Broadband Equipment

Realising the broadband dream

Commercial 5G services were launched in 2019 in key economies globally. Large edge-data centers were deployed with network on top of their own network connectivity. Tower fiberization and broadband connectivity grew.

Commercial 5G services were launched in 2019 in key economies globally. Large edge-data centers were deployed with network on top of their own network connectivity. Tower fiberization and broadband connectivity grew.

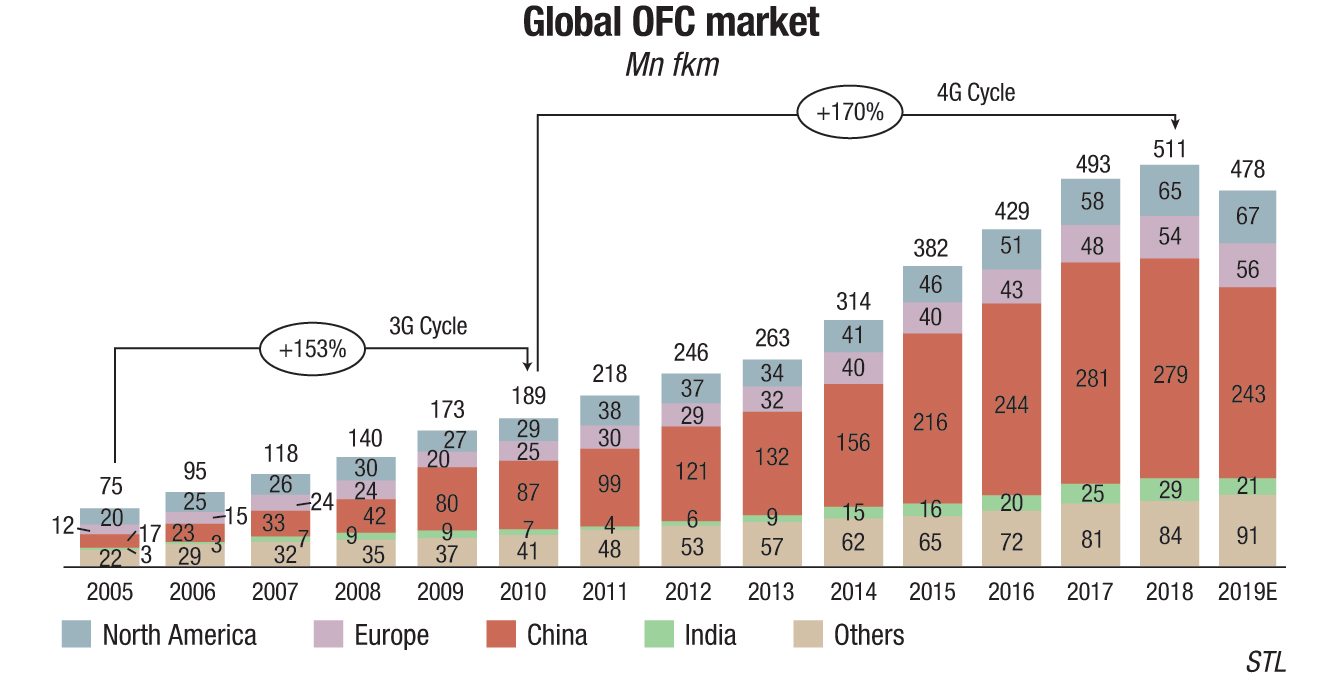

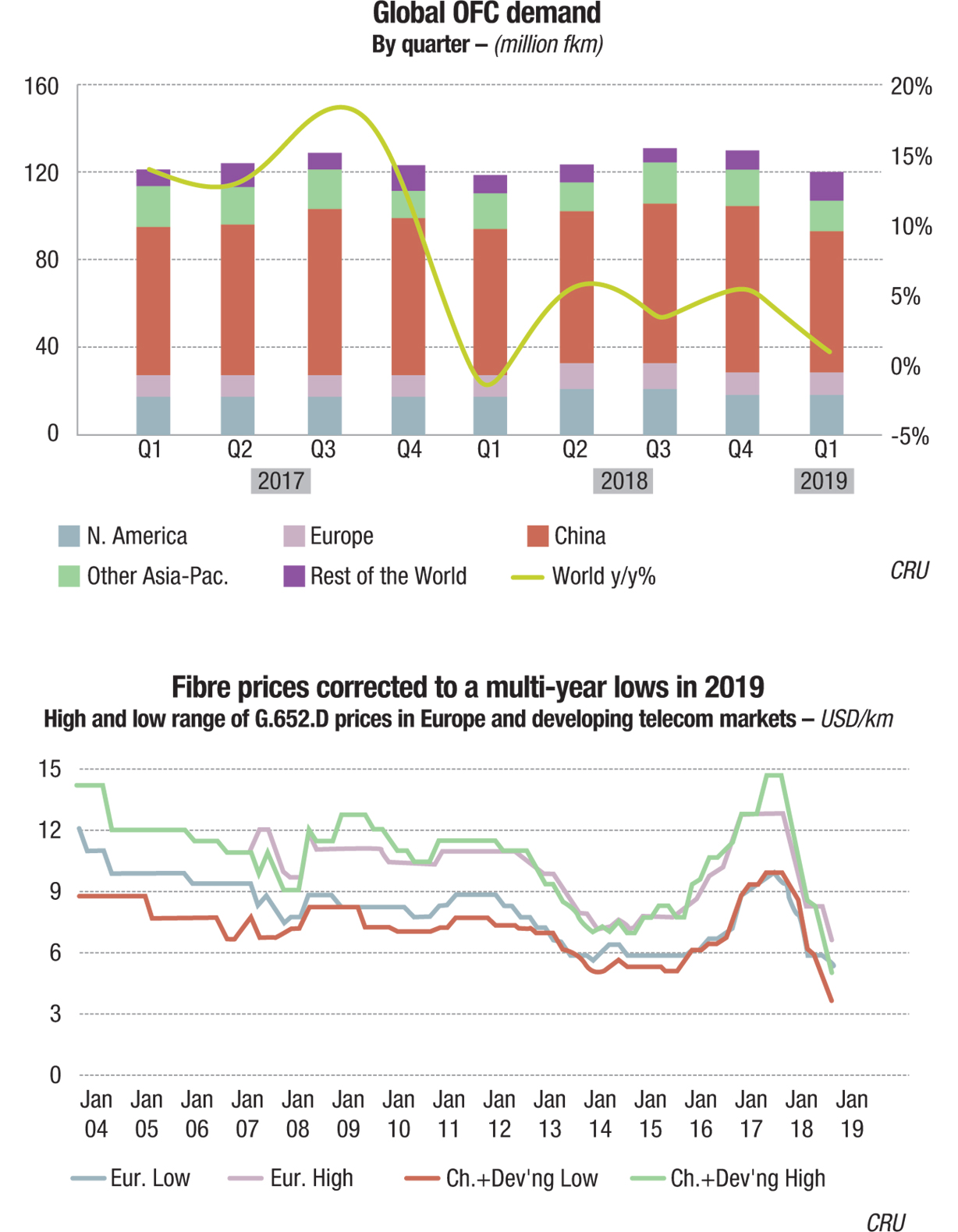

The year saw global fiber demand come down by 7 percent. While demand in China fell by 13 percent, US and Europe saw a 4 percent increase. The Indian telecom industry also restructured and the fiber demand in India saw a degrowth of 29 percent.

Despite significant investments, India’s per capita fiber coverage stands at meagre 0.09 fiber km as against the 0.87 fiber km for China and 1.3 fiber km for Japan and the US. The US has deployed over 400 million km of fiber for one-third the size of India’s population and China has deployed more than 1 billion km, while in India fiber deployed is only around 100 million km. This offers tremendous opportunity in converting the telecom landscape with optical fiber-based networks, which help to derive huge advantages with futuristic network topologies.

An investment of Rs 7 trillion is anticipated in the next 4 years from both the Indian government and the industry as broadband connectivity is made to all villages by 2022. To achieve this, apart from BharatNet’s installations, deployment of an additional optical fiber cable of 3 million km route km, and fiberization of towers from 30 percent to 70 percent is planned.The projections made below are not final. The coronavirus pandemic is far from over, and its impact on the economy remains in an exceptionally fluid situation. Once normalcy returns, we plan to update the forecast later in the year.

