Headlines of the Day

Would the second phase of telecom disruption come in the home broadband market? Motilal Oswal

India’s Home Broadband market, unlike the developed markets, has remained highly underpenetrated for years due to a weak wired infrastructure, plagued by execution woes, high investment requirements, and long-standing regulatory issues. This has led to the substitution of wireless data consumption. However, RJio’s recent foray (with tall targets), especially after delivering huge success in the Wireless market, has attracted all eyes on the opportunity in the Home Broadband market. In this report, we discuss the current market situation, opportunity, competitive position, economics of the business, and earnings potential for RJio and Bharti.

Dull market for a decade

India’s Home Broadband market has a minuscule USD2b market size, accounting for a meager 9% share of the country’s INR1.7t Wireless market. Subscriber growth has been modest in the last five years, with annual CAGR of just 5%. It has largely been an urban product, with low penetration of 7% – due to limited network connectivity with just 80–100m estimated home passes – which has restricted subscriber growth. This has given way to increased wireless consumption in India, which has a far easier and convenient installation/activation. This is the classic chicken and egg story – telcos historically have neither invested in network nor increased home passes, given the high gestation period and lower business viability; on the other hand, consumer complaints related to the lack of network/product availability are observed frequently. So, what has changed for the Home Broadband market?

Market potential in sync with RJio targets

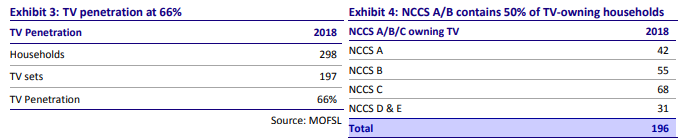

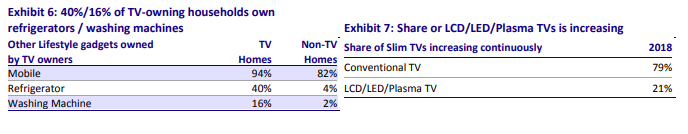

Globally, wired broadband is a well-networked infrastructure leveraged for data consumption, driven by higher FTTH (Fiber to the Home) penetration, supported by lower FTTH deployment cost/subscriber. However, in India, the Home Broadband market has seen limited investments, which has resulted in a lag in subscriber growth and a shift toward wireless consumption. Recently, RJio announced the target of achieving 50m subscribers. A player of this scale and past record could clearly drive growth in the ecosystem. The RJio target is a massive 2.5x higher than the existing industry subscriber base of 20.5m. However, if seen in the context of total households in India at 298m and 197m TV-owning households, the market potential seems strong. Its aim to reach 1600 cities ties well with NCCS data indicating: a) 20% of TV households (i.e., 40m) are located in metro/tier 1 & 2 cities with higher per capita incomes and data consumption and b) a high proportion of these consumers use household electronics (see exhibits below). Yet, the slow activation process due to a) execution woes, b) high investment requirements, and c) regulatory hurdles may keep subscriber growth gradual. This is evident from the slow pace of industry growth seen in the last year despite the aggression displayed by broadband players.

Opportunity for both small and big players

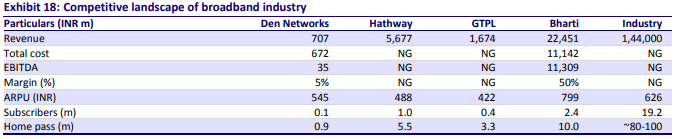

The Indian Wireline market is currently dominated by the telcos (BSNL, Bharti, and RJio), which account for ~57% of the total market size. The market is divided in that 20–25% of subscribers are premium high ARPU customers, while the rest are satisfied with low ARPU data connectivity plans. With RJio’s launch, Bharti (among select other players) has stepped up network rollout / home passes to gain ground and protect its turf. Instead of merely offering conventional pure-play data connectivity plans, telcos are targeting sticky premium customers with higher ARPU (nearly 2x) fiber-based plans (FTTH), along with value-added services such as entertainment, home security, and automation. Nevertheless, the market for even regional players remains buoyant, especially in the recent lockdown, as our channel check suggests there is increased demand for low ARPU conventional home broadband connectivity. This is also evident from the performances of regional players over Mar–Aug’20, which accounted for 84% of the overall wireline subscriber growth of 7%. This indicates there is a market for both sets of players.

