OFC

OFC industry in a take-off stage

The global demand for optical fiber cable (OFC) in 2018 is estimated at 511 million fkm, valued at USD 7.64 billion. It is expected to register a CAGR of over 12.26 percent to USD 13.63 billion in 2023. Growth in the telecom industry and favorable government initiatives aimed at developing network infrastructure across regions continue to be key drivers.

The global demand for optical fiber cable (OFC) in 2018 is estimated at 511 million fkm, valued at USD 7.64 billion. It is expected to register a CAGR of over 12.26 percent to USD 13.63 billion in 2023. Growth in the telecom industry and favorable government initiatives aimed at developing network infrastructure across regions continue to be key drivers.

Telecom is the largest consumer of OFC, contributing to more than 40 percent of the total market value. The segment includes communication service providers and network infrastructure vendors. Optical fiber technology in data transmission and communication services enables high-speed data transfer services both in small- and long-range communications. Communication service providers are consistent in adoption of high-speed network infrastructure in order to offer enhanced internet services. Optical fiber cables are widely deployed for various applications ranging from backbone infrastructure of telecommunications to data networking, Ethernet systems, and broadband distribution. Optical fiber networks allow telecom network links to be established over longer distances with minimal power loss. The telecom segment is anticipated to continue its dominance in the application arena.

Growth of data centers expected to drive the market. By offering benefits in terms of cost savings and high-speed data transmission benefits, compared to copper cables, the usage of optical fiber cables is becoming evident across data centers. The increasing consumption of social networking sites, videos, and other consumer apps, signifies the considerable demand for data. The rising data center growth considering the connected devices and data storage, and the need for high-speed data transfer augments the adoption of the optical fiber cables.

Growth of data centers expected to drive the market. By offering benefits in terms of cost savings and high-speed data transmission benefits, compared to copper cables, the usage of optical fiber cables is becoming evident across data centers. The increasing consumption of social networking sites, videos, and other consumer apps, signifies the considerable demand for data. The rising data center growth considering the connected devices and data storage, and the need for high-speed data transfer augments the adoption of the optical fiber cables.

In the recent years, as optics has been a base on which medical equipment are being built, the demand for fiber optic cable exists across the healthcare industry.

High costs and complex installation act as major restraining factors for OFC market. Despite the fact that optical fiber installation costs are dropping by 60 percent every year, installation of optical fiber cable is relatively expensive as compared to that of copper cables.

High costs and complex installation act as major restraining factors for OFC market. Despite the fact that optical fiber installation costs are dropping by 60 percent every year, installation of optical fiber cable is relatively expensive as compared to that of copper cables.

Multi-mode cables segment retains its dominance followed by the single-mode cables segment. Amongst the cable type, the market is dominated by the multi-mode cable segment and is expected to continue its dominance. Multi-mode cables have larger diametric core that allow multiple modes of light (signals) to propagate. These cables are primarily used in metro regions for internet connections, resulting in higher density networks. Due to higher density of metro cables, multi-mode fiber cables witness higher demand as compared to single-mode counterparts. Whereas the diametric core of single-mode cable is small, which allows only one optical signal to propagate, the single-mode cable is typically used to cover longer distances and offers low power loss as compared to that of multi-mode cable. The segment is expected to have a substantial growth due to growing number of upcoming projects for long-haul networks. However, it is expensive than multi-mode optical fiber cable, thereby limiting its use to long-distance networks.

Asia-Pacific is the fastest growing market, followed by MEA. Asia-Pacific leads the overall OFC market worldwide. The market is primarily backed by China, Japan, Korea, India, and Indonesia having significant penetration of optical fiber cables. These countries are expected to increase the deployment of FTTH, due to consistent expenditure over communication infrastructure. China holds the largest market share of more than one-third of the total regional market value. The country has high density of optical fiber networks and is aggressively investing in new optical fiber infrastructure. Establishment of 5G network solution will further enhance the demand for optical fiber cables in China.

Asia-Pacific is the fastest growing market, followed by MEA. Asia-Pacific leads the overall OFC market worldwide. The market is primarily backed by China, Japan, Korea, India, and Indonesia having significant penetration of optical fiber cables. These countries are expected to increase the deployment of FTTH, due to consistent expenditure over communication infrastructure. China holds the largest market share of more than one-third of the total regional market value. The country has high density of optical fiber networks and is aggressively investing in new optical fiber infrastructure. Establishment of 5G network solution will further enhance the demand for optical fiber cables in China.

