Daily News

Reliance Jio’s Festive Offer Of Low-Priced Phone Led By Piling Inventory

Reliance Jio’s festive offer of a lower-priced JioPhone is likely to have been driven by higher inventory of the feature phone in a market where new buyers are increasingly turning to smartphones.

“While this will boost Jio’s October subscriber additions, given that this offer is limited to the festive season, it is unlikely to clear the 40 million in channel handset inventory. Thus, an extension cannot be ruled out. In addition to risk of increased subscriber churn, the cut in the price may adversely impact Airtel’s and Vodafone Idea’s ability to monetise voice subscribers,” wrote Deepti Chaturvedi, analyst at CLSA.

Last week, Jio, telecom arm of Reliance Industries, said it would during the Dussehra and Diwali period make the JioPhone available for a special price of Rs 699, against the current Rs 1,500. Feature phone users can get a JioPhone for Rs 501 under an exchange; they will have to pay another Rs 594 upfront for six months of service, taking the effective upfront cost of switching to Rs 1,095.

Chaturvedi says there have been almost 110 million 4G (fourth-generation technology) feature phone shipments between June 2017 and September 2019. The JioPhone user base itself is around 70 million. So, at least 40 million phones are in the inventory and this will take three or four months to clear.

“More, the recent stepdown in Jio’s monthly subscriber addition from an average of 10 million in FY19 to 8 million during April-August (first five months of FY20) could also drive Reliance Jio to extend this offer. After two years of launch, JioPhones have gained a mere estimated 15 percent share of the almost 500 million feature phone base. Extension of this offer will help boost its share in the future,” wrote Chaturvedi.

The firm said the offer was targeted at the 350 million 2G users, currently paying extremely high rates for poor quality data. “This offer indicates Jio’s intention to continue to focus on user addition, especially at the low-end. While we consider the ARPU (average revenue per user) upgrade decision — particularly on its smartphone offering — to be independent to this offer, we do not expect tariff (rate) hikes any time in the near term (for the next six months at least),” said Sachin Salgaonkar, analyst, Bank of America Merrill Lynch.

While older majors Airtel and Vodafone Idea have managed to stabilise their subscriber base with minimum recharge plans, they are not likely to introduce any new ones to counter this move.

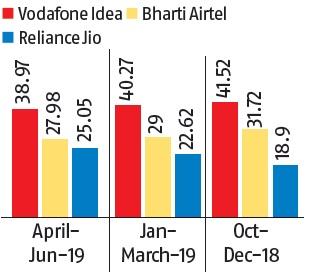

The user addition from this offer will figure in the third quarter numbers and will not impact the coming second quarter subscriber share news for the firms. Vodafone Idea leads in rural subscriber market share, where a large number of 2G and feature phone users are concentrated.―Business Standard

You must be logged in to post a comment Login