5G Features

On the brink of a new era of connectivity

Now 5G is slowly becoming a reality around the world, and will naturally evolve from the existing 4G networks. But 5G will mark an inflection point in the future of communication, bringing instantaneous high-powered connectivity to billions of devices. In addition to that, 5G will offer ultra-low latency, improved data rates, and enable network slicing. This opens the door for new services, network operation, and customer experience for telecom operators.

It will change telecom’s role – telecoms will not only be technology distributors, but also service providers. This shift will require telecoms to engage with governments, enterprise customers, and alter their sales approach to help customers leverage the power of 5G. If CSPs are to successfully claim their share of a market estimated to be worth USD 3.6 tn by 2022, they must re-align their investment strategies and offer reassurance to enterprises that they will accelerate innovation and speed-to-market, invest in better understanding their customers’ business needs, and improve collaboration with other valued partners. CSPs are already losing enterprise business to more agile digital players. This trend will continue unless they act now. They must abandon traditional, restrictive product development and replace it with leaner, more agile operations that encourage innovation, speed, and experimentation.

Some obvious trends taking shape as we move forward are:

OTT. Fueled by streaming video and public demand for more non-linear media consumption, 2020 is set to be another pivotal year for over-the-top (OTT) service growth. The year is likely to see further efforts from telcos and other service providers to partner with and become primary OTT-solution providers in their own right in order to push revenues, offset downward price pressures on last-mile connectivity, and build customer loyalty.

Security. Telcos around the world trail only bank and credit card companies in the degree of trust consumers place in them. In emerging countries, they even top the bank and credit card companies. That makes privacy a tremendous opportunity for telcos. If they make it easier for consumers to take control of and maintain their privacy, while engaging in the digital world, they could gain a competitive advantage going forward.

Having said that, many large telecoms today struggle to maintain a decent level of cybersecurity owing to tough competition and limited budgets. Consequently, some do not even have any form of up-to-date asset inventory, privilege segregation, or internal security monitoring. Given the volume of valuable data of their clients, telcos are an attractive low-hanging fruit for cybercriminals. A thorough investigation will likely detect a sophisticated and undetected intrusion into any, virtually any, large telco in the world. There is nothing their clients can do about this but presume that all communication channels are insecure and encrypt all their traffic.

According to cybersecurity firm Cybereason, at least ten telecom companies have been hacked across the globe. It is thought the reason for the organized surveillance operation is to spy on VIPs’ location and call records. Targets include politicians, diplomats, and foreign agents. The hackers reportedly swiped information including location data, billing information, text message records, and call detail records. Cybereason said that the hackers had access to the carriers’ entire active directory, an exposure of hundreds of millions of users, and they were reportedly able to peruse those databases as though they were employees of the telecom companies. The attackers used a variety of techniques, including the creation of admin accounts and using virtual private networks (VPNs), to mask where they were based. Some of the activity was detected as far back as 2012, and the hackers apparently were able to hone their techniques over time.

Breaches like these have made network operators and telcos realize that they need to protect more than just the data being transferred over their systems. As networks become increasingly software-defined, their infrastructure is as vulnerable to attacks as the bits and bytes sent through the network. In 2020, holistic network security will become more important than ever and expect to see encryption transition from a niche play to a more pervasive technology.

Breaches like these have made network operators and telcos realize that they need to protect more than just the data being transferred over their systems. As networks become increasingly software-defined, their infrastructure is as vulnerable to attacks as the bits and bytes sent through the network. In 2020, holistic network security will become more important than ever and expect to see encryption transition from a niche play to a more pervasive technology.

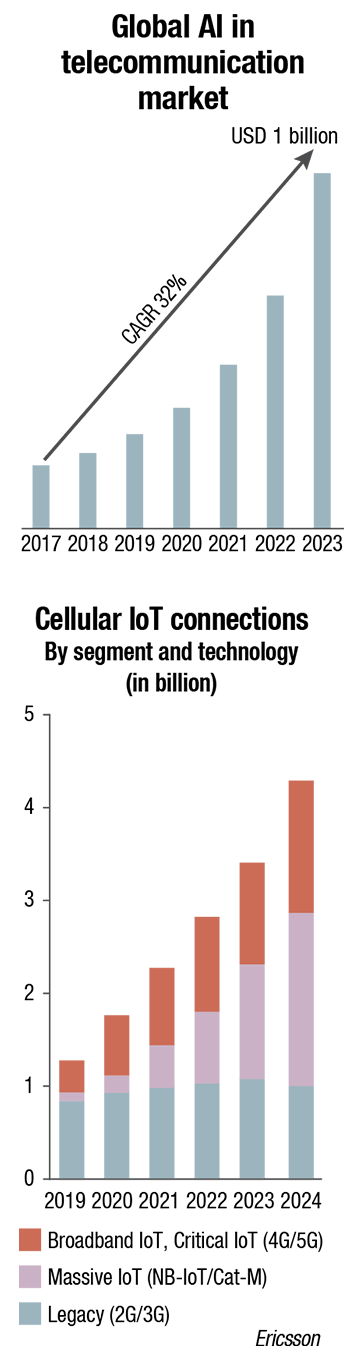

IoT. Internet of Things comes with the concept that every device should be electronically integrated and interconnected. Hence, telecom operators are now using digital platforms that combine the connectivity, analysis, mobile, security, and cloud to support business and all these factors help generate greater revenue.

IoT technology also helps telecoms monitor base stations and data centers remotely. Since telecom is so instrumental in providing IoT infrastructure, the industry is uniquely poised to develop and offer their own services for IoT. The IoT telecom services market size is estimated to reach USD 17.67 billion by 2021, at a compound annual growth rate (CAGR) of 43.6 percent, according to MarketsandMarkets. While there are still a lot of unknowns regarding the transformation IoT will have for telecoms, there is little doubt that it will disrupt the industry.

AI. Artificial intelligence is essential for the optimization and predictive maintenance of telecommunication companies’ networks. Additionally, through predictive analytics, AI offers new routes to agility, efficiency, and monetization to a telecom operator. Network, operation, customer service, and marketing all can be improved and more efficiency can be brought with AI and analytics play.

RPA. Intelligent automation or robotics process automation (RPA) can take over repetitive, rules-based, high-frequency processes and complete them very accurately. RPA is a significant driver of telecom investment worldwide, and it is used extensively in every function and use case. Cost savings of ~25–50 percent becomes achievable through RPA. When telecoms deploy RPA for tasks, error rates and costs are reduced while customer service and operational efficiency are boosted. It offers high levels of scalability and agility, and can take over many tasks, such as report generation, responding to customer questions, order processing, price tracking, and more.

Blockchain technology is used in multiple applications in the telecom industry. Being able to hold historical records of users, without any chance of those records being tampered with, makes it possible to manage different aspects of the users’ accounts. Some of the blockchain applications in the telecom industry include automation of many internal operations, such as billing systems, roaming, and supply chain management.

The cloud. The cloud continues to disrupt the telecom industry. Cloud computing’s pay-per-use service model helps telecoms introduce new services, reduce their costs, and adjust to market demands more effectively. The cloud offers economies of scale, scalability, and cost effectiveness to telecoms.

Not only can telecoms be cloud service providers, but they can also use the cloud themselves. When telecoms adopt cloud technology and switch important business functions to the cloud, they benefit from the cloud’s efficiency. The move to cloud also reflects a broader trend about the convergence between network and IT domains. Historically, these were seen as quite distinct, with separate suppliers, technologies, and protocols. But just as Ethernet and IP have displaced telecom-specific technologies, such as frame-relay and ATM, CSPs are looking to cloud technology as an alternative to the complex infrastructure that supports their IT systems (including their OSS and BSS functions), and even as an alternative to the hardware that supports network-specific functions like routing and switching. The telco cloud covers three different application types – the NFV cloud, the enterprise service cloud, and the IT cloud.

