Trends

Subscriber addition slow on COVID second wave / lockdown, ICICI Securities

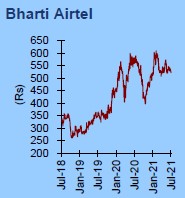

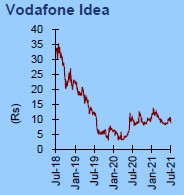

The Telecom Regulatory Authority of India (TRAI) has released monthly data on subscribers (subs) for Apr’21. Industry-active subs rose 3.4mn with Bharti Airtel’s (Bharti) net add at 2.6mn; Reliance Jio’s (RJio) net add decelerated to 3.5mn subs despite aggressive offer on JioPhone. Industrywide mobile broadband (MBB) subs adds stood at 5.1mn with fewer adds for Bharti at 2.2mn. Bharti’s MBB subs market share rose 16bps to 28.6% on active basis, while RJio’s improved 23bps to 50.2%. MNP has dip slightly, but remains elevated at 9.7mn with MNP churn rate at 0.8%. Wired broadband subs adds was strong for RJio and Bharti at 0.2mn and 0.1mn.

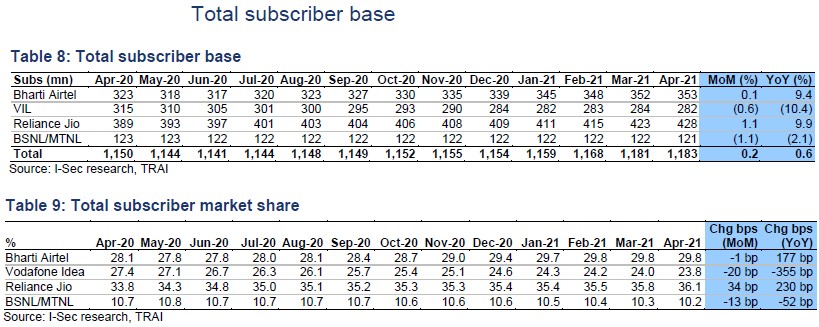

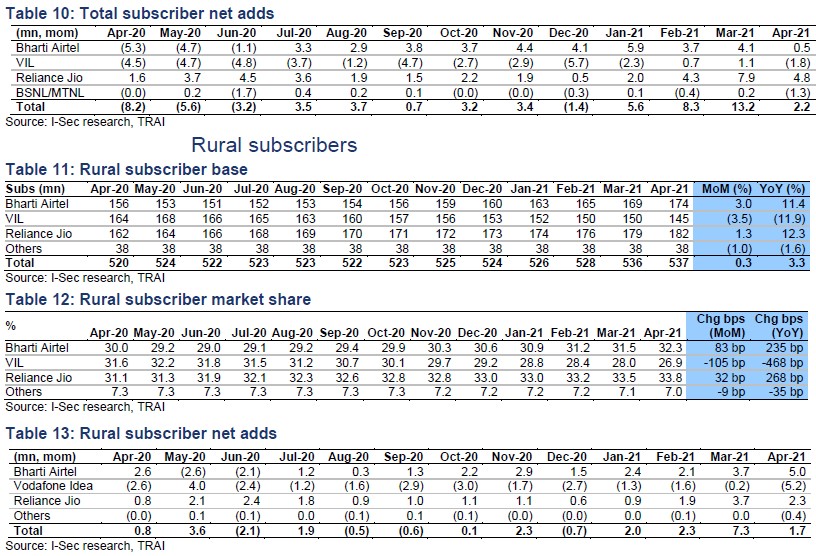

Industry-active subs rose by only 3.4mn; likely impacted by covid second wave

- Industry-active subs base expanded by 3.4mn to 997mn (up 0.3% MoM, 4.1% YoY), which was helped by total subs addition of 2.2mn (or 0.2% MoM).

- RJio’s active subs base grew by 3.5mn to 335mn in Apr’21. RJio had seen active subs jump of 7.3mn in Mar’21 on launch of new offer for Jiophone (long validity with aggressive pricing), which slowed significantly in just one month after launch. Despite long-validity subs addition under the new Jiophone offer, active subs portion (% of total subs) for RJio dipped 6bps MoM to 78.4%.

