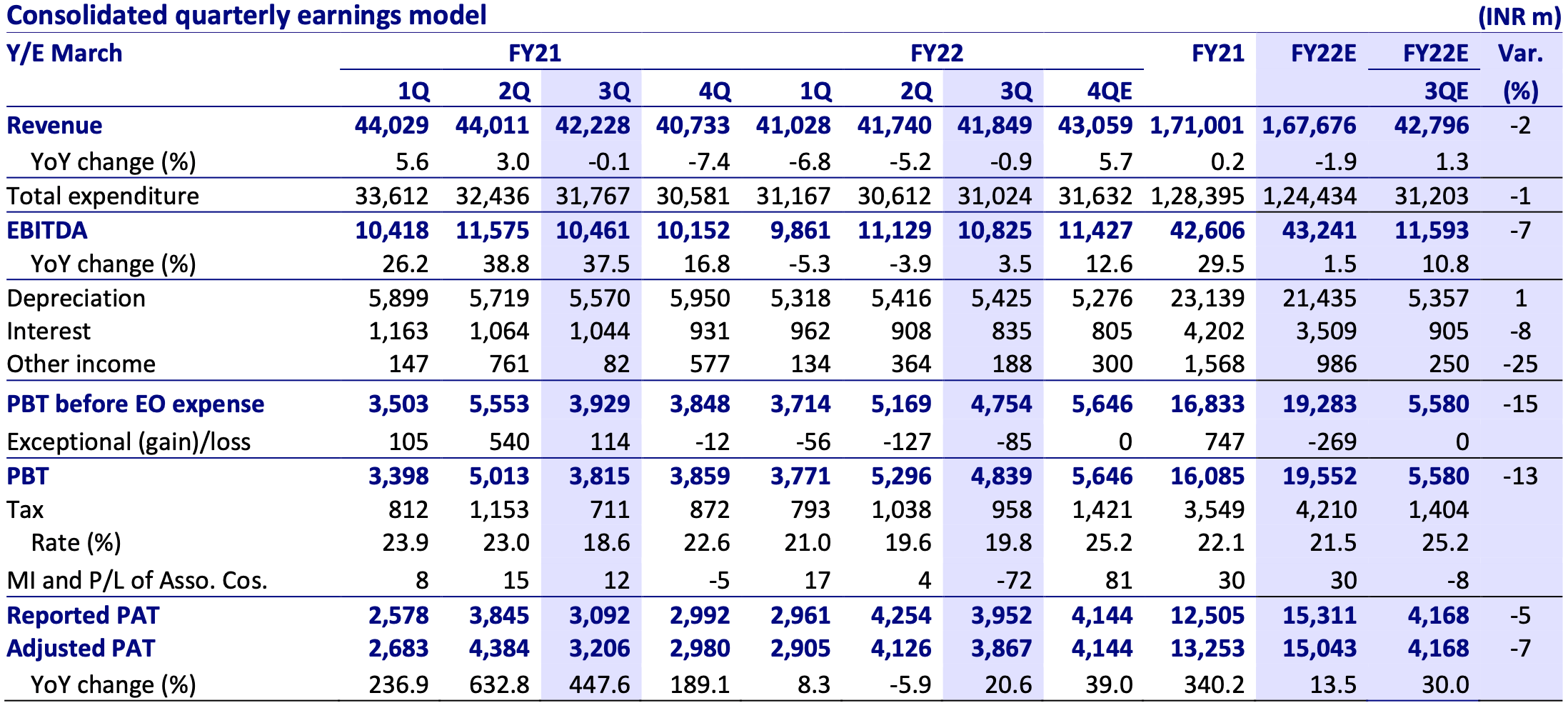

Normalized EBITDA growth was soft at 2% (7% below our estimate), but the key silver lining was the steady net debt decline for the second quarter in a row by ~INR6b to INR71.9b on better working capital mix and robust OCF generation.

