Trends

Smartphone AP market grew 35 percent in Q1 2022

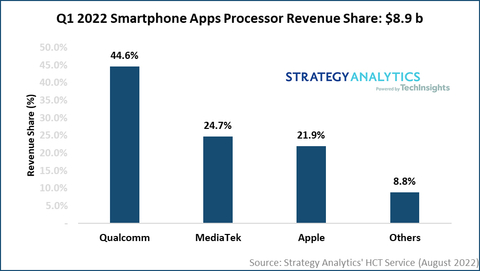

The global smartphone applications processor (AP) market grew 35 percent to $8.9 billion in Q1 2022, according to Strategy Analytics’ Handset Component Technologies (HCT) service report.

- Qualcomm led the smartphone AP market with a 45 percent revenue share, followed by MediaTek with 25 percent and Apple with 22 percent.

- 5G-attached AP shipments accounted for 53 percent of total smartphone APs shipped in Q1 2022.

- Top-selling Android AI APs include Dimnesity 700, Snapdragon 778G, Snapdragon 8 Gen 1, Dimensity 810, Dimensity 900 and Snapdragon 888/888+.

- TSMC manufactured 80 percent of smartphone APs shipped in Q1 2022. Despite momentum with Snapdragon flagship chips, Samsung Foundry lost share due to weak Exynos shipments.

- Smartphone APs manufactured in 7 nm and below process nodes accounted for 48 percent of total smartphone AP shipments in Q1 2022.

- The low-end smartphone market demand is currently weak. We think inventory digestion will happen in 2H 2022 as vendors continue to destock their supplies.

- New entrants Google and JLQ Technologies (a JV of Leadcore and Qualcomm) together shipped less than a million APs in Q1 2022. On the other hand, HiSilicon’s shipments declined to near zero.

Sravan Kundojjala , author of the report and Directorof Handset Component Technologies service at Strategy Analytics, commented, “Qualcomm’s 4 nm-based flagship AP Snapdragon 8 Gen 1 gained strong traction in Q1 2022. The company’s increased share in Samsung’s Galaxy S devices drove its smartphone apps processor (AP) revenue to an all-time high. Qualcomm has been able to navigate China and macro concerns well with its premium and high-tier 5G APs, which are seeing high demand from Android smartphone manufacturers. Samsung’s Exynos AP shipments fell 40 percent in Q1 2022 due to increased competition from Qualcomm at Samsung Mobile. However, the company showed signs of recovery with mid-range APs such as Exynos 1280, featured in high-volume Galaxy A-series devices.”

Kundojjala continued, “MediaTek and Unisoc both posted an impressive performance in Q1 2022. MediaTek’s Dimensity 9000 premium tier AP was off to a promising start but shipments amounted to slightly less than 1 million during the quarter. However, the company’s increased focus on high-end could help it withstand weakness in the mid-range in 2022 and help it maintain ASPs. Unisoc, on the other hand, gained significant share in 4G APs, thanks to increased traction with tier-one design-wins.”

CT Bureau

You must be logged in to post a comment Login