CT Stories

Mixed performance by the leading telecom vendors

2022 was a mixed year for the telecom equipment manufacturers. Huawei stood tall, with the Chinese telcos being its saviour. Nokia, with a diversified customer base, and Ciena, with gains from what Huawei may have vacated, performed well, while Ericsson, restricted by catering primarily to telcos, saw overall margins erode.

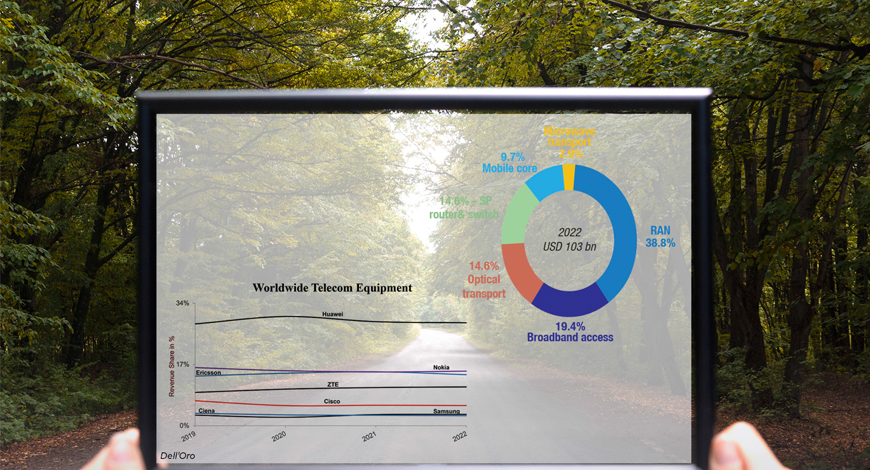

The value of the global overall telecom equipment is estimated at USD 103 billion in 2022, an increase of 3 percent year on year, a dramatic drop from the 8 percent increase in 2021, according to Dell’Oro group. The market is poised for a 1 percent increase in 2023. This includes six telecom networking technology categories – broadband access, microwave transport, optical transport, mobile core network (MCN), radio access network (RAN), and service provider router and switch.

The RAN market accounted for about USD 40 billion, broadband access another USD 20 billion, optical transport USD 15 billion, service provider router and switch USD 15 billion, mobile USD 10 billion, and microwave transport USD 3 billion.

Huawei is still by far the overall global telecom equipment market leader in 2022, “despite on-going efforts by the US government to limit Huawei’s TAM (total addressable market) and access to the latest silicon,” noted Stefan Pongratz, vice president, Dell’Oro.

Huawei’s dominance comes largely, but not exclusively, from its leading position in China, where the major operators have been investing heavily in 5G and fibre access networks in recent years and have been handing much of the work to the domestic vendor duo of Huawei and ZTE.

Huawei still has the solid foundation of seemingly endless business in China. In 2022, the vendor’s domestic revenues accounted for 63 percent of all sales, driven by investments in 5G and fibre access networks by the three major network operators and increasing enterprise customer spending, while EMEA generated 23 percent of revenues, Asia-Pacific 7 percent, and the Americas just 5 percent.

Nokia, Ericsson and Huawei are the top three telecom equipment vendors outside China in 2022, with market shares of 20 percent, 18 percent and 18 percent respectively. It seems likely, though, that Huawei’s share outside China will shrink further in the coming years as pressure weighs in key markets such as Germany, where the Chinese vendor is still very active but now faces a potential ban.

Globally, the market is still dominated by seven vendors, Huawei, Nokia, Ericsson, ZTE, Cisco, Samsung and Ciena, with a combined market share of 80 percent.

The worldwide telecom CapEx, the sum of wireless and wireline telecom carrier investments increased at a low-single digit rate year-over-year in nominal USD terms in 2022, down from the high-single digit growth in 2021. Global telecom CapEx is projected to decline at a 2 percent to 3 percent CAGR over the next 3 years, as growth in India will not be enough to offset sharp CapEx cuts in North America. Dell’Oro projects capital intensity ratios will improve and approach 16 percent by 2025, hinging crucially on the assumption that carrier revenues will remain flat and outperform CapEx.

PERFORMANCE BY VENDORS

HUAWEI reported steady operations throughout 2022, having generated CNY642.3 billion (USD 93.5 billion) in revenue, a slight increase compared to CNY636.8 billion (USD 92.69 billion) in revenue in 2021. Revenue from carrier business was CNY284 billion in 2022, as against CNY281.5 billion 2021.

Eric Xu

Rotating Chairman,

Huawei

“In 2022, a challenging external environment and non-market factors continued to take a toll on Huawei’s operations. In the midst of this storm, we kept racing ahead, doing everything in our power to maintain business continuity and serve our customers. We also went to great lengths to grow the harvest – generating a steady stream of revenue to sustain our survival and lay the groundwork for future development. 2023 will be crucial to Huawei’s sustainable survival and development.”

Huawei reported net profits of CNY35.6 billion (USD 5.18 billion) in 2022, a drop of 68.68 percent year over year compared to its CNY113.7 billion (USD 16.55 billion) in 2021. Its net profit margin of 5.5 percent for 2022 was a low point in the company’s history. The drop in profits is attributed to pandemic lockdowns and an increase in R&D to counter access restrictions to the US technology.

