Headlines of the Day

RJio’s active subs add surprised positively, ICICI Securities

The Telecom Regulatory Authority of India (TRAI) has released its monthly data on subscribers (subs) for Dec’21. Industry-active sub base grew 0.4% MoM with Bharti Airtel’s (Bharti) net add at 0.8mn. The positive surprise was Reliance Jio (RJio) with active subs net add of 4.7mn despite total sub-base dip of 12.9mn in Dec’21. VIL saw active sub decline by 2.1mn. Industry-wide mobile broadband (MBB) subs dipped 11.4mn due to sub-base clean-up by RJio and Bharti’s decline of 0.8mn. Bharti’s MBB sub market share dipped 36bps to 28.9% on active basis, while RJio’s improved by 22bps to 51.1%. MNP rose to 8.6mn with churn rate at 0.7% (vs 0.6% in Nov’21). Wired broadband sub add was stable for RJio at 0.23mn and for Bharti at 0.12mn.

Industry-active sub-base rose 4.2mn.

- Industry-active sub base rose 4.2mn to 1,001mn (0.4% MoM, 2.6% YoY), and likely impacted from tariff hike in prepaid category by 20-25%.

- RJio’s active sub base grew 4.7mn (average 3.6mn in past six month) to 364mn in Dec’21 which looks stronger than expected. Total subs dipped 12.9%, while VLR ratio improved to 87.6% (from 83.9% in Nov’21).

- Bharti’s active sub base improved 0.8mn to 349mn. Its total sub base increased 0.5mn which means existing subs base was stable despite tariff hike.

- VIL’s active subs dipped 2.1mn (2.7mn in Nov’21) to 229mn in Dec’21. Total subs reduced by 1.6mn. It looks VIL continues to be impacted by SIM consolidation.

- RJio’s active sub market share improved by 32bps to 36.4% MoM, while Bharti’s stood at 34.8% (down 7bps MoM) and VIL’s fell 31bps MoM to 22.9%. RJio continues to expand lead in active sub market share.

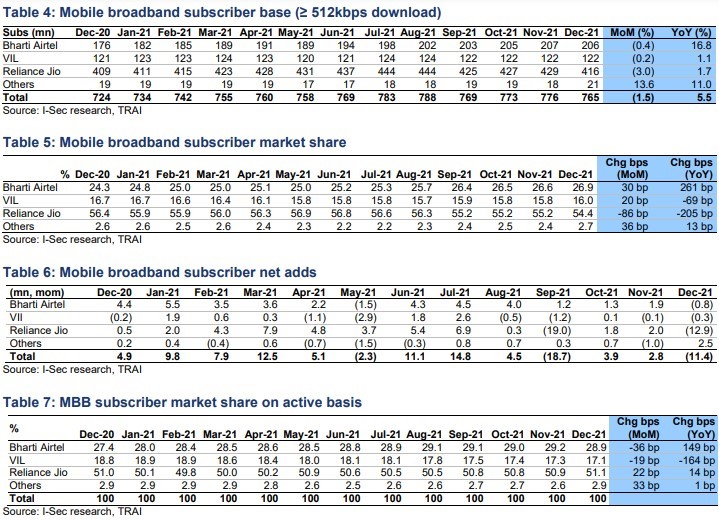

Industry MBB (mobile broadband) subs dipped 11.4mn

- Industry-wide MBB subs dipped 11.4mn to 765mn in Dec’21. Bharti’s dipped by 0.8mn subs in this category was disappointing. Its average net add stood at 2.9mn per month in the six months.

- RJio’s MBB sub base dipped by 12.9mn to 416mn. Adjusted for inactive subs, its MBB market share stood at 51.1% (up 22bps MoM), while Bharti’s was 28.9% (down 36bps MoM) and VIL’s 17.1% (down 19bps MoM).

- VIL’s MBB sub base decreased 0.3mn to 122mn, which is disappointing.

Wired broadband sub net add steady for Bharti / RJio

- Wired broadband sub base was up by 2mn MoM to 26.4mn (up 8.2% MoM / up 18.6% YoY growth) in Dec’21. Net add for Bharti was 0.12mn (vs 0.14mn in past six month). Others category grew by 1.78mn subs to 12.5mn.

- RJio’s market share declined to 17.3% (down 48bps MoM), and net add stood at 0.23mn (vs 0.22mn in past six month). Bharti’s market share was 15.9% (down 82bps MoM). BSNL lost 0.13mn subs and its market share was down 180bps MoM to 15.4%.

Industry MNP churn rate rose slightly at 0.7%

- Industry porting was steady at 8.6mn in Dec’21. MNP churn rate was 0.7% (vs 0.6% in Nov’21).

Active subs: Industry sub net add at 4.2mn

Active subscribers, or visitor location register (VLR), is a temporary database of subs who have roamed in a particular area that an operator serves. Each BTS is served by exactly one VLR, hence, the unique registration. The VLR data is calculated on the basis of active subs in VLR on the date of peak VLR of a particular month for which the data is being collected. This data is collected from switches having a purge time of not more than 72 hours.

Mobile broadband subscribers: Industry lost 11.4mn subs

Total subscriber base

Wired broadband subscribers

CT Bureau

You must be logged in to post a comment Login