Besides Asia-Pacific, North America is the second largest consumption market, followed by Europe. The UK government has announced its plans for an industry-led switchover from copper to full fiber. In North America and Europe, the OFC market has a consolidated structure, whereas in Asia-Pacific, the market is fragmented due to a large number of regional players operating in the region.

Middle East and Africa (MEA) are estimated to witness an impressive growth in the OFC market due to growth in the telecom industry and increased industrialization. United Arab Emirates (UAE) has the highest internet penetration in the world with over 99 percent of its citizens using the internet.

Inorganic expansion to remain the key strategy. The market in Asia-Pacific is highly fragmented in nature due to presence of large number of regional as well as international players. These players are adopting several strategies, such as new product launches and mergers and acquisitions in order to sustain their presence in competitive environment. Amongst these, merger and acquisitions form among the key strategies as they allow the companies to expand their product portfolio and geographic reach, thereby gaining exposure to larger consumer base.

Key development in the market. In January 2018, Corning Incorporated, a key player in the OFC market, inaugurated a new cable-manufacturing facility in North Carolina. The company’s investment was intended to cater to its customers’ need to address the growing demand for optical fiber and cable. The strategic decision was also made in line with its plan to achieve the goal of USD 5 billion in the annual sales of optical communications by 2020.

Key development in the market. In January 2018, Corning Incorporated, a key player in the OFC market, inaugurated a new cable-manufacturing facility in North Carolina. The company’s investment was intended to cater to its customers’ need to address the growing demand for optical fiber and cable. The strategic decision was also made in line with its plan to achieve the goal of USD 5 billion in the annual sales of optical communications by 2020.

Major global players include Corning Inc., Sumitomo Electric Industries Ltd., Finisar Corporation, AFL Communications LLC, Leoni AG, Prysmian Group, Sumitomo Electronics Industries (SEI), Furukawa Electric Co. Ltd, General Cable Corporation, Finolex Cables Ltd., AFL Global, LS Cable & System (LS Group), Sterlite Technologies Ltd., Yangtze Optical Fiber and Cable Joint Stock Ltd Co., Hengtong (HTGD), Fujikura Ltd., Futong Holdings, CommScope Inc., Fiberhome, OFS Fitel LLC, and Coherent, Inc.

Indian Market Dynamics

The Indian market for optical fiber cable in 2018 is estimated at 29 million fkm, projected to grow at a CAGR of 17 percent through 2023. Growth in the market is majorly expected to be backed by rising investments in OFC network infrastructure by the Indian government to increase internet penetration across the country, which is in line with the government’s initiatives such as Smart Cities Vision and Digital India. Moreover, growing demand for OFC from IT and telecom sector, rising number of mobile devices, increasing adoption of FTTH (fiber to the home) connectivity, and surging number of data centers is anticipated to fuel optical fiber cables market in India over the coming years.

Mobile data access has been the key driver of internet penetration and data consumption. As telecom operators upgrade networks to increase data speeds and capacity, they require higher proportion of the network to be connected via fiber. For the primarily voice-focused 2G networks, only 2-4 percent towers were required to be fiberized as bulk of the voice traffic could be carried on low-cost microwave backhaul. Indian operatorsrelied primarily on microwave backhaul as getting right of way (RoW) in India has been difficult and economics for fiber network for voice is unfavorable. But, 3G network requires 15–18 percent of the sites to be fiberized, while 4G requires 65–75 percent of the network to be fiberized. Advent of 5G will require not only 100 percent of the network to be fiberized, but also significant densification of the network and fiberized fronthaul investments to support the cloud radio access network (C-RAN) architecture.

Mobile data access has been the key driver of internet penetration and data consumption. As telecom operators upgrade networks to increase data speeds and capacity, they require higher proportion of the network to be connected via fiber. For the primarily voice-focused 2G networks, only 2-4 percent towers were required to be fiberized as bulk of the voice traffic could be carried on low-cost microwave backhaul. Indian operatorsrelied primarily on microwave backhaul as getting right of way (RoW) in India has been difficult and economics for fiber network for voice is unfavorable. But, 3G network requires 15–18 percent of the sites to be fiberized, while 4G requires 65–75 percent of the network to be fiberized. Advent of 5G will require not only 100 percent of the network to be fiberized, but also significant densification of the network and fiberized fronthaul investments to support the cloud radio access network (C-RAN) architecture.

