Headlines of the Day

Strong subscriber growth at Airtel across mobile and home drives earnings

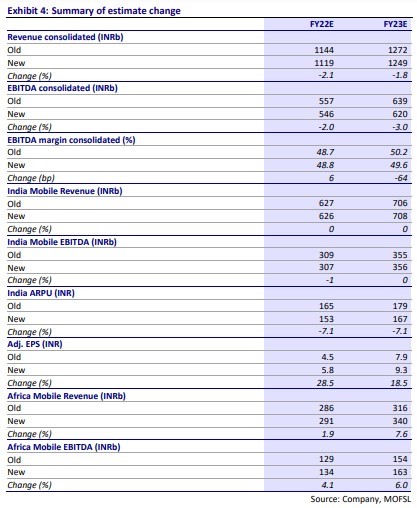

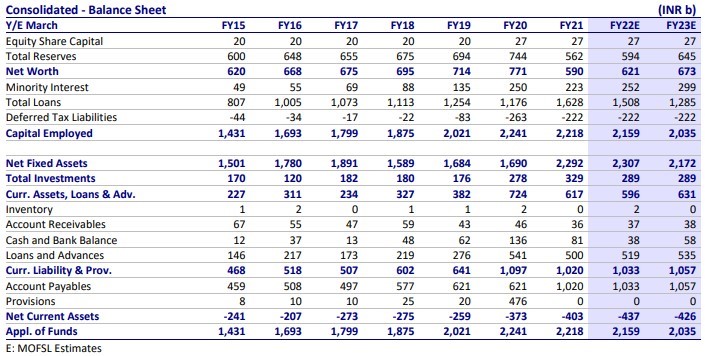

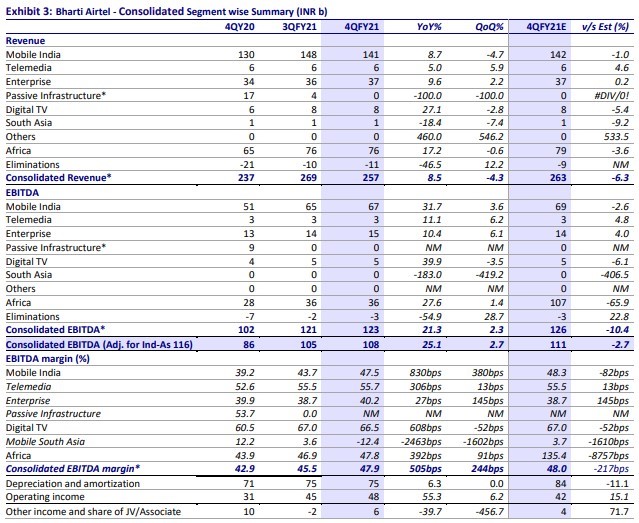

- Consolidated EBITDA grew 2% QoQ (in line) in 4QFY21 on the back of India mobile EBITDA growth of 4% (in line), even without a tariff hike, led by steady subscriber gains. The miss in estimate was on lower than estimated flattish ARPU and higher opex curbing incremental EBITDA margin at 40% v/s our expectation of 60-65%.

- Bharti’s consistent and commendable rise in 4G subscribers/ARPU/India mobile EBITDA of 32%/7%/32% over the last four quarters, translating to better FCF, should continue. We expect 17%/21% consolidated/India mobile EBITDA CAGR over FY21-23E, without factoring a tariff hike. Maintain Buy.

Mobile India EBITDA up 4% QoQ (in line) despite no tariff hike

- Consolidated revenue fell 3% QoQ to INR257.4b (in line) on the back of a 5% fall in India mobile revenue. Adjusted for the ARPU IUC recast, consolidated revenue/India mobile revenue grew 2%/4% QoQ.

- Consolidated EBITDA grew 2.3% QoQ to INR123.3b (in line) on 4% India mobile EBITDA growth. Consolidated EBITDA margin improved 240bp QoQ (80bp below our estimate) to 47.9% due to IUC recast. Adjusted for the same, it improved 60bp.