Steep operating leverage offers room for aggressive pricing

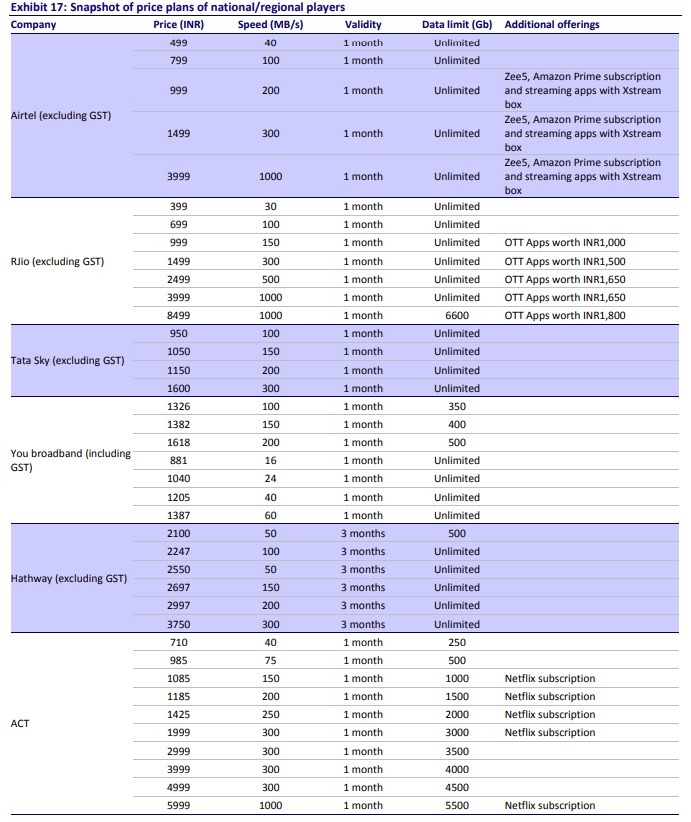

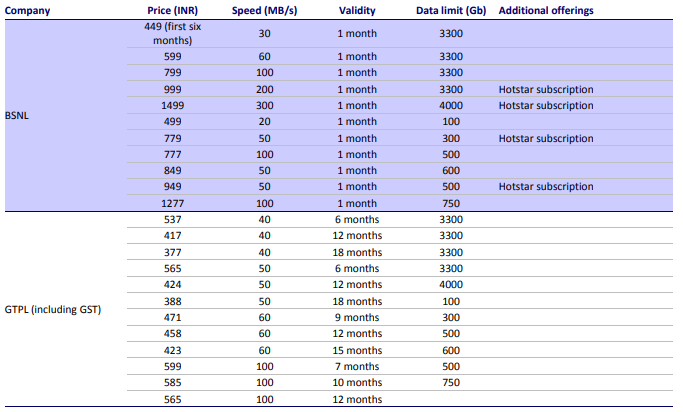

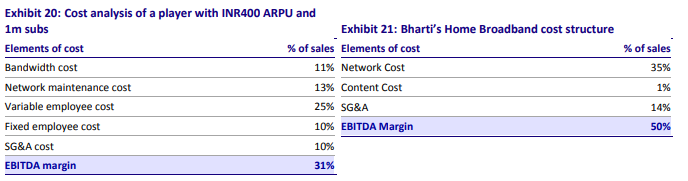

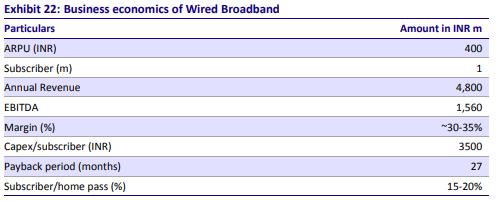

Industry ARPU in the Home Broadband market has remained fairly stable at an ARPU of INR400–500 for purely connectivity and INR700–800 for FTTH packages. However, JioFiber’s aggressive foray begs the key question – will it follow the fierce price disruption trend in the Wireless market? Our cost analysis of the Home Broadband business (with INR400 ARPU and 1m subs) indicates 30–35% margin potential, with similar 35% semi-variable as well as fixed cost. Bharti, with ~INR799 ARPU, garners 50% margin. This presents the opportunity a) to take sharp ARPU cuts to expand its share of the pie in the market, similar to wireless or b) improve margins to 45–50% even at a low INR400–500 ARPU with a healthy growth trajectory. RJio’s recent move to cut ARPU by ~40% with starting price plans at INR399 is on similar lines. However, the aggressive pricing may be restricted by the number of home passes, which is often plagued by regulatory and execution woes, thus limiting new connections, unlike Wireless market growth. As a result, RJio may have limited JioFiber to 1600 cities with the requirement to pre-apply for new connections.