Go green. Climate is a growing public-policy concern, and the telecom industry will play an increasing role to support green, sustainable energy solutions. They can do this either by purchasing guarantees of origin (GOs) from their energy providers or by entering into power-purchase agreements (PPAs) with companies that produce green energy.

Infrastructure and network sharing. Network sharing, network sourcing, or managed services transactions aim to decrease the weight of non-critical assets in the balance sheet, maximizing return on investment for assets held.

Avoiding downtime. With new services being brought online all the time, a minor error could mean entire IT system go down and stay down for a number of hours. Because telcos have millions of data points, just one system change by one person in one area can have a domino effect. Telcos need to identify issues before they affect the user. By gathering information across technology and operational and organizational silos, telcos can make well-informed decisions with the necessary insight to predict, detect, and address issues before services are impacted. By on-boarding a comprehensive estate-monitoring system, telcos can suppress the white noise, and hone in on what is valuable. In this way, they can gain insight ahead of time and pre-empt system failures.

Standards. The standardization of cellular communication’s technical specifications plays a critical role in enabling future innovation. Overseen by 3GPP and other standardization organizations, each wave of various specifications is structured as releases, which each provides a set of enabling functionalities.

Following the successful finalization of 3GPP Release 16 in December 2019, the work to develop the next wave of innovation will begin immediately with 3GPP Release 17 (Rel-17) in 2020. The contents of 3GPP Rel-17 have already been agreed to by 3GPP stakeholders throughout 2019. By June 2021, the Rel-17 standards are expected to be finalized and published. 3GPP Rel-17 will bring more use cases where mobile communication can be utilized.

Following the successful finalization of 3GPP Release 16 in December 2019, the work to develop the next wave of innovation will begin immediately with 3GPP Release 17 (Rel-17) in 2020. The contents of 3GPP Rel-17 have already been agreed to by 3GPP stakeholders throughout 2019. By June 2021, the Rel-17 standards are expected to be finalized and published. 3GPP Rel-17 will bring more use cases where mobile communication can be utilized.

Outlook. Global mobile subscriptions will grow strongly in 2020, reaching 7.3 billion, according to a December 2019 report from The Economist Intelligence Unit. Growth will be particularly rapid in Asia, the Middle East, and Africa, where mobile penetration will grow by 11 percent compared with 2019. However, in most regions, the number of fixed lines will continue to decline.

The sole bright spot will be fixed-broadband subscriber lines, which will reach nearly 1.1 billion in 2020. There are also substantial risks to these forecasts, including the US-China trade war, Brexit, and the backlash against Huawei’s dominance.

“The global telecom sector can bank on yet more global growth during 2020, but the challenge will be to make that growth profitable. Most subscribers are unwilling to pay more for extra telecom services or faster speeds. Operators will try to come up with compelling use cases, but many of them are likely to have cut costs during 2020 in order to improve their average revenue per user,” says Matt Kendall, chief telecoms analyst, The Economist Intelligence Unit.

5G

The rollout of commercial 5G networks is rapidly gathering pace. On the face of it, 2019 has been a year of 5G progress. Countries like South Korea, the US, and Switzerland have created a global-leadership position, signing up 5G subscribers on 5G tariffs via 5G devices.

Investment in 5G and fiber fixed-line services is likely to be the top priority for operators in 2020, but they will face challenges. The rollout will require a coordinated approach among regulators, governments, and operators, to ensure that spectrum is released on time and at affordable prices. Even so, telecom companies will find it hard to monetize 5G technology. Among consumers, only tech-savvy early adopters will be willing to pay a premium; so, operators need to persuade businesses that 5G can revolutionize the way they operate. That will not happen in 2020.

The booming Chinese market is set to ensure that 5G is quicker out of the starting blocks than any previous mobile technology, according to CCS Insight’s 5G forecast. The forecast predicts that 5G connections will reach 1 billion worldwide in mid-2023, taking less time than 4G to reach this milestone.

As early as 2022, China will account for more than half of all 5G subscribers. Even by 2025 – following deployment in most world regions – it will still represent more than four in ten 5G connections globally. South Korea, Japan, and the US are fighting it out to be the first to launch commercial 5G networks, but China will take an early lead in the number of subscribers. Despite the EU’s lofty ambitions, network rollout in Europe will trail by at least a year.

In the longer term, CCS Insight sees 5G adoption taking a broadly similar path to 4G LTE technology. Subscriptions to 5G networks will reach 2.6 billion in 2025, equivalent to more than one in every five mobile connections. It sees mobile broadband access on smartphones as the principal area of 5G adoption. By 2025, it will still represent a colossal 99 percent of total 5G connections.

Nevertheless, CCS Insight sees fixed wireless access, positioned as a complementary service to fixed-line broadband, as 5G’s first commercial application. However, the long-term opportunity will remain small and the forecast sees it representing only a tiny fraction of total connections.

Nevertheless, CCS Insight sees fixed wireless access, positioned as a complementary service to fixed-line broadband, as 5G’s first commercial application. However, the long-term opportunity will remain small and the forecast sees it representing only a tiny fraction of total connections.

Despite the industry’s seeming obsession that in the future everything will be connected, 5G will account for a relatively low number of connections in the IoT. Here, 4G networks will satisfy demand until narrowband technology is fully supported within the 5G standard. Network operators have only recently begun investing in LTE technologies, such as NB-IoT and Cat-M, to support devices that have life spans of several years. Significant numbers of 5G connections in this area are unlikely before the second half of the 2020s. Lastly, the so-called mission critical services, such as autonomous driving – regularly touted as a killer application in 5G – will have to wait even longer to come to the fore.

5G is about creating a network that can scale up and adapt to radically new applications. For operators, network capacity is the near-term justification; the IoT and mission-critical services may not see exponential growth in the next few years, but they remain a central part of the vision for 5G. Operators will have to carefully balance the period between investment and generating revenue from new services.

Operators will not be able to recoup their investments in 5G simply by cutting costs and charging consumers more for more and/or faster data. In fact, consumers continually expect to have more – more data, more connectivity, more functionality – while paying the same or less.

While IDC projects that mobile service providers will collectively spend nearly USD 57 billion on the rollout of 5G through 2022, Morgan Stanley’s equity analyst Gary Yu forecasts capital expenditures of USD 872 billion through 2030, 1.7 times the cost of building out 4G. The high cost of acquiring spectrum – a scarce global resource – is a key part of these costs because 5G needs new spectrum across different frequencies to operate effectively.

Although the synchronized rollout could help to lower initial 5G equipment pricing through scale, Morgan Stanley estimates China, changing from a follower to a leader in this cycle, and rolling out its 5G network together with traditional leaders the US, Japan, and Korea, having a 5G CapEx at around USD 421 billion over the next decade, which could initially drag down return on invested capital and become a negative catalyst for telecom shares.

In other regions, the lift could be lighter. In the US, the big four carriers could spend USD 26 billion on spectrum purchases over the next three years, along with total 5G CapEx of USD 265 billion. Morgan Stanley also forecasts USD 129 billion in Japan and USD 58 billion in Korea over the next decade.

In other regions, the lift could be lighter. In the US, the big four carriers could spend USD 26 billion on spectrum purchases over the next three years, along with total 5G CapEx of USD 265 billion. Morgan Stanley also forecasts USD 129 billion in Japan and USD 58 billion in Korea over the next decade.

The company estimates that the top seven 5G use cases – fixed wireless, manufacturing automation, cloud gaming, autonomous vehicles, surveillance/smart cities, drones, and remote healthcare services – could drive a combined USD 156 billion of incremental annual revenue by 2030.

For investors, another key aspect of the rollout is an industry shakeup. The rollout of 5G could trigger industry consolidation or bring disruptive entrants. Indeed, the two usual reasons for consolidation – spectrum and CapEx – could be magnified in the 5G era. Faced with limited resources to acquire new spectrum and build expensive networks, smaller wireless providers will be forced to seek M&A opportunities or get shut out of the 5G market.