- Reported net profit stood at INR15.1b. Excluding exceptional benefit of INR4.2b, net profit after minority interest stood at INR3.2b (est. INR19.4b).

- India mobile revenue declined 4.7% QoQ to INR140.8b. Adjusted for the IUC impact, it grew 4.2% QoQ (in line). The increase is attributed to a 4.6% growth in subscribers, with flattish ARPU. EBITDA rose 4% QoQ to INR66.9b (in line), with a 380bp margin improvement to 47.5%. Adjusted for the optically high margin due to IUC recast, margin declined 30bp to 47.5%.

- Incremental EBITDA margin stood at 40% (est. 60-70%) due to a 8% jump in network cost on heavy capex (8.2k site additions) and increase in fuel cost.

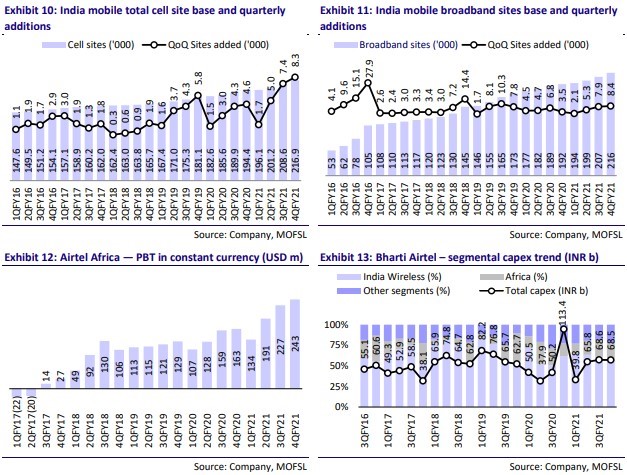

- The strong trend in subscriber additions seen in the last couple of quarters continued, with 13.4m additions, or up 5% QoQ, to 321m. RJio added 15.4m subscribers, with over two-third estimated to be on low ARPU Jio Phone). Strong 4G subscriber additions continued (13.7m) for the third consecutive quarter, touching 179m subscribers, or 59% of total subscribers.

- ARPU declined by INR21 (14% QoQ) to INR145 due to IUC recast. Adjusted for the IUC impact, ARPU was down 1% QoQ to INR145, due to lesser number of days in 4QFY21 and increased competitive intensity in the market. The lower ARPU is disappointing in the backdrop of strong 4G subscriber additions.

- Capex remained high at INR68.5b (INR241b in FY21), yet FCF improved to INR18.8b v/s INR12.9b in 3Q. Debt rose INR5b to INR1,155b due to DTH stake buyback and investment in spectrum. Despite earnings growth, FCF generation and deleveraging has been poor in the last one year. This should improve in FY22E, with an improvement in earnings and capex peaking out.

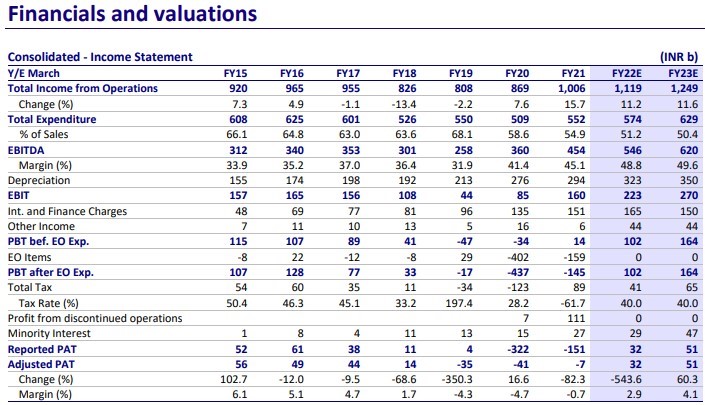

- Consolidated FY21 revenue/EBITDA grew 16%/26% YoY to INR1t/INR454b, with margins expanding by 370bp to 45.1%, while cash from operations improved by 166% YoY to INR482b.