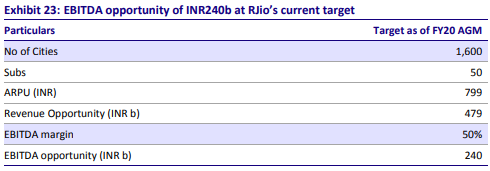

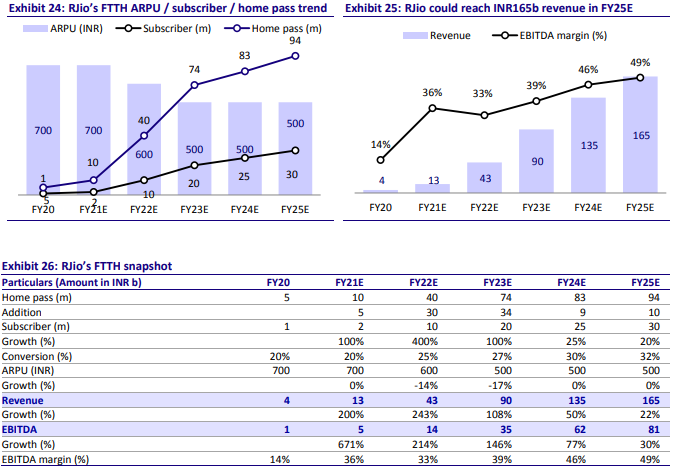

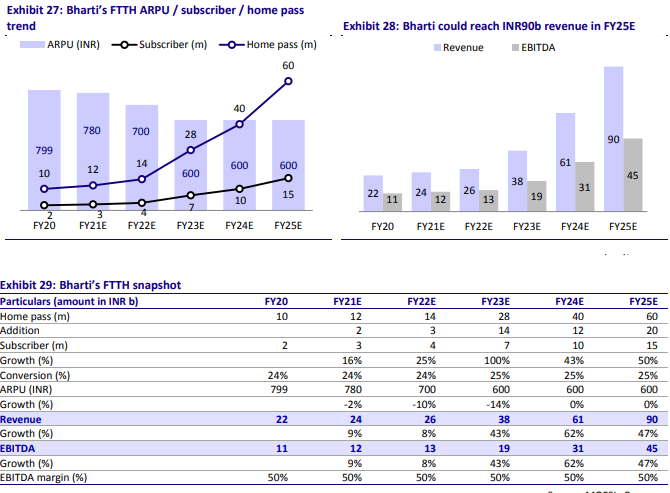

RJio–Home Broadband an INR240b EBITDA opportunity within three years; high prospects for Bharti too

RJio’s recent interest in the Home Broadband market is understandable as it has a revenue/EBITDA opportunity of INR480b/INR240b (at 50m target base), higher than RJio’s Wireless business scale (as of FY20). Similarly, Bharti, with a similar product capability and home passes / subscriber base, could achieve a sizeable profit pool from Home Broadband. We expect RJio to intensify competition in the Home Broadband space with an aggressive push for home passes, lower price point packages, and aggressive marketing. Nevertheless, it should be able to improve the EBITDA margin given the inherently strong operating leverage in the business. Assuming 30m subscribers by FY25, with 94m home passes, it could post revenue of INR165b at ARPU of INR500. While this is lower than its 50m subscriber target, it is still over 1.5x the current market size, which underscores the potential growth in the industry. At this scale, it could well achieve ~50% margins, garnering EBITDA of INR81b. We do not see this as a risk to Bharti given it has a merely 3% EBITDA contribution from Home Broadband. On the other hand, Bharti could also certainly ride the wave as its product and network capability are at par with RJio and consumer awareness and demand for home broadband solutions are picking up. Assuming it achieves 15m subscribers with 60m home passes at ARPU of INR600, Bharti could generate INR90b revenue and EBITDA of INR45b at 50% margin. We have not captured these numbers in our model.