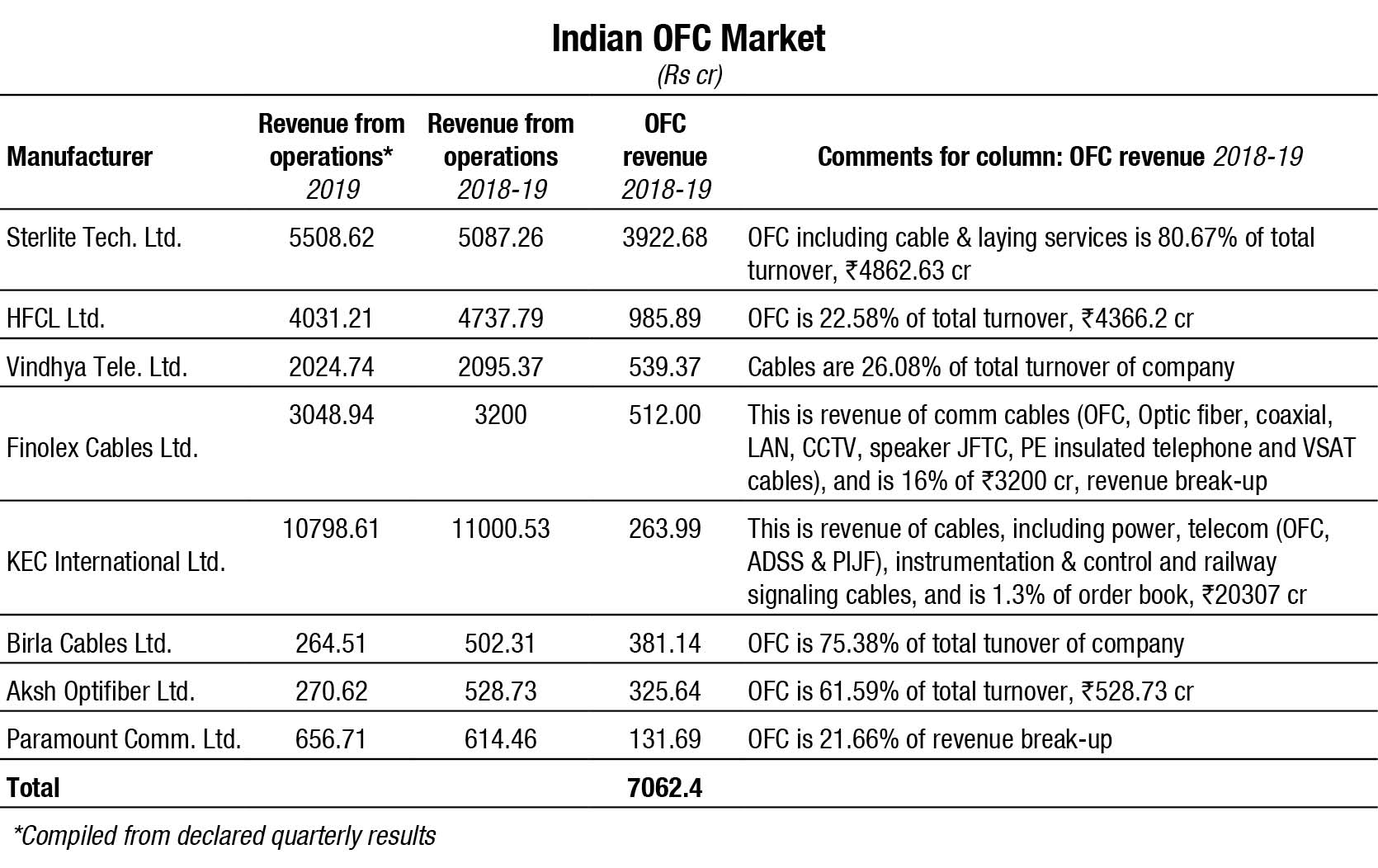

Major players operating in the Indian market include Sterlite Technologies Limited, Himachal Futuristic Communications Ltd., Aksh OptiFiber Limited, Finolex Cables Limited, Birla Cables Limited, Vindhya Telelinks Limited, UM Cables Limited, Uniflex Cables Limited, and Paramount Communications Limited.ICRA estimates the present market value of fiber assets owned by major private telecom operators to be about Rs 1.2 trillion. While the Indian OFC market is pegged at Rs 65,200 million in 2019, the extent of investment in fiber rollout over the next few years is estimated as Rs 2.5 trillion to Rs 3 trillion. Sharing of fiber among multiple telcos will be the key driver of a reasonable return on capital.

Major players operating in the Indian market include Sterlite Technologies Limited, Himachal Futuristic Communications Ltd., Aksh OptiFiber Limited, Finolex Cables Limited, Birla Cables Limited, Vindhya Telelinks Limited, UM Cables Limited, Uniflex Cables Limited, and Paramount Communications Limited.ICRA estimates the present market value of fiber assets owned by major private telecom operators to be about Rs 1.2 trillion. While the Indian OFC market is pegged at Rs 65,200 million in 2019, the extent of investment in fiber rollout over the next few years is estimated as Rs 2.5 trillion to Rs 3 trillion. Sharing of fiber among multiple telcos will be the key driver of a reasonable return on capital.

Fiber deployments in India were slow owing to a number of factors including difficulties in obtaining right-of-the-way (RoW) permissions, huge RoW charges per km, high cost of customer premises equipment, and allied civil construction costs. All these are being addressed proactively in the already-approved National Digital Communications Policy 2018, which aims to debottleneck the field issues and catapult the industry to new heights.

The key drivers may be identified as rising investments in OFC network infrastructure by the Indian government to increase internet penetration across the country, which is in line with government initiatives like Smart Cities Vision and Digital India. Impetus will also come from the IT sector, rising number of mobile devices, and surging number of data centers. On the telecom side, universalization of 4G, FTTH, and LTE, aimed at enabling the urban hinterland and rural India with superior high-speed data connectivity, will demand OFC installations.