5G could also attract new entrants to the industry, thanks to additional markets such as industrial IoT applications. Big tech companies could also play a role, given their strong interest in the connected home. A jump from the home to the enterprise market could be close behind.

Finally, and perhaps most important, 5G could provide a rare opportunity to return pricing power to the telcos. Although the consensus holds that 5G would not significantly change the telecom industry’s eroded pricing power, Morgan Stanley’s analysts disagree. They believe that 5G could allow telecom providers a rare opportunity to see a higher return on investment. “The business opportunities for 5G are just exponentially bigger than previous-generation networks,” comments Simon Flannery, equity analyst covering North American telecom services, Morgan Stanley.

While 5G, the fifth generation of wireless technology, has received the most attention, the future is not just about mobility. Fixed networks are also crucial to break away from the stagnant revenue of the recent past and realize maximum gains from the coming era.

While 5G, the fifth generation of wireless technology, has received the most attention, the future is not just about mobility. Fixed networks are also crucial to break away from the stagnant revenue of the recent past and realize maximum gains from the coming era.

In a recently held forum, Ao Li, Director of the Technology and Standards Research Institute of CAICT and Deputy Secretary General of the Broadband Development Alliance, said: “From the perspective of the fixed-network development history, we have witnessed the narrowband era (64 Kbps) represented by the PSTN/ISDN technology; broadband era (10 Mbps) represented by the ADSL technology; ultra-broadband era (30–200 Mbps) represented by the VDSL technology; and megabit era (100–500 Mbps) represented by the GPON/EPON technology. Now we are entering the 5th generation, gigabit broadband era featuring the 10G PON technology. By penetrating into vertical industries, gigabit optical-fiber networks will break the boundaries of traditional industries, and bring about huge industrial and economic benefits.”

Compared with previous generations, the fifth-generation fixed network features full-fiber connection, ultra-high bandwidth, and ultimate experience. Fibers will connect not only homes, but also more vertical industries, such as enterprises, transportation, security, and campuses. Symmetric Gigabit and Wi-Fi 6 will further upgrade network capabilities. End-to-end network latency will become lower and more stable, and operators will shift from traffic-centric operation to experience-centric operation.

Most operators are looking at the ITU G.9807.1 standard for symmetrical 10 Gbit/s PON, called XGS PON. Some deployments have already begun. Aside from XGS PON, a minority of operators (most notably Verizon today) plan to move to NG-PON2 (ITU G. 689), which combines time-division multiplexing (TDM) and wavelength-division multiplexing (WDM) PON to deliver 4×10 Gbit/s symmetrical wavelengths per system. Regardless of approach, operators agree that the next rate is symmetrical 10 Gbit/s.

To sum up, meeting the communication demands of the coming Fourth Industrial Revolution will require a combined effort of mobile and fixed networks. Operators that myopically focus only on the 5G opportunities risk losing out on the full set of financial rewards.

Looking ahead – A word of caution

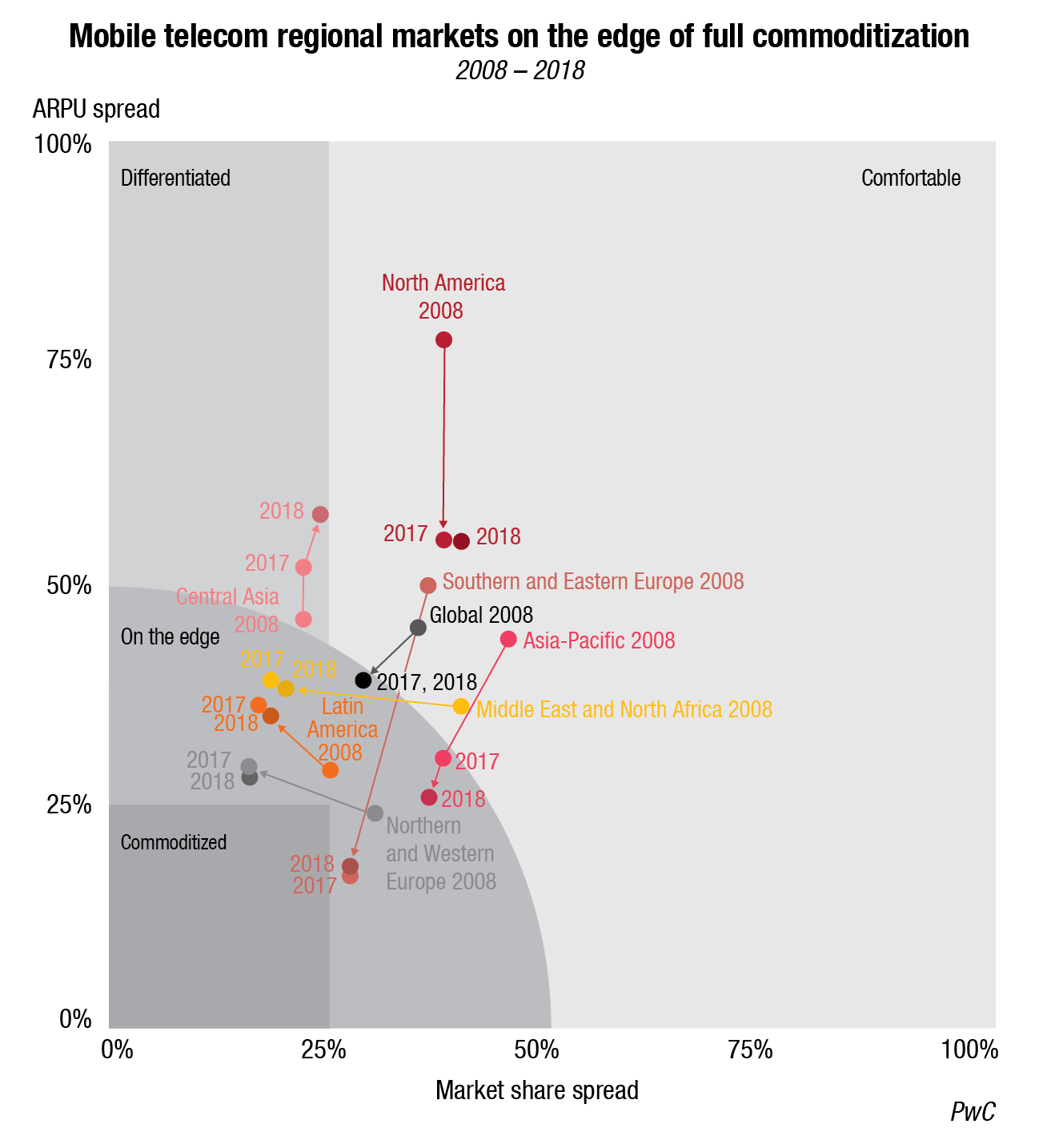

The past several years have not been kind to the global telecom industry. Wireless markets are saturated, fixed-line services are under pressure from cord cutting and both are increasingly commoditized in many regions. Competition is becoming ever more brutal, owing to both aggressive operators within the industry and interlopers moving in from adjacent industries. Regulatory changes are becoming less predictable. Consumers are more resistant to price increases. Telecom companies are facing huge investment decisions over the next few years.

Telecom executives are well aware of their declining attractiveness to investors. In hopes of reversing the trend by boosting shareholder value, many are looking for a better strategic path. PwC’s strategy-consulting business elucidates on two options for creating value in this disruptive age. The first path is diversification – increasing revenues and profits by moving into new businesses. AT&T’s purchase of Time Warner and Orange’s moves into financial services are examples. The second path is an infrastructure play – to double down on or restructure the company’s assets while improving results through renewed management focus and increased transparency for investors. This path can position a company for new networking-oriented revenue streams. Case in point: TDC, Denmark’s incumbent operator, which recently split into Nuuday for its market-facing brands and TDC NetCo for its network operations; or Telstra in Australia, which has set up a separate InfraCo business division for its fixed infrastructure assets and operations.

The logic of each choice, from the point of view of shareholders and investors, is sound. Those looking for growth will likely be attracted to the companies looking to diversify, whereas those who prefer steady dividends will look to the infrastructure plays.