- Bharti’s active subs base increased by 2.6mn to 347mn, while its total subs net add slowed to just 0.5mn in Apr’21. We believe Bharti should have benefitted from the SIM consolidation triggered due to lockdown.

- VIL’s active subs declined by 2.1mn (vs average 0.3mn dip in the past 3 months), resulting in an active subs base of 254mn in Apr’21. Total subs base shrunk by 1.8mn after the net add seen in past two months.

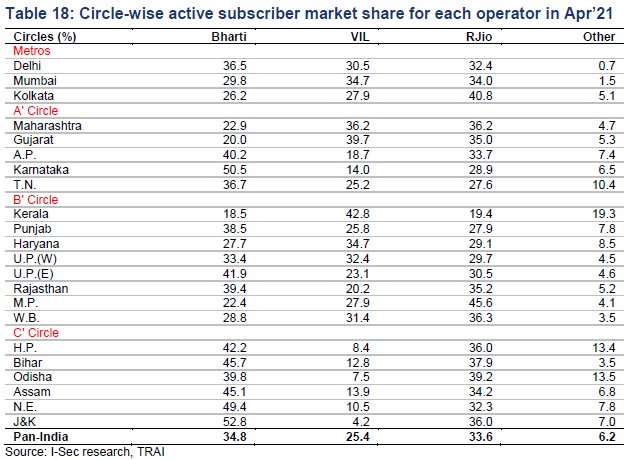

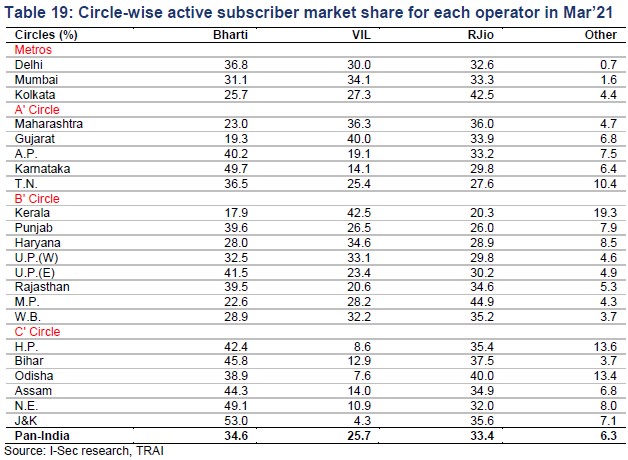

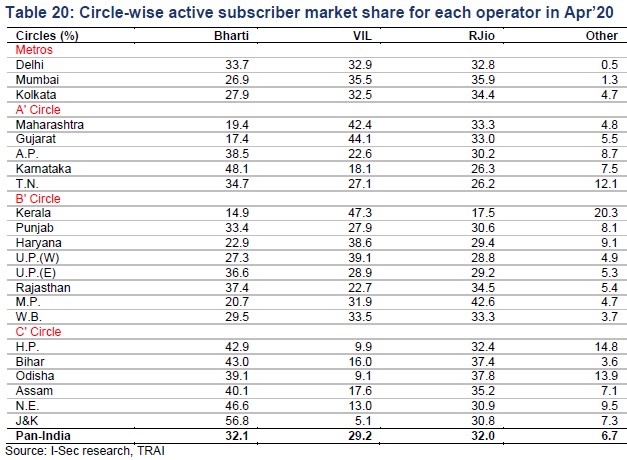

- RJio’s active subs market share improved by 23bps to 33.6% MoM, while Bharti’s stood at 34.8% (up 14bps MoM) and VIL’s dipped 30bps MoM to 25.4%. Bharti has maintained a good lead in active subs market share against RJio.