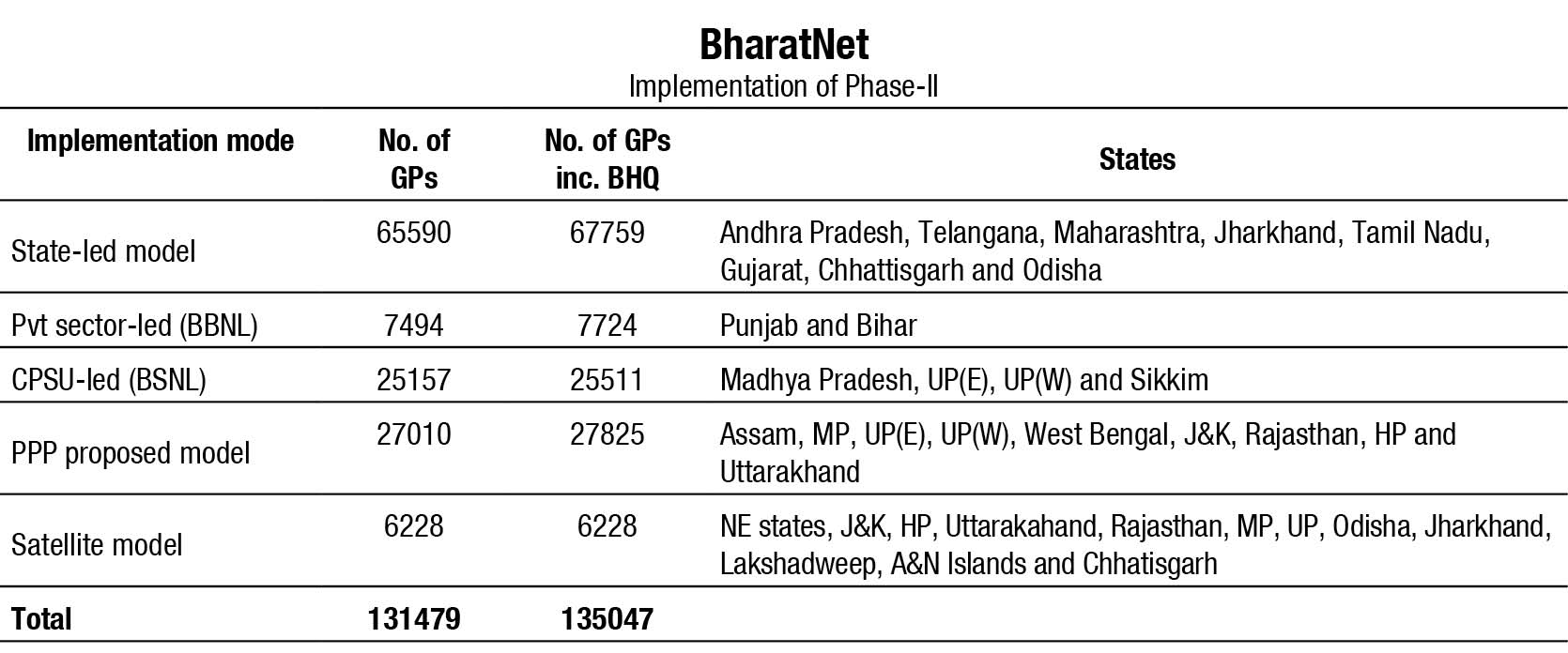

In 2020, the government plans to continue with its investments. BharatNet is the world’s largest rural broadband initiative undertaken by the Government of India. It is a part of the Digital India vision, implemented through a partnership with states and the private sector. 100,000 GPs were connected across India through BSNL, RailTel, and PGCIL in Phase-I. Around 19,952 out of 27,534 km of lossy OF cable of BSNL was replaced by new OF cable. Additional work front of 26,264 GPs was done to complete 100,000 GPs. In Phase-II, 131,000 GPs, including GPS over satellite media are being connected. Till February 2020, 150,029 GPs were laid with OF cables and 136,693 GPs were made service-ready on fiber and satellite. The length of total OFC laid amounted to 424,299 kms.

Recently there has been activity in the Telangana project. The various states are also in different stages. In the near future, Tamil Nadu, Gujarat, and Haryana, are looking at setting up their networks. These will be followed by Madhya Pradesh and a few more states. The Rs. 3500-crore system-integration project for a digital communications network, being executed by Sterlite Technologies for the Indian Navy, has a huge OFC component.

Sterlite was also responsible for contributing to solve the global shortage problem of optical glass preform. Growing adoption of optical fiber resulted in a looming shortage of optical fiber preform. This, in turn, culminated in a shortage of fiber, thereby triggering the price hike of telecom fiber. The situation prompted manufacturers of optical fiber preform to increase their production capacity. Several companies, including Corning Incorporated and Yangtze Optical Fiber Cable Joint Stock Limited Company, went on to announce projects to expand their existing preform facilities and to invest in new preform facilities at the beginning of 2017. Sterlite Technologies Limited constructed one of the world’s largest preform-manufacturing facilities. Since late-2019, there is enough capacity available for the world’s operators and hyperscale/cloud companies to consume well over 600 million kilometers of fiber, and unleash the potential of next-era 5G networks.

There has been lower than expected network creation for Indian telcos. Signs of slowing demand on account of Jio spending pause, and other incumbents deferring their CapEx investment, was observed in 2019. A large part of it is attributed to low order booking in the last quarter and evident signs of the customers delaying pickup of further existing order book. Some pricing pressures are also expected on contract renegotiations for 2020 because of short-term oversupply situation, which has been created in the industry to address the expected 5G demand. Taking both these factors into consideration, on a conservative basis, lower growth in revenues in FY20 as compared to FY19 is expected to be reported. And, 2HFY20 (October 2019 to March 2020) profitability would be weaker than 1H (April 2019 to September 2019). This would also include the impact of the additional 5G-related R&D investment in the second half of the current year.

GLOBAL SCENARIO

The global fiber optics market is projected to grow at CAGR of 12.26 percent over the next five years. The increasing demand for optical communication and sensing applications for diverse purposes provides avenues for industry growth. The growing importance of cloud computing, data transfer and storage, and IoT is driving the use of the internet. Moreover, the increasing demand for cost-effective, power-efficient, and high-level integration of IT infrastructure is expected to drive demand.

The global fiber optics market is projected to grow at CAGR of 12.26 percent over the next five years. The increasing demand for optical communication and sensing applications for diverse purposes provides avenues for industry growth. The growing importance of cloud computing, data transfer and storage, and IoT is driving the use of the internet. Moreover, the increasing demand for cost-effective, power-efficient, and high-level integration of IT infrastructure is expected to drive demand.