Many telecoms are hoping not to have to choose, but it is becoming more difficult to follow both paths and bring investors on the journey. Each path requires different capabilities, a clear right to win, and enough investment to demand full commitment (a company’s right to win is its ability to consistently compete with a high expectation of success). So far, few telecom companies have settled on a single path (or a well-designed combination path) that clearly demonstrates their capability to disrupt new sectors or to deliver predictable capital returns from infrastructure.

Winning through diversification. The determination of telecom operators to diversify their activities is entirely understandable. Revenues are flat or down at many companies, thanks to saturated markets, ongoing price wars and commoditization of services, and consumer resistance to price increases. Yet, these companies already possess many of the capabilities needed to compete successfully in businesses that are ripe for digital disruption. The telecom operators have trusted brands, sales reach, customer-experience focus, data-analytics experience, and more.

Thus, just as technology companies have edged their way into a variety of adjacent activities – cloud services, the auto and healthcare industries, and telecom itself – some operators have been looking well beyond the provision of broadband and wireless services for new ways to bring in more revenue from existing customers and broaden their customer base. Areas of interest include financial services and insurance, healthcare, home security and management, telematics, identity and security operations, and media and content. In the US, Verizon is a good example. It has made acquisitions over the years in cybersecurity, IT services, telematics, and media and entertainment.

So far, however, the results have been decidedly mixed for most telecoms, for two reasons. First, many operators have struggled to devote the focus needed to create sufficient scale in the businesses they have chosen to pursue, and to put in place the innovative business models and nimble operating models needed to succeed in the digital world. When they have tried to diversify through acquisition, they have often failed to unlock synergies that could change the competitive dynamics in the market.

Second, some operators have made moves outside the telecom realm into areas where they had no clear right to win in this market. Typically, in these cases, the competition was too entrenched and the operator did not have the right capabilities or business model needed to successfully disrupt the incumbents. Furthermore, carriers that operate in a single country, or group of countries, because of licensing rules governing legacy telecoms, will inevitably struggle against stronger global competitors with internationally recognized brands.

The infrastructure play. There is, of course, a whole group of telecom companies that continue to see value in doubling down on their strengths in infrastructure and networking. This strategy can make sense if the goal is to maintain or slowly grow revenues while increasing profits through careful cost management — and thus provide investors with reliable dividend yields.

As with a diversification strategy, consideration for each type of infrastructure asset.

As with a diversification strategy, consideration for each type of infrastructure asset.

The first, along the exhibit’s horizontal axis, is the time horizon for returns from a particular type of infrastructure; the second, along the vertical axis, is the ability of the telecom company to defend its position within its market, through economies of scale or high barriers to entry, for example.

Thus, for instance, 5G-based fixed-wireless access (FWA) is likely to provide medium-term returns (given the right type of customer base and location). Deploying fiber to the home (FTTH) is likely to have a longer-term return horizon but can create significant barriers to entry for other ultra-fast broadband plays, both wired and wireless. The way each company positions itself on the grid will also depend on its relative capabilities and the dynamics in its market.

A further consideration is the degree of regulatory scrutiny to be expected for each type of infrastructure, in each market. Providing incentives for new infrastructure and tolerating higher margins would also enable and encourage operators to invest and innovate.

Several possibilities for partnering exist for infrastructure players to generate incremental returns that can flow back into network improvement and expansion. Infrastructure-focused mobile operators, for example, could act as mobile virtual-network enablers, offering networking and business services to MVNOs (mobile virtual-network operators). They could work with fixed-network operators that do not have substantial mobile infrastructure to strengthen their mobile operations in exchange for favorable backhaul services. Or they could partner with various OTT (over-the-top) content and experience providers that depend on superior connectivity to enable new services such as 8K video and virtual reality entertainment.

From dilemma to decision. Clearly, trying to be all things to all customers is not working for most telecom providers – or for their investors. It is time for operators to assess their situation and make the strategic choices needed to jump-start investor interest. A clear diversification strategy, underpinned by strong capabilities and with the potential for disruption, will resonate with some categories of investors; configuring an efficient infrastructure powerhouse with real economies of scale and high barriers to competitors will attract others.

There is no single correct answer to this dilemma. The need to choose one to the exclusion of the other cannot be advocated, although either one alone could be a viable long-term approach. A tale of two telecoms. A report by Strategy&, PwC’s strategy consulting business, describes these approaches in more detailed scenarios. But leaders in telecom enterprises can benefit by making deliberate fact-based decisions, and using them as the basis of clear stories to be told to shareholders and other constituents. This will help determine which capabilities they need to move forward with their chosen strategies – and which they lack. And it will increase their attractiveness to investors who, at the end of the day, have many options for where to put their capital.

The US concern – Lessons to be drawn from here

The scope of telecommunication technology and of the industry itself has grown dramatically over the past few decades, driven primarily by the success of the Internet and its applications, by the digitization of all types of media and forms of communication, and by the rising importance of communication as a key enabling technology.

The powers that be in United States have been debating if they need to have a leadership position if telecommunications move offshore, as has occurred for many other entire industries. Nations such as China, Japan, Korea, and member states of the European Union have identified telecommunication as a strategic area for economic development and have launched a variety of initiatives to enhance academic, industry, and joint industry-academic research in accord with vigorously promulgated national visions. Equipment vendors in a number of countries (such as China) now compete strongly with US firms and have been very successful in emerging markets. Some nations’ active support for their domestic industries has extended beyond investment in research to include measures for protection of domestic telecommunication industries, thus placing further stress on the US telecommunication industry.

Telecommunication products and services generally become commoditized over time as multiple firms acquire the know-how to supply similar, competing products, and such competition has benefits in terms of lower prices for goods and services. To maintain leadership – or even a strong position – in telecommunication in the face of pressures from lower costs overseas for labor and other essentials thus requires that US firms constantly focus on achieving high-value innovation as a foundation for developing non-commodity products and services. Research leadership in telecommunication by US academic research institutions and government and industry labs has historically given the nation an advantage in terms of access to new technologies and the highest-calibre engineering talent.

Despite many potential avenues for significant improvements in areas ranging from security to real-time audio and video transmission, research and development has become largely incremental in nature. Moreover, the current architecture is largely commoditized, and firms from other nations will become increasingly able to deliver competitive products and services. Research aimed at defining future architectures promises particular benefits because US firms will be positioned to offer new kinds of services and not just incremental improvements to existing ones.

Without a continuing focus on telecommunication R&D, the United States will increasingly be forced to purchase telecommunication technology and services from foreign sources.

And funding should be consistent with the vital role played by telecommunication in the US economy and society and with the direct contributions made by the US telecommunication industry to the nation’s economy and security. Funding should also be consistent with telecommunication’s role as a critical element of information technology (some 16 percent of the total federal networking and information technology research and development budget today goes to telecommunication). Finally, the investment should be large enough to support a critical mass of researchers and research; one estimate can be drawn from the pre-divestiture Bell Labs, whose budget of over USD 500 million (in today’s dollars) for basic research was sized to provide the breadth and depth to comprehensively address telecommunication research issues.

And funding should be consistent with the vital role played by telecommunication in the US economy and society and with the direct contributions made by the US telecommunication industry to the nation’s economy and security. Funding should also be consistent with telecommunication’s role as a critical element of information technology (some 16 percent of the total federal networking and information technology research and development budget today goes to telecommunication). Finally, the investment should be large enough to support a critical mass of researchers and research; one estimate can be drawn from the pre-divestiture Bell Labs, whose budget of over USD 500 million (in today’s dollars) for basic research was sized to provide the breadth and depth to comprehensively address telecommunication research issues.

What was the US concern a few years back is fast becoming India’s concern too.