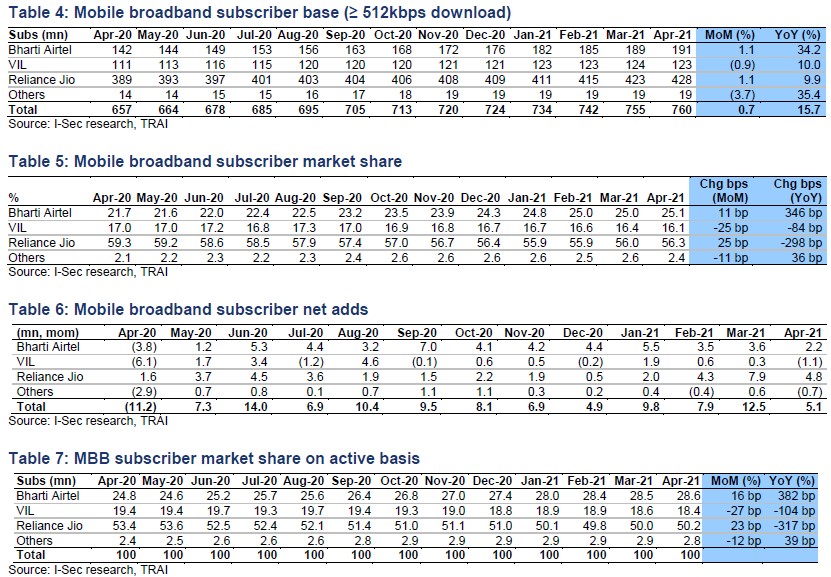

Industry MBB (mobile broadband) subs rose only 5.1mn

- Industrywide MBB subs rose 5.1mn to 760mn in Apr’21. Bharti’s addition was healthy at 2.2mn, but has lower than average 4.5mn net add in past 10 months.

- RJio’s MBB subs base grew by 4.8mn to 428mn. Adjusted for inactive subs, its MBB market share stood at 50.2% (up 23bps MoM), while Bharti’s was 28.6% (up 16bps MoM) and VIL’s 18.4% (down 27bps MoM).

- VIL’s MBB subs base shrunk by 1.1mn, which is disappointing, to 123mn.

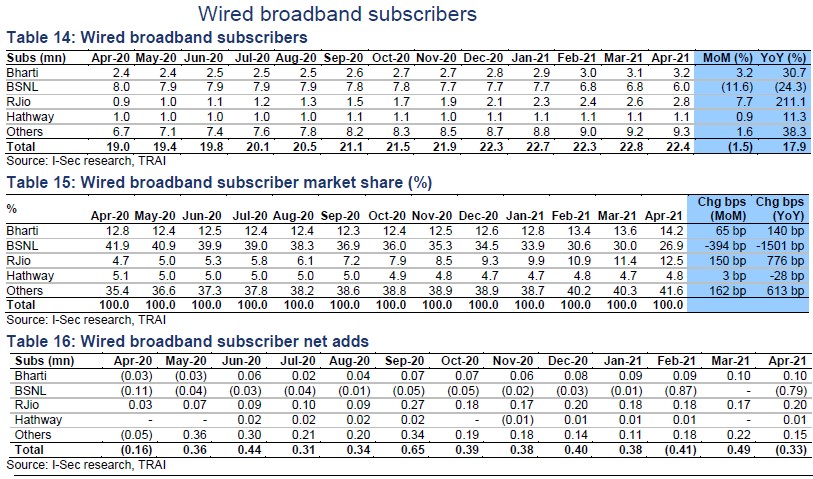

RJio’s wired broadband subs add was steady at 0.2mn, to 2.8mn

- Wired broadband subs base declined by 0.33mn MoM to 22.4mn (down 1.5% MoM, up 17.9% YoY) in Apr’21.

- RJio’s market share improved to 12.5% (up 150bps MoM), and net add stood at 0.2mn. Bharti’s net add was at 0.10mn and its market share rose to 14.2% (up 65bps MoM). BSNL’s subs fell by 0.79mn to 6mn and market share was down to a low of just 26.9%.

Industry MNP churn rate dipped to 0.8%

- Industry porting slightly decreased to 9.7mn in Apr’21. MNP churn rate dipped to 0.8% (vs6% previously).

Active subs: Industry adds 3.4mn subs

Active subscribers or visitor location register (VLR) is a temporary database of subs who have roamed in a particular area that an operator serves. Each BTS is served by exactly one VLR, hence the unique registration. The VLR data is calculated on the basis of active subs in VLR on the date of peak VLR of a particular month for which the data is being collected. This data is collected from switches having a purge time of not more than 72 hours.

Mobile broadband subscribers: Industry net add was 5.1mn

CT Bureau

You must be logged in to post a comment Login