Headlines of the Day

PLI scheme to unlock India’s manufacturing capacity: ICRA

The Government of India with the intention of boosting India’s manufacturing, employment generation, import reduction and exports growth has announced the Production-Linked Incentive scheme (PLI) covering 14 significant sectors of the economy involving a total outlay of ~ Rs. 3 trillion. In its latest Sectoral Strategy Report, ICRA has analysed the cumulative positive impact of the PLI scheme. It says that the sectors have been strategically selected by the Government, considering India’s surging demand (solar, semiconductors/electronics, automobiles etc.), and are critical to develop manufacturing capabilities (semiconductors, telecom gears, medical devices).

Commenting further, Rohit Ahuja, Head of Research and Outreach, ICRA says, “Manufacturing capex forms around 20-25% of the total capex in India currently. The PLI scheme, launched with the aim of incentivising manufacturing, is estimated to attract a capex of approximately Rs. 4 trillion for the next five years. It has the potential to generate employment for >3 million (skilled and unskilled labour) in India. Further, there will positive implications due to reduction in net imports, as incremental revenues are expected at Rs. 35-40 trillion over the next 5 years. Sectors under which PLI scheme have been announced currently constitute ~40% of the total imports. The scheme, spread across 14 sectors, can enhance India’s annual manufacturing capex by ~15 to 20% from FY23. However, potential challenges are expected from execution delays, increasing funding costs, availability of requisite infrastructure and delays in approvals.”

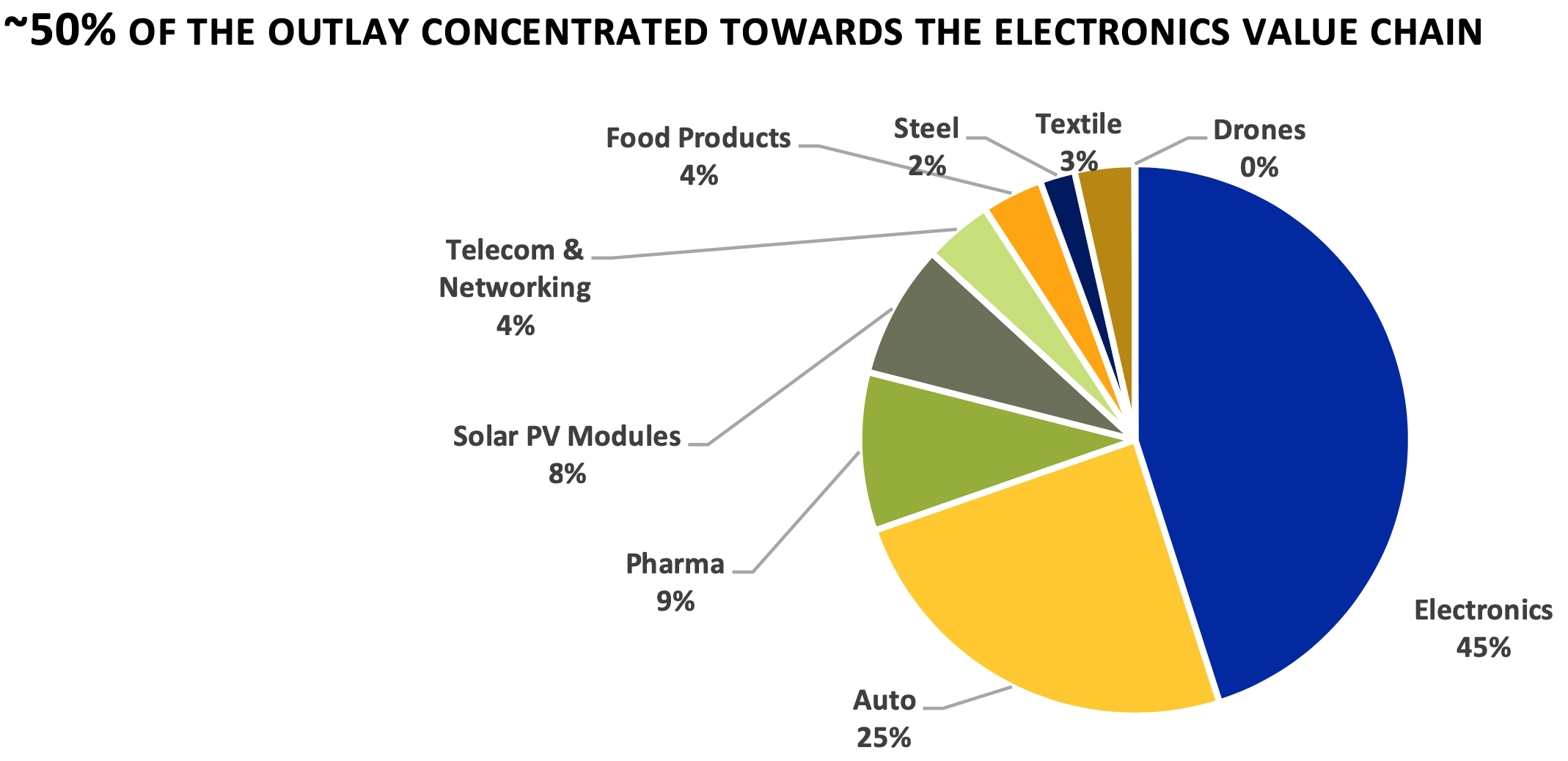

Of the total manufacturing outlay, about ~80% is concentrated towards electronics, auto, solar panel manufacturing of which the focus towards semiconductors/electronics value chain is ~50% of outlay. Incentives are based on incremental production/revenue, spread over five years on an average across sectors. Some schemes are also linked to capital investments.

Coming to specific sector outlays, PLI for semiconductor manufacturing is at Rs. 760 bn, and aims to make India one of the leading manufacturers globally of this critical component. Shortage of semiconductor chips is leading to major production delays in autos and electronics globally as they are critical components used in automobiles and electronic items such as mobile phones/ smartphones, televisions, washing machines, refrigerators etc. Given the fact that India’s dependence on semiconductors is expected to increase substantially, this PLI scheme is critical. For automobiles, the cabinet has approved Rs. 259 bn (out of Rs. 570 bn earmarked) and bids for the same have been closed. Additionally, the PLI for ACC battery is estimated at Rs. 181 bn with incremental production estimated at 50 GW.

The PLI allocation of solar PV modules has been increased to Rs. 240 bn (from Rs. 45 bn). Considering India’s ambitious plans to expand solar generation, this scheme may continue to attract addition allocation every year. For pharma, an outlay of Rs 249 bn is further bifurcated into Rs. 69 bn towards KSMs/DIs and APIs, Rs 150 bn for pharma sector and balance Rs. 30 bn towards bulk drug parks. This apart, in telecom, Rs. 122 bn has been allocated, food processing has been given an outlay of Rs 109 bn, textile exports of Rs. 107 bn, specialty steel Rs. 63 bn and drone segment Rs. 1.2 bn.

Ahuja concludes, “Globally, India’s manufacturing output as a percentage of GDP is comparable with developed economies like the United States, the European Union and developing economies like Russia and Brazil, however, it is way behind China. Massive opportunity emerging for India, as the world looks to diversify away from Chinaand the PLI scheme is a step in the right direction.”

CT Bureau

You must be logged in to post a comment Login