Headlines of the Day

Spectrum auction is about advancing the pawn, ICICI Securities

Though the general perception is that the upcoming auction will be focused on renewing spectrums expiring in CY21, fact is that renewal of spectrum has now become less relevant. The auction could used by operators to align their spectrum portfolio for eventual launch of 5G and to strengthen their existing 4G services. 1,800MHz and 2,300MHz bands would play a crucial role in the fast-evolving 5G ecosystem. 700MHz is becoming popular in sub-GHz bands for 5G rollout, but the forthcoming auction would be a miss for this band due to higher reserve price. We expect the auction to be aimed at beefing up spectrum holding in the 1,800/2,300MHz bands, which potentially can be ‘queen’ in 5G (‘king’ being the Cband).-See report below- Spectrum auction 2021: Countdown begins with guidelines dated January 7, 2021

How we should see the upcoming auction: The upcoming auction appears focused towards renewing spectrums expiring in CY21. However, we see operators, particularly Bharti Airtel (Bharti), advancing its pawn (1,800/2,300MHz spectrums, these were ‘king’ in 4G!) for the bigger game in 5G. Bharti, which wants to have equal footing in 5G, may play by advancing its pawn for the bigger role of ‘queen’ in 5G deployment. 1,800MHz and 2,300MHz bands are increasingly becoming popular globally for 5G deployment and, considering that they provide better coverage (compared to C-band), they may play a crucial role in 5G.