Furthermore, the increasing cloud-based applications, audio-video services, and video-on-demand (VoD) service further stimulate the demand for fiber optic installations. The growing adoption of technology in communication and data-transmission services will fuel the market.

Furthermore, the increasing cloud-based applications, audio-video services, and video-on-demand (VoD) service further stimulate the demand for fiber optic installations. The growing adoption of technology in communication and data-transmission services will fuel the market.

Geographically, Asia-Pacific, dominated by two major economies of the world, India and China, constitutes the lion’s share of the fiber optics market. These regions are spearheading revenue growth owing to technological advancements and large-scale adoption of the technology in IT and telecommunication and administrative sectors. Additionally, increasing application of fiber optics in the medical sector is catapulting growth across countries like China, Japan, and India, thus propelling the overall demand at a significant rate. Also, the consistent rise in the use of smartphones and internet facilities in the region contributes to the adoption of optical fiber cables, for telecommunication applications. 5G connections (excluding IoT) are anticipated to reach USD 670 million in Asia-Pacific, by 2024, accounting for approximately around 60 percent of the global 5G connections, according to GSMA. Moreover, the governments of developed nations like China and Japan are heavily investing in security infrastructure at country levels. All the above factors are expected to pave the way for new opportunities.

Corning Incorporated, Optical Cable Corporation, OFS Fitel, Prysmian S.p.A. AFL, Yangtze Optical Fibre and Cable Joint Stock Limited Company, General Cable Corporation, Sumitomo Electronics Industries, LS Cable & System, Leoni AG, and Furukawa Electric are the key players in manufacturing fiber optics globally. Though the giants have occupied considerable market share, there are still a large number of manufacturers of fiber optic cables with small capacities around the world.

LEADING GLOBAL VENDORS

Corning

Corning

The number one supplier of fiber optic cable is Corning, based in New York, USA.

Since ushering in the telecommunications revolution with the invention of low-loss optical fiber in 1970, Corning has been continually innovating to increase the speed and capacity of optical networks, while reducing installation costs, and are delivering solutions for growing segments like fiber-to-the-home, 4G/5G densification, wireless technology, and hyperscale data centers.

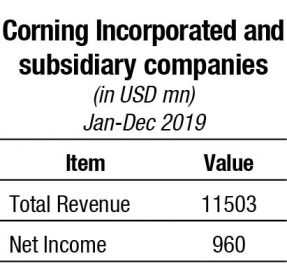

For the fiscal year ended December 2019, Corning Incorporated revenues increased 2 percent to USD 11.5 billion. Net income decreased 11 percent to USD 862 million. The company’s Optical Communications segment manufactures a broad range of end-to-end fiber and wireless solutions for communications networks, and contributed net sales of USD 4.1 billion and net income of USD 489 million in 2019. The company expects Optical Communications sales to decline by 5 percent to 10 percent as the lower level of sales experienced in the second half of 2019 continues throughout the first half of 2020. Corning expects year-over-year growth in Optical Communications sales and profit to resume in the back half of 2020, driven by projects for 5G, fiber-to-the-home, and hyperscale data center deployments.

Advancing global presence remains one of YOFC’s key development strategies. Since its listing in Hong Kong Stock Exchange, YOFC has worked to make inroads into overseas markets and has found factories in Myanmar, Indonesia, and South Africa, thus securing sustained double-digit growth in overseas revenue in recent years.

Yangtze Optical Fibre and Cable

Yangtze Optical Fibre and Cable

Yangtze Optical Fibre and Cable Joint Stock Limited Company is principally engaged in the manufacture and sales of optical fiber preforms, optical fibers, and optical fiber cables.

Furukawa Electric In 2019, YOFC maintained its global leading position in terms of optical fiber cable business. YOFC’s revenue from optical fiber cables was RMB 5.727 billion (USD 822.47 million), increased by 13.74 percent compared with last year.

In 2019, YOFC maintained its global leading position in terms of optical fiber cable business. YOFC’s revenue from optical fiber cables was RMB 5.727 billion (USD 822.47 million), increased by 13.74 percent compared with last year.

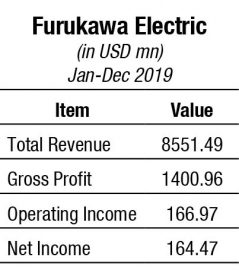

Furukawa Electric manufactures mining equipment and advanced materials, including fiber optic cable. The vendor is steadily making capital investment for increasing its production capacity for optical fibers in North America and Japan and for reducing costs, and strengthening the production capability for the products, for which an increase in global demand is expected over the mid-to long-term.

Fiberhome Telecommunication Tech Co. Ltd.Hengtong Optic-Electric Co. Ltd.

Fiberhome Telecommunication Tech Co. Ltd.Hengtong Optic-Electric Co. Ltd.

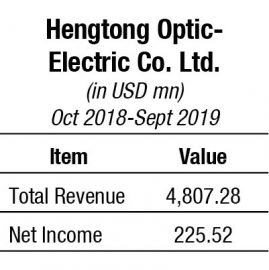

HTGD has built up a complete optical communication industry chain, from preform to optical fiber to optical cables to optic device. HTGD has maintained its advantage in copper communications cables, with a full range of products used in consumer electronics, data transmission, and railway networks.