Commoditization and convergence

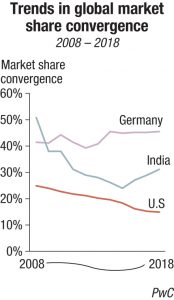

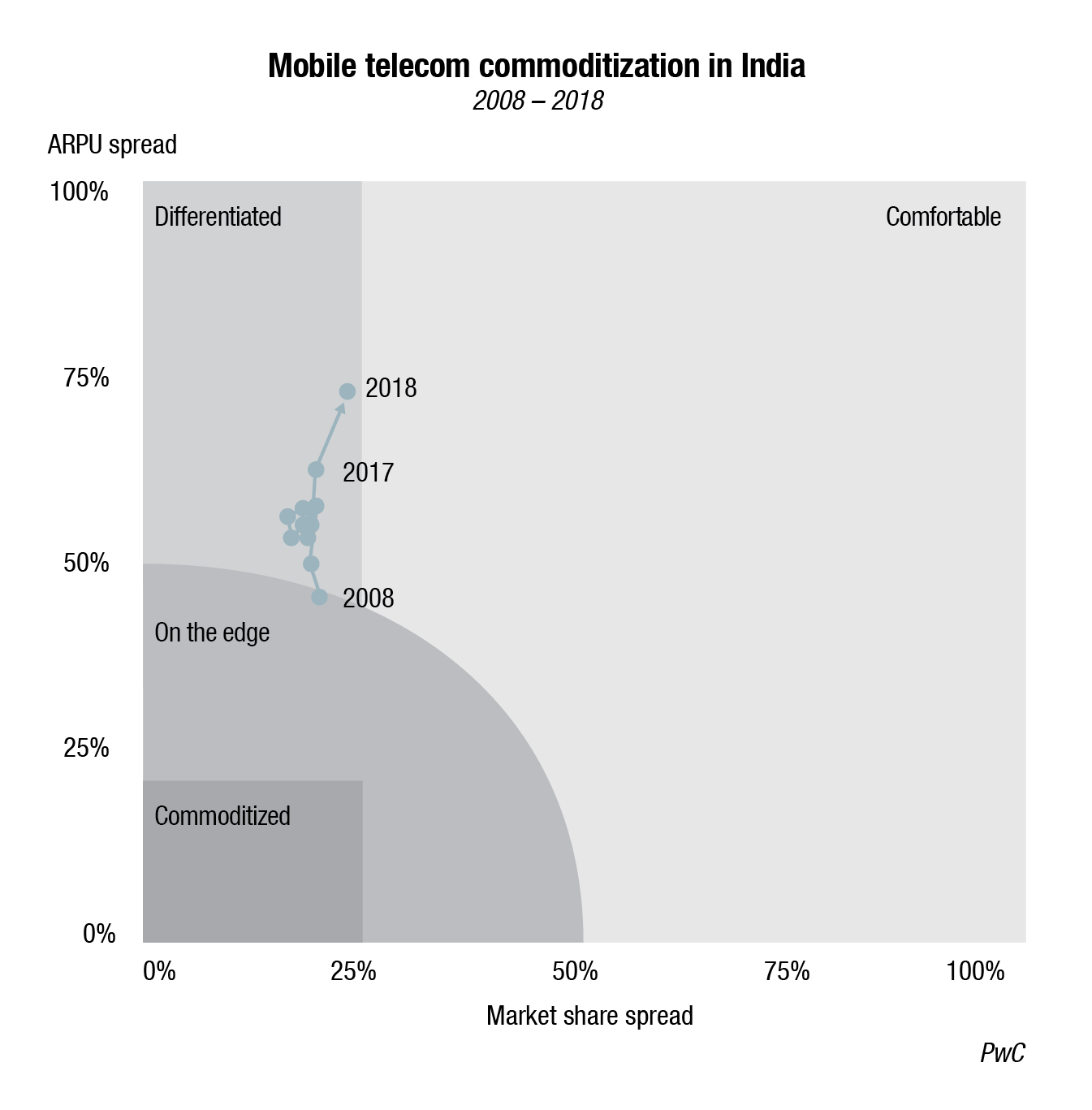

A recent report by Strategy&, part of the PwC network, supports the National Academy of Sciences, USA, in that two trends that are shaping the global telecom industry are commoditization and convergence. In 2019, Strategy&, PwC’s strategy consulting group, conducted its third annual study of commoditization in the worldwide mobile telecom industry. And for the first time in 10 years, what has seemed like an inexorable process of commoditization has stalled, at least temporarily. And that too, with exceptions. While overall it has come to a halt in the past year, it increased in the Asia-Pacific region, and in Central Asia it has gone into reverse. Unlike the mobile market, the market for fixed telecom services continued on its long-term path to commoditization, which has increased by 11 percent since 2008.

Commoditization is signified as narrowing market share and shrinking spreads between low- and high-priced services. It is a loss of differentiation, making companies vulnerable to competition, based on price alone, and thus to shrinking margins. The two metrics provide a clear picture – the decline of the ARPU spread from 45 percent to 39 percent, and an even larger decline of

India is an exception to the rule. It has become strongly commoditized over the past decade, largely thanks to a narrowing of the overall average revenues per account (ARPA) spread. BSNL has dominated the fixed market, capturing a 56 percent market share. The next two largest providers of fixed services, Airtel and MTNL, have grown their subscriber base steadily over the past decade, but both have experienced declining market share, owing mainly to the growth in the number of other fixed players entering the market. But the increased competition has led to a rapid narrowing of the market’s ARPA spread, which has declined a total of 62 percent since 2010, landing the market on the edge of fixed commoditization.