Thereon, we expect telecom operators to increase investment toward fiberization of networks to augment data capacity to meet future demand. In comparison, China has been deploying 13.7x more OFC per annum due to higher penetration of broadband subscribers. However, we expect India’s fiber rollout to increase significantly as the government continues to invest in building networks to bridge the digital divide and strengthen the country’s defense networks. Mobile operators are investing in improving backhaul to cater to burgeoning data demand.

Broadband service providers aggressively expand fiber installations to cater to high-speed data by using FTTH/FTTB. While the country has already embarked on its ambitious BharatNet initiative, the world’s largest rural broadband connectivity project to connect 600,000 villages, the Department of Telecommunications has introduced another ambitious plan in its new draft national telecom policy. The draft envisages providing wireline broadband access to 50 percent households, deploying 10 million Wi-Fi hotspots and attracting investment of USD 100 bn by 2022. It also aims to provide universal broadband coverage at 50 Mbps to every citizen, 1 Gbps to gram panchayats and 100 Mbps to key development institutions, along with fabrication of 60 percent base stations, compared to less than one-fourth towers that are currently connected to fiber, to prepare for 4G/5G technologies. Besides, there will be significant investments from the telecom players to improve connectivity.

Some of the major manufacturers in India are Sterlite Technologies Limited, Himachal Futuristic Communications Ltd., Finolex Cables Limited, Aksh OptiFiber Limited, Paramount Communications Limited, Vindhya Telelinks Limited, Birla Cables Limited, UM Cables Limited, Uniflex Cables Limited, and West Coast Optilinks.

Some of the major manufacturers in India are Sterlite Technologies Limited, Himachal Futuristic Communications Ltd., Finolex Cables Limited, Aksh OptiFiber Limited, Paramount Communications Limited, Vindhya Telelinks Limited, Birla Cables Limited, UM Cables Limited, Uniflex Cables Limited, and West Coast Optilinks.

Vendor Update

Sterlite Technologies is a technology-led global company, with an expanding footprint in over 100 countries, where its network technologies are enabling ultra-high speed 4G, 5G, and FTTx networks to millions of homes and businesses.

In India, Sterlite Tech’s customers include telecom companies and state governments. The company is commissioned by the Indian Army for setting up optical fiber infrastructure in the challenging terrains of Jammu & Kashmir. It is also a vendor to BharatNet Phase-I. It has presence in international markets across the globe including Europe, Middle East, Latin America, and Asia.

The company’s revenue growth saw a 3-year CAGR of 19 percent. Revenues for 2018 stood at Rs 3205 crore (up 24 percent from FY17). Exports accounted for 54 percent of 2018 revenues. The company’s international revenues more than tripled from Rs 537 crore in 2016 to Rs 1735 crore in 2018, up by 81 percent against 2017.

The company set up a glass-manufacturing and fiber-draw tower in Shendra, Aurangabad, to take its current capacity of 30 million fkm to 50 million fkm by June 2019, with an investment of up to Rs 1200 crore spread over 2 years. It has won an advance purchase order of Rs 3500 crore to design, build, and manage Indian Navy’s communications network. It will lead the planning and designing of a converged multi-protocol label switching (MPLS) infrastructure on a two-layered centrally-managed internet protocol (IP) backbone. The company has several long-term contracts signed with key customers. These include British Telecom, UAE-based du Telecom, and managing the smart city of Kakinada in Andhra Pradesh.

With full control over the fiber manufacturing value chain, Sterlite is fully integrated across the optical fiber manufacturing value chain. It is backward integrated to manufacture optical fiber from sand, and forward integrated to offer system integration and telecom software. Sterlite Tech has a significant competitive advantage because it manufactures its own preform, an extremely precision-sensitive and intellectual property-protected process. Preform dictates the supply side of the fiber production chain and Sterlite Tech, being one of fewer than 10 companies globally that manufacture their own perform, is the only company in the world to be fully integrated from silicon to software.