Highlights from the management commentary

- The Mobility business should gain from subscriber additions; ARPU improvement from upgrade of 142m non-4G Airtel customers, monetization of digital apps, which have 200m monthly active users, and 54m Airtel Payment bank customers.

- Incremental EBITDA margin of 60-65% will be achieved in coming quarters v/s 40% in 4QFY21.

- Capex has passed its peak and will be at similar levels going forward, but the composition will change to Transport and non-Wireless (broadband), while 4G radio capex will reduce. With better earnings, FCF should improve.

- Focus on the non-Wireless business (Home and Enterprise) is expected to drive strong growth, with aggressive additions in Home passes and higher market share (widening client base and increasing wallet share) in the Enterprise business.

Valuation and view

- Bharti’s superior execution quality is reflected in its strong performance in the last four quarters, market share gains, 13% subscriber growth, and 32% 4G subscriber growth (~4m monthly). ARPU improved 7% in the last four quarters without a tariff hike.

- During the spectrum auction in Mar’21, Bharti has acquired a healthy portfolio of 355MHz of spectrum for INR187b and now holds sub-GHz spectrum across circles. This is expected to improve network coverage and help tap additional 90m subscribers in remote areas.

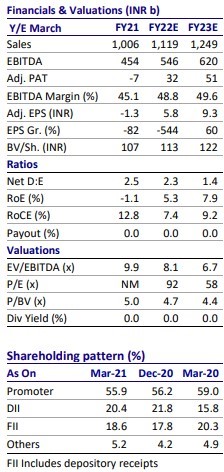

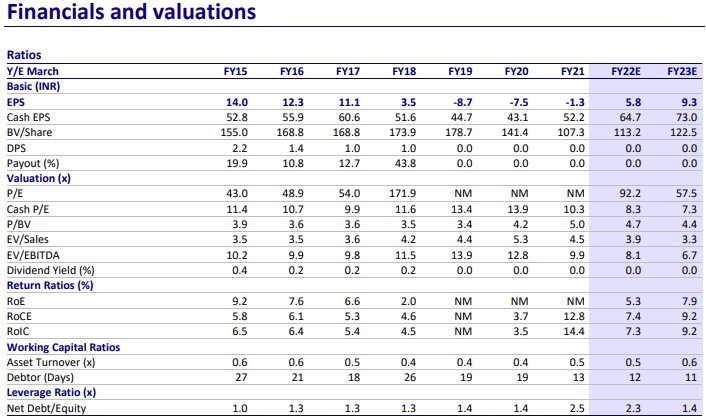

- We expect 17% consolidated EBITDA CAGR over FY21-23E on the back of 21% India mobile EBITDA CAGR. While the street has been concerned about the timeline of a potential tariff hike, we believe strong earnings growth can be achieved even without a tariff hike.

- Bharti’s Africa business is trading at a mere ~3x on FY23E, thus the implied valuation for the India business looks expensive at 11x EV/EBITDA. We see potential for a re-rating upside in both India and the Africa business on the back of steady earnings growth.

- We value Bharti on FY23E, assigning 11x/6x EV/EBITDA to the India /Africa business, arriving at a SoTP-based TP of INR720. Our higher target multiple for the India mobile business reflects expected ARPU hikes and rise in market share gain, both of which may not be fully captured in our model. Maintain Buy.

Africa numbers were muted

- Africa revenue/EBITDA growth was muted at -1%/1% QoQ in CC terms. In reported currency, it grew by nil/2% to USD1,038m/USD840m.

- Subscriber/ARPUs grew -1%/2%, with healthy data revenue offset by muted voice and Airtel Money revenue.

Other segments offering strong tailwinds

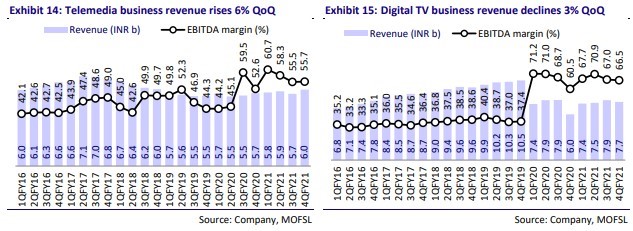

- Home business revenue/EBITDA saw 6% QoQ growth after the decline to INR6b/INR3.3b in 3QFY21. This is on the back of strong (10%) subscriber growth driving demand elasticity on a 3%/15% ARPU decline in 4QFY21/last four quarters. Number of cities covered has seen a continuous rise to 291 v/s 219/111 in 3QFY21/Mar’20.