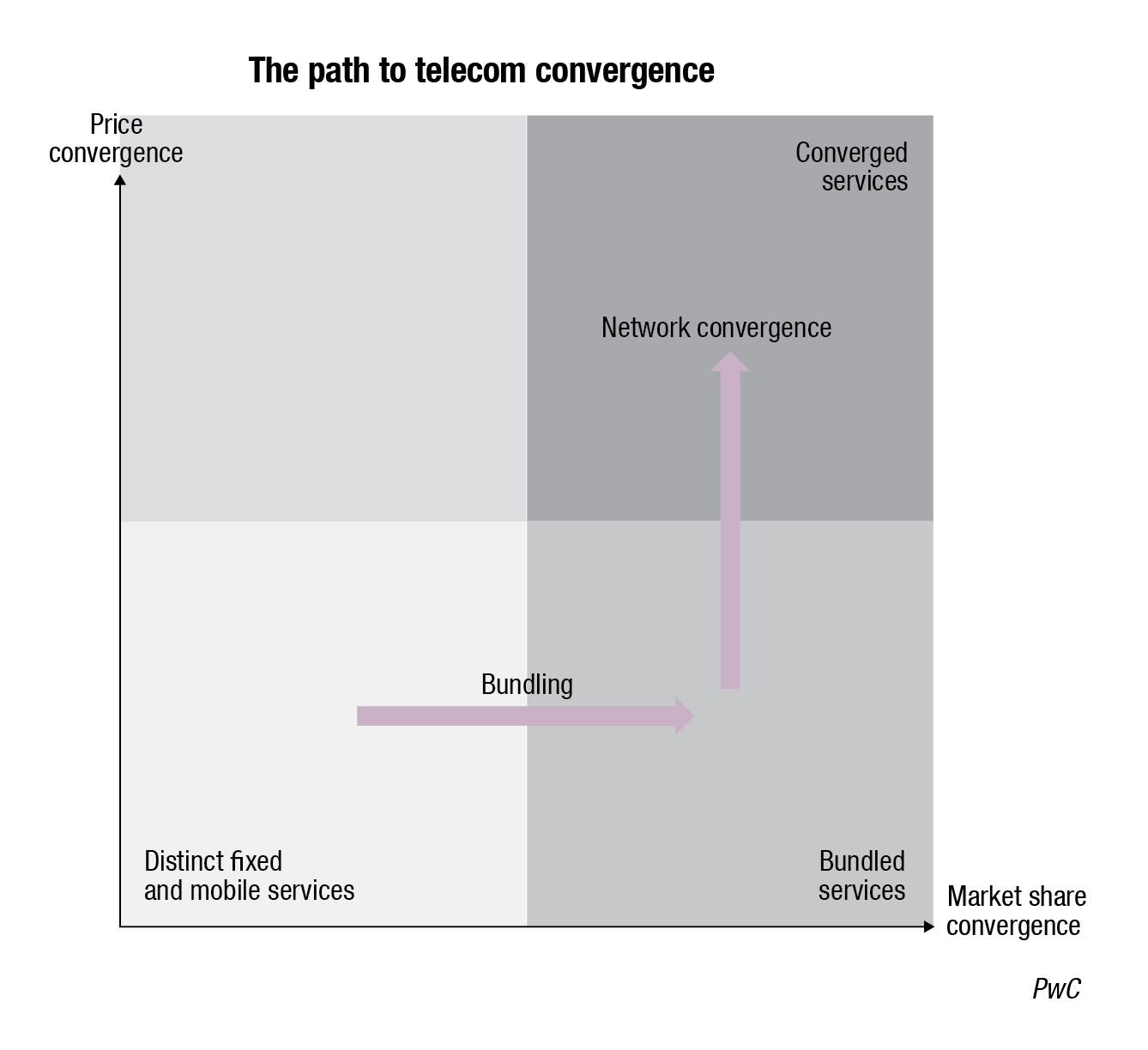

The second trend is convergence – the continued erosion of the boundaries between fixed and mobile telecom services. A host of new technologies are finally bringing about the long-predicted marriage of these two sectors, though at very different rates in different markets. As the markets for fixed and mobile services become increasingly blurred, carriers will have new ways to differentiate their services, and thus also will have new ways to compete.

The second trend is convergence – the continued erosion of the boundaries between fixed and mobile telecom services. A host of new technologies are finally bringing about the long-predicted marriage of these two sectors, though at very different rates in different markets. As the markets for fixed and mobile services become increasingly blurred, carriers will have new ways to differentiate their services, and thus also will have new ways to compete.

Telecom markets will experience two kinds of convergence, in market share first, and then in price. The first step, bundling, will give providers a proportionately equal share of the combined mobile and fixed markets, while they continue to compete on the basis of price. In hopes of gaining market share, carriers will likely begin by offering quasi-quad plays (voice, internet, mobile, and television) – as Xfinity Mobile has in the US – with little or no discount for bundling these services.

Over time, carriers will continue their push to expand their network nationally and try to gain market share by acquiring competitors, by making wholesale agreements with MVNOs (mobile virtual-network operators), and in some cases by encouraging the construction of state-owned networks, such as NBN in Australia and Red Compartida in Mexico. Building the capabilities and the new products and services needed may be done organically and by developing interim technologies that temporarily lower the cost of providing converged services, such as offering mobile services over local hotspots.

Only in the second step, when technologies such as FTTN (fiber to the node) and, ultimately, 5G, CBRS (citizens broadband radio service), and 6 GHz implementation allow fixed and mobile networks to converge fully, will markets experience price convergence. In this final stage, every provider will offer the same single product – a fully converged offering of mobile and fixed services. Because there will be no difference among the offerings of different carriers, or because only one offering will be available, there will be no difference between ARPU and ARPA.

Once a market is fully converged, competition among carriers will no longer be based on their physical network assets. Instead, they will all compete for the same mobile customers and fixed households or businesses, differentiating themselves by the kinds of services customers want, and by other options such as speed and bandwidth.

As pleasant a scenario as this sounds for consumers, full convergence will likely open up a threatening new chapter of commoditization for telecom companies. First movers in offering fully converged services will likely gain an advantage in both market share and pricing. But once others follow, carriers will run out of ways to differentiate themselves. In short, convergence offers the specter of an almost perfectly competitive, almost perfectly efficient market. But that will be a highly commoditized market as well.

Given just how different the process of convergence is for fixed and mobile services in each market, predicting the future is tricky. Factors include their current competitive setup, networking structure, and regulatory burden. And, of course, the willingness and ability of operators to make the investments necessary will greatly affect the timetable in every market. But one way or another, virtually every market can expect to experience convergence over the next five to 10 years.

And convergence can only mean further commoditization, as the services offered by players become less and less distinctive. This will present an existential problem for all players, unless they can find a way to distinguish themselves from their peers.

In the end, convergence, and especially the promise of 5G, could help telcos save themselves from becoming commoditized businesses. New consumer content and services will enrich everyone’s digital lives. IoT offers a wealth of data and control over industrial activities in every sector. Ultra-high-performance networks will enable the customization of networking needs. Data privacy and security could be controlled centrally as internet activities move through carriers’ networks.

Few, if any, of these opportunities will come to pass, however, if telecom executives do not find the will to develop a clear and coherent strategy for their company’s future – one that is decisively differentiated and clearly committed to a competitive edge. Too many operators are still trying to be all things to all people, and the results are bloated cost structures, mixed marketing messages, confusing brand identities, overextended managements, and unfocused innovation efforts.

The telecom industry is on the brink of a new era of connectivity, brought about by 5G, the IoT, and powerful new data analytics. Now is the time to devise and begin to carry out a focused strategy, one that stands a good chance of leading each company out of the dilemma of commoditization and into the brave new world of convergence.

Industry viewpoint – Huawei

The intelligent world is close enough to touch

Change is coming and it is coming fast – AI, 5G, IoT, and other emerging technologies are converging to forge a world of new experiences and productivity for all.

Toddlers giving commands to smart assistants. Robots going where we can never go. The disappearance of touch-based commands as home appliances begin speaking to us. Traffic lights that see more than we do. Endangered species living in threatened ecosystems protected by smart devices and AI these are just some of the changes happening around us.

The intelligent world is arriving. And it is close enough to touch.

Today, Huawei’s end-to-end global capabilities are ready to deliver new functions,

new opportunities, and unprecedented performance for every individual, company, and industry.

Global Industry Vision describes 10 trends that explain how ICT is driving change for everyone, everywhere. We hope that you are as excited as we are about the intelligent world unfolding before us.

Ten Trends for 2025

These are ten exciting trends that are shaping the future and inspiring a new age of digital inclusion. Together, we can bring the benefits of digital technologies to every person, home, and organization.

Trend 1: Living with bots

- GIV predicts that by 2025:

- The number of smart nursing bots will increase from 6.2 million in 2017 to 23 million. Each care home for the elderly will have 10 nursing bots in G8 nations (Canada, France, Germany, Italy, Japan, Russia, the UK, and the US).

- The number of smart home devices will rise to 20 billion.

- 470 million homes, or 14 percent of households worldwide, will have smart butler bots, quadrupling the 25 million shipments made in 2018 and creating a market worth USD 9 billion.

Increasingly connected, networked, and function-rich robots are creating a blue ocean that will be worth billions of dollars to the ICT industry. Carriers, developers, robotics companies, and AI companies will benefit, alongside individuals, homes, and industry verticals like health and education.

Personal robots will also be a boon for inclusivity, empowering people who are at risk of being side-lined, for example, the elderly and those with physical disabilities and mental health issues. They will also give children an early and fun start to education, and free up more time for family members to do something more productive than housework.

It is time to start thinking about that new family member.

Trend 2: Super sight

Super sight will be enabled by technologies like 5G, AI, machine learning, VR, and AR. It will help us to see beyond distance, surface, distortion, and history. With super sight, we will be able to see things we could not see before. And we will be able to better understand what we already see.

- By 2025, GIV forecasts that:

- The number of VR/AR users will have increased to 337 million.

- 10 percent of companies will be using VR/AR.

Trend 3: Zero search

Zero-search requires AI algorithms that are continuously trained, using massive sets of user data. These algorithms offer high-quality user experiences. The increasing population of internet users will undoubtedly provide more data to train AI and optimize its recommendations. Zero-search maintenance is driven by the growth in IoT, 5G networks, intelligent devices, and cloud apps, and will become an important part of smart cities and high-end equipment manufacturing.