A China-based company, FiberHome is principally engaged in the manufacture and sales of communication equipment. The company’s main products include communication system equipment, optical fibers, cables and data networking products, like the optical networking products, internet protocol (IP) data products, broadband access products, optical fibers and cable products, wireless communication products and power supplies, as well as the optoelectronic devices. The company mainly distributes its products in domestic and overseas markets.

FiberHome has become one of the world’s ten most competitive enterprises in optical communications. It ranks among the top six enterprises in the world in income from optical transport products, and among the top four in the world in overall strength of optical cables. It has ranked first in export among optical cable enterprises of China for eight consecutive years. Its revenue is estimated at CNY 24.64 billion, and net income CNY 832.15 million on Jan 2, 2020.

FiberHome has become one of the world’s ten most competitive enterprises in optical communications. It ranks among the top six enterprises in the world in income from optical transport products, and among the top four in the world in overall strength of optical cables. It has ranked first in export among optical cable enterprises of China for eight consecutive years. Its revenue is estimated at CNY 24.64 billion, and net income CNY 832.15 million on Jan 2, 2020.

Futong

Futong, which was founded in 1987, has been ranked as one of the top 500 Chinese private enterprises. It is a global vendor of basic internet materials, and is leading in optical fiber and cable industry in China with 30 factories and a total of 12,200 employees worldwide. Its main products are optical fiber preform, optical fiber, optical cable, and end-use fiber optic products like broadband-access equipment and high-temperature superconductor cable. Futong has been awarded the National Major Technological Invention Award of Information Industry and Second Prize of National Scientific and Technological Progress as the standard setter of opticatl fiber preform and technology.

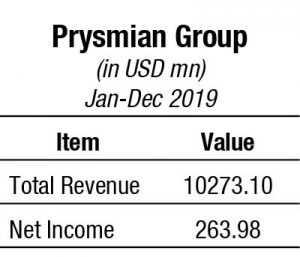

Sales of the telecom segment in 2019 amounted to €1648 million (USD 1469.75 million), with a slight organic growth (+0.4 percent), despite the order slowdown in the second half of the year due to the surplus stock accumulated by several clients (telecom operators). Europe and North America contributed the most. Including €7 million resulting from the IFRS 16 impact, adjusted EBITDA stood at €274 million, compared to €295 million in 2018, which had been particularly positive, thanks to several one-off effects and the significant contribution of the Chinese subsidiary YOF that nearly halved in 2019. The main factors that impacted profitability in 2019 included lower volumes and price pressures partially offset by cost efficiencies. Adjusted EBITDA ratio to sales went to 16.2 percent from 18 percent in 2018.

Prysmian Group

Prysmian Group

Prysmian is a conglomerate that provides cable to energy and telecommunication companies worldwide. It is a union of Prysmian, Draka, and General Cable.

Sumitomo Electric  The optical fiber cables business recorded a positive growth overall, negative in the second half of the year due to higher stock accumulation by several customers. The result was driven by its ability to seize the constant broadband network demand in North America and the positive effects of increased volumes at constant price levels recorded in Europe. In the backdrop of trade tensions between the United States and China having gradually intensified, and the recent developments relating to the COVID-19 virus and its impact on the global economy, Prysmian Group expects that the uptrend seen in North and South America in 2019 will continue in 2020.

The optical fiber cables business recorded a positive growth overall, negative in the second half of the year due to higher stock accumulation by several customers. The result was driven by its ability to seize the constant broadband network demand in North America and the positive effects of increased volumes at constant price levels recorded in Europe. In the backdrop of trade tensions between the United States and China having gradually intensified, and the recent developments relating to the COVID-19 virus and its impact on the global economy, Prysmian Group expects that the uptrend seen in North and South America in 2019 will continue in 2020.

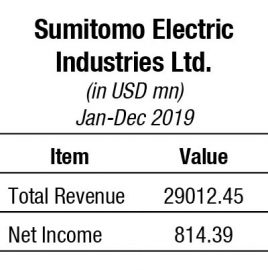

Sumitomo Electric manufactures advanced materials used in automotive manufacturing and the energy industry like rubber and steel, in addition to fiber optics for telecommunications. The Infocommunications division of the company supplies products and systems that support today’s internet services like optical fiber cable, opto-electronic devices, gigabit Ethernet-passive optical network (GE-PON), and other devices. Sales of Infocommunications division in 2019 is USD 2030.87 million, 7 percent of the total revenue of USD 29012.45 million.

ZTT While sales of optical fiber cables continue to expand, the effect of transferring part of this business to other segments and so forth saw net sales decrease by ¥11.9 billion (5.4 percent) to ¥208.4 billion. Despite the promotion of cost reductions through productivity improvement, operating income fell by ¥2.2 billion to ¥16.4 billion due to an intensifying business competition and associated sales price decline. The target for FY 2019 was net sales of ¥220.0 billion and operating income of ¥12.0 billion.

ZTT was established in 1992. It is publicly traded on the Shanghai Stock Exchange, and produces nearly 100 series and over 1000 varieties of fiber optic communication and power transmission products.

Recently, ZTT’s three new fiber optic cable products and new technologies have passed identification, and the comprehensive performance has reached the international advanced level. The three new products and technologies are metallic loose-tube fiber optic cable for terrestrial communication, mirco-module tube-blowing fiber optic cable, and RFID-based fiber optic cable identification technology.