Valuation and view

Bharti. We value Bharti on an SOTP basis to arrive at Target Price of INR650/share – we assign EV/EBITDA of 11x to the India business and 6x to the Africa business on an FY22E basis. We expect Bharti to generate post-interest FCF of INR64b in FY22E after factoring in spectrum renewal cost of INR130b. This could subsequently be used for deleveraging. Strong FCF, improving RoCE, and the expectation of an incremental price hike should garner a better valuation for Bharti. Maintain Buy.

RJio. We value RJio with an EV/EBITDA multiple of 18x on Sep’22E EBITDA to arrive at TP of INR900 (for 66% stake). Our higher multiple captures potential gains from an incremental tariff hike, digital revenue opportunity, and growing market share in the Low-cost Device market.

Market standing–A dull market for the past decade

Stagnant subscriber base since the last 10 years

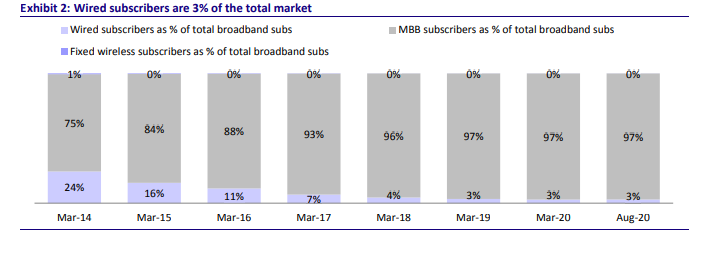

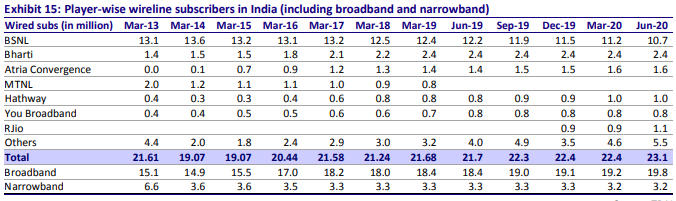

India’s Home Broadband market has remained muted since the past decade with an insignificant market size of USD2b. This is just a fraction (9%) of the Wireless market, sized at INR1.7t. The Home Broadband subscriber base posted a modest annual CAGR of just 4% from Mar’14 to Mar’20 – it increased to 19.18m in Mar’20 from 14.86m in Mar’14. The subscriber base has seen some traction in the last few months, with 7% growth over Mar–Aug’20 (annualized growth of 17%), led by increased data demand in the nationwide lockdown due to the COVID-19 pandemic. Against this, the wireless data subscriber base grew 15x to 695m over Mar’14– Aug’20 as the lack of availability of seamless wired data connectivity has driven the shift among consumers to wireless data consumption.

Of the total wired broadband subscribers, ~3m would be connected through the high-speed FTTH network, while the rest remain connected through copper wires. Furthermore, wired broadband has largely remained an urban product, contributing ~90% to the total subscriber base.

Of the total wired broadband subscribers, ~3m would be connected through the high-speed FTTH network, while the rest remain connected through copper wires. Furthermore, wired broadband has largely remained an urban product, contributing ~90% to the total subscriber base.

Lower home passes restrict market growth

One of the key hindrances to growth in home broadband subscribers is the lack of network availability, with just 80–100m estimated home passes in India across players. A wired network connection has multiple deployment challenges and needs to be individually connected in each home, building, or location. On the contrary, wireless network deployment allows easy access and coverage to the entire region, enabling easy installation and service activation. This has paved the way for wireless data consumption. Furthermore, with the availability of cheaper wireless data plans, particularly since RJio’s entry, customers’ intent to move to wired broadband has faded – due to the cumbersome process, comparatively higher prices, and poor connectivity/service in many locations. Telcos’ focus and investments in the Home Broadband space have also remained muted historically. This is attributable to a high capex requirement, along with a long gestation period, lower business viability, and stressed balance sheets. However, we see winds of change in market potential and investments given the subscriber growth seen recently and to protect the turf against RJio’s increased focus and aggressive subscriber addition targets in the space.

Growth opportunity–Tall targets by telcos

RJio has tall targets

RJio’s mammoth target of achieving 50m wireline subscribers and expanding its reach to 1600 cities has gained everyone’s attention as the target is 2.5x the current market subscriber base. A player of RJio’s size has the ability to single-handedly drive the market and could force the entire ecosystem to evolve, as seen in the wireless market – RJio’s entry made the entire ecosystem conducive for 4G adoption. Looking at the current Home Broadband market size of merely 20.5m subscribers, with its low single-digit historical growth, the task appears challenging. However, market potential seems strong from the perspective of the overall household and its propensity to spend.