- Enterprise revenue/EBITDA grew 2%/6% QoQ to INR37b/INR14.9b.

- Digital revenue/EBITDA declined 3% QoQ to INR7.7b/INR5.1b.

Other highlights

- India mobile data traffic grew 9% QoQ to 9.2b GB, with usage at 16.8 GB/user. Data traffic and data subscribers are nearly half of RJio, with a lower capacity gap, highlighting better network experience and room for improvement.

- MoU remained stable (up 3%) at 1,053 minutes, with an 8% increase in voice traffic to 996.7b minutes.

FCF improved; net debt increased due to spectrum auction

- Capex remained high at INR68.5b (INR241b in FY21). FCF, post interest, improved to INR18.8b v/s INR12.9m in 3QFY21.

- 4G base stations/towers continues to see strong (38k/8k) additions to 607k/216k, apart from the healthy 19k km ramp up in fiber addition.

- Despite the healthy FCF, net debt (excluding lease liability) increased by INR5b to INR1,155b due to INR63b upfront spectrum payment in the recent auction and INR9b cash paid to Warburg Pincus towards the DTH stake buyback. Including lease liability of INR330b, net debt stood at INR1,485b, with net debt/EBITDA of 2.95x/3.2x on a 4Q/FY21 annualized basis.

Key positives

- EBITDA steady despite no price hikes: Consolidated EBITDA grew 2% QoQ (in line) with the 4% QoQ steady growth in India mobile EBITDA, without a price hike. Despite any tariff hike in the last four quarters, EBITDA is up 32%, which indicates that the healthy subscriber/ARPU equation is showing gains. All this without any tariff hike.

- Adding quality 4G subscribers: India mobile added 14m 4G subscribers, the third straight quarter of high 4G additions and cumulatively adding 41m in the last nine months. In 4QFY21, ARPU was flat due to lesser number of days in the quarter. Overall mobile subscriber additions too were healthy at 13.4m.

- Other segments to offer tailwinds: After the growth in Africa in 3QFY21, Home and Enterprise saw 6% QoQ EBITDA growth in 4Q. The Home business has seen 10% subscriber additions on price elasticity and increased coverage, which should rise further in coming quarters.

- Superior network capacity: Despite robust data traffic volumes of 9.2b GB, with usage at 16.8 GB/user, data traffic/subscriber is ~50% of RJio, thus highlighting healthy network capacity and room for improvement. It has healthy (607k) base stations (closer to RJio), with unique broadband towers at a robust 216k.

Negatives

- Higher capex and spectrum spends limiting deleveraging: Capex remained high at INR68.5b (INR241b in FY21), yet improved to INR18.8b v/s INR12.9m in the preceding quarter. Debt increased by INR5b to INR1,155b due to investment on spectrum and DTH stake buyback. In the last one year, despite earnings growth, FCF generation and deleveraging has been poor. This should improve in FY22E.

Highlights from the management commentary

Key highlights

- The Mobility business should gain from subscriber additions; ARPU improvement from upgrade of 142m non-4G Airtel customers, monetization of digital apps, which have 200m monthly active users, and 54m Airtel Payment bank customers.

- Incremental EBITDA margin of 60-65% will be achieved in coming quarters v/s 40% in 4QFY21.

- Capex has passed its peak and will be at similar levels going forward, but the composition will change to Transport and non-Wireless (broadband), while 4G radio capex will reduce. With better earnings, FCF should improve.

- Focus on the non-Wireless business (Home and Enterprise) is expected to drive strong growth, with aggressive additions in Home passes and higher market share (widening client base and increasing wallet share) in the Enterprise business.

