Daily News

MTNL-BSNL Merger: Limited Spectrum To Be A Challenge For Combined Entity

There is a hitch in the government’s plan to allot additional 4G spectrum or airwaves to BSNL and MTNL.

There simply isn’t that much spectrum available to be allotted to these companies unless there is policy support for an unconventional decision.

The government release on Wednesday noted it would provide an “administrative allotment of spectrum for 4G services to BSNL and MTNL so as to enable these PSUs to provide broadband and other data services”.

Given the type of mobiles in the market and the technology available off the shelf for these two state-run companies, this would mean making the best use of the 2100 ecosystem.

This is the best and the only feasible spectrum for the merged company to offer 4G services.

Incidentally, 4G service in telecom parlance means making the available data at speeds that are up to 10 times faster than what 3G can provide.

Given the huge demand for video-based services, a 4G-based ecosystem is today regarded essential to keep them satisfied.

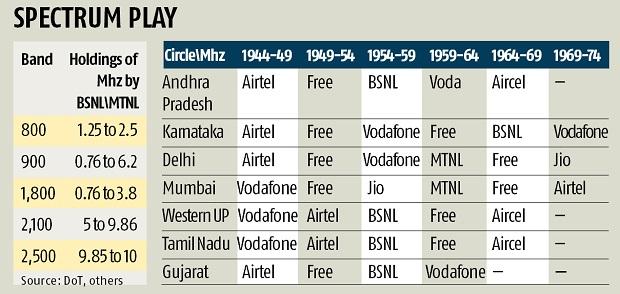

Telecom waves travel at the speed of light. The higher the frequency range or band, the shorter is the wavelength. While sound or voice travels best at levels like the 800, 900 and 1,800 bands, telecom companies have learnt to use lower and higher frequencies to provide data services. BSNL, as the chart shows, has been saddled with the responsibility to provide primarily voice services and has its maximum airwave holdings in the 800, 900 and 1,800 bands.

To offer data service to customers, the company needs to be present in the 2,100 or the 700 MHz bands, but those pieces of real estate have already been gobbled up by competitors.

BSNL has a nice piece of real estate in the 2500 band, but doesn’t have the engineering capacity to farm the band. Also there are hardly any mobiles that can make use of it, which means the allotment is useless.

In the 2,100 band, the company has just about 5 MHz in each telecom circle or region of India (see table). To provide a seamless data service in this band, one needs at least 10 MHz, according to all telecom textbooks. But even if the government were to try to provide the additional 5 MHz band free, it will not help because of two constraints.

First, the available pan-Indian free inventory of this band is only 275 MHz. The availability per circle is not more than 20 MHz at best and usually less at 15 or 10. To prise out 5 MHz in each circle — the minimum required to make BSNL data services implies there will be no possible auction of any airwaves from this band in future.

Secondly, even if it were done, BSNL will not get contiguous bands. For instance, in congested circles like Delhi, Mumbai, Western Uttar Pradesh, each of the companies Airtel, Vodafone, or BSNL (MTNL) are standing virtually on each other’s feet, so intense is the demand for airwaves. As the table shows the promised additional blocks of 5 MHz in each of the circles will be spread in different reaches of the band. It will be like driving in one lane in one city and then hopping across to another lane in another city instead of a seamless drive. Thanks to mergers and acquisitions within the telecom sector the others have mostly solved this problem. Still despite the harmonisations Indian consumers still perceive their data quality to be poor. BSNL has not even begun to walk this route.

A third option is to provide the public sector company a space in the 700 MHz band. But this is a new playground for emerging technologies. The government expects to make massive gains from auctions in this band, which will be considerably reduced if BSNL has to be accommodated here. Also the state owned company will have to struggle with a far higher level of capital expenditure to claim any success here.

Surprisingly without considering these constraints, in the past couple of years the company’s former chairman Anupam Shrivastava had signed ambitious MoUs with Ericsson, Nokia and Cisco to offer support to their 5G-enabled device manufacturing plans in India. So even with the additional spectrum, BSNL’s 4G service will not take off, despite a higher capital expenditure which will come from the government books.

While Telecom Department Secretary Anshu Prakash has said the spectrum to make 4G services viable will be allocated through administrative routes to both BSNL and MTNL within a month, it might be worth considering an alternative. But it would need the telecom department to strike out on novel path.

After a massive analysis of the available spectrum, industry analyst Parag Kar has suggested in his blog a switch of spectrum holdings between Vodafone and BSNL in the 2,500 and 2,100 bands. He shows that while 2100 is crowded, the 2500 band is fragmented and broken into two parts spaced out by a gap of 80 MHz.

After a massive analysis of the available spectrum, industry analyst Parag Kar has suggested in his blog a switch of spectrum holdings between Vodafone and BSNL in the 2,500 and 2,100 bands. He shows that while 2100 is crowded, the 2500 band is fragmented and broken into two parts spaced out by a gap of 80 MHz.

BSNL does not have the ability to use 2,500 but Vodafone can. So there can be a switch, which “will be beneficial for BSNL, as they will get 4G spectrum in 2,100 MHz spectrum in lieu of this band (2,500), which they are not using and some of which they had already returned in the past, thereby greatly enhancing the utilisation of spectrum”.

―Business Standard

You must be logged in to post a comment Login