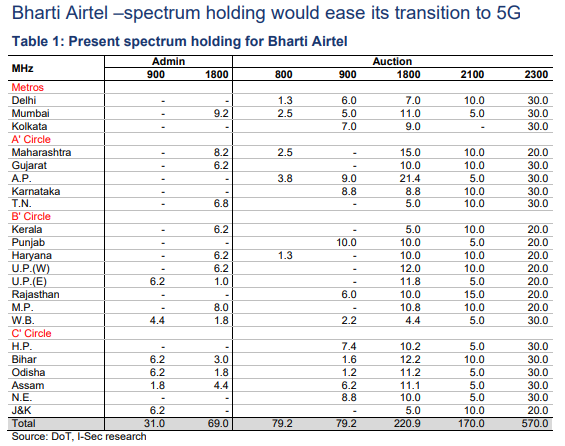

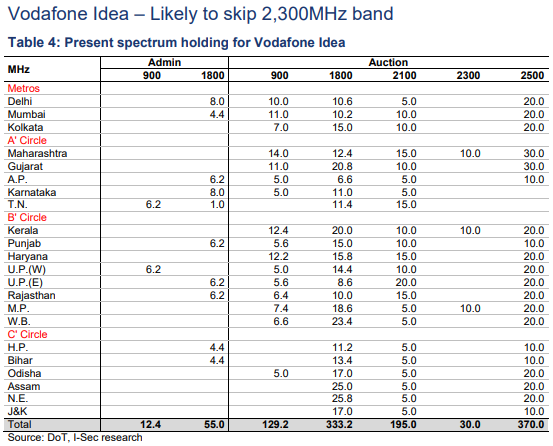

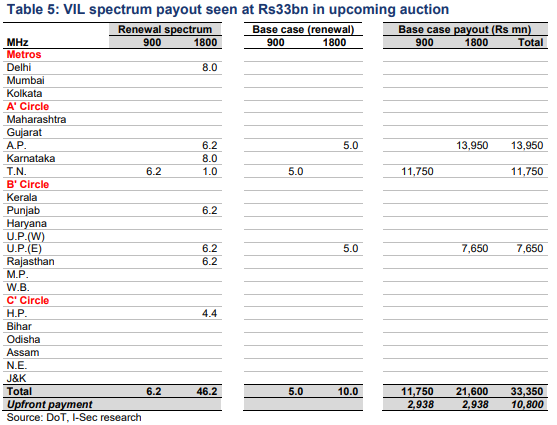

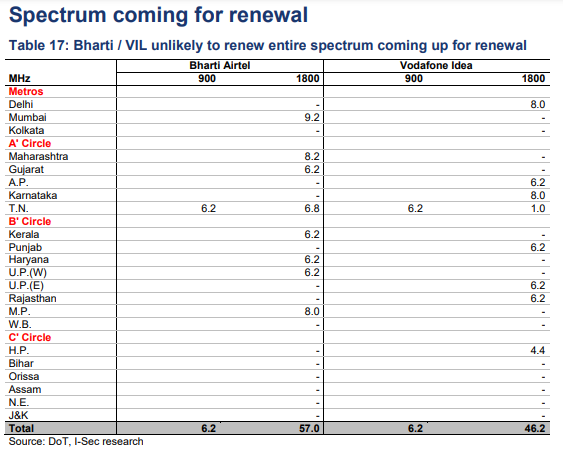

What telcos would buy in the upcoming auction: Bharti has 57MHz spectrum (eight circles) in 1,800MHz and 6.2MHz (one circle) in 900MHz coming up for renewal. These are traditionally 2G spectrums that have very little relevance for the future as significant amount of industry revenue has moved to 4G. Thus, we don’t see the imminent auction as aimed at spectrum renewal, but more as spectrum that can be used for 4G today and 5G in future. VIL has 46.2MHz spectrum (eight circles) in 1,800MHz and 6.2MHz (one circle) in 900MHz coming up for renewal.

Band-wish demand driver. Demand explained for each band.

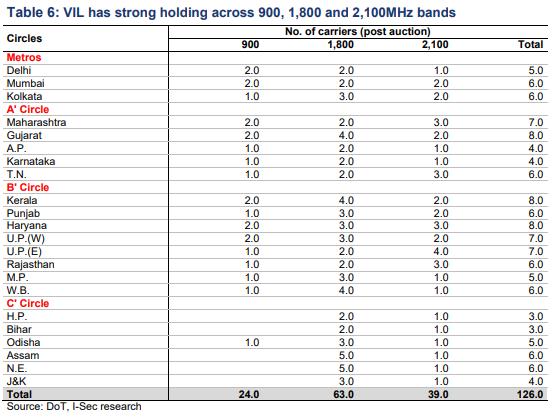

- 1,800MHz: Bharti and VIL have the highest spectrum coming up for renewal in 1,800MhZ. However, they already have a lot of excess spectrum in this band. Bharti and VIL would therefore make their buying decision based on number of carriers (and also justifiable investment) in these circles. Bharti may want to take its total number of carriers to five in each circle with cumulative spectrum holding in 900, 1,800 and 2,100MHz bands – where one carrier can be put for 2G services, and the remaining four for 4G. VIL already has >5 carriers in many circles, hence would have very limited demand.

- 2,300MHz: Bharti’s CEO Mr. Gopal Vittal has stated earlier that the company sees a spectrum portfolio gap in sub-GHz bands and 2,300MHz band. In the upcoming auction, Bharti may take its spectrum holding to at least 30MHz in each circle, and may also opt for up to 40MHz in a few circles based on price.

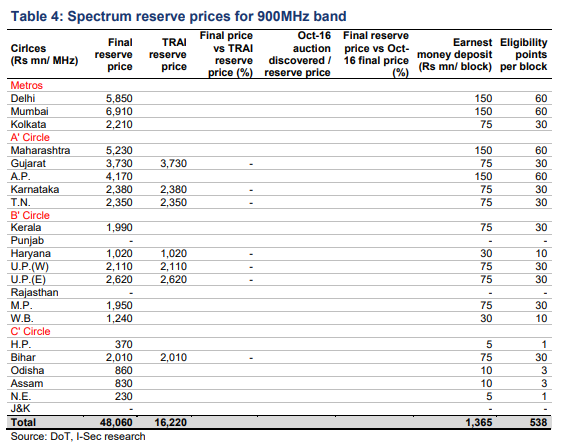

- 900MHz: Sub-GHz is a critical band, and both Bharti and VIL may renew their expiring spectrums in this segment.

- 800MHz: Bharti got a little 800MHz spectrum on acquisition of Tata Tele, but none of it is 5MHz, hence cannot be used for 4G. Further, this band is not really popular for 5G (at least today) and to use it for 4G would increase complexity of network. Bharti may therefore give a miss to 800MHz spectrum.

