Trends

Qualcomm, UNISOC, ASR lead IoT module chipset market in Q1

Global cellular IoT module chipset shipments grew 35% YoY in Q1 2022, according to the latest research from Counterpoint’s Global Cellular IoT Module and Chipset Tracker by Application. China was the key region for cellular IoT module chipset consumption during the quarter, with China, North America and Western Europe accounting for over 75% of the volume. PC, router/CPE and industrial were the top three applications for 5G.

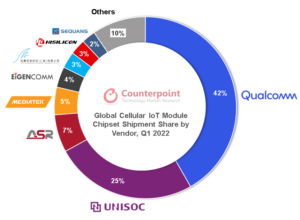

Commenting on the market dynamics, Research Analyst Anish Khajuria said, “Qualcomm, UNISOC and ASR held the top three positions in the global cellular IoT module chipset market in Q1 2022, accounting for nearly 75% of the total shipments. UNISOC, Qualcomm and ASR were top chipset players in China in terms of shipments. For the rest of the world, Qualcomm led, followed by UNISOC and Sequans. 4G (Cat 1 and Cat 1 bis) grew 79% YoY in this quarter.”

Qualcomm led with a 42% share and 30% YoY growth across nine out of the ten key regions globally. However, competition from local players in China, such as UNISOC and ASR, in key fast-growing segments like LTE Cat-1/Cat-1 bis and NB-IoT limited Qualcomm’s growth opportunities in the world’s largest IoT market, China. However, Qualcomm has been broadening its IoT chipset portfolio, targeting premium 4G and 5G solutions for verticals such as retail, automotive, industrial robotics and smart cities. It is also collaborating with several industry application and technology providers, including Microsoft, ZTE, BMW and Bosch, to focus on high-value artificial intelligence and 5G IoT capabilities, also termed as the 5G AIoT segment.

UNISOC, the second-largest cellular IoT chipset player globally with a 26% share in shipments, has been strong across 4G (Cat 1 and Cat 1 bis) and NB-IoT technologies. Its cellular IoT chipset shipments have continued to grow for nearly last five quarters, filling the gap which HiSilicon left in the market. Moreover, it is making steady improvements in advanced cellular technologies such as 4G Cat4+ and 5G. It has also succeeded in expanding its customer base, adding Quectel, Fibocom, China Mobile and other international module players. This helped it to capture more than one-fourth of shipments in Q1 2022. UNISOC is focused on low-end applications like smart metering, POS and industrial with stronger demand for its Cat1 bis 8910DM chipset.

ASR Microelectronics maintained its third rank in the cellular IoT chipset market in Q1 2022 due to strong performance in the high-volume 4G Cat 1 and 4G Cat 4 module segments. China continues to be the key market for ASR. The company is yet to launch NB-IoT and 5G solutions and thus will have to work on its long-term capabilities and strategy to maintain this high growth which could continue through 2025. ASR has increased its production capacity this year to meet demand. Local partnerships with several module players in 4G Cat 1 and Cat 4 technology, like Quectel, SIMCom, Neoway, Longsung and Rinlink, are helping drive the scale.

Commenting on the competitive dynamics, Vice President Research Neil Shah said, “The cellular modem chipset competition is heating up in the IoT module space with a growing number of players entering the higher-volume LPWA (LTE-M and NB-IoT) and lower-category 4G LTE (Cat 1 and Cat 1 bis) segments as incumbent players such as Qualcomm and MediaTek focus on the higher-value and more integrated 4G LTE and 5G segments. The move from a two-chip (discrete MCU + cellular modem) to an integrated SoC solution is happening as we enter the 5G era. Further, the addition of AI/ML capabilities in future advanced cellular IoT applications is also catalyzing this trend. However, the low-power and less advanced applications will continue to prevail into the next decade and we could see some adoption of SoC-based integrated solutions. But the discrete solutions will prevail, driving sizeable opportunities for the likes of UNISOC, ASR, Sequans, Sony Semi, Eigencomm, Xinyi and Nordic Semi.”

Other players

MediaTek took the fourth position in this market. However, it is not much focused on the cellular IoT market compared to the smartphone chipset market. This is one of the key reasons for MediaTek having a 5% shipment share in this quarter. The company is also focusing on 5G enhancement and recently launched Kompanio 900T, a new 5G platform for tablets, notebooks and other IoT devices. The MediaTek T750 chipset launched earlier is growing strong in FWA and CPE devices.

Eigencomm registered the highest growth of 869% YoY during Q1 2022, thanks to a strong partnership with Quectel and Fibocom for NB-IoT modules. However, the brand needs to diversify in terms of supporting cellular technologies beyond NB-IoT in its portfolio as well as beyond China.

Xinyi was the second fastest growing chipset player in the market during the quarter with 230% YoY growth. Similar to Eigencomm, the company is currently focusing on the NB-IoT chipset and China region. For the near-to-mid-term, Xinyi needs to leverage its strong partnership with major module vendors such as Quectel, China Mobile, Fibocom, SIMCom, Cheerzing, Longsung, MeiG and Ai-Link and expand into newer cellular technologies to maintain the growth and market share.

Sequans was also in a growth mode in Q1 2022 with a robust 4G, LPWA and 5G chipset portfolio and rising demand in key markets such as smart meters, healthcare and asset tracking. Sequans is the world’s second chipset vendor after UNISOC to commercialize the 4G Cat-1 bis chipset to increase its share and design wins in the growing Cat 1 bis-based IoT applications.

Sony Semicon (Altair) also saw growth this quarter with solid cooperation with Sierra Wireless and Wistron NeWeb focusing on the markets for smart meters, asset trackers and smart cities. Sony is only focusing on LPWA technology with low-power and high-security features on chipsets.

CT Bureau

You must be logged in to post a comment Login