KEC International Limited, an RPG Group company is an infrastructure EPC major with presence in power transmission & distribution (T&D), railways, civil, smart infrastructure, solar, and cables businesses. The company has established its footprint in 100 countries (including EPC and supply) across the globe. The revenue increased by 15.3 percent YoY to Rs 10,096 crore in 2017-18 on the back of strong performance demonstrated by T&D, railways, and civil business.

The cables business secured orders worth Rs 1024 crore in FY 2017-18. The company merged its Silvassa plant operations with Vadodara plant in the last quarter of FY 2017-18 for better operational efficiencies. Due to higher GST and shifting of Silvassa plant, the revenue of cables business got impacted in FY 2017-18.

Cable manufacturing capacity includes power cables (~40,000 km per annum), instrumentation cables (3600 km per annum), optical fiber cables (6 lakh fkm per annum) and copper telecom cables. Cables form 2 percent of the order book, and India 55 percent. The telecom cables revenue declined owing to global shortage of fiber, and increased fiber prices due to increased demand from China.

Himachal Futuristic Communications Ltd. The net sales of HFCL during FY18 stood at Rs 3070.08 crore as compared to Rs 2015.95 crore in FY17, an increase of 52 percent YoY. OFC manufacturing contributed consolidated revenue of more than Rs 980 crore during FY18 as against revenue of Rs 700 crore during FY17, showing 40 percent growth over the previous year. With a strong order book and the proposed capacity expansion during FY19, the trend is likely to continue. HFCL received purchase orders worth Rs 305 crore and Rs 278 crore aggregating to Rs 583 crore from Bharat Broadband Network Limited for creating optical fiber cable GPON network and radio network in the state of Punjab under BharatNet Phase-II project of the government.

Optical fiber cables demand grew so rapidly in the past two years that it surpassed globally available fiber and preform manufacturing capacity, resulting in acute shortage of optical fiber. Sensing this opportunity and in view of future market potential, the company went in for a greenfield project in Hyderabad, Telangana, to manufacture 6.4 mfkm per annum, targeting May 2019 as completion date. Another greenfield optical fiber cable manufacturing plant in Hyderabad is also planned. With this additional facility, HFCL (along with its subsidiary’s plant at Chennai) will have an OFC manufacturing capacity of 22 mfkm. During FY18, its Goa plant developed new compact designs for micro optical fiber cables with lesser diameters and new dry-dry optical fiber cables. These new variants are extremely popular in FTTx networks.

The manufacturer has developed and marketed its products in more than 50 countries worldwide. In FY18, it secured a three-year contract from Nokia for supply of optical fiber cables for Digital Poland project, funded by the EU. Likewise, it is also trying to offer its OFC solutions to many other countries, which are in the process of digitization through optical fiber connectivity. In the domestic market, as a preferred vendor, it has been supplying optical fiber cables to Reliance Jio. The vendor maintained its market share in the Indian OFC market and grew exports by 12.5 percent.

The manufacturer has developed and marketed its products in more than 50 countries worldwide. In FY18, it secured a three-year contract from Nokia for supply of optical fiber cables for Digital Poland project, funded by the EU. Likewise, it is also trying to offer its OFC solutions to many other countries, which are in the process of digitization through optical fiber connectivity. In the domestic market, as a preferred vendor, it has been supplying optical fiber cables to Reliance Jio. The vendor maintained its market share in the Indian OFC market and grew exports by 12.5 percent.

Aksh Optifiber Ltd. AOL is a vertically integrated player with optical fiber and optical fiber cable capacity, housed under one single manufacturing facility. AOL’s operations are also diversified with fiber reinforced plastic (FRP) rods. The company has also been supplying optical fiber cable to the country’s defense sector for the last few years. It has also won an order to design, build, and manage Jaipur smart city project. It is capable of manufacturing high fiber count cables, i.e., 512F, 768F, 864F, 1080F, and 1728F cables. It has OFC plants in Bhiwadi, Silvassa, and Mauritius, and OF plants in Bhiwadi and Dubai. It has customer reach in more than 70 countries.

AOL’s revenue from operations amounted to Rs 589.39 crore in 2017-18, as compared to Rs 478.04 crore in the previous year. Manufacturing revenue was Rs 581.16 crore, an increase of 23.94 percent over the previous year. The company has a current optical fiber cable manufacturing capacity of 10.7 mfkm in total and an optical fiber drawing capacity of 3 mfkm in Bhiwadi.