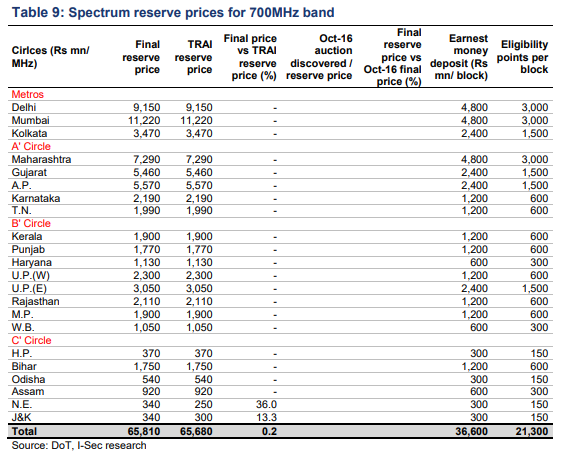

- 700MHz: This is emerging as a popular sub-GHz band for 5G rollout and should be of interest for each telco. However, the reserve prices looks higher, and may not find any bidder. Ideally, Bharti should aim to own 700MHz spectrum for 5G rollout in future

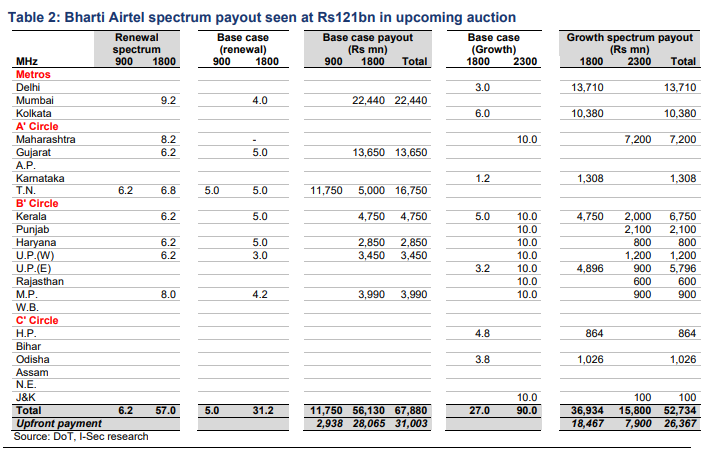

Spectrum payout. Based on above thoughts for each band: 1) Bharti may buy 5MHz (one circle) in 900MHz band, and 31.2MHz (eight circles) in 1800MHz out of the spectrum coming up for renewal, which would amount to Rs68bn (upfront payment of Rs31bn); also, Bharti may buy growth spectrum of 27MHz (seven circles) in 1,800MHz band and 90MHz spectrum (nine circles) in 2,300MHz band, which could cost Rs53bn (upfront payment of Rs26bn). Therefore, total payout for Bharti is seen at Rs121bn (upfront payment of Rs57bn); 2) VIL may buy 5MHz spectrum (one circle) in 900MHz band, and 10MHz (two circles) in 1,800MHz band out of spectrum expiring in CY21. This implies spectrum payment of Rs33bn (upfront payment of Rs14bn).

Spectrum portfolio. Bharti may end up own five carriers (cumulative in 900, 1800, and 2100MHz bands in most key circles except in Kolkata and West Bengal), and would have 30MHz spectrum pan-India in 2,300MHz band. This should put Bharti in a strong position for 4G services and a good advance towards 5G rollout. VIL already has strong spectrum portfolio (thanks to merger of Vodafone India and Idea Cellular), and has more than five carriers (cumulative in 900, 1800, and 2100MHz bands) in most crucial circles except in Andhra Pradesh and Karnataka. High leverage should restrict VIL from investing in 2,300MHz band.

5G – beyond C-band (n77 & n78)

The king (most popular band) in 5G is C-band (3,300-4,200MHz spectrum). DoT has not put up any spectrum in this band for the upcoming auction, and it may therefore be part of next auction. However, there are other spectrum bands that are also gaining popularity in 5G deployment and, considering these bands provide much better coverage (compared to C-band), they can eventually play the critical role of ‘queen’ in 5G rollout, particular for non-standalone 5G deployment.

The spectrum bands that interest us are – n28 (700MHz spectrum band which has been put up in the upcoming auction), n41 (2,300MHz band), n1 (2,100MHz band, which was earlier used for 3G rollout, and has been refarmed to 4G), and n3 (1,800MHz band). These are the bands that are either owned by telcos in India or have been put for auction.

