Trends

Netgear’s Q4 revenue almost flat at $249.1 million

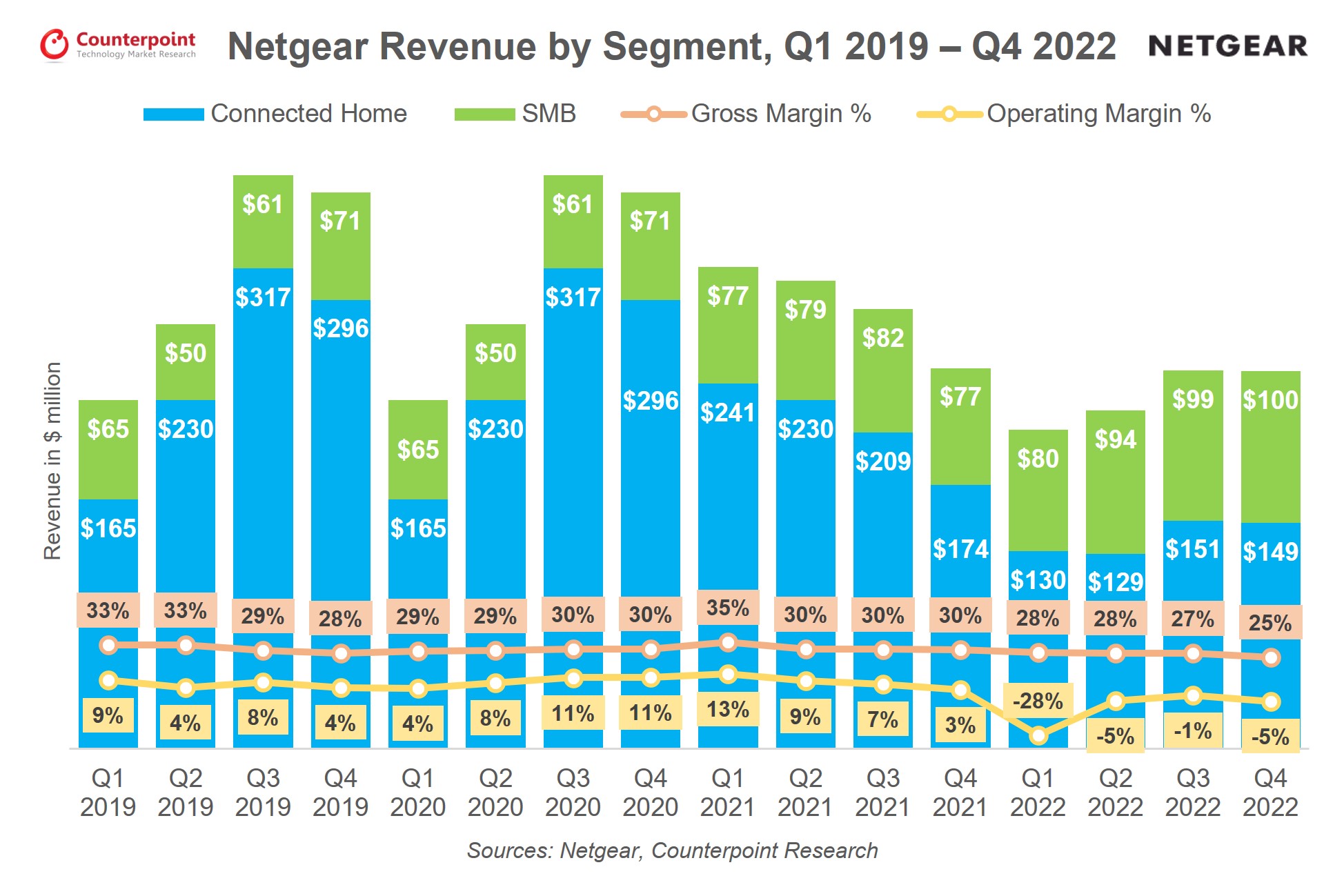

Netgear’s Q4 2022 revenue was almost flat at $249.1 million, a marginal decline of 0.8% YoY. However, it was at the high end of its guidance range on the back of a strong performance from its SMB segment, which exceeded $100 million for the first time. On the other hand, demand for consumer networking products, especially in the low- and mid-range, declined sharply, leading to a 14% YoY decline for Netgear’s Consumer and Home Products segment revenue. Supply issues were largely resolved in Q4, slightly reducing the reliance on costly air freight. The company continues to experience strong demand for its Orbi premium mesh Wi-Fi, 5G mobile hotspot and Pro AV switches.