Finolex Cables Limited. The company mainly operates in two segments – electrical cables and communication cables. The communication cables include JFTCs, LAN cables, coaxial cables, speaker cables, OF, OFC, VSAT cables, and CCTV cables. In 2017-18, communication cables sale was Rs 476.93 crore as compared to Rs 368.51 crore the previous year. The joint venture with Corning SAS, Corning Finolex Optical Fiber Pvt. Ltd. has clocked sales of over Rs 237.26 crore in the year 2017-18 as against Rs 201.59 crore in the previous year and has achieved a profit of Rs 11.32 crore. There was a significant improvement in both volumes and value of products supplied during the year – all product lines under this segment delivered moderate volume growth. Consequently plant utilizations across all product lines improved. EBT for the year amounts to 9.8 percent in this segment as compared to 9.1 percent in the previous year due to revision in selling price of major supplies.

Vindhya Telelinks Limited. An MP Birla company, it operates in two business segments – cables and engineering procurement and construction (EPC). During 2017-18, it achieved gross revenue from operations of Rs 1351.38 crore as compared to Rs 1026.54 crore in the previous year, registering a growth of 31.64 percent. The revenue from exports, including project exports, increased substantially to Rs 36.17 crore as compared to Rs 18.41 crore during the previous year. The cables business segment, contributing 30.14 percent to the turnover, registered a significant growth of 44.99 percent in gross revenue in comparison with the previous financial year due to robust orders inflow, capacity augmentation, product diversification, and improved operational efficiencies.

Expansion-cum-diversification of the company’s copper cable facility was successfully implemented and it became operational during the year, which enabled the company to launch certain variants of cables and conductors for Indian Railways, solar energy, and power distribution segments. The company is also implementing substantial expansion of its optical fiber cables facility (OFC unit) at Rewa, to be executed in phases. The first phase is an expansion project for doubling the existing production capacity of optical fiber cables at an incremental capital outlay of Rs 51.71 crore.

The company is already involved in creation of IP-1 OFC network (infrastructure provider status/license from Department of Telecommunications), and thereby leasing out the fiber capacity to the telecom operators, who are interested in choosing this IP-1 model of business, wherein the indefeasible rights to use the telecom network along with operations & maintenance services can be enjoyed by the telecom operators.

Birla Cables Limited. Formerly known as Birla Ericsson Optical Limited, the company’s main business activities are manufacturing and sales of all types of optical fiber cables, copper telecommunication cables, structured copper cables, and specialty wires and cables. A division under MP Birla Group, it is a global Indian company, which has a reach of more than 60 countries catering to all the needs of communication cables across the segments. The company possesses the required quality certifications like quality management system, environment and health and safety management systems in an integrated manner with its state-of-the-art cable manufacturing facilities located in Rewa, Madhya Pradesh.

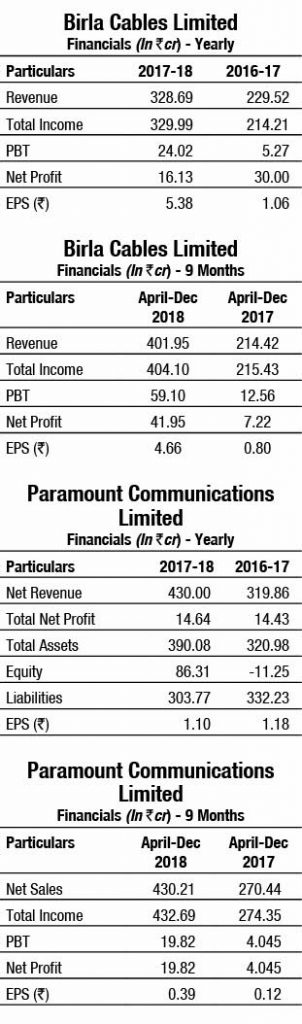

In 2017-18, the revenue from gross operations increased by 43.2 percent to Rs 328.69 crore as compared to Rs 229.52 crore in the previous year. The year saw a huge jump in OFC business, which reached Rs 249.89 crore as compared to Rs 186.36 crore in the previous year due to huge influx of orders from both domestic and overseas customers. Out of this, exports have also grown in a tremendous fashion touching a figure of Rs 101.16 crore. The company’s domestic sales turnover on account of traditional jelly-filled telephone cables (JFTC) saw a decrease from Rs 3.18 crore in the previous year to Rs 1.84 crore during the year. This is mainly due to the focus on replacing the copper-based networks to optical fiber. Further, the combined sales of other copper-based cable products, viz., structured cable, co-axial cable, and power cable stood at Rs 66.66 crore from both domestic and export market segments.

