Headlines of the Day

Multiple agencies to probe Chinese phone companies

The federal government has opened a multi-agency probe in opposition to the Indian operations of top Chinese language cellphone corporations Xiaomi, Oppo and Vivo, amid allegations of “lapses and discrepancies” of their statutory monetary filings and different reporting over the previous couple of years, other than trying into their enterprise practices.

The businesses will search to analyze if there was concealment of revenue, deliberate makes an attempt to suppress earnings to evade taxes, and abuse of dominant place within the smartphone market to the detriment of the native trade. Apart from, insurance policies associated to alleged non-transparent strategies in sourcing parts and distribution of merchandise may even be regarded into, sources accustomed to the deliberations instructed.

Top sources within the authorities instructed that the widening of the probe comes amid the current searches carried out in opposition to the Chinese language makers by numerous businesses, together with the revenue tax division and the Directorate of Income Intelligence (DRI).

Honest play regulator Competitors Fee of India might also be roped in over prices of abuse of dominant place and restrictive commerce practices, stated a supply.

“An preliminary evaluation of the statutory monetary reporting filed by the businesses over the previous few years has thrown up lapses, particularly pointing to attainable tax evasion, concealment of earnings, and manipulation of books. There are main issues, and we’re trying into all attainable points,” a top official stated.

The matter can also be being carefully adopted by the Ministry of Electronics and IT (Meity).

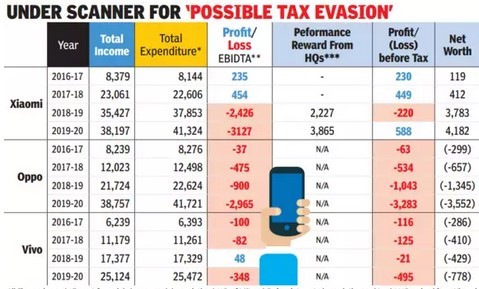

An evaluation of filings with the registrar of corporations (RoC) confirmed that the foremost Chinese language handset gamers reported operational losses though that they had sturdy gross sales and have been claiming top slots available in the market league tables.

An in depth questionnaire despatched to the Indian subsidiaries of Xiaomi, Oppo and Vivo remained unanswered on the time of going to press. Oppo and Vivo are owned by Chinese language electronics big BBK that additionally controls the OnePlus and RealMe manufacturers which might be bought in India.

Officers stated that regardless of gaining in income and market share in India with a cumulative turnover of over Rs 1 lakh crore in 2019-20 (they haven’t filed monetary information for fiscal 2020-21 but), Xiaomi, Oppo and Vivo paid any taxes in India. “The truth is, Oppo and Vivo have been displaying adverse web price in India since fiscal 2016-17.”

Within the case of Xiaomi, which claims to be the chief of the Indian smartphone market, losses have been heavy, although a few of these have been negated via a particular entry into the Revenue & Loss assertion (marked as revenue from distinctive gadgets), titled ‘reward acquired from Hong Kong’ for enterprise efficiency. This was to the tune of Rs 2,447 crore in fiscal 2018-19, and Rs 3,277 crore in fiscal 2019-20.

In the previous couple of years, because the sway of the Chinese language corporations grew in India, the maintain of homegrown corporations comparable to Lava, Karbonn, Micromax and Intex went down quickly. The share of Indian corporations within the smartphone market is in low-single digits, in opposition to a dominant place they occupied until a couple of years in the past.

One other bone of competition is the reluctance of the Chinese language corporations – particularly Oppo and Vivo — to align with native gamers for distribution. The businesses want to have Chinese language companions as Tier 1 distributors and haven’t opened up the chain.

“The identical is the case in the case of sourcing of components and parts, the place there’s full lack of transparency. The Tier 1 suppliers, and even Tier 2, are largely Chinese language and this ensures that they tightly management the know-how and pricing features,” an official stated. Global Onlinemony

You must be logged in to post a comment Login