Spectrum auction 2021: Countdown begins with guidelines, ICICI Securities

January 7, 2021

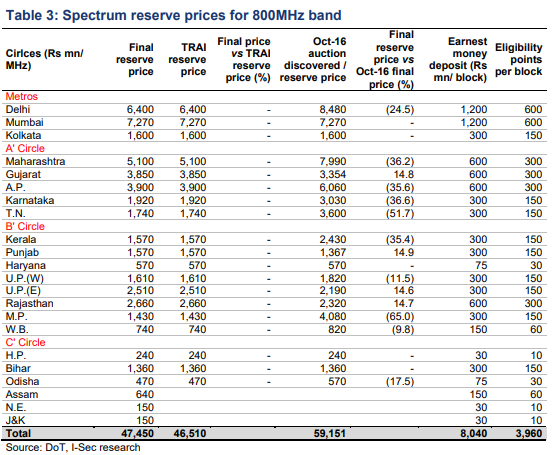

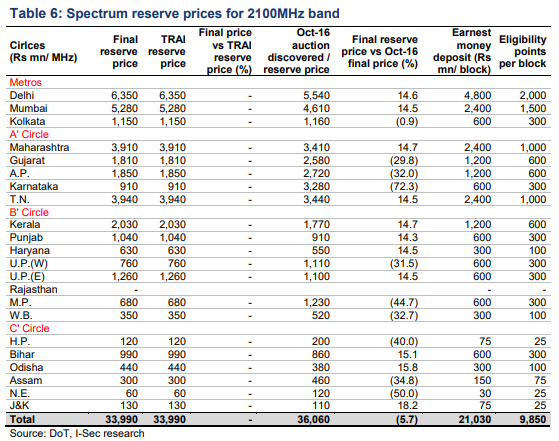

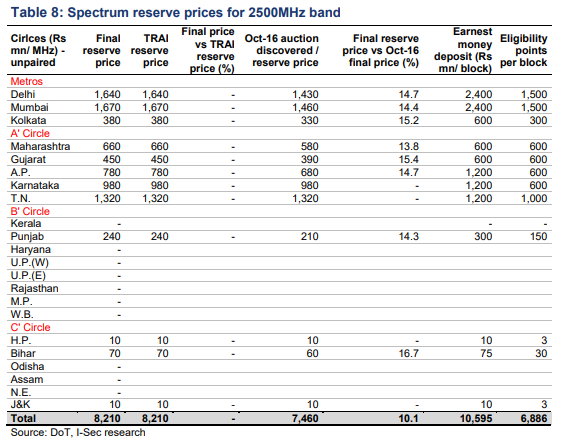

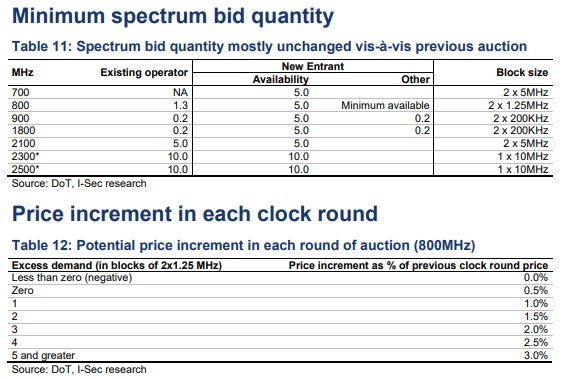

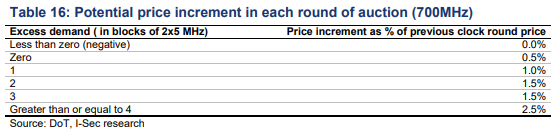

The Department of Telecommunications (DoT) has released its notice inviting applications for the spectrum auction scheduled to start on 1st Mar’21. Spectrum supplies across bands remain excessive (including spectrum coming up for renewal in CY21). Final auction prices are same as recommended by the regulator in CY18, and 800MHz reserve prices are 18.5% lower than the Oct’16 reserve prices, while 1800/2300MHz prices have been increased by 14.5% and 17.5% respectively. 700MHz band prices remain significantly high to find any bidders. We expect Bharti Airtel (Bharti) and Vodafone Idea (VIL) to renew their expiring spectrum only partially due to excess spectrum holding.