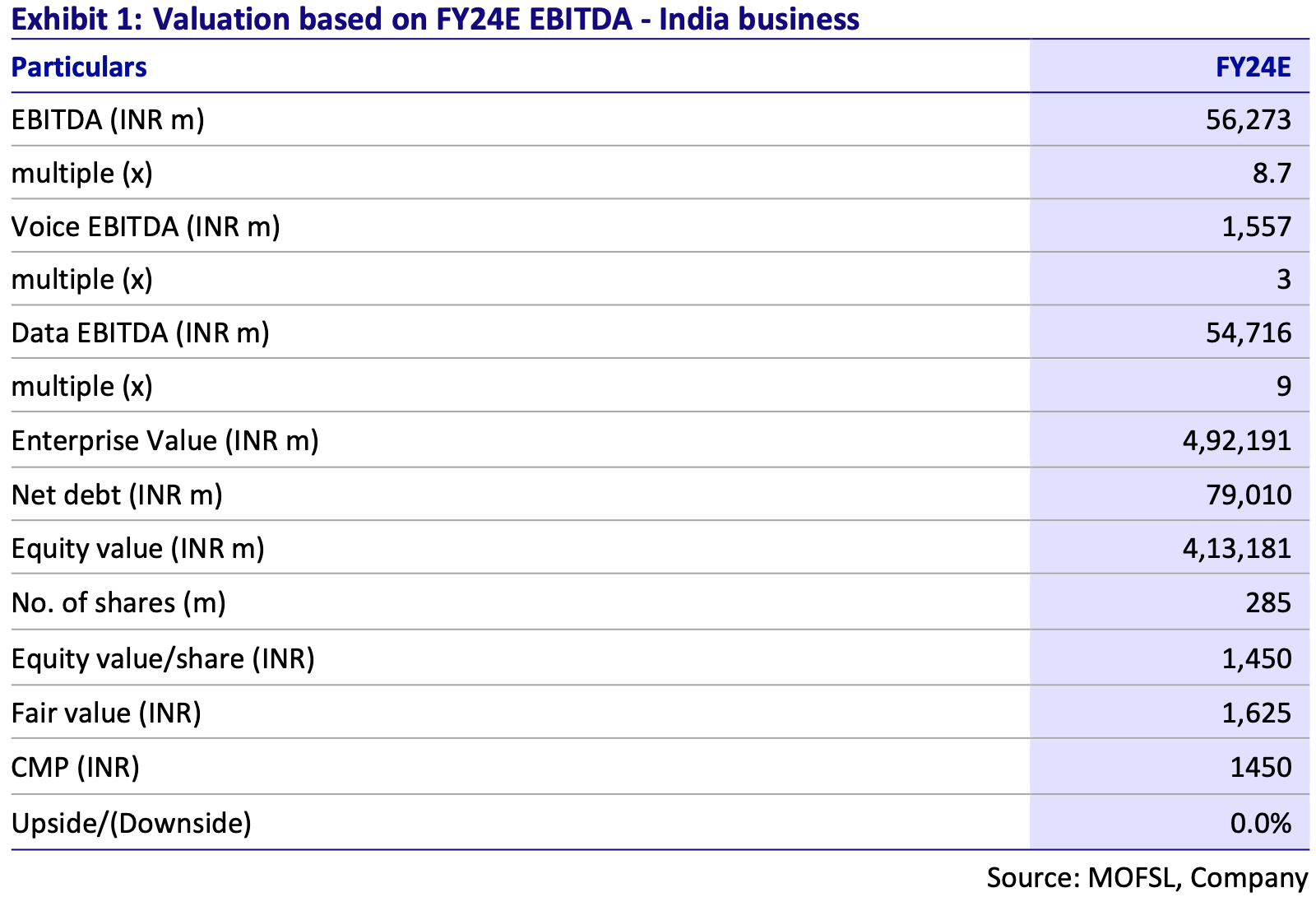

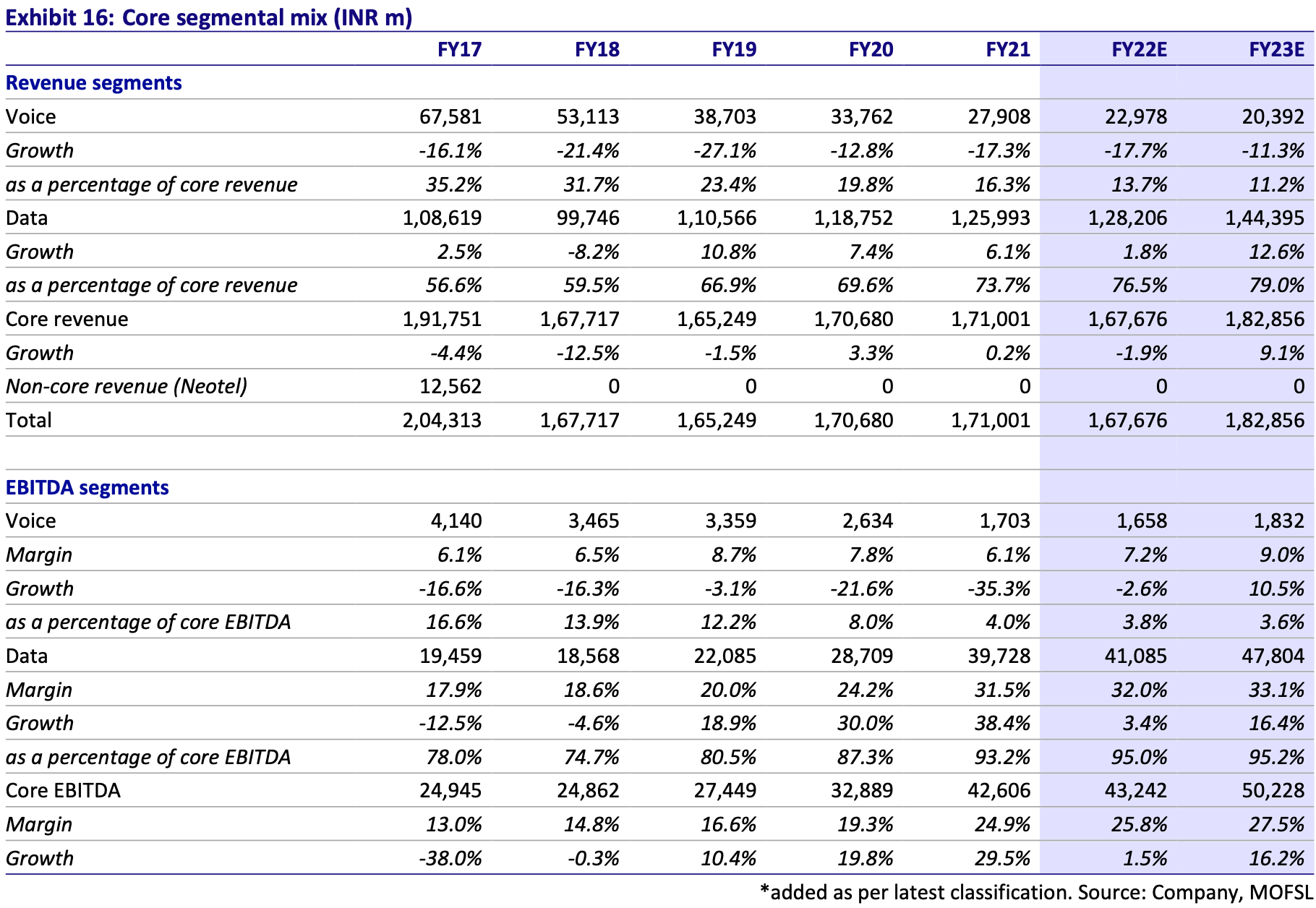

We expect 10% revenue CAGR over FY22-24E as Connectivity (~70% revenue mix) has a low growth outlook. We factor in an improvement in margin on a favorable Data mix, curbing of losses in the Incubation business, and 15% EBITDA CAGR. We maintain our Neutral rating.

Muted revenue growth, but normalized EBITDA at 2%

- TCOM’s consolidated revenue was flat QoQ at INR41.8b in 3QFY22, led by a 3% growth in Data revenue (the key growth driver), even as Voice and other segments declined sharply. The modest sequential topline growth was propelled by a gradual pick up in business across all Data segments.