SMB delivers record revenue

- The SMB segment ended Q4 2022 with record revenue of $100.1 million, a 30% YoY growth from Q4 2021. Pro AV switches have grown by more than 60% in 2022 and have been a major contributor to the growth shown by the SMB business line.

- There is a huge demand for AV over IP switches in the market as more enterprises look to upgrade to a digitally advanced AV network.

- Netgear has focused on developing managed ethernet switches for the commercial AV industry and has looked to strengthen partnerships with AV OEMs and integrators.

- A lot of enterprises are now returning to the office. Many offices still have Wi-Fi 5 or older technologies. Consequently, there’s a strong demand to upgrade to the latest Wi-Fi 6/6E technology.

Connected Home segment sees weak demand

- The consumer home segment contracted by more than 20% in 2022 with especially weak demand in the low- and mid-range segments of consumer networking devices. Netgear is a leader in the US retail consumer networking market, so faced the brunt of demand contraction.

- The segment revenue ended at $149 million, declining by 14% YoY. Netgear and its channel partners are working to reduce channel inventory to align with the lower market size.

- A bright spot has been the Orbi line-up of premium mesh routers, which continues to perform well in contrast to the general trend of consumer networking. Orbi has become a strong sub-brand and Netgear can be confident about its premium market focus.

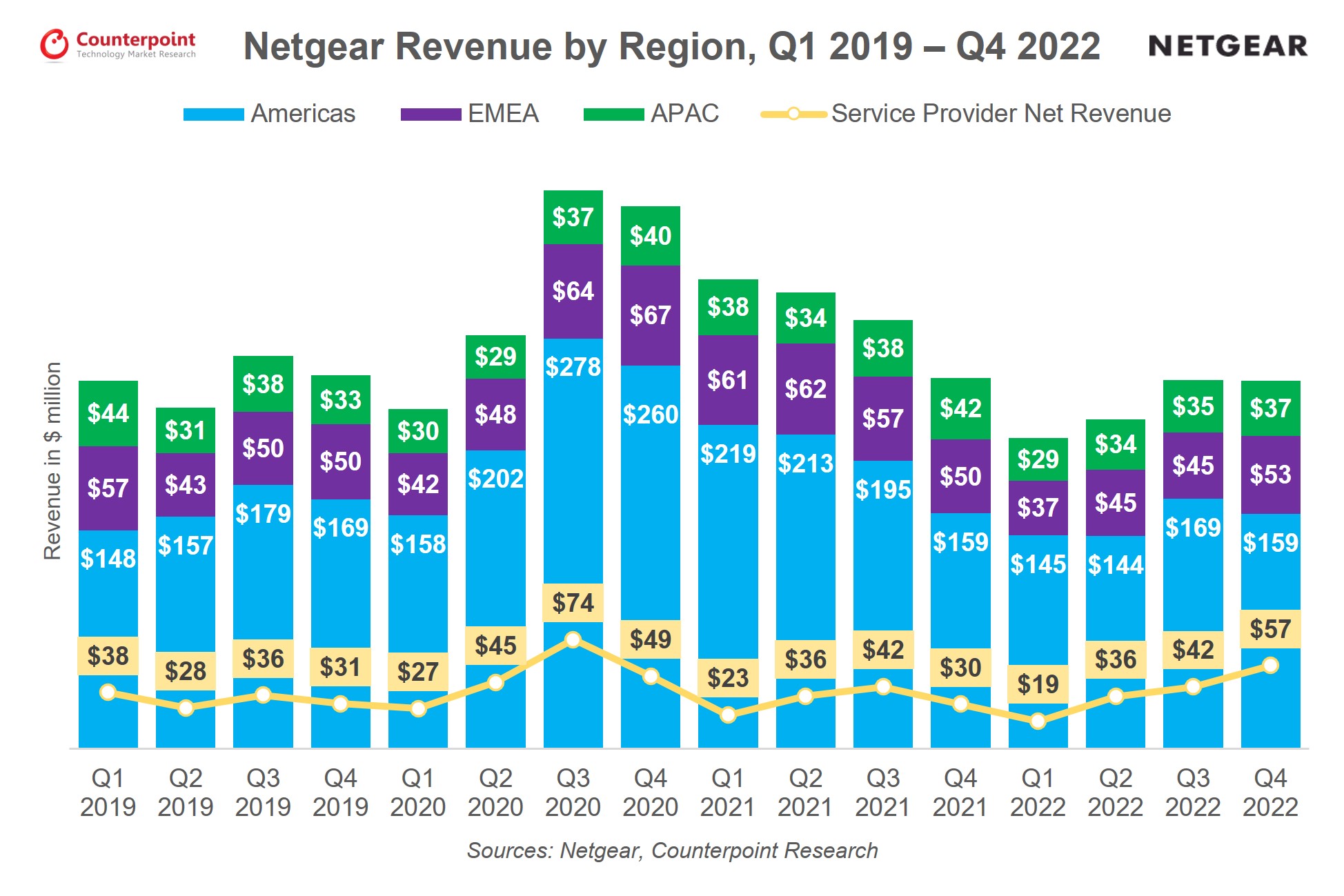

Service Provider revenue grew by 86% YoY

- The demand for 5G mobile hotspots remained high and helped the service provider segment’s revenue recover to $57 million, near pre-pandemic levels.

- Netgear’s M6 and M6 Pro 5G mobile hotspots are Sub-6 and mmWave enabled routers that have experienced interest and demand from telecom operators across the world.

Shipments decline by 19% YoY

- Netgear shipped around 2.2 million units of wired and wireless networking devices. It shipped around 647,000 units of all types of routers and gateways. Wireless remains the dominant segment, driving the revenues with a 57% share.

- Regionally, Americas’ performance remained similar to Q4 2021. EMEA grew by 5.4% and APAC declined by 10.8% mostly due to currency fluctuations across multiple markets on the dollar’s strength.

Operating margins remain under pressure

- The supply chain improved in Q4, slightly helping reduce the reliance on air freight. However, as Netgear looked to fulfill orders on time, especially for SMB, it still relied on air transport, straining margins.

- Netgear is focusing on higher-margin products such as Orbi premium mesh Wi-Fi, 5G mobile hotspots and Pro AV systems, which should help margins in the coming quarters.

- However, it may need to rely on air transport until all backorders are cleared, so a recovery to profitability remains in doubt.