Button-free interaction and the Me Network will provide users with simpler digital experiences based on complex groups of intelligent technologies that support a wide range of user scenarios. Ubiquitous connectivity means constant data transmission and 24/7 connectivity among many devices that connect people to things and things to other things. With the help of intelligent devices and edge computing, smart home appliances and intelligent connected cars can perceive user needs and automatically adjust.

- GIV forecasts that by 2025:

- The adoption rate of intelligent personal digital assistants will reach 90 percent.

- 470 million smart speakers will be in use worldwide.

- 6.2 billion people will use the Internet globally.

Trend 4: Tailored streets

Congestion-free traffic-management systems and virtual emergency lanes lie at the heart of the tailored streets concept. They will form key basic technologies for the smart city and safe city projects of the future. These systems will dynamically connect pedestrians, drivers, vehicles, and roads in a unified network. Dynamic planning will enable intelligent transport systems to make more efficient use of road resources, and shorten emergency response times. In addition to saving lives, savings will be created in public budgets, and productivity for citizens and businesses will increase owing to less time wasted in commuting and transportation. Intelligent systems will also reduce the environmental pollution caused by traffic.

All of this requires vast computing resources, carrying out high-dimensional analytics on spatio-temporal data, which cannot be supported by current computing architecture. As a result, companies and research institutes are increasing their R&D efforts to speed the development of new technologies like quantum computing.

- GIV forecasts that by 2025:

- 15 percent of the world’s vehicles will be equipped with C-V2X (cellular vehicle-to-everything) technology.

- 20 percent of large companies expect to benefit from quantum computing.

Trend 5: Working with bots

Automation and robots, particularly AI-powered bots, are changing the way we live and work. This technology will allow us to focus our energy on creative, knowledge-based tasks.

Intelligent robots will handle hazardous, repetitive, and high-precision tasks without rest or error, greatly boosting productivity and safety. Today, smart automation is widespread in various fields, including manufacturing, the law, biopharmaceuticals, and surgery.

GIV predicts that by 2025 industrial robots will work side by side with people in manufacturing, with 103 robots for every 10,000 employees.

Trend 6: Augmented creativity

Not only will technologies help reduce the time take to discover new drugs, it also lowers the barrier of entry into artistic creation. With a smartphone embedded with AI chips, anyone can realize their creative potential. As more people get involved in creative pursuits, technology will help lay the foundation for mass creativity.

GIV forecasts that by 2025:

- 97 percent of large companies will introduce AI into their business operations or management processes.

- The total number of smartphones in use around the globe will reach 6.1 billion.

Trend 7: Frictionless communication

Frictionless communication gives companies a clearer, more precise understanding of their customers at lower cost. More importantly, it reduces error and misunderstandings by providing open and transparent information for all. AI translation devices will enable communication and business to flow across borders, helping companies around the world expand their reach globally. IoT technologies and smart wearables will draw everyone into the economy, offer each person opportunities to realize their unique value, and deliver the benefits of the digital economy.

AI is the enabler for frictionless communication. AI systems are not static; they can be continuously improved by training them with complete and diverse datasets. To capture, transport, and deliver the vast amounts of data generated, we need to create a web of ubiquitous connectivity.

GIV forecastws that by 2025:

- Companies will be making efficient use of 86 percent of the data that they produce.

- There will be 100 billion connected devices in the world.

Trend 8: Symbiotic economy

Open, diverse ecosystems, based on cloud platforms, will benefit every participant in the ecosystem. They represent a core channel for the broader uptake of the latest technologies and the future of the global symbiotic economy. Cloud technology is constantly advancing – cloud is already the platform on which most corporate innovation occurs, and the primary tool for increasing the speed and effectiveness of innovation. The platforms for developing artificial intelligence, and the ecosystem of partners, who apply AI technologies to industrial use cases, will create new opportunities for innovation by industries, companies, and developers. As industries produce richer streams of data, AI algorithms and learning tools will only become more effective.

AI is already the key tool for growth for many companies; soon it will also offer vital support for company management and operations.

GIV predicts that by 2025:

- 100 percent of companies around the world will be using cloud technology. 85 percent of business applications will be cloud-based.

- 97 percent of large companies will use artificial intelligence.

Trend 9: 5G’s rapid rollout

5G’s biggest impact will come not so much from technical breakthroughs, but from how it enables industries to advance, and consumers to enjoy and share smarter lifestyles. For many people, their most direct experience of 5G will come from access to HD live-video broadcasts. Autonomous vehicles and virtual/augmented reality devices will become widespread following the rollout of 5G. The widespread application of 5G technology will also stimulate the growth of cloud services and the development of new applications on the cloud. The global rollout of 5G networks will not just lead to higher sales of 5G-ready phones, it will stimulate massive growth in intelligent lifestyle sectors.

These sectors range from microchips and batteries, phones, tablets, PCs, and smart home equipment, to services like photography.

GIV predicts that by 2025:

- There will be 2.8 billion 5G users around the world.

- 5G networks will cover 58 percent of the world’s population.

- 6.5 million 5G base stations will be installed globally.

Trend 10: Global digital governance

Ubiquitous connectivity will generate vast quantities of data, and the analysis and mining of this data will help drive further progress in internet technologies. The ability to obtain and mine customer data in a legally compliant manner is now one of the key capabilities that companies require to sustain growth. Legal data capture determines smart data analytics and conversion, and data analytics and conversion determine a company’s ability to innovate and compete.

GIV predicts that by 2025:

- The amount of global data produced annually will reach 180 ZB.

Industry viewpoint – Nokia

5G begins and ends with trust

Rajeev Suri

Rajeev Suri

President and CEO,

Nokia

“Trust is not a nice-to-have. It is the foundation of any business relationship. That is particularly true in the telecommunications business, where huge amounts of personal data move between devices every day.

Trust will be especially critical in the 5G era. This new generation of connectivity will bring with it a trillion-dollar opportunity for new networks and new services – but only if those networks and services are completely watertight. Consumers do not want their private information to fall into the wrong hands. The same goes for businesses, who will use 5G networks to transfer business-critical and highly-sensitive data.

The way I see it, 5G is only worth it if it begins and ends with trust. This is not about political issues or differences between countries. After all, the importance of trust is something we can all agree on.

Securing a network with no borders

5G will introduce an entirely new characteristic, called network slicing – isolating distinct, end-to-end virtual slices of the network tailored to specific customers or applications. Because each slice will be different – one might be used for a public safety solution, another for cloud gaming – their security needs will vary. So 5G security has to be flexible enough for that too.

The stakes are high. 5G slicing represents a huge new revenue opportunity for service providers. But those providers, like end users, need to be confident that the network and applications are safe.

Security essentials in 5G

There are a few prerequisites for achieving that safety: scalability, sophistication, and speed.

Scalability means giving a company’s security operations the ability to secure every application in real time – even those running in the cloud. This would address one of today’s biggest security risks – the fact that threats are so numerous, varied, and complex that traditional means of dealing with them simply cannot keep pace with the constant streams of network alarms. The answer to this challenge is orchestrated analytics, machine learning, and automation, which can detect and extinguish threats automatically, with minimal human input.

The 5G environment will also demand more sophisticated security features. As services evolve and new cloud-native services are created, the service landscape will become increasingly varied, and software updates will become ever more frequent. That could open the door to new vulnerabilities.

Finally, speed is at the center of 5G’s value proposition. By utilizing advancements, such as edge-computing, we are able to move data processing away from remote centralized hubs and nearer the end user. This will dramatically improve latency – in other words, the time it takes for your device to respond to what you tell it to do. Security solutions will be able to use this too, bringing the security blanket closer to at-risk devices.

Building trust in 5G

I believe that businesses and consumers should be very excited about 5G. It is faster, more reliable, and more flexible than any previous generation of mobile technology. But in a world where these things are just accepted, what will become one of the key differentiators?

The answer is trust and security.

