Trends

Our 5.something framework for internet IPOs, ICICI Securities

With a barrage of internet companies about to hit the markets, ‘which model?’, ‘which vertical?’, ‘which company?’ etc. are currently the billion dollar questions for investors. However, less important and ephemeral metrics (e.g. GMV, ‘near-term’ losses / valuations) are now commanding undue attention of the street / media. Category adoption / brand building => dented profitability (e.g. Amazon over 1994-2003) => optically-bloated ‘near-term’ multiples (Google’s IPO was priced 120x T-EPS). However, the more fundamental drivers of long-term scalability, sustainability and profitability are often overlooked. Our ‘five point something’ framework tries to address this white space in the street’s thought process. The five points are: 1) frequency of app usage, 2) TAM per player, 3) data monetisability, 4) back-end operational muscle, and 5) unit economics (proxied by contribution). And the ‘something’ is: adjacent optionality! On our framework, higher the overall score the better. Across the gamut of internet businesses, we think of this framework as an indicative filter before analysing company-specific value proposition / metrics.

• High frequency of usage => Strong customer engagement and scalability. Frequency of usage across categories is a wide spectrum – from food-tech, payments, ride hailing, and e-commerce at one extreme to auto, real estate classifieds, matrimony, etc. on the other. Given the memory / processing limitations on phones, customers often have only a limited set of apps that are more frequently used. This in turn has implications on customer engagement, behavioural data, brand recall / loyalty, size of the network created, hence scalability.

• High TAM per player => High industry maturity and scalability. Learning from mature internet businesses (e.g. recruitment, real estate classifieds) suggests that industry should eventually consolidate into monopolies or duopolies for the players to be able to make profits / cash flows sustainably. Low TAM per player => an industry with scalability challenges or intense competition. In such segments, investors betting on potential winner(s) will take it all. On the other hand, industries with high TAM per player (e.g. food-tech, payments) have smoother risk-reward pay-offs.

• Data is the new oil – If and only if one can refine and monetise it! Internet firms have access to lot of data on customer behaviour. However, the ability to monetise varies – with search, social networks, payments, etc. on one extreme to ride hailing, etc. on the other. At times, even the operational (e.g. traffic density in ride hailing) and regulatory hurdles may limit the monetisability. In the new age data economy, investors should identify models with high degree of data monetisation moat.

• Strong back-end operational muscle => High retention and sustainability. Great technology platform, UI / UX are critical to drive customer adoption. However, once the customer is on the platform, it is the back-end operational muscle of a company that drives customer satisfaction, retention and eventually the sustainability of the business model. Notwithstanding the great technology interface, companies like Tiny Owl and Doormint had to wind up due to operational weakness.

• Unit economics – Critical to assessing long-term viability and profitability. Most good internet businesses are not profitable at this juncture. This is largely due to spends – marketing, advertising & promotions, discounts, cash backs, etc. – targeted at driving customer adoption and branding. Notably, these front-ended investments should create strong moats and drive back-ended benefits in the form of brand recall and network effect. Investors should scout for businesses with promising unit economics / contribution margins before these marketing overheads.

• The adjacent ‘something’! – the difficult piece to price. Optionality-related to future use cases is a critical component of the internet business models. Learning from the likes of global companies like Meituan suggests that one use case (e.g. food delivery, payments) can often be used as a hook to cross-sell / upsell other use cases / services. For instance, nearly 85% of the first-time users come to Meituan app to scout for food delivery. Interestingly, >50% of users who stayed on the platform for 3 years, buy all the top-5 selling services on the platform.

Globally, rich valuations of internet companies surprised value-conscious investors from time to time. The valuation premia can be partly explained by the adjacent optionality (sometimes non-linear). We understand that valuing this optionality can be a tricky affair. Nevertheless, investors should look at the feasible adjacencies that the companies can tap into and scale up.

