CT Stories

Promising road ahead for OFC

Overall investments in broadband infrastructure – specifically fiber networks – have skyrocketed, with private equity fueling a growing number of buildouts. Investing in network infrastructure – which has not been cool since the late 90s – is suddenly all the rage

The valuations of fiber networks have increased significantly, driven by increased demand for residential broadband, ongoing 5G network buildouts, and an expectation that fiber networks still need hundreds of billions in new investments to keep pace with the expected bandwidth demand.

Fiber access networks have reached a major tipping point, driven by the simultaneous catalysts of the shift to next-generation fiber technology, and the shift to openness, disaggregation, and automation.

Fiber is the preferred choice for 5G networks because of its scalability, security, and its ability to handle the large amount of backhaul traffic that is generated. Fiber is also preferred for the fronthaul portion of the network. Fiber can handle the increased speeds that come with 5G networks with lower attenuation, immunity to electromagnetic interference, and nearly unlimited bandwidth potential.

Fiber infrastructure is the key to establishing and maintaining 5G network support for three key reasons.

Fiber supports the creation and transfer of real-time data. A 5G network must support the Internet of Things (IoT) and big data, both of which rely on real-time data collection and transfer. Decisions are being made instantaneously, based on this data. To ensure that the data is transferred, lower latency and higher bandwidth levels are required. Because of fiber’s unlimited bandwidth potential, fiber is naturally the cable of choice to support these requirements.

Fiber can meet the increasing network demands. The 24/7 data collection and transfer process means that there are more demands put on networks. Networks need to have higher availability levels, full wireless network coverage, lower latency, and higher bandwidth capabilities. This is partially due to the high amount of devices people carry, which connect their users to unlimited data. However, at large facilities like stadiums or arenas, devices that are not controlled or managed by people need to connect directly to the network and operate independently. When you bring fiber to these networks, these devices, such as security cameras, can utilize the 5G network’s improved bandwidth and capacity levels to perform well.

Fiber supports higher radio networks and small cells. More tiny cells/nodes and mobile edge computing will be needed to overcome any network bottlenecks and allow 5G networks to reach their full performance potential. The mmWave frequency is often used for deploying these nodes, and fiber-cable infrastructure provides the backhaul for these networks. Additionally, 5G mobile networks use substantially higher radio frequencies to manage bigger data volumes than previous-generation networks. However, because of the limited range of these frequencies, more cells covering smaller areas must be deployed throughout a venue.

These cells re-distribute the signals from network carriers, either over the air or through a direct channel, and spread them out across a large region in order to deliver multi-gigabit service to the users at applications that need access to 5G networks. The cells can be femtocells, tiny cells, business RANs, DASs, or even Cloud RANs, depending on the use case (CRAN). Carrier signal will be weak within the buildings without these cells.

5G networks need to be linked through fiber optics since higher frequencies cannot pass through obstacles like walls, trees, or windows. More fiber optic cables connecting nano-masts are required for 5G to function at its full potential. Compared to fiber, 5G’s speed is much superior. Therefore, limitations in 5G performance are to be expected without the use of fiber optics.

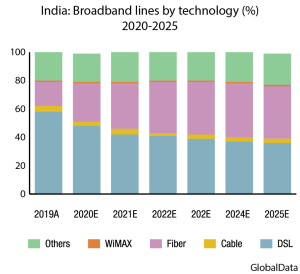

India has 3.5 million kilometers of OFC, and about 36 percent of cell towers in India are backhauled using fiber optics. That number contrasts with other developing countries, such as Thailand at 90 percent and Malaysia at 80 percent, and the so-called developed countries – US, China, and Japan, which have surpassed an average of 75-percent tower fiberization. The Indian government has called for 70 percent of all towers to have fiber backhaul by 2024, investment projections being Rs 45,000 crore.

A threefold increase in OFC demand annually is expected in India to 60 million fiber km, this includes government’s 25 million fiber km. Cumulative demand is anticipated at 240 million fiber km in four years.

BharatNet is providing high-speed internet and broadband to all Gram Panchayats (GPs). Phase-I connecting 100,000 GPs is completed. The implementation is through CPSUs, BSNL, Rail Tel, and PGCIL. The existing fiber of BSNL (between block and GPs) has been used to lay and connect new OFC under the project. Work is under progress in the remaining GPs.

In Phase-II, connectivity for 42,000 GPs, excluding block headquarters (BHQs), is in progress. New OFC from block to GPs and lifetime maintenance of network by dedicated fibers providers for GPs is also being done.

The Indian government’s commitment to BharatNet phase three is a USD 10 billion plus program. As of January 30, 2023, 613,868 km of OFC has been laid; 198,408 GPs have been connected on OFC (OFD laid GPS); and 191,751 GPs have been made service-ready (on fiber and satellite).

The Indian telcos estimate that they will be spending anything between USD 1.5 and 2.5 billion on OFC in the next three to four years.

Global fiber optic cable demand is expected to go up from USD 89.91 billion in 2022 to over USD 227.54 billion by 2024, a CAGR of 26.1 percent. China accounted for 46 percent of the total, with North America representing the fastest-growing region at 15 percent year on year.

