Headlines of the Day

Reliance Jio’s growth leadership goes missing in 2020, as Airtel catches up

In India’s telecom market, Reliance JioInfocomm Ltd has been the proverbial hare that races far ahead of its competition. It became the market leader in terms of revenues just three years after starting operations in September 2016.

The growth in leadership was expected to continue in 2020 as well. After all, though all telcos raised tariffs in December 2019, Jio’s tariffs remained at a significant discount to its competitors.

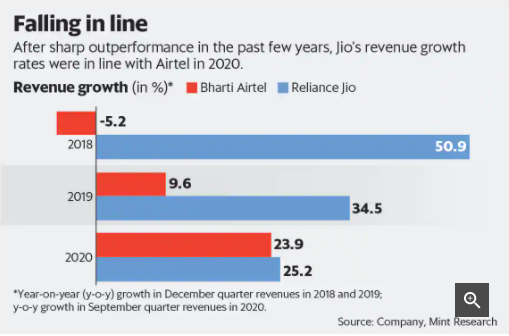

However, as it turns out, Jio’s revenue growth rate so far this year has only matched the growth reported by Bharti Airtel Ltd’s India wireless business. Jio’s September quarter revenues were 25.2% higher compared to the quarterly revenue run rate in the December 2019 quarter. Airtel’s growth in the India wireless segment stood at 23.9%.

However, analysts say Jio’s revenues include an incremental contribution of about ₹200 crore from the fixed broadband segment, where the company started charging subscribers this year. Besides, the ban on international travel hit Airtel’s roaming revenues in the past six months. Adjusted for these, Airtel’s growth rates are a tad higher compared to Jio in 2020.

“At the beginning of the year, it was expected that Jio’s growth leadership will continue. However, the high base factor appears to be playing a role, besides reports that the company’s capacity is stretched in some urban areas,” says an analyst at a domestic institutional brokerage.

The high base is clearly at work. In terms of absolute incremental revenue, Jio is still ahead of Airtel. However, with similar growth rates in percentage terms, revenue market share gains for both firms will be identical. Both companies are gaining at the expense of Vodafone Idea Ltd, where quarterly revenues in Q2 fell marginally, compared to the December 2019 quarter.

In Q2, Jio’s subscriber base rose by 7.3 million, much lower than the 10.2 million subscriber additions in the June quarter. Airtel, on the other hand, reported a huge 13.9 million jump in subscriber base last quarter. The latter’s subscriber base is being driven by the 4G segment, which has risen 23% since December 2019, compared to a 4% growth in the overall subscriber base. “Strong 4G subscriber addition momentum demonstrates high value customers’ preference towards Bharti’s network, which is driving higher average revenue per user (Arpu),” analysts at Edelweiss Securities Ltd said in a note.

Also, while the total data traffic on Jio’s network rose 19% compared to the December 2019 quarter, Airtel’s data traffic rose by 38%, albeit on a lower base. All of the above is also reflected in a faster growth in operating profits at Airtel this year.

Despite the outperformance, Airtel shares are in a rut, giving up most of their gains from the strong pre-covid rally. As pointed out in this column, investors are worried about the effects of competition with a cash-rich Jio. However, as the performance in 2020 shows, Airtel is competing fairly well. Live Mint

You must be logged in to post a comment Login