Trends

Smartphone Growth In Emerging Markets Will Continue In 2019

Posted by Counterpoint Research

Recently, the International Monetary Fund (IMF) projected that economic growth in emerging markets, during 2019, will be faster (4.7%) than developed markets (2.1%). This is a good omen for the smartphone market, which is still reeling from its first ever annual decline in 2018.

Although the economic strength of emerging markets will not be good enough to bring back growth to the overall smartphone market, they can certainly help arrest the decline. This is why we believe that the smartphone supply chain will keep a close eye on the emerging markets in 2019.

The IMF defines emerging markets (Exhibit 1) based on the GDP and other economic parameters.

Impact on the Global Smartphone Markets

Emerging markets alone contribute to 59% of global smartphone shipments. Even if one excludes China, they contribute to 32% of the global smartphone market. As per Counterpoint’s Market Outlook, emerging markets excluding China (EMXC) will grow faster (6%) than in 2018 (4%). The growth rate continues to be faster than the overall smartphone market, which is likely to see a second successive year of decline in 2019. Therefore, growth in emerging markets is a positive indicator for certain OEMs looking to expand in these markets.

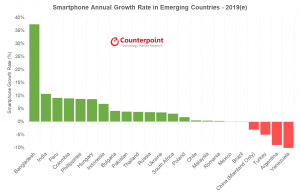

In 2018, 14 out of 23 emerging markets show positive year-on-year (YoY) smartphone growth. This year, 18 out of 23 emerging markets are likely to grow YoY. The markets which will drive the smartphone growth include Bangladesh (37%), India (11%), Colombia (9%), and Philippines (9%). We believe that the low internet penetration in these countries, in terms of unique subscribers, and a healthy GDP growth predicted for 2019 will propel smartphone sales. The internet penetration in these countries, in terms of unique subscribers, is still below 50%. Other factors which will work in favor of these countries is a healthy mix of sub-US$100 installed base of smartphone users who are likely to upgrade.

Bright Spots Among Emerging Markets

Asian emerging markets will lead the growth and are also likely to benefit from the ongoing US-China trade war. If companies decide to re-think their supply chain, countries like Malaysia, India, Indonesia, Thailand, and India will stand to benefit.

Moreover, the Indian economy continues to perform well with healthy domestic consumption. The 2019 general elections brought a strong government. This is likely to bring in certainty in regulatory and policy frameworks which will aid overall economic growth. Bangladesh, at the same time, is pushing is domestic manufacturing and focusing on financial and digital inclusion of its citizens. An uptick in employment levels drives the Philippines’ growth. This will have a positive impact on the replacement cycle of the smartphones, especially in the sub-US$100 segment.

Overall, the LATAM region is recovering with high growth rates estimated for countries like Peru, Chile, and Colombia. Colombia’s market is undergoing positive smartphone growth with the new government at the center betting big on a digital economy.

Other markets which are likely to see smartphone growth include Indonesia, Pakistan, Peru, Russia, Thailand, and Ukraine.

Exhibit 2: Smartphone Annual Growth Rate in Emerging Markets – 2019 (e)

Strugglers within Emerging Markets

Of course, not all emerging markets have a positive outlook. Some will fare better than others. There are certain emerging markets which will continue to undergo macroeconomic, regulatory, and political challenges. These markets include Argentina, Brazil, Mexico, and Turkey. Brazil’s economy is not picking up so far, and it will most likely not happen throughout 2019. However, the decline will not be as steep the one it experienced in 2018.

Turkey is bracing for a long recession ahead with inflation reaching a 15-year high. Currency in these markets remains volatile too. Argentina is unlikely to grow too, and the upcoming general election in late 2019 will be key in terms of providing a roadmap for certain reforms and economic policies. Mexico remains in the shadows of ongoing trade war and concerns over any upcoming tariffs. However, the US has recently scrapped plans to increase tariffs as part of an agreement between the two countries on immigration issues. But uncertainty still looms over the future.

Emerging Europe is facing a slowdown driven by a recession in Turkey. Russia is likely to grow, but Ukraine faces tighter monetary conditions. The inflationary pressure for emerging European markets will remain throughout the year.

To summarize, we believe that emerging markets will exhibit stronger growth in 2019 as compared to last year. This is a positive trend for the top five OEMs in these markets as their combined share has been steadily increasing over the past few quarters. Users in these emerging markets are now empowered and becoming digitally literate. Financial inclusion is happening, and dissemination of information for users is stronger than before.―CT Bureau

You must be logged in to post a comment Login