Not all communication service providers will want to invest in comprehensive, belt-and-braces security. Some will be satisfied with a network that does the basics, but nothing more than that. That is fair enough, when you consider the huge spend needed to roll out 5G globally. But it also provides an opportunity for bolder, more visionary operators to distinguish themselves by being the most secure and trusted player in their market.

I believe that communication service providers who take this route will attract more customers, inspire greater loyalty, and, importantly, represent a far more compelling prospect for businesses that want to digitize.

In other words, for the 5G pioneers, everything will – and must – start and end with trust.”

Industry viewpoint – Ericsson

Six key trends manifesting the platform for innovation

Erik Ekudden

Erik Ekudden

Senior Vice President,

Chief Technology Officer and Head of Group Function Technology,

Ericsson

“Affordable and efficient connectivity is a fundamental component of digitization and has become as important as clean water and electricity in creating a sustainable society of the future. Recognition of this fact is of critical importance as we enter a new era that is defined by the combinatorial effects of a multitude of transformative technologies in areas such as mobility, the Internet of Things (IoT), distributed computing, and artificial intelligence (AI).

The universal connectivity network that we use today is built on voice and mobile broadband services that currently serve 9 billion connected devices globally. This technology is recognized and acknowledged for its availability, reliability, integrity, and affordability, and it is trusted to handle sensitive and important information. Today’s network provides pervasive global coverage on a scale with which no other technology can compete. It has quickly become a multipurpose network, ready and able to onboard all types of users, as well as supporting a large number of new use cases and a plethora of new technologies to meet any consumer or enterprise need. As such, it is ideally suited to serve as the foundation for future innovation in any application.

Appropriate and universal connectivity

The multipurpose network is significantly more cost-efficient than specialized or dedicated network solutions, making it the most affordable solution to address society’s needs across the spectrum from human-to-human to human-to-thing and thing-to-thing communication. It supports everything from traditional voice calls to immersive human-to-human communication experiences. In terms of human-to-thing communication, it enables everything from digital payments to voice-controlled digital assistants, as well as real-time sensitive drone control and high-quality media streaming.

With regard to IoT communication, the ubiquitous connectivity provided by the multipurpose network enables the creation of a physical world that is fully automated and programmable. Examples of this include massive sensor monitoring, fully autonomous physical processes, such as self-driving cars and manufacturing robots, as well as digitally embedded processes, such as autonomous decision-making in tax returns.

Key technology trends

In my view, the ongoing evolution toward the future network continues to rely heavily on the five key technology trends that I outlined in last year’s trends article. Therefore, in this year’s technology-trends article, I have chosen to build on last year’s conclusions and share my view of the future network platform in relation to those five trends, with one addition – distributed compute and storage.

Trend 1: Internet of Skills

The Internet of Skills has the potential to bridge the geographical distance between humans as well as between humans and things. A high quality of experience (QoE) is essential to create immersive interactions that allow humans to attend meetings remotely with the same ability to participate as if they were physically present. Humans have to trust the network to enable critical remote operations and interaction with things.

Trend 2: Cyber-physical systems

CPS results from the integration of different systems to control a physical process and uses feedback to adapt to new conditions in real time. This is achieved by integrating physical processes, networking, and computation. A CPS generates and acquires data, so that the relevant elements involved have access to the appropriate information at the right time. Therefore, the CPS can autonomously determine its current operating status, and corrective actions are realized by the actuators. Information comes from sensors and from other related CPSs. The role of humans is to supervise the operation of the automated and self-organizing processes.

Main characteristics. The interconnect between different kinds of networks, from local to wide-area coverage, builds a global network that provides a platform for pervasive global services. The inherent mobility within and between the networks creates unprecedented coverage, both indoors and outdoors. Utilizing all these network assets enables a distributed environment to access, compute, and store. These assets are virtualized, distributed across the network, and are made available where they are needed and are most efficient. Applications and processes are dynamically deployed throughout the network. Network-slicing enables streamlined connections for different applications, enhancing the efficiency of the total usage of the network.

Autonomous deployment, operation, and orchestration is an essential capability of the network platform to enable cost-efficiency. Just as important are the reliability and resilience to fulfil expectations from the industry and society. Built-in, automated security functions protect the network and the integrity of its users from external threats.

The network platform offering. The network platform offers a wide range of capabilities to all its users. It provides a seamless universal connectivity fabric with almost unlimited, scalable, and affordable distributed compute and storage. Sensors and actuators can be attached anywhere throughout the network. Latency can be optimized by interacting with the control of access, compute, and storage. Embedded into the platform is a distributed intelligence that supports users with insights and reasoning.

The addressability and reachability capabilities make it possible to connect anyone or anything regardless of location and time. Together with the inherent security and availability, the network platform can also meet communication needs relating to secure identification of users and networks. It also provides the scalability to automatically adapt to the exact needs of individual users and applications. As an example, adaptive power consumption is enabled by a flexible air interface. Another example is automated life-cycle management of devices, users, and applications. This guarantees the most cost-efficient solution for users, in both the long and short term.

The network-platform offering is consumed through an automated digital marketplace. Network services and data are available through consistent and open-business interfaces for the applications (APIs). Data, such as location, connectivity conditions, and user behavior, can be made available from the network platform.

With all these capabilities, the network platform offers the most accessible and valuable foundation for future innovation.

Trend 3: Distributed compute and storage

Future applications will require new processing capabilities from the network in order to reduce the amount of data that needs to be communicated, provide low latency, and increase robustness and security.

Today’s processors and accelerators will eventually experience the end of Moore’s law, and new heterogeneous computing solutions will emerge. Commodity hardware has been joined by a highly heterogeneous set of specialized chipsets – often referred to as accelerators – that are optimized for a certain class of applications.

The network platform will benefit from the seamless integration of specialized compute and storage hardware to boost performance for a wider range of emerging, complex applications. The advanced compute and storage capabilities will be moved to the edge of the network, closer to where the data is generated. Further, the network will be able to support developers with efficient and transparent programming models. Edge-native applications will be designed from the ground up to fully capitalize on compute and storage resources anywhere.

Trend 4: Ubiquitous radio access

Improved indoor coverage, maximal energy-efficiency, fiber-like performance, and support for both small cells and a wide range of new use cases are key features of the 5G networks that are currently being rolled out. These networks will be the baseline for future radio networks and the network platform itself.

Trend 5: Security assurance

The need for protection and assurance (or even compliance) is growing rapidly as business and society increasingly rely on universal connectivity and compute. In the autonomous networks, security assurance procedures play the important role of verifying security properties of the network platform.

Trend 6: Zero-touch networks

A zero-touch network is capable of self-management and is controlled by business intents. Data-driven control logic makes it possible to design the system without the need for human configuration, as well as to provide a higher degree of information granularity. Applying AI technologies will enable zero-touch automation of network life-cycle management, including optimizing system performance, predicting upcoming faults and enabling preventive actions.

Way forward

Much more cost-efficient than specialized or dedicated network solutions, the network platform is clearly the most affordable solution to address society’s needs across the spectrum from human-to-human to human-to-thing and thing-to-thing communication. One of its major advantages is that it is available through an open marketplace that is accessible to anyone, anywhere, and any time.

The multipurpose network is rapidly emerging as a secure, robust, and reliable platform where applications, processes, and other technologies can be developed, deployed, and managed. The Internet of Skills and cyber-physical systems – trends 1 and 2 – are important examples of use cases that it needs to support.

A key characteristic of the future network platform will be its ability to instantaneously meet any application need, anytime. Four technology areas – trends 3–6 – are playing critical roles in its ongoing evolution – distributed compute and storage, ubiquitous radio access, security assurance, and zero-touch networks.

Self-driving vehicles, intelligent manufacturing robots, and real-time drone control are just a few examples of the myriad of ways in which the multipurpose network is enabling the automation of the physical world and, ultimately, the creation of a sustainable society of the future.”

For complete article please visit, www.communicationstoday.co.in/six-key-trends-manifesting-the-platform-for-innovation

You must be logged in to post a comment Login