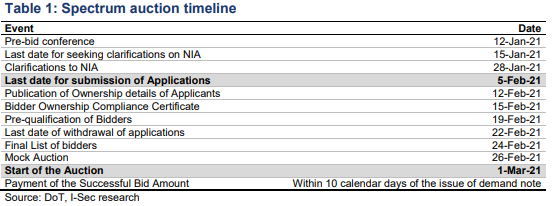

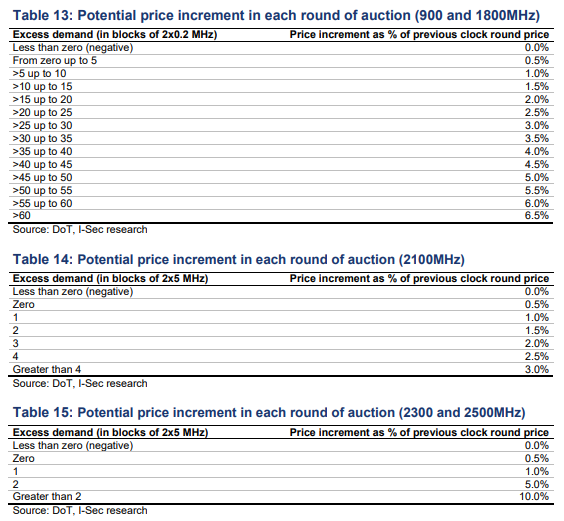

DoT releases notice inviting applications. DoT has released a notice inviting applications (NIA) for the spectrum auctions (in 700, 800, 900, 1800, 2100, 2300 and 2500MHz bands), which are scheduled to begin from 1st Mar’21. The auction does not include the popular 5G spectrum band (3,300-3,600MHz), which was broadly known. The upcoming auction includes spectrum due for renewal in CY21 too. The auction guidelines are broadly in line with regulator’s recommendation on spectrum reserve prices and block size. The key date to watch for is 5th Feb’21, the deadline for interested operators to submit their applications.

Interest rate fixed at 7.3% (vs 9.3% in 2016). DoT continues to provide deferred payment option for successful bidders with upfront payment of 50% of final bid amount in 1800, 2100, 2300 and 2500MHz bands, and 25% in 700, 800 and 900MHz. Thereafter, operators would get moratorium for two years. They have to pay balance amount in 16 equal annual installments at an interest rate of 7.3% (vs 9.3% in the previous auction).

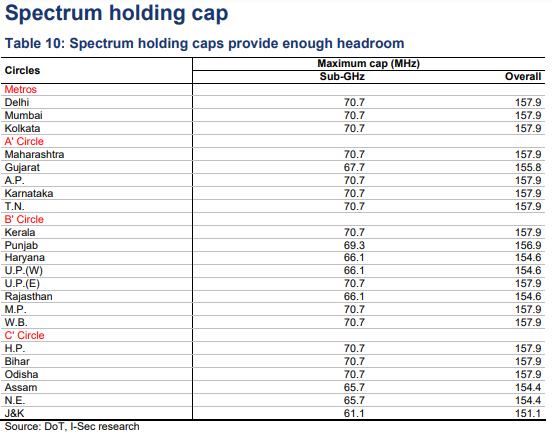

Other highlights. 1) Auctions would be held simultaneously across the aforementioned bands; 2) validity of spectrum awarded would be for 20 years; 3) spectrum holding caps remain unchanged at 50% for sub-GHz (700, 800 and 900MHz), and 35% of total spectrum available in each circle; and 4) DoT may carry frequency reconfiguration or rearrangement of spot frequencies resulting in contiguity of spectrum and improve spectrum efficiency.

800MHz spectrum price cut; 1800/2300MHz prices increase vs Oct’16 reserve prices. Final reserve price for 800MHz spectrum in the upcoming auction is 18.5% lower than the Oct’16 price, which should benefit the relevant operators. In comparison, 1800MHz final reserve price for the upcoming auction is 14.5% higher than the Oct’16 reserve price, and 2300MHz price is 17.5% higher. Though 700MHz spectrum price has been cut by 43% to Rs66/MHz pan-India, it remains very expensive and is unlikely to find any bidders.

Reserve price = final price? We expect the final auction prices across spectrums to be equal to the reserve prices due to: 1) significant spectrum supply, and 2) likely limited demand for expiring spectrums. Bharti has 57MHz in 1800MHz band and 6.2MHz in 900MHz band coming up for renewal in CY21, but it has amassed huge spectrum via M&As, which should significantly lower its renewal requirement in the upcoming auction. VIL has 46MHz spectrum in 1800MHz band and 6.2MHz in 900MHz due for renewal, and we expect very little renewal requirement for VIL as well.

Spectrum auction timeline: 5th Feb’21 is the key date

The next spectrum auction is scheduled to begin on 1st Mar’21. However, the crucial date to watch for is 5th Feb’21, the final date for interested operators to submit their applications. The earnest money deposit would provide operators intension for spectrum investments. We expect the upcoming auction to be restricted to airwaves coming up for renewal, and we don’t expect the 700MHz spectrum to find bidders.

CT Bureau

You must be logged in to post a comment Login