Market scope is high

Total households in India are at 298m and TV-owning households at 197m. Furthermore, 40m (20%) of them reside in metro / tier 1 & 2 cities, which ties well with RJio’s target to reach 1600 cities. Nearly 97m (49%) belong to the higher economic strata of the NCCS A/B category, indicating a healthy propensity to spend and higher data requirements. This is also validated by the fact that 40%/16% of TVowning households also own refrigerators / washing machines. 21% of the total TVs is LED/LCD/plasma TVs, which highlights the growing aspirations and desires of these households to own modern devices. These households would have higher disposable incomes and the ability to pay for broadband connections. Thus, these could be the initial target customers; the telcos could target other low-income group households in the second phase.

India’s Wireline market penetration very low v/s global levels

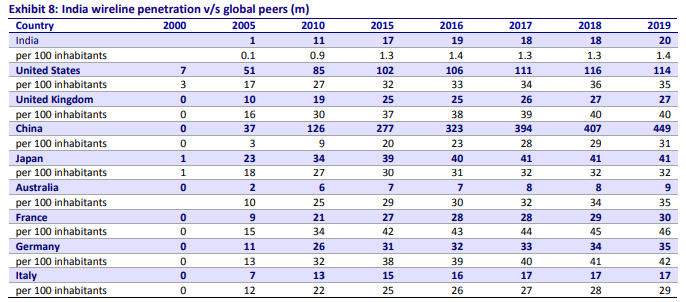

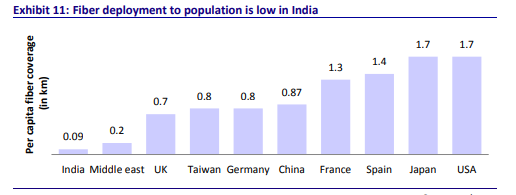

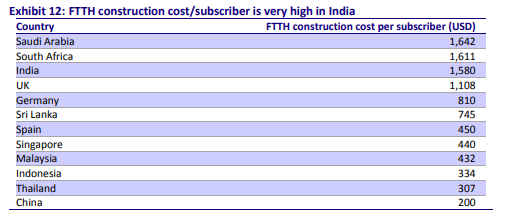

Wired broadband is well-established and significantly utilized for data consumption globally as it is cheaper than wireless. On the other hand, in India, the need for data consumption is fulfilled through wireless as it is cheaper. India’s wireline subscriber penetration stood at just 7%, with 20.5m connections (i.e., 1.45 per 100 inhabitants). This is far lower than global peers – subscriber penetration for US/UK/China is 35/40/31 per 100 inhabitants. FTTH penetration is even lower at 1%, v/s 92%/78%/76% in Singapore/China/South Korea, as most service providers use a copper-based network. The lower penetration is attributable to poor network connectivity (evident from the minuscule number of 80–100m estimated home passes) due to significantly high FTTH deployment cost/subscriber in India (USD1,580) v/s global peers. Furthermore, our channel check indicates tower fiberization in India is <25% v/s 70-80% in developed countries. Superior tower fiberiztion could be leveraged to connect nearby regions.

Challenges with fiber deployment–Greatest hindrance in Home Broadband

Despite having huge market potential, India’s wireline network connectivity remains weak, with limited reach. The biggest reason for this is the capital-intensive and time-consuming nature of the business. Permission for Right of Way (RoW) to lay down a fiber network comes with a huge cost, ranging from INR0.1m to INR5m/km. As per our channel check, the cost for Customer Premise Equipment (CPE) is INR3,500–4,000 for each subscriber and Optical Line Terminal (ONT) is about INR30,000. This increases the investment requirement and initial capital burden to expand the subscriber base. Additionally, the lengthy process of acquiring approvals and permissions from the government increases the challenges faced by operators to increase their wired network reach. This, in turn, reduces network connectivity and also increases the final selling price. Thus, lower demand for home broadband, especially in rural India (due to cheaper wireless data plans), makes the business case to invest in this segment unviable for telcos.