- EBITDA declined by 2.7% QoQ to INR10.8b (6.6% below our estimate). EBITDA margin contracted by 80bp sequentially to 25.9%. Normalizing for one-off benefits of INR500m in 2Q (related to employee cost and reversal of provisions), EBITDA grew 1.8% QoQ in 3QFY22, with a 50bp improvement in margin.

- TCOM saw an exceptional gain of INR84.9m on staff optimization costs.

- Other income declined by 48.4% QoQ and interest cost fell 8.1% QoQ (8% below our estimate) due to a decrease in net debt. Adjusted PAT (for exceptional items) fell 6% QoQ to ~INR3.9b (7% below our estimate).

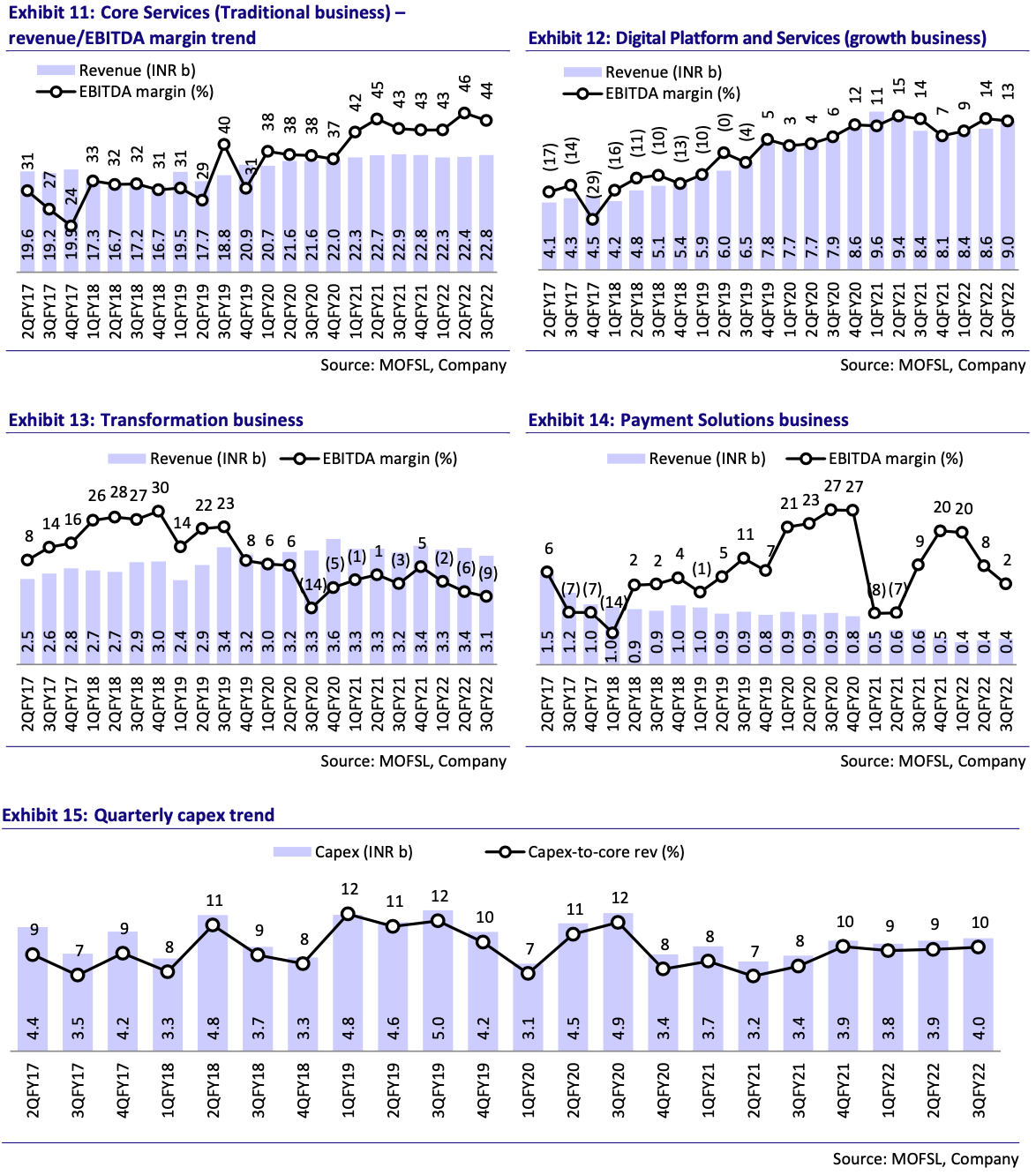

- Capex stood at INR4b in 3QFY22 similar to INR3.9b QoQ and INR3.4b YoY.