The Power & Telecommunication Systems Company deals with power cables, telecommunication cables, aluminum wires, enameled wires, optical fibers, optical fiber cables, telecommunication components, optical components, fiber optic equipment, network equipment, and installation. It aims to be a business that possesses high earning power, and a powerful metabolism that enables it to reinvent itself. Although the continued robust demand for optical fiber has been impacted by easing in the demand-supply relationship, the company is making progress on rolling out solutions, mainly based on high-density, small-diameter optical fiber.

Fujikura Group

Fujikura Group

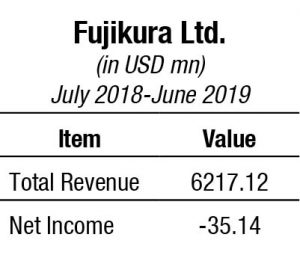

The Group classifies its businesses into four segments, Power & Telecommunication Systems Company, Electronics Business Company, Automotive Products Company, and Real Estate Business Company, considering similarities in production methods, production processes, applications, and sales methods.

Nexans Optical fiber and OFC are important contributors to the telecom systems division. In 2019, for the Power & Telecommunication Systems Company the net sales increased from ¥354.8 billion in 2018 to ¥36.5 billion (USD 3109 million) in 2019 and ratio of operating income to net sales from 5 percent to 4.1 percent. As its corporate mission, Fujikura provides customers and societies with unique Tsunagu technologies to lead them to the future.

Nexans Optical fiber and OFC are important contributors to the telecom systems division. In 2019, for the Power & Telecommunication Systems Company the net sales increased from ¥354.8 billion in 2018 to ¥36.5 billion (USD 3109 million) in 2019 and ratio of operating income to net sales from 5 percent to 4.1 percent. As its corporate mission, Fujikura provides customers and societies with unique Tsunagu technologies to lead them to the future.

As a global player in the cable industry with over 120 years of experience, Nexans works behind the scenes to develop resilient products and state-of-the-art services designed to help customers meet the constantly growing energy and data needs. The Group’s sale in 2019 was €6.5 billion (USD 6006.54 million). The Telecom & Data segment represents 9 percent, translating to USD 540.59 million of the group’s sales. It includes data transmission (submarine, fiber, FTTx), telecom network, hyperscale data centers, and LAN cabling solutions.

2019 saw the demand-supply balance for optical fiber deteriorate in China, which is the largest source of demand among countries, and prices fell substantially. Growth of the communications networks in China is, however, promising.

Vendors are accelerating business expansion in terms of sales for FTTx and hyperscale data center customers in the US, where demand is strong. If not already present, they are also seeking to break into Europe and other regions to maintain and strengthen profit margins by actively expanding sales of differentiated products.

Outlook

Globally, fiber demand is expected to grow from 2HFY21 on the back of 5G deployment, FTTH rollouts, and data center investments. Favorable long-term outlook with sizeable investments is required to meet the projected bandwidth requirement globally. Several markets have switched to 5G, following the introduction of new 5G-compatible smartphones during CY2019. As 5G devices increasingly become available and more service providers launch 5G, the global 5G subscriptions are pegged at 10 million by the end of 2019. 5G networks require denser optical fibers with low latency. The deployment of optical fibers have increased with introduction of 5G, increasing demand prospects for optical fiber manufacturers globally. While there is supply overhang issue in the near term, overall outlook for OF/OFC remain favorable over the long term owing to increasing digitization as well as higher bandwidth requirement.

Reduction in OF and OFC realizations due to supply overhang will pressurize profitability; persisting low offtake from China could impact realizations going forward. OF realizations dropped in the international market because of supply overhang as China, which alone accounted for about half of global OF production, witnessed reduction in demand. While long-term contracts remained largely unaffected owing to annual reset of prices, spot-market sales were impacted. Given the decline in global OF demand during CY2019, the overall realization is likely to remain suppressed over the next 2–3 quarters.

India has yet to introduce 5G, the mother of all telecom evolutions witnessed in the last three decades. 5G is going to unleash a phase of such deep and intense fiberization that would create many times bigger demand for cables and fiber than witnessed in the last one decade, possibly. The next wave of growth would be driven by broadband and network expansion through fiberization. Growing technological advancement would generate high demand for more data and devices with high speed and capacity, and huge CapEx is expected from the telecom operators for creating new networks.

Given the 5G requirement for latency reduction (from 50 m to 1 m) and speed from 100 Mbps to 10 Gbps, the fiber deployment in the country will need to increase from current market of 16–18 million fkm per year to at least 2–3x per year. 5G will also require a multi-fold increase in small-cells deployment, with each small cell having backhaul on fiber. The percentage of tower backhaul on fiber for the operators will need to increase significantly from 20 percent to 70–80 percent levels. The current main drivers for the increase in deployment lie in the increased 4G deployments in Tier-I and Tier-II cities and increased FTTH deployments by telecom operators, ISPs, and MSO providers. The other drivers for increase in fiber demand include the rural broadband project, BharatNet and large connectivity projects by the Defense. Lastly, optical fiber is a critical component to make the Smart Cities project a success. Enabling early adoption of 5G, it would be prudent for the manufacturers to work with key stakeholders – DoT, TRAI, telecom operators, equipment vendors, and start-ups to enable 5G deployments in the country.

