Headlines of the Day

Q4 FY 21 earnings estimates for the telecom sector

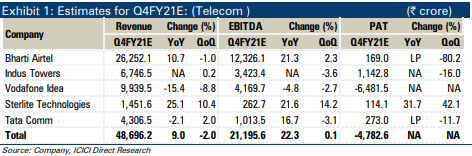

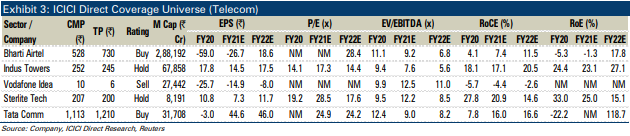

ICICI Direct’s estimates for Q4 FY21

Airtel to report strong operating print again!

We expect Airtel to lead subscriber addition again in Q4FY21. For Bharti Airtel (Airtel), we bake in subscriber addition of ~9 million (mn) while for Vodafone Idea (VIL), we expect sub loss of ~2 mn (similar to Q3). Q4FY21 will witness the impact of IUC going to zero impacting both topline and costs. For Airtel, reported ARPU is likely to see ~6.5% QoQ decline (~9% decline owing to IUC impact offset by ~2.5% like to like growth) at Rs. 155. Indian wireless revenues are expected to see 3.1% QoQ decline at Rs. 14,326 crore. For Vodafone Idea, with ARPU decline of ~9% QoQ (~11% decline owing to IUC impact offset by ~2% like to like growth) at Rs. 110, we expect overall revenues to decline 8.8% QoQ at Rs. 9940 crore.

EBITDA margins to improve optically with IUC going to zero

With IUC going to zero, removal of revenues, costs will result in improved optical margins (Airtel being a net payer would gain in absolute terms while VIL being a net receiver would lose). For Airtel, we expect India EBITDA margins at 48.5%, up 330 bps QoQ. Africa margins are expected to be stable QoQ at 46.5%. Reported EBITDA at Rs. 12,326 crore, is expected to grow 2.3% QoQ with margins expected at 47%, up 150 bps QoQ. For Airtel, we expect PAT of Rs. 169 crore. For Vodafone Idea, EBITDA at Rs. 4170 crore, will decline by 2.7% QoQ. We expect margins at 42%, up 270 bps QoQ. VIL is expected to post a net loss of Rs. 6481 crore

Indus Towers too reported muted numbers

Indus Towers (erstwhile Bharti Infratel) is likely to report muted numbers as Q3 had higher exit penalty receipts. On a merged basis, we bake in net tenancy addition of ~3670. We expect merged entity rental revenues at Rs. 4180 crore, 3% QoQ decline. Energy revenues are expected to be up 5.9% QoQ (on a like to like basis) at Rs. 2566 crore. Overall margins are expected at 50.7%, down 200 bps QoQ on a like to like basis.

Muted quarter for TCom

For Tata Communication (TCom), with disruption in the European region due to Covid-19 and continued delays in closure of transformation deals, the data business is expected to post 2.5% QoQ topline growth (up ~1.1% YoY) at Rs. 3636 crore. Hence, overall revenue is expected to grow 2% QoQ (down 2.1% YoY) at Rs. 4307 crore. Data segment margins are expected at 26.9% (down 200 bps QoQ given one-offs in Q3) but up 400 bps YoY.

STL to report stellar numbers

Overall margins are expected at 23.5% (down 130 bps QoQ). Sterlite Tech (STL) is expected to report topline growth of 25% YoY to Rs. 1452 crore driven by depressed base (wherein revenue had fallen ~35%) and some recovery in product segment demand. EBITDA margins for the quarter are expected to fall 50 bps YoY to 18.1%, given higher product pricing in the base quarter. Reported PAT at Rs. 114 crore is expected to be up 42% YoY.

Exhibit 2: Company Specific view – Telecom

| Bharti Airtel | We expect continued traction in subscriber addition at ~9 mn. Q4FY21 will witness the impact of IUC going to zero (with effect from January 1, 2021) impacting both topline and costs. The reported ARPU is likely to see ~6.5% QoQ decline (~9% decline owing to IUC impact offset by ~2.5% like to like growth) at Rs. 155. Indian wireless revenues are expected to see 3.1% QoQ decline at Rs. 14,326 crore. India non-wireless revenues traction is expected to remain robust especially broadband and enterprise. Africa is likely to witness revenue growth of 0.9% QoQ to Rs. 7712 crore. Consolidated reported revenues are expected to be down 1% QoQ at Rs. 26,252 crore. We expect India EBITDA margins at 48.5%, up 330 bps QoQ. Africa margins are expected to be stable QoQ at 46.5%. Reported EBITDA at Rs. 12,326 crore is likely to be up 2.3% QoQ with margins expected at 47%, up 150 bps QoQ. We expect PAT of Rs. 169 crore. Key monitorable: Commentary on ARPU trajectory and non wireless business |

| Indus Towers (erstwhile Bharti Infratel) |

Indus Towers is likely to report muted number as Q3 had higher exit penalty receipts. On a merged basis, we bake in net tenancy addition of ~3670. We expect merged entity rental revenues at | 4180 crore, 3% QoQ decline. Energy revenues would be up 5.9% QoQ (on a like to like basis) at | 2566 crore, driven by higher diesel prices. Overall margins are expected at 50.7%, down 200 bps QoQ on like to like basis, as base quarter had merger led benefits. Key monitorable: Future outlook and growth plans |

| Vodafone Idea | We expect churn for Vodafone Idea to remain controlled driven by completion of network integration. We consequently bake in ~2 million customer exits on a QoQ basis (similar to Q3). We build in ARPU decline of ~9% QoQ (~11% decline owing to IUC impact offset by ~2% like to like growth) at | 110. We expect overall revenues to decline 8.8% QoQ at | 9940 crore. EBITDA at | 4170 crore is expected to decline 2.7% QoQ. Reported margins are expected at 42%, up 270 bps QoQ, largely the IUC led revenues cost exclusion impact. The company is expected to post a net loss of | 6481 crore. Key monitorable: Fund raising plans and ARPU trajectory commentary ahead |

| Sterlite Tech | Given the benign base (wherein revenue had declined ~35%) and some recovery in product segment demand, we bake in topline growth of 25.1% YoY to | 1452 crore. Consolidated EBITDA is expected to grow 21.6% YoY at | 263 crore while EBITDA margins for the quarter are expected to decline 50 bps YoY to 18.1%, given the higher product pricing in the base quarter. Reported PAT at | 114.1 crore, is expected to be up 42.1% YoY driven by strong operating profit growth. Key monitorable: Management commentary on overall demand & ramp up of solutions based business |

| Tata Comm | Revenue for the voice business is expected to decline ~0.5% QoQ (down 16.5% YoY) to | 671 crore. Given the disruption in European region due to Covid-19 and continued delays in closure of transformation deals, the data business is expected to post 2.5% QoQ topline growth (up ~1.1% YoY) at | 3636 crore. Hence, overall revenue is expected to grow 2% QoQ (down 2.1% YoY) at | 4307 crore. Data segment margins are expected at 26.9% (down 200 bps QoQ given one-offs in Q3) but up 400 bps YoY. Overall margins are expected at 23.5% (down 130 bps QoQ). Key monitorable: Growth outlook commentary |

CT Bureau

You must be logged in to post a comment Login