- The key silver lining is the steady decline of ~INR6b in net debt (for the second consecutive quarter) to INR71.9b v/s INR77.6b/INR80b in 2Q/1QFY22, backed by a better working capital mix and robust OCF generation.

Highlights from the management commentary:

- Its order book saw sluggish growth in 3QFY22 on slower large deal closures, semiconductor shortage, and talent attrition.

- Stable capex guidance of USD250m, improvement in DSO days, and continued positive operating free cash flow generation will keep net debt-to-EBITDA ratio below 2x.

- TCOM posted a higher EBITDA margin in 3QFY22 as compared to the management’s guidance of 23-25%. The same is expected to normalize as it plans to recruit over 1,000 employees to support its sales growth.

Valuation and view

- In the last two years (FY19-21), TCOM delivered 25% EBITDA CAGR and a PAT of INR12.5b v/s a loss of INR824m on the back of 830bp improvement in EBITDA margin. Growth in Revenue/EBITDA is expected to remain flattish in FY22E.

- Recent rejig in business segments and focus on driving higher deals in digitalization will result in healthy growth. The management commentary on deal wins and demand for networking solutions has been bullish since the onset of the COVID-19 pandemic. However, Data revenue – the key driver of growth – has continued to remain muted for the last few quarters.

- We expect lower revenue growth visibility considering Connectivity (71% revenue mix) has a low growth outlook. This, coupled with flat EBITDA margin guidance of 23-25% v/s the current high of 25.9% and overall double-digit EBITDA growth, could be challenging. Yet we factor in an improvement in margin from the curbing of losses in the Incubation business and a favorable Data mix, building in 15% EBITDA CAGR over FY22-24E.

- Operating leverage below EBITDA should drive healthy PAT growth. The strong improvement in earnings in the last two years, but no increase in capex has led to healthy FCF and a deleveraging opportunity, which could provide a 5-7% upside.

- Deal wins and a deal-to-revenue conversion will be the key monitorables going forward to achieve double-digit earnings growth.

- We maintain our Neutral rating with a TP of INR1,450/share (assigned 9x/3x EBITDA to the Data/Voice business).

