Trends

Samsung accounts for nearly 44% of LatAm smartphone sales

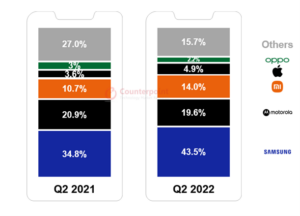

Latin America’s smartphone shipments increased 9% YoY and 8% QoQ in Q2 2022, according to the latest data from Counterpoint Research’s Market Monitor service. The growth came despite the regional economic crises and weak global smartphone shipments. Argentina led the region with 32% YoY growth, followed by Mexico and Colombia. Samsung’s shipments and market share reached all-time highs during the quarter.

Commenting on the market dynamics, Principal Analyst Tina Lu said, “Samsung, Xiaomi and Apple’s shipments grew YoY in the LATAM market. These brands managed to offset the loss registered by other brands in LATAM’s overall shipment numbers. But the shipments didn’t match consumer demand, resulting in a record-high inventory, especially for Samsung and to a lesser degree for Xiaomi.”

Lu added, “Inventory was especially high in the higher price bands. Shipments in the $250 and above price band more than doubled YoY. The economic crisis did not allow the consumer demand to be as high as the OEMs’ expectations. Furthermore, in terms of product rotation, many retailers and operators were offering longer payment terms of up to 24 installments. 5G is still not widely demanded in the region. Most 5G devices are from the high-end segment.”

Research Analyst Andres Silva said, “Q2 is usually the second biggest quarter of the year in terms of seasonality as it includes Mother’s Day and Father’s Day in most markets. Both these festivals see key promotional sales. This year too, OEMs had promotions to offer, like Xiaomi had the ‘Xiaomi Day’, where most models had double-digit discounts. Colombia also had the “Dia sin IVA”, a VAT (value-added tax)-free day. Although it was only for one day, it accelerated the market to some extent”.

Q2 2022 market summary

- Samsung was one of the few OEMs that were able to resolve or significantly improve the supply chain issue. This drove a massive surge in volume in both YoY and QoQ terms.

- Samsung’s shipments and share in Q2 2022 were at all-time highs. The brand saw strong shipments but softer sell-through, resulting in high inventory, especially in the mid-high- and high-price segments.

- Supply shortages impacted Motorola’s shipments for most of Q1 2022. Starting Q2, it increased shipments and launched low-price models in the region, which led to higher sell-through despite the slower consumer demand.

- Xiaomi continued to grow YoY and QoQ. Very aggressive pricing for the Note series, specifically the Redmi Note 11 model, led to this growth.

- Xiaomi’s sub-brand Redmi grabbed 91% of its volume in the region. Redmi has been very aggressive in dropping the price of its Note series to compensate for the absence of the A series.

- OPPO saw a shipment volume decline, but the brand improved its position in the region. Most of its volume is still concentrated in Mexico.

- OPPO is pushing to increase its participation in the affordable premium segment ($300-$500). It has launched the Reno 7 model in the region but is facing fierce competition from established OEMs. The brand is intensifying marketing, particularly at the sales point.

- Apple grew YoY driven by the iPhone 11 model and Apple Store and premium resellers partnering with banks to offer installment payments.

- Apple’s volume and share in the region continued to grow. Its older 4G model iPhone 11 drove the growth. Brazil, Chile and Mexico led in volume terms.

- The “Others” category continued to decline YoY, affected by larger OEMs’ aggressive promotions and bundling.

CT Bureau

You must be logged in to post a comment Login