Trends

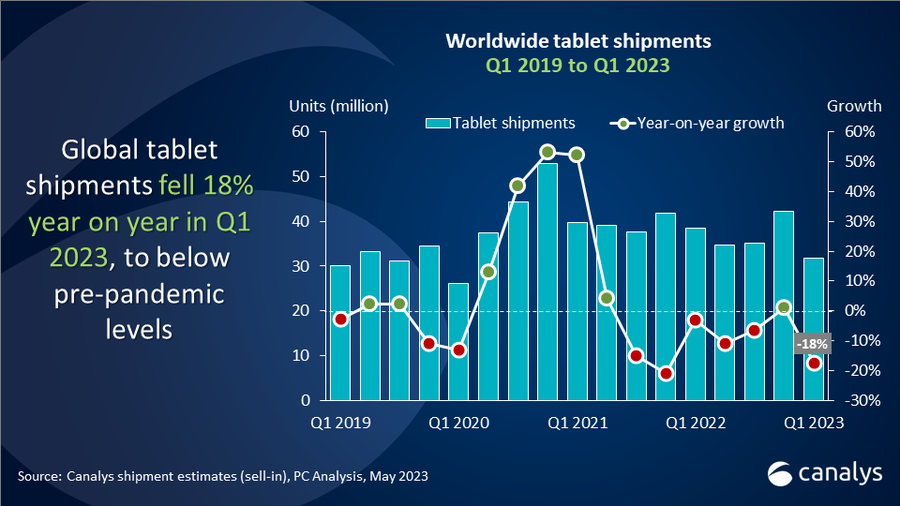

Tablet shipments fall to below pre-pandemic levels with 18% decline

According to the latest Canalys data, global tablet shipments fell 18% year on year in the first quarter of 2023 to 31.7 million units. This is the lowest number of shipments since the onset of the pandemic in Q1 2020, when supply and distribution were heavily disrupted. While shipments are set to hover around pre-pandemic levels in the short term, vendors will benefit from opportunities in the premium consumer segment and from increased deployments in commercial and education environments.

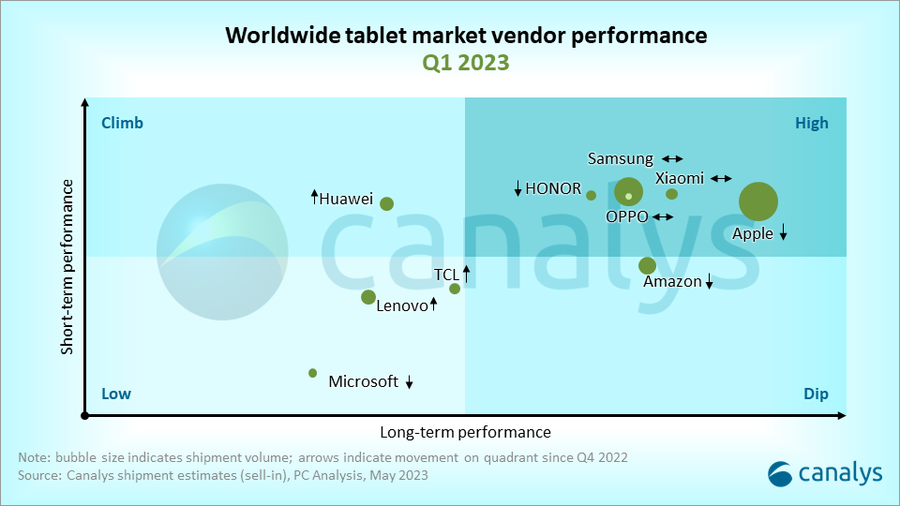

The big drop in Q1 2023 followed a quarter in which strong promotional activity helped keep the market afloat with 1% growth. “A drop in demand for tablets after the holidays is always expected, but the cutback in consumer spending amid high inflation has been severe this time around,” said Himani Mukka, Research Manager at Canalys. “In addition, there is a more structural correction as the massive demand drivers during the pandemic largely wear off. As a result, tablet vendors and retailers are prioritizing working through high inventory levels as they recalibrate expectations for more modest, predictable demand. But the global installed base of tablets grew massively over the last two years, so there are significant opportunities to move users up the value chain with future upgrades. Vendors have begun showcasing products that deliver more premium user experiences, whether through chipset innovation, better displays for content consumption or improved productivity functions. Reinforcing the importance of the tablet within an ecosystem of interoperable devices will also be important to maintain momentum from the trend of hybrid workstyles. Vendors such as Huawei, OPPO and Xiaomi have been successful pursuing this strategy.”

“Beyond consumers, tablet vendors will also see future growth opportunities from commercial and education deployments,” said Mukka. “There has been some stagnation in procurement from businesses and the public sector amid economic challenges, but budgets are set to rematerialize. Education demand in Asian markets will be a big volume driver, particularly for low-to-mid-range Android devices, while digitalization in verticals such as healthcare and manufacturing will allow for some workloads to move to tablets. Overall tablet demand is expected to gradually recover in the second half of 2023 and accelerate in 2024, with shipments staying above pre-pandemic levels.”

Apple remained top of the worldwide tablet market with 12.4 million units shipped, for a 17% year-on-year decline. A strong push to fill the channel in the previous quarter and a lack of new launches in Q1 led to a relatively muted quarter for iPads. Samsung held second place with 6.7 million units shipped, posting a 14% decline. Third-placed Amazon shipped 2.5 million units, posting a 30% year-on-year drop. Lenovo narrowly secured fourth place but faced the largest decline of the top five vendors, with its tablet shipments down 37% to 1.9 million units. Huawei finished fifth with a relatively modest decline of 4%, buoyed by strong demand in its home market of China.

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q1 2023 |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Apple |

12,350 |

38.9% |

14,881 |

38.6% |

-17.0% |

|

Samsung |

6,721 |

21.2% |

7,850 |

20.4% |

-14.4% |

|

Amazon |

2,502 |

7.9% |

3,568 |

9.3% |

-29.9% |

|

Lenovo |

1,892 |

6.0% |

3,004 |

7.8% |

-37.0% |

|

Huawei |

1,607 |

5.1% |

1,679 |

4.4% |

-4.3% |

|

Others |

6,647 |

21.0% |

7,551 |

19.6% |

-12.0% |

|

Total |

31,719 |

100% |

38,532 |

100% |

-17.7% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2023 |

|||||

CT Bureau

You must be logged in to post a comment Login