Segmental highlights

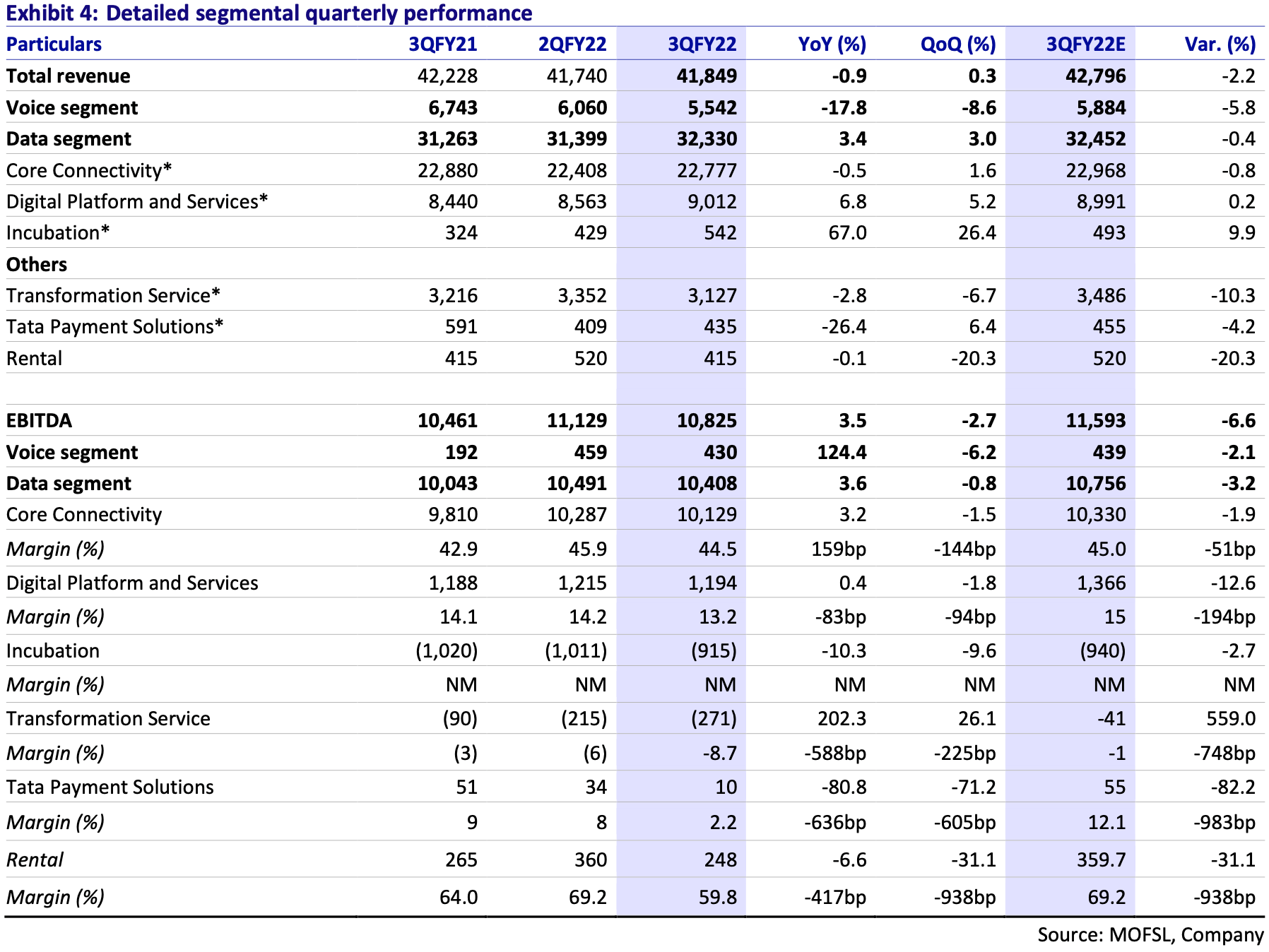

Data revenue, the key growth driver, rose 3% QoQ to INR32.3b (in line) led by a recovery across all segments. EBITDA declined marginally by 0.8% to INR10.4b, with margin at 32.3%.

- Within Data, core connectivity (contributing 70% of Data business) rose 1.6% QoQ. However, EBITDA declined by 1.5% QoQ to INR10.1b, with a 140bp margin contraction to 44.5%.

- Digital Platform and Services (contributing 11% of total EBITDA) saw a 5.2% growth in revenue to INR9b. However, EBITDA declined by 1.8% to INR1.2b. Except Collaboration, all sub-segments within Digital grew in the 7-20% range sequentially.

- Revenue from Incubation Services rose 26.4% QoQ. Operating loss narrowed by 10% QoQ to INR915m.

- Both Transformation and Payment Solution segments continued to languish. The Transformation segment saw a 6.7% QoQ revenue decline (10% below our estimate) to INR3.1b. Operating loss widened to INR271m. The Payment Solutions segment saw an 11.2% QoQ revenue growth to INR455m, while EBITDA fell 14% QoQ to INR29m. This business continues to remain impacted by the third COVID wave. Average daily transactions in 3Q stood at 57 (v/s 56 in 2QFY22).

- Voice revenue declined by 8.6% QoQ to INR5.5b, while EBITDA (contributing 4% of total EBITDA) fell 6.2% to INR430m.

- Rental revenue/EBITDA witnessed a sequential decline of 20.3%/31.1% to INR415m/INR248m in 3QFY22.

| Key takeaways from the management call |

Key highlights

Detailed notes

Business performance:

Strong balance sheet:

Business outlook:

|

Story in charts:

Financial and valuations

CT Bureau

You must be logged in to post a comment Login