CT Stories

Strong investment momentum in the OFC market

The OFC industry is on a roll with demand at an all-time high in India and international markets.

The domestic optical fiber cable (OFC) market environment continues to be strong with the current market demand of OFC products at 35–40 million fiber km per annum, which is expected to grow significantly over the next few years on account of creation of 5G network across the country, expansion of existing 4G network, deployment of fiber-to-the-home network, implementation of BharatNet projects, and creation of multiple data centers across the length and breadth of our country. In India, BharatNet alone will lead to an opportunity of laying 16 lakh km of OFC translating in almost 50 million fiber km. The Indian telcos are estimated to spend ₹15,000 crore on optical fiber alone over the next three–four years, and deploy more than 200,000 cable km in the next two years. India has set a target to achieve 1.3 fiber/capita by 2035, translating into a deployment rate of 150 million km fiber every year.

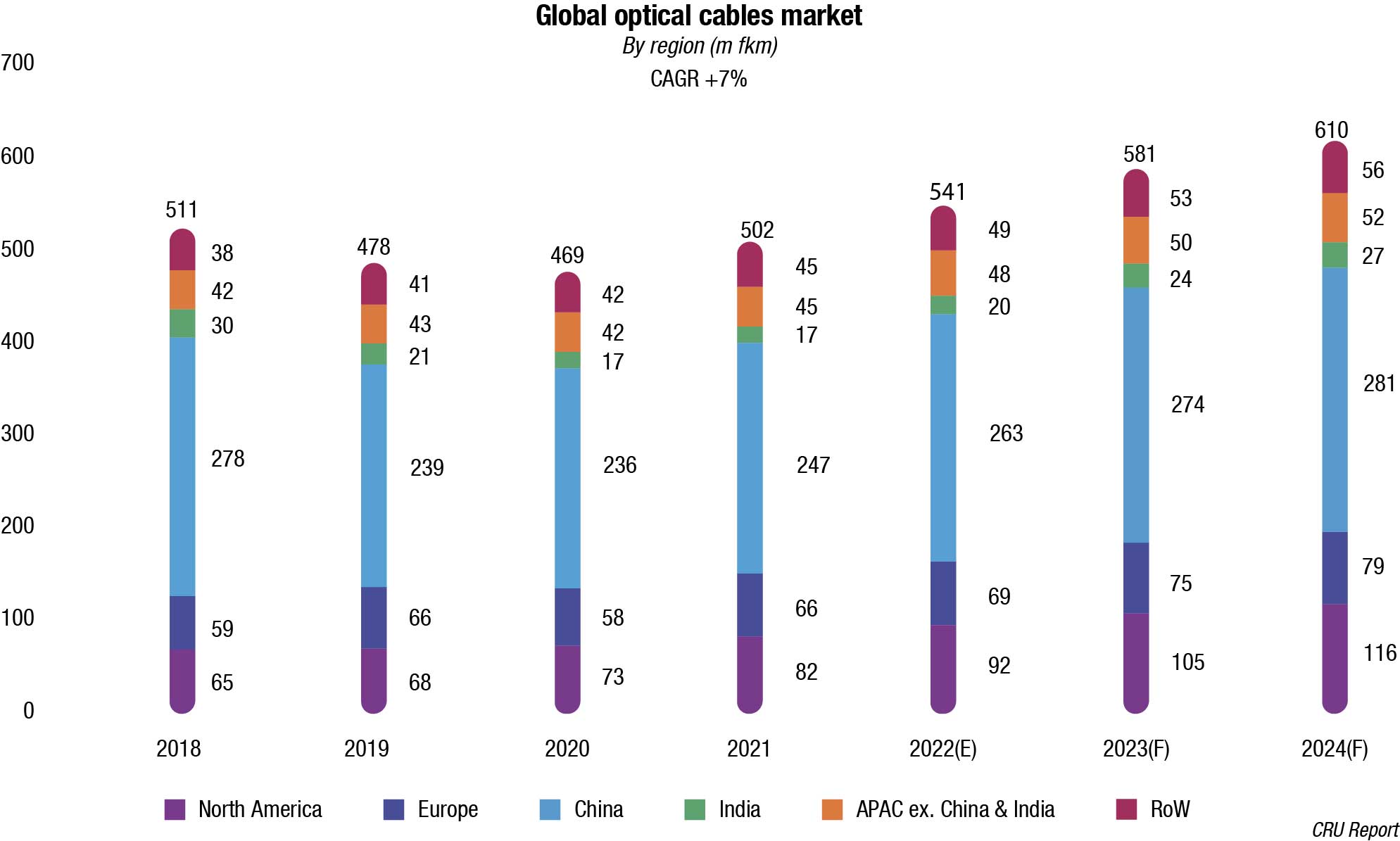

There is a tremendous opportunity in global markets as well. United States, United Kingdom, Germany, and Europe are investing heavily on building robust fiber connectivity for the deployment of 5G network and FTTH networks. The global annual market demand of optical fiber cable is estimated to increase from USD 9.2 billion (502 million fkm) in 2021 to USD 12 billion (610 million fkm) by 2024, a CAGR of 10 percent.