The global fiber optic network industry is expected to witness a surge in demand, with the market size valued at nearly USD 2346.69 billion by 2028, growing at a CAGR of 4.95 percent during 2022–2028. This growth is fueled by significant investments by governments and mobile operators, who are expected to spend over USD 1.1 trillion on 5G and fiber networks between 2020 and 2025. The integrated network economy is expected to reach USD 60 trillion by 2025. The fiber optic network market is expected to reach USD 8.2 billion by 2027, growing at a rate of 10.9 percent. This rise in demand is driven by the need for single-mode fiber-to-the-home (FTTH) cabling for 5G deployment, FTTH broadband, and other applications.

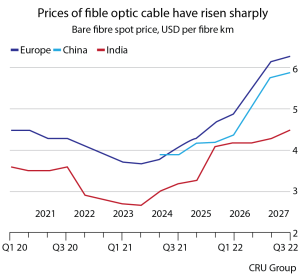

Prices have increased by 135 percent in the past two years. They have now reached their highest level since July 2019.

Europe, India, and China are among the regions most affected by the shortage crunch, with prices for fiber rising by up to 70 percent from record lows in March 2021, from USD 3.70 to USD 6.30 per fiber km, according to CRU Group. Underpinning the shortage are rising prices of some of the critical components that go into fiber optic technology, in which light is carried along flexible fibers with a glass core. Prices of silicon tetrachloride, key component in fiber production, have increased by up to 50 percent.

Although North America has been less severely hit than Europe, China, and India and in the US, prices increased by only 2 percent in 2022 and had otherwise fallen every year since 2012.

Manufacturers in response to meet the soaring demand from governments, telecoms companies, and big tech groups, are ramping up production.

The industry is currently facing multiple challenges due to a worldwide shortage of fiber optic cable. Governments have set ambitious targets for the rollout of superfast broadband and 5G. Companies like Amazon, Google, Microsoft, and Meta are expanding their data center empires to meet soaring demand, including laying vast international fiber networks under the ocean, both of which require vast quantities of fiber-optic cable to be laid under the ground. Although the pandemic prompted some of the biggest tech and telecoms groups to slash their CapEx, there has been a surge in demand for internet and data services, leading to a shortfall in availability.

There has been a shortage of helium, a crucial component in the manufacture of fiber-optic glass, in part caused by plant outages in Russia and the US.

Questions are being raised whether countries are going to be able to meet targets set for infrastructure build, and whether this could have an impact on global connectivity.

India, with an annual capacity to manufacture 100 million fiber km, has sufficient production to meet the multiple increase in demand as well as take a larger share of the global market. Most of the investments required for expansion have already been made. Having said that, India’s share of the OFC global supply at 10 percent of the total non-China global market is very small. India accounts currently for 4 percent of the global demand for OFC, in contrast to China’s 50 percent.

The telcos are facing numerous difficulties during large-scale fiber rollout projects, including long distances, complicated processes, and the need for proper communication and management. The fiberization projects are complex, and the lack of proper planning and skilled labor exacerbates the issues. Time-consuming field surveys, multiple approvals from various authorities, and a shortage of skilled technicians slow down the fiber deployment process, adding to the difficulties. Despite the many advantages of fiber optic cable, its deployment can be complex and time-consuming, often requiring extensive planning, multiple approvals, and skilled labor, resulting in delays and increased costs. This poses a challenge to the optical fiber industry.

The availability of alternative technologies, such as microwave, can impact the growth and success of the optical fiber industry. A lower cost and faster deployment time that it offers is often favored in remote areas or areas where fiber infrastructure is not available. Recently, Nokia has been working to upgrade its Wavence microwave portfolio to reach remote areas, providing an alternative to fiber optic cable.

Wavelength division multiplexing (WDM) is the recent technological improvement in the fiber cables. A key trend driving growth, in this technique of multiplexing, the number of optical carrier signals through a single optical fiber channel varying the wavelengths of laser lights.

WDM allows communication in all directions in fiber cable. WDMs are used on a single optical fiber to blend light signals coming from different optical fibers. This is attained by using a coupler at the WDM input. In 2023, Asia-Pacific is expected to be the fastest-growing market for WDMs, and multiple companies in China such as ZG Technology, Optic Network Technology are the leading manufacturers and suppliers of WDMs.

Industry leaders have been compelled to reevaluate their strategies, in light of the widespread adoption of high-speed broadband. Newer business models are being adopted.

Operators have formed separate fiber businesses in an effort to increase the use of fiber to save costs and deleverage their financial sheets. The value of assets could be increased via collaboration; excess capacity could be put to good use; the most efficient routes could be developed; operational efficiencies could be realized; and more financial freedom could be gained.

Some tower companies are considering playing host to FTTH providers as neutral parties. Future towers may serve as neutral hosts for telcos, allowing them to focus on meeting the demand for FTTH services. Since the neutral-host model gives the user a choice of which service provider to choose, it naturally sees more acceptance. It also lowers service providers’ total capital expenditures. The neutral host’s specialized knowledge may also help service providers shorten their development and deployment cycles.

The future of the fiber optics industry looks promising with the growing demand for high-speed internet, the increasing popularity of cloud computing, and the rise of IoT devices. With the ongoing development of fiber optic technology, a faster, more reliable, and more efficient fiber optic networks that will further transform the way we communicate, work, and live is expected. Additionally, the increasing demand for fiber optics in various sectors, such as healthcare, military, and automotive, is likely to drive the growth of the industry in the coming years. Fiber optics is poised to continue to play a crucial role in the development of new technologies and the improvement of existing ones, making it an exciting and dynamic field to be a part of.

You must be logged in to post a comment Login