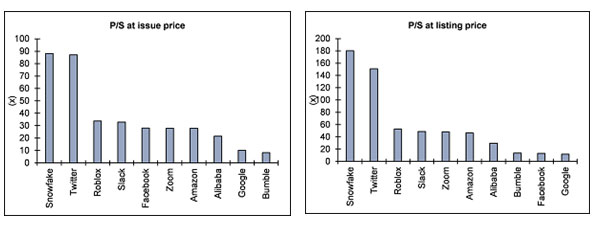

Near term valuations at IPOs are optically… …high and misleading

Near term valuations at IPOs are optically… …high and misleading

Source: Company Data, I-Sec Research Source: Company Data, I-Sec Research

CT Bureau

| Our 5.something framework for internet IPOs, ICICI Securities |

With a barrage of internet companies about to hit the markets, ‘which model?’, ‘which vertical?’, ‘which company?’ etc. are currently the billion dollar questions for investors. However, less important and ephemeral metrics (e.g. GMV, ‘near-term’ losses / valuations) are now commanding undue attention of the street / media. Category adoption / brand building => dented profitability (e.g. Amazon over 1994-2003) => optically-bloated ‘near-term’ multiples (Google’s IPO was priced 120x T-EPS). However, the more fundamental drivers of long-term scalability, sustainability and profitability are often overlooked. Our ‘five point something’ framework tries to address this white space in the street’s thought process. The five points are: 1) frequency of app usage, 2) TAM per player, 3) data monetisability, 4) back-end operational muscle, and 5) unit economics (proxied by contribution). And the ‘something’ is: adjacent optionality! On our framework, higher the overall score the better. Across the gamut of internet businesses, we think of this framework as an indicative filter before analysing company-specific value proposition / metrics.

- High frequency of usage => Strong customer engagement and scalability. Frequency of usage across categories is a wide spectrum – from food-tech, payments, ride hailing, and e-commerce at one extreme to auto, real estate classifieds, matrimony, etc. on the other. Given the memory / processing limitations on phones, customers often have only a limited set of apps that are more frequently used. This in turn has implications on customer engagement, behavioural data, brand recall / loyalty, size of the network created, hence scalability.

- High TAM per player => High industry maturity and scalability. Learning from mature internet businesses (e.g. recruitment, real estate classifieds) suggests that industry should eventually consolidate into monopolies or duopolies for the players to be able to make profits / cash flows sustainably. Low TAM per player => an industry with scalability challenges or intense competition. In such segments, investors betting on potential winner(s) will take it all. On the other hand, industries with high TAM per player (e.g. food-tech, payments) have smoother risk-reward pay-offs.

- Data is the new oil – If and only if one can refine and monetise it! Internet firms have access to lot of data on customer behaviour. However, the ability to monetise varies – with search, social networks, payments, etc. on one extreme to ride hailing, etc. on the other. At times, even the operational (e.g. traffic density in ride hailing) and regulatory hurdles may limit the monetisability. In the new age data economy, investors should identify models with high degree of data monetisation moat.

- Strong back-end operational muscle => High retention and sustainability. Great technology platform, UI / UX are critical to drive customer adoption. However, once the customer is on the platform, it is the back-end operational muscle of a company that drives customer satisfaction, retention and eventually the sustainability of the business model. Notwithstanding the great technology interface, companies like Tiny Owl and Doormint had to wind up due to operational weakness.

- Unit economics – Critical to assessing long-term viability and profitability. Most good internet businesses are not profitable at this juncture. This is largely due to spends – marketing, advertising & promotions, discounts, cash backs, etc. – targeted at driving customer adoption and branding. Notably, these front-ended investments should create strong moats and drive back-ended benefits in the form of brand recall and network effect. Investors should scout for businesses with promising unit economics / contribution margins before these marketing overheads.

- The adjacent ‘something’! – the difficult piece to price. Optionality-related to future use cases is a critical component of the internet business models. Learning from the likes of global companies like Meituan suggests that one use case (e.g. food delivery, payments) can often be used as a hook to cross-sell / upsell other use cases / services. For instance, nearly 85% of the first-time users come to Meituan app to scout for food delivery. Interestingly, >50% of users who stayed on the platform for 3 years, buy all the top-5 selling services on the platform.

Globally, rich valuations of internet companies surprised value-conscious investors from time to time. The valuation premia can be partly explained by the adjacent optionality (sometimes non-linear). We understand that valuing this optionality can be a tricky affair. Nevertheless, investors should look at the feasible adjacencies that the companies can tap into and scale up.

Near term valuations at IPOs are optically… …high and misleading

Near term valuations at IPOs are optically… …high and misleading

Source: Company Data, I-Sec Research Source: Company Data, I-Sec Research

CT Bureau

You must be logged in to post a comment Login