Competitive position–Fragmented market with select large players

Telcos have majority market share

India’s Wired Broadband market has remained fragmented, with many regional players operating in different areas. Moreover, in metro cities such as Mumbai and Delhi, players are restricted within localities. While BSNL has the majority market share of 48% (including broadband and narrowband), its share is declining gradually – it fell to 48% in Jun’20 from 61% in Mar’13. The high market share is largely in the rural and narrowband network, where business economics are weak and private players therefore have limited connectivity. The market is divided in that 20–25% subscribers are premium high ARPU customers, while the rest are satisfied with low ARPU data connectivity plans. Telcos (BSNL, Bharti, and RJio) govern over two-thirds of the total market, while the rest is catered to by pure-play ISPs.

Large players turning aggressive–What is the opportunity for them?

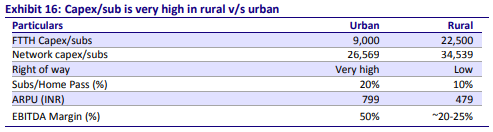

There are currently three large players in the market – BSNL, Bharti, and RJio. With RJio’s entry into the Home Broadband space in 2019 and its huge target, other players such as Bharti have increased their focus in this space in a bid to gain ground. Telcos are currently present in metro / tier 1 cities, especially in high-rise 60.7 6.5 0.2 9.1 1.7 1.6 20.2 BSNL Bharti Airtel Atria Convergence MTNL Hathaway You Broadband Rjio Others 48.1 10.7 7.3 4.3 3.6 4.6 21.5 BSNL Bharti Airtel Atria Convergence MTNL Hathaway You Broadband Rjio Others 27 November 2020 10 Telecom | Update buildings, owing to a large number of potentially high-paying households and lower incremental cost to acquire additional customers in the same building. Furthermore, these players largely target 20–30% high ARPU customers through bundled plans, including a) broadband, b) linear TV through DTH, c) entertainment and content offerings, and d) home automation and security solutions. This allows them to charge higher and also increase customer stickiness with longer term plans. In addition to expanding the base in metro / tier 1 cities, telcos are looking to make inroads into smaller towns through a) aggressive pricing and b) acquisitions and partnering models. RJio recently launched an INR399 starting price plan and Bharti followed suit with an INR499 plan. RJio has acquired the Hathway and Den networks to increase its reach. Bharti, on the other hand, seeks to partner with local cable operators (LCOs) to gain ground in smaller towns and alleviate the concern of high capex requirement in rural areas (2–3x metro areas), coupled with low home pass to subscriber conversions and lower margins. This offers huge opportunity for the larger players in both urban and rural areas.

There are currently three large players in the market – BSNL, Bharti, and RJio. With RJio’s entry into the Home Broadband space in 2019 and its huge target, other players such as Bharti have increased their focus in this space in a bid to gain ground. Telcos are currently present in metro / tier 1 cities, especially in high-rise 60.7 6.5 0.2 9.1 1.7 1.6 20.2 BSNL Bharti Airtel Atria Convergence MTNL Hathaway You Broadband Rjio Others 48.1 10.7 7.3 4.3 3.6 4.6 21.5 BSNL Bharti Airtel Atria Convergence MTNL Hathaway You Broadband Rjio Others 27 November 2020 10 Telecom | Update buildings, owing to a large number of potentially high-paying households and lower incremental cost to acquire additional customers in the same building. Furthermore, these players largely target 20–30% high ARPU customers through bundled plans, including a) broadband, b) linear TV through DTH, c) entertainment and content offerings, and d) home automation and security solutions. This allows them to charge higher and also increase customer stickiness with longer term plans. In addition to expanding the base in metro / tier 1 cities, telcos are looking to make inroads into smaller towns through a) aggressive pricing and b) acquisitions and partnering models. RJio recently launched an INR399 starting price plan and Bharti followed suit with an INR499 plan. RJio has acquired the Hathway and Den networks to increase its reach. Bharti, on the other hand, seeks to partner with local cable operators (LCOs) to gain ground in smaller towns and alleviate the concern of high capex requirement in rural areas (2–3x metro areas), coupled with low home pass to subscriber conversions and lower margins. This offers huge opportunity for the larger players in both urban and rural areas.