Business performance

- EBITDA: Incremental EBITDA stood at 45-47% (v/s 65%) due to rise in diesel and transportation costs. The targeted 60-65% incremental EBITDA will be achieved in coming quarters.

- Spectrum: The company has acquired mid-band spectrum in the 1,800, 2,300, 900 MHz bands to strengthen its pan India network and cover an additional population of ~90m. It expanded its network coverage footprint by 8,300 cell sites, and has further strengthened its pipeline network to be ready for the 5G rollout.

- Subscriber addition: It added 43m/1.9m prepaid/postpaid subscribers in FY21. India ARPU has increased to INR148 in 4Q (on an equated day basis) from INR146 in 3QFY21.

- Active subscribers: A VLR subscriber, at 324m, is any customer who has latched on to the network (regardless of whether the customer generates revenue) and also includes international roaming customers, while actual revenue generating customers stood at 321m in FY21.

- Leverage: The company has raised USD12b in FY21. Leverage stands at 2.95x and is comfortable v/s global peers. Investments in Bangladesh and Africa have turned attractive. It has successfully monetized assets in Africa via a stake sale in the Towers business and Airtel Money, and sharing of spectrum with RJio.

- In FY21, debt increased by USD3b (of which AGR-related debt was USD3b). Excluding AGR, debt has actually fallen after factoring spectrum payment. FCF is expected to grow as capex has peaked and debt is expected to drop going forward. Rating agencies are comfortable with the company’s debt as core debt remains low ~USD2b. Debt in Airtel Africa is also expected to reduce, led by monetization opportunities in the Towers business.

B2B segment offers a large opportunity

- Revenue market share in the Enterprise segment rose to 31% in Dec’20 from 23% in Dec’18. About 20% of total customers constitute 80% of business revenue.

Home Broadband:

- It has over 3m customers (added 0.1m Home passes in 4QFY21). The company has expanded into new towns and is currently present in over 200 cities, led by the LCO model.

- ARPU stands at INR684. The entire impact of the pricing has been baked in, and there won’t be any ARPU dilution going forward. INR799 is its most attractive plan.

- Differential cost of production stands at 25-30% for LCO-based rollout v/s a company-based rollout. It aims to reach 20-25m Home passes.

- DTH business: Airtel is the second largest player in India. Its revenue market share in the DTH business has increased to 27% in Dec’20 from 22% in Dec’18, outperforming competitors. It intends to rollout dedicated plans for 50m potential high-income households (of which 30m have been on boarded with Airtel).

- Digital apps have 200m monthly active users, of which Airtel Xstream/Airtel Thanks has 37m/96m active subscribers.

- Airtel Payments Bank has 54m active users and INR230b of throughput. It is seeing lower customer churn and expects to achieve profitability by FY22.

- Airtel Ads offers brand engagement solutions to corporates to launch ad campaigns on Airtel’s digital platform, which has a huge market opportunity.

- ARPU accretions: 142m Airtel customers have still not upgraded to 4G, which will be ARPU accretive in the future.

- Enterprise segment: The size of the non-Connectivity business market is pegged at INR400b. Segments for SME focus are: a) Cloud Communication business (delivers voice, video, and messaging through APIs), b) Cyber Security business (seems very attractive for security purpose), c) Airtel IoT (which presents an amazing opportunity over the next 5-7 years), d) Public Cloud business (low margin, but no capex), and e) Private Cloud business (better margin profile).

- DTH: ARPU remains fixed in the DTH business due to regulations. Bharti has added over 1m subscribers annually for the past three years. In DTH, its One Airtel product plan is expected to gain some market share from cable operators.

- In-house team: The company is reinforcing its entire outsourced SME sales team with an internal team to enhance team productivity.

- New products: It is developing data centers to support Airtel IQ and Airtel Cloud applications and has launched Airtel IoT in 4QFY21 to enable IoT-related applications.

- Promoter stake sale: The Bharti family and Singtel have no intention to sell any stake in Bharti Airtel.

CT Bureau

You must be logged in to post a comment Login