Paramount Communications Limited. PCL offers a comprehensive range of products including optical fiber cables, railway signalling cables, axle counter cables, high-voltage and low-voltage power cables, aerial bunch cables, control and instrumentation cables, house wiring and cables for submersible pumps, thermocouple extension and compensating cables, fire performance cables, jelly-filled telephone cables, installation cables for electronic exchanges, hook-up/jumper/drop wire, etc. The company caters to a wide array of sectors, including power, railways, telecom and IT, petrochemicals, construction, defense, and space research projects.

The gross turnover of the company for 2017-18 is Rs 439.18 crore as compared to Rs 354.32 crore during the previous year. The company achieved a net profit of Rs 14.64 crore in 2017-18 as against a net profit of Rs 14.43 crore during the previous year. The turnover of the company in OFC rose in FY18 to Rs 66.51 crore as compared to Rs 37.45 crore in the previous year. Optical fiber cables comprised 15 percent of the turnover. The company sold jelly-filled telephone cables amounting to Rs 2.88 crore against Rs 50.28 crore in the previous year. Jelly-filled telephone cables segment comprised about 1 percent of company’s turnover.

UM Cables Ltd. exports 60 percent of its production to 70 destinations across the globe. Its state-of-the-art infrastructural units are handled by expert technicians with an in-depth industry experience. It is an Indian multinational company with manufacturing facilities in India (Silvassa), UK, Thailand, and Dubai. It also has marketing setups in Scandinavia, UK, USA, UAE, Dubai, Vietnam, South Africa, and Bangladesh.

West Coast Optilinks, formerly known as Sudarshan Telecom, has its manufacturing facility in the electronics zone at Mysore. The company started its commercial production with an initial technical collaboration with Sumitomo, Japan. Later, the capacity of the plant was enhanced by installing buffering and stranding equipment from Rosendahl, Austria, for manufacture of optical fiber cables. The company has annual capacity to produce over 50,000 km optical fiber cables (1 million fkm) with fiber count up to 432F and 1.5 million CKM of PIJF copper telephone cables up to 800 pairs. The company introduced new products FRP (fiber reinforced plastic) and glass roving in the year 2014 for captive consumption as well as outside sale. The company exports its cables to Scandinavia, Vietnam, Laos, Malaysia, Bangladesh, Dominic Republic, Middle East, and African countries.

Uniflex Cables Ltd. is an ISO: 9001 2000 certified manufacturer and exporter of a highly reliable range of cables. This range of cables includes fiber optic cable, and jelly-filled telecommunication cables.

Fiber will be the key to success of 5G

5G will only be as powerful as the fiber networks that serve them. Integral to the success of 5G technology is an extensive optical fiber network, where all projected performance goals of 5G will ultimately depend on the strength of fiber connectivity. In order to achieve the full potential of 5G speeds, an underlying consideration is that networks need to be supported by an advanced fiber infrastructure. From the macro cells and small cells, to the data centers that deliver apps and services, it is crucial that fiber connects all non-wireless aspects of the network.

The key to building an ultrafast 5G-ready network is to have greater density of fiber and bringing fiber as close as possible to the end user. More fiber allows for a greater number of cells, and ultimately more reliable bandwidth. This is integral to ushering the way for developments in AI, such as autonomous vehicles and virtual reality, which all require large amounts of bandwidth.

With growing appetite for bandwidth-heavy and high-performance activities, such as HD video streaming and advanced gaming, it is more important than ever to ensure infrastructure is capable of meeting greater computing and connectivity needs. Robust fiber infrastructure is also the key for industries looking to implement futuristic technologies such as IoT, which requires more advanced networks. By supporting the expansion of fiber coverage, consumers are able to experience high performance capabilities enabled by 5G connectivity.

You must be logged in to post a comment Login