Smaller players still growing–Benefitting from lockdown

Although larger players are increasing their focus on the Home Broadband segment, smaller players are continuing to grow. This is evident from their increasing market share during the lockdown – to 43.2% in Aug’20 from 40.5% in Apr’20 (in wired broadband). Smaller players generally have a regional presence (in case of metro cities such as Delhi and Mumbai) and contain many LCOs (which provide broadband services along with cable services). Unlike larger players, these target low ARPU paying customers and offer pure data connectivity services. Moreover, they offer lower speed due to copper-based connectivity and thus the price points are lower. Local operators have better customer reach and their stagnated growth in the last few years could be largely attributable to limited capital. However, telcos’ growing focus in this space and their push to increase reach through partnering should provide smaller players with much needed capital. This would offer opportunity for both kinds of players to operate in parallel and grow the market

Margin levers to maneuver ARPU, earnings

Economics of the FTTH business

Our case study of a typical player with ~1m subscribers and ARPU of INR400 indicates the EBITDA margin potential of the business is 30–35%. This implies a payback period of about 27 months, i.e., ~2.5 years on capex/subscriber of INR3,500 – assuming a subscriber to home pass ratio of 15–20% and a stable state operation Bharti’s EBITDA margin at ~50% is better than smaller players as it has better scale, higher ARPU of INR799 (as of Mar’20) and superior subscriber to home pass ratio. Furthermore, it has a higher share of the FTTH network, which reduces operational cost; the company could also leverage this cost across the Wireless business.

As nearly half the costs are fixed in nature, there is healthy opportunity to achieve operating leverage with a higher scale of operations. This provides players such as RJio and Bharti enough headroom to cut the price to increase subscriber adoption, given the prevailing low subscriber base in the industry. It could also drive sharp margin improvement over time as scale is achieved. RJio has recently launched price plans at INR399, against previous plans starting at INR699. To attract market share – as growth in network and home passes creates a base for subscriber expansion and comes with an inherent network-related cost – it may be keen to attract more subscribers to leverage the network. However, the price elasticity of demand is limited in the business as a) unlike the Wireless business, there are fixed costs of nearly INR3,500–4,000/subscriber for new activations, b) the new activation may be limited only to the pool of home passes, and c) the business may be unviable in many locations with low subscriber demand. Thus, blanket price cuts may not lead to subscriber growth.

Cost structure of the business

Out of the two network-related costs, namely bandwidth cost and network maintenance cost, bandwidth cost is variable in nature and should grow in proportion to data consumption. The optimum cost level is about 8–9% of revenue internationally, but with a lower scale in India, it would typically hover at 10–12%. Network maintenance cost is fixed and higher in India due to a higher proportion of copper wire-based network in India and poor infrastructure, leading to repeated cuts in cable network. Currently, in India, the FTTH network accounts for 22% of the total network. Network cost is around 15% of revenue and may reduce over time with increased FTTH contribution in the total network and the growing scale of operations.

Other major costs associated with the business are employee and SG&A expenses. Employee costs have both variable and fixed components – costs associated with frontline manpower, including installation / sales executive, are semi-variable and may see some acceleration in the initial phase of expansion, but reduce over time, contributing 25% to revenue. On the other hand, the remaining corporate employee costs and SG&A exp. are combined 20% of revenues.

High subscriber base to home pass–Key to operating leverage

Growth in Home Broadband business is largely dependent on two factors: a) increase in the number of home passes and b) increased conversion of home pass to subscriber. This, unlike the Wireless business, limits growth as each home pass and connected home requires dedicated investment. We believe the first leg of growth could come from an increase in home passes across the industry as increased demand for home broadband recently and higher competitive intensity in the market would trigger network ramp-up by most players. However, the next leg of growth should kick in from increased conversion of home pass to subscribers. Our channel check indicates the home pass to subscriber conversion currently stands at 15–20% for smaller players and is marginally higher for larger players with a concentrated network, mainly in high-rise buildings and metro cities. To increase home passes, players would need to incur significant capex, and a lower subscriber conversion ratio would limit returns. Thus, to garner healthy RoCE and capitalize on operating leverage, telcos need to drive increased conversion of home pass to subscribers over time.

Home Broadband–A huge opportunity for RJio/Bharti

Jiober offers INR240b EBITDA opportunity – bigger than prevailing wireless EBITDA

The Indian market has huge potential for Home Broadband, as discussed above. Thus, RJio’s target of achieving 50m wireline subscribers, 2.5x the prevailing market size, is not inconceivable. At ARPU of INR799 and a subscriber base of 50m, RJio’s aggression is understandable, with revenue/EBITDA opportunity of INR480b/INR240b – which is larger than its current Wireless business, with EBITDA of INR216b in FY20. To achieve exponential growth, it needs to first make the product/network available and then offer attractive pricing.