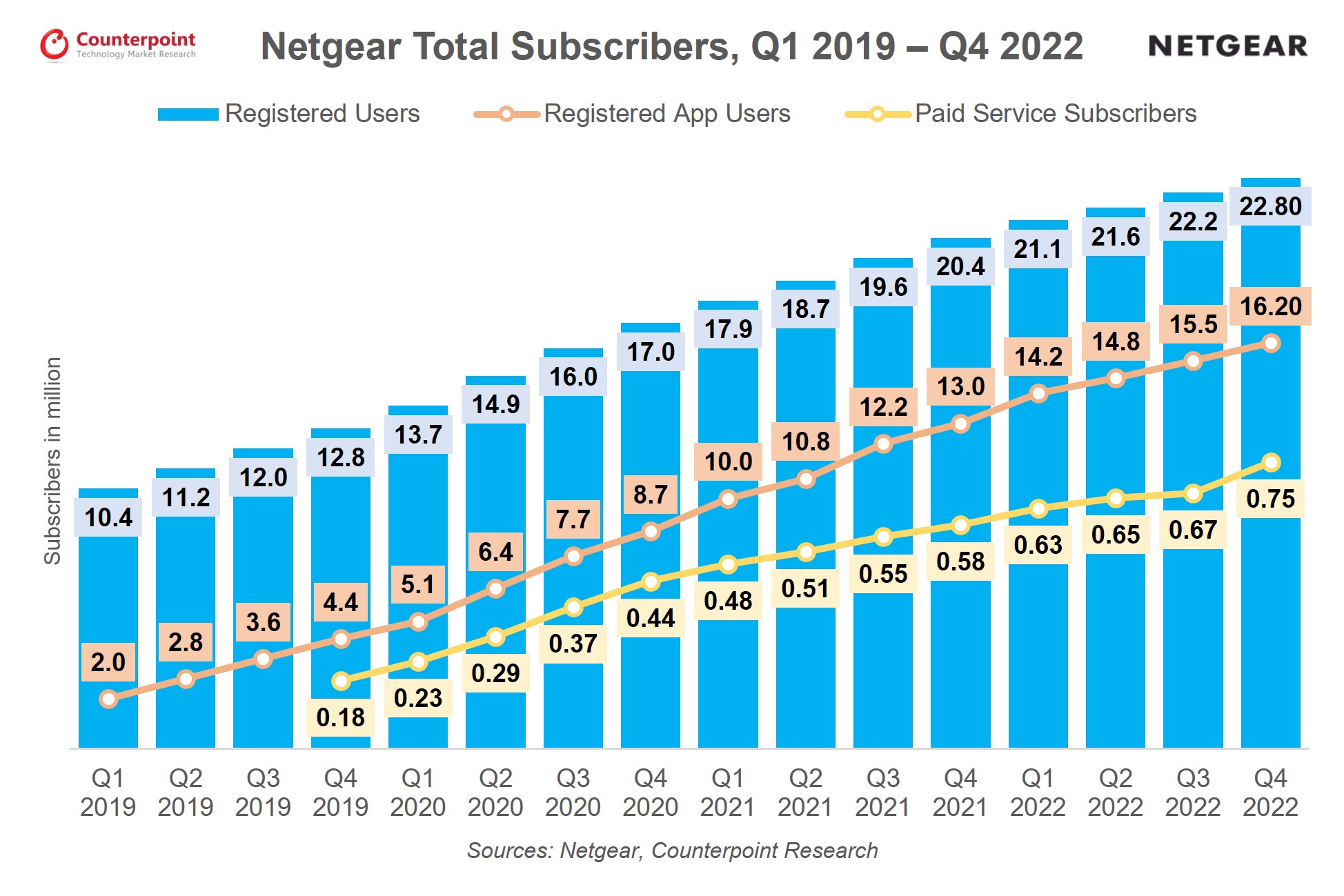

Strong growth recorded in paid subscribers

- Netgear ended 2022 with 747,000 subscribers for its paid services, an increase of 28% from the same period in 2021. It is offering a one-year trial for Netgear Armor in select channels to increase the adoption of its paid services.

- Services revenue was up by 23.9% annually in Q4 to reach $8.9 million, indicating that Netgear has been experiencing decent demand for its service subscriptions. Overall, it crossed 22.8 million users with 16.2 million app users.

Netgear to experience sluggish demand in H1 2023

- Netgear expects the Q1 2023 revenues to be in the range of $185-$200 million as it looks to reduce orders for low- and mid-range against the backdrop of excess inventory. It also expects revenues from Service Provider customers to come down to around $25 million in Q1 2023.

- Netgear is looking to strengthen its position in the premium consumer segment in 2023 with new technology launches, especially Wi-Fi 7.

- It also expects to add more than a million paid subscribers to its subscription services which have been gaining traction. It has more than 10 million users worldwide who use Netgear’s app to control devices. This is a potential audience Netgear is looking to tap into in the future.

- The margins are expected to improve slightly in H1 2023. However, the situation is expected to improve considerably in H2 2022 with the supply chain becoming smoother and the consumer segment seeing stronger demand, especially for new technologies.

- Select channel marketing and consumer-oriented performance marketing campaigns will be pushed to drive the premium consumer segment.

Key Takeaways

- Netgear has successfully demonstrated the need for premium networking products in the consumer segment. The number of connected devices in households has increased substantially and consumers are more aware about the networking backbone they are using. This should translate into a good demand for such products.

- As 5G grows worldwide and in the US, the demand for portable mobile hotspots is expected to remain steady as they become more powerful and provide better battery backup.

- The majority of consumer networking devices are now being supplied by service providers. Netgear can tap into partnerships with these service providers to scale its low- and mid-range consumer products.

- With Wi-Fi 7 emerging and competitors launching Wi-Fi 7-enabled products earlier than expected, Netgear must expedite its product introductions in the critical premium segment.

- Netgear will look to introduce more enterprise-specific products in the future as it sees success for its Pro AV and managed access points line-up. Netgear’s services revenue is expected to jump twofold this year as it taps more users.

CT Bureau

You must be logged in to post a comment Login