Strong investment momentum

5G

- 5G investments: expected to be USD 500

billion from 2022 to 2025 - As per Ericsson, 210 service providers

have launched commercial 5G services

globally - 5G subscriptions: 690 million as of Q2

2022 and expected to reach to 4.4 billion

by 2027 - 5G base stations in China: 1.97 million to

reach to 3.65 million by 2025

FTTH

- USD125 billion earmarked for FTTH

deployments in the North America for next

5 years - AT&T to double its fibre coverage to 30

million locations by 2025 - Frontier targets 10 million FTTH locations

by 2025 - Brightspeed to invest USD 2 billion to

pass 3 million FTTH locations by 2028 - UK’s BT Openreach plans to reach 25 Mn.

FTTH locations by 2026

With operators expecting to invest USD 500 billion in 5G over the next three years, and set to strengthen their respective OFC networks, the Indian industry is upbeat with STL looking at an increase in operating profit by Rs 40–50 crore per quarter from Q4FY23 onwards and HFCL targeting to double its revenue from the global markets in two years. The Indian manufacturers have a combined production capacity of 100 million fkm per annum.

Additionally, several governments announced their intention to fund fiber/broadband connectivity to bridge the digital divide. The UK Government has set a target to see at least 85 percent of UK premises able to access gigabit-capable broadband by 2025, and to achieve close to 100-percent coverage thereafter. Project Gigabit scheme has been allocated a budget of £5 billion (USD 5.9 billion). The first major subsidy contract has officially been awarded in August 2022 with Wessex Internet securing £6 million (USD 7 million) to connect remote properties in South-West England to high-speed broadband. This is expected to kick start a handful of similar contracts in the coming months, with USD 690 million worth of procurements spanning half-a-million premises set to be announced by the end of the year. Initially, more than 1 million homes and businesses are being targeted, half of which would be in Cambridgeshire, Cornwall, Cumbria, Dorset, Durham, Essex, Northumberland, South Tyneside, and Tees Valley.

The Broadband Data Act of March 2020 requires the FCC to establish a process to collect granular data from broadband providers in order to generate publicly available coverage maps of a common dataset that include all the residential and business locations across the United States. The new maps will replace and phase out a bi-annual service provider broadband availability reporting process that is mostly commonly referred to as 477 data. A total of USD 97 billion has been pledged for operators to build networks where connectivity either doesn’t exist or where speeds are under the minimum 100 Mbps download and 20 Mbps upload threshold that the US government has targeted for all American homes to reach by 2027.

These include Rural Digital Opportunity Fund (RDOF), a USD 20-billion program, and the Federal Communications Commission has announced that it is ready to authorize more than USD 640 million through the Rural Digital Opportunity Fund to fund new broadband deployments in 26 states, bringing service to nearly 250,000 locations. To date, the program has provided USD 4.7 billion in funding to nearly 300 carriers for new deployments in 47 states to bring broadband to almost 2.7 million locations. NTIA programs include USD 1-billion Middle Mile Program (MMP), USD 1.98-billion Tribal Broadband Connectivity Program (TBCP), and a USD 42.5-billion Broadband Equity, Access, and Deployment (BEAD) program. The BEAD Program is the single-largest broadband investment in United States history and lays the groundwork for widespread access, affordability, equity, and adoption of broadband services. It will be distributed to states and territories to primarily finance broadband deployment projects. These investments are crucial to help connect all Americans, and ensure that unserved populations can reap the benefits of a 21st century digital economy. Capital Projects Fund (CPF) with USD 10-billion and American Rescue Plan Act (ARPA) with USD 20-billion funding are being administered by the Treasury and Reconnect Round 4, a USD 1.15-billion by USDA.

Strong investment momentum

Data centres

- Data center CapEx to grow by 10 percent CAGR over the next five years, to USD 350 billion by 2026

- Cloud and colocation data center CapEx is expected to reach USD 125 billion by 2023

- Google plans to invest USD 9.5 billion in building offices and data centers in the US in 2022

- Data center investments in India expected to surpass USD 20 billion by 2025

Citizen Networks

- US implementing investment of USD 65 billion in broadband as a part of Infrastructure act

- UK aims for gigabit- broadband to be available nationwide by 2030 and to connect 85 percent of premises by 2025

- Germany puts nationwide supply of FTTH as a priority for the Federal Government

- Indian government planning for BharatNet to connect all villages

As expected the industry faces headwinds. Fiber optic cable prices are ballooning and lead times are increasing amid a global supply shortage. Prices have risen the most in Europe, India, and China. Fiber prices have risen by up to 70 percent from record lows in March 2021, from USD 3.70 to USD 6.30 per fiber km.

The US has been the least affected, with prices rising around two percent – but after price cuts every year since 2012. “Given that the cost of deployment has suddenly doubled, there are now questions around whether countries are going to be able to meet targets set for infrastructure build, and whether this could have an impact on global connectivity,” said Michael Finch, an analyst at Cru.

Similar to shortages in semiconductors and coolants, the cause of the supply contract is a multifaceted perfect storm. Not only has demand risen with the pandemic fiber build-out and continued hyperscale but key components have also been supply constrained.

Plant outages in Russia and US have led to a shortage in helium, with prices rising 135 percent over the last two years. At the same time, prices of silicon tetrachloride, another key component, has increased by up to 50 percent according to Cru. Lead times for some fiber products have risen to 20 weeks for large customers, to almost a year for many smaller customers.

Notwithstanding, governments across the world are determined to lay fiber access networks which will connect everything, everywhere.

You must be logged in to post a comment Login