To increase its reach, RJio may have to aggressively ramp up home passes – it requires 150m home passes (50% of the total households), assuming a 33% conversion ratio (against the industry standard of 15–20%). RJio’s acquisition of the Hathway and Den networks is a positive move and the first step to increasing its network reach. With 40m prospective TV-owning households in metros and tier 1 and 2 cities, it could reach 30m subscribers by FY25 on the back of 94m home passes, assuming a conversion rate of 32%. To increase subscriber adoption, it may offer attractive pricing, bundled with value-added offers, for the next 3–4 years. The recent launch of price plans starting from INR399 is a step in a similar direction. At a blended ARPU of INR500 and 30m subscribers, it could achieve sizeable scale in FY25, with revenue of INR165b.

Margins have healthy scope for operating leverage given that nearly 50% of the cost is fixed. The rest of the semi-variable cost, such as Feet on Street, could also be leveraged over time with a higher scale of operations. Thus, it could comfortably achieve an EBITDA margin of 49%, at par with Bharti’s 50%, even at a lower ARPU of INR500. This provides an EBITDA opportunity of INR81b, which is 37% of FY20 EBITDA, indicating strong growth opportunity.

Bharti–Limited risk to existing profit base; presents opportunity to leverage market expansion

RJio’s aggressive push toward Home Broadband may pose limited threat to Bharti given the segment’s single-digit contribution to Bharti’s consolidated numbers. On the contrary, this presents the opportunity to expand its legs in a market that has been stagnant for the past decade, in line with Wireless market growth. This is attributable to customer awareness increasing with changing data requirements since the lockdown and increased marketing by RJio, along with other players. Bharti has already followed RJio by launching a lower price plan at INR499, although at a premium to RJio. In line with the Wireless business, Bharti’s plans could remain at a premium to RJio, targeting quality customers. Subsequently, its home passes may also be at a lower scale v/s RJio. Assuming 60m home passes, benchmarking about two-thirds of RJio, along with a 25% home pass to subscriber conversion ratio, Bharti could achieve 15m subscribers by FY25. Note that this indicates massive growth, at ~75% of the prevailing subscribers in the industry. Its ARPU may soften to INR600 from INR779 currently as it prioritizes subscriber growth.

Bharti’s EBITDA margin, already at 50% as of FY20, could be sustained at FY20 levels in the longer term. This is because despite softening ARPU, an increase in subscribers could offer healthy operating leverage on sizeable fixed cost in the business. Thus, it could generate EBITDA of INR45b with 50% margin.

Valuation and view

Bharti–Buy, with TP of INR650/share

Bharti is set to gain additional EBITDA opportunity from any potential increase in tariff or market share gains. Our workings indicate VIL requires a sharp 74% ARPU hike to achieve EBITDA (pre-Ind-AS 116) of INR300b to sufficiently furnish its cash obligations sustainably in FY23, including deferred spectrum payments. A tariff hike of even half the amount could take Bharti’s EBITDA to INR598b (incremental EBITDA margin of 65%), with incremental EBITDA of INR114b. Subsequently, Bharti could utilize this additional cash flow for deleveraging.

We assign EV/EBITDA of 11x to the India Wireless business and 6x to the Africa business on FY22E. Subsequently, we arrive at SOTP-based TP of INR650 (34% upside). Our higher target multiple for the India Wireless business captures expected gains from any potential ARPU increase or higher market share gains – both of which are not fully captured in our model.

RJio is currently enjoying the market leader position in a three-player market and is the price maker. Subsequently, it could utilize its position to drive its ARPU/EBITDA. Furthermore, it is transforming itself from a telecom player to a digital one, which could expand its revenue opportunities.

We assign EV/EBITDA of 18x on Sep’22E to arrive at value/share of INR1,354. After factoring in the recent stake sale of 34%, RJio’s contribution in RIL

comes to INR900. Our higher multiple captures any additional digital revenue opportunity, potential tariff hikes, or market share gains/growing subscriber share in low-cost devices not captured in our model.

You must be logged in to post a comment Login