The country’s broadband dreams remain rooted to the ground, in the simple technology of optic fiber. And the success or failure of the dreams will be written by how fast the fiber network expands!

OPTICAL FIBER

The global optical fiber and plastic conduit market was valued at USD 4151.2 million in 2018, and is projected to reach USD 11,779.9 million by 2026, growing at a CAGR of 20.6 percent from 2019 to 2026, according to a recent report by ResearchAndMarkets.com.

The optical fiber industry is expected to provide promising growth prospects over the next five years, owing to increase in investments and research undertaken by prominent optical fiber cable manufacturers in the industry to develop and upgrade the optical fiber technology application area. In addition, the plastic conduit systems market denotes a promising picture for future growth of efficient cable management. The recent business scenario has witnessed an upsurge in usage of cable conduit systems across commercial and industrial constructions. Companies are now adopting efficient techniques to provide consumers with innovated and cost-efficient products. Makers are finding it a challenge to provide solutions for low and high volume mix applications.

Fibers that have been designed to meet specific optical properties are used in a variety of applications. The construction of these specialty fibers varies in types and dimensions of core, cladding and coating and challenge the industry to provide solutions for low and high-volume mix applications. Processing these fibers, like cutting, splicing and removal of coatings are common processes often related to connectivity. Tapering fiber diameters or increasing fiber diameters using for example capillaries are also common techniques for transitioning to other media. And, the ability to shape fiber tips into flat angles, conical or ball lens solutions are techniques to redirect the optical paths are fiber processing examples.

The rising demand for single-mode optical fibers is expected to grow as the world is facing a shortage of single-mode cabling. The main reason for this fiber shortage is the rise in fiber-to-the-home (FTTH) network projects, which has increased the fiber consumption by 46 percent of the whole world. Moreover, single-mode optical fiber cable offers numerous benefits, which include high attenuation and dispersion, greater data-transmitting capabilities, usability within high-speed and large-capacity networks, and others, which have been boosting its adoption among the end users. Furthermore, ongoing efforts to increase the penetration of telecom services in the emerging countries of the Asia-Pacific region are attributed to the increasing demand for single-mode cable in the region, which is opportunistic for the optical fiber and plastic conduit market.

Factors like widespread implementation of 5G, increasing adoption of FTTH connectivity, emergence of Internet of Things, and growing demand for highly secure and safe wiring systems are anticipated to be major drivers of the global optical fiber market. However, high installation cost and complications in installation of optical fiber, growing demand for wireless communication system, and increasing prices of raw materials act as major drivers hampering the market growth globally. Furthermore, technological advancements in optical fiber cables, rising investments in optical fiber cable network infrastructure, and emergence of cable in conduit system offer lucrative opportunities to the market growth globally

TESTING

With telecommunication service providers and cable television multiple-system operators (MSO) continuing their fiber build-outs, the market for fiber optic test equipment (FOTE) is expected to grow from USD 781.3 million in 2018 to USD 1.31 billion in 2025. The lack of fiber expertise among access-network technicians and the sheer volume of fiber deployments required in a short time will enable innovative FOTE manufacturers to differentiate themselves in the market.

For fiber optic testing being critical, the equipment used in the testing plays a major role in the network handling. From technological advancement perspective, FOTE market is expected to be driven by deployment of real-time 40 gig and 100 gig network deployments, as it creates need for high fiber optic performance.

Increasing complexity of electronic products and network demands development of FOTE with easy-to-use and better functionality. Technology advancement for better error-rate testers and next-generation testing systems will increase testing frequency, thereby adding to market revenue. Though FOTE market is growing substantially, the lack of awareness for testing in customers hampers the growth of the market.

FOTE product segments include optical time domain reflectometers (OTDR), optical light sources (OLS), optical power meters (OPM), optical loss test sets (OLTS), optical spectrum analyzers (OSA), remote fiber test systems (RFTS), and fiber inspection probes (FIP).

Asia-Pacific is projected to be the largest market, and is anticipated to grow with the highest CAGR over the next five years due to the growing demand for fiber optic equipment in telecommunication and defense industry. Hefty capital investments in communication technologies by the government of these regions are expected to drive the market growth of FOTE. Large number of smartphone and mobile internet users in developing economies like China and India are also expected to bolster the growth of FOTE market in this region.

North America is projected to be the fastest growing market and is anticipated to grow with the highest CAGR during the forecasted period owing to the rising importance of integrated FOTE. Governing policies for the deployment of fiber-to-the-home (FTTH) and rising usage of smart phone lead to the demand for fiber optic network in this region, which in turn are expected to create high opportunities for the FOTE market. Europe is expected to witness a swift growth over the forthcoming period owing to rising sale of smartphones and gaming, creating a momentous potential for growth of fiber optic. Increasing FTTH deployment is also expected to contribute in the market growth of FOTE in this region.

“A significant development that is impacting demand for optical test equipment is the evolution of 5G and its fixed wireless access (FWA) trials. 5G is expected to support the wide-scale implementation of fiber and boost the demand for test equipment,” asserts Sujan Sami, program manager, Measurement & Instrumentation, Frost & Sullivan. “Telcos and cable MSOs will be the biggest growth drivers for FOTE manufacturers, generating USD 4 billion in revenue between 2018 and 2025.”

You must be logged in to post a comment Login