In 2022, Huawei pumped CNY161.5bn (USD 23.2bn), representing 25.1 percent of the company’s annual revenue and bringing its total R&D expenditure over the past 10 years to more than CNY977.3 billion. That level of R&D ‘intensity’ is “among the highest in Huawei’s history,” says Meng Wanzhou, who has become rotating chairwoman effective April 1.

After the US government began attacks on Huawei several years ago, the company responded by putting more of its focus on other markets around the world, especially in emerging economies. Huawei expects that by 2027 its addressable markets will exceed USD 1 trillion as countries around the world develop their digital economies.

Huawei’s global focus in 2023 is with Telecom Argentina and Claro in Brasil in Latin America; True and AIS in Thailand; HKT from Hong Kong in Asia Pacific ; Safaricom and Ethio Telecom in Africa; Zain and STC in Saudi Arabia; Etisalat by e& in UAE; Telefonica in Europe and Turkcell in Turkey.

The vendor seeks to diversify its product and services portfolio: It needs to do that as its traditional strong lines of business – telecom network infrastructure and mobile handsets – have been affected by years of US sanctions. Now the company sees future growth coming from the enterprise technology and cloud services sectors.

Its carrier division, doing business with the world’s telcos, generated 44 percent of its revenues, with sales up by 0.9 percent year on year at CNY284bn.

NOKIA is taking market share, the growth is broad-based and India is “the highlight of this story,” as stated by Pekka Lundmark, president and CEO, Nokia. The vendor sees 2023 also as a year of growth ahead.

Pekka Lundmark

President and CEO,

Nokia

“We said at the start of 2022 that it would be a year of acceleration and we delivered what we promised. The strong growth in net sales in India was related to mobile networks, as 5G deployments started to ramp up. It is really impressive the way India has been systematically building the digital ecosystem. Now the most ambitious and the fastest by a big margin 5G rollout in the world, these are our building blocks for the future economic growth in any country and India is really taking a lead in this respect.”

Nokia has diversified its customer base from network service providers to industrial customers who set up their own private 5G networks at power plants, utilities and mines among others.

Nokia’s net sales growth accelerated to 6 percent growth with EUR 24.9 billion in 2022, contrast to EUR 22.2 billion in 2021.

Reported operating profit in full year 2022 was EUR 2.32 million, or 9.3 percent of net sales, down from 9.7 percent in the year-ago period. Comparable operating profit increased to EUR 3.1 million, while comparable operating margin was flat year-on-year at 12.5 percent.

While gross profit increased in full year 2022, this was largely offset by higher operating expenses, which were negatively impacted by foreign exchange fluctuations, as well as a significant swing in other operating income and expenses.

CSPs contributed 81 percent to its net sales, amounting to EUR 9,911 million in 2022. This is an 11 percent increase EUR 17 977 million in 2021.

For 2023, Nokia expects net sales between EUR 24.9 billion and EUR 26.5 billion, which implies between 2 percent and 8 percent growth in constant currency. The comparable operating margin target is in the range of 11.5 percent to 14 percent.

Nokia India sales grew 25 percent (15 percent in constant currency), from 1,035 million euros in 2021 to 1,290 million euros.

In India, Nokia has bagged 5G equipment contracts from both, Reliance Jio and Bharti Airtel. India was the fastest-growing market for Nokia, as sales in North America fell 3 percent from 4Q21 to 4Q22 while sales in the Greater China region declined 9 percent in the same period. The company, however, posted sales growth in Asia, Europe, Latin America, the Middle East, and Africa.

ERICSSON reported sales increased by 17 percent to SEK 271.5 billion in 2022. A weaker Swedish krona (SEK) had a positive impact on reported sales in all segments. Networks sales increased by SEK 25.6 billion to SEK 193.5 billion. Cloud Software and Services sales increased by SEK 4.3 billion to SEK 60.5 billion. Enterprise sales increased by SEK 9.1 billion to SEK 15.4 billion. Sales in other segment increased by SEK 0.2 billion, to SEK 2.2 billion. Sales adjusted for comparable units and currency increased by 3 percent.

Börje Ekholm

President and CEO,

Ericsson

“We remain positive on the long-term outlook for our business. However, the near-term outlook remains uncertain. We expect operators to continue to sweat assets in response to macroeconomic headwinds and adjust inventory levels as supply situation eases. These trends started to impact Networks in Q4 and we expect them to continue at least during the first half of 2023. At the same time, we expect good growth from market share wins, albeit not fully offsetting the near-term headwinds.”

Net sales in India in 2022 was SEK 10.957 billion, as compared to SEK 7.482 billion in 2021, a 4 percent share of the global operations. Although in the quarter ended December 2022, India contributed 6 percent, second only to USA.

IPR licensing revenues increased to SEK 10.4 billion primarily as a result of a new patent license agreement including 5G.

Gross income increased to SEK 113.3 billion with increases in all segments. Gross margin decreased to 41.7 percent in 2022, as compared to 43.4 percent in 2021. It was negatively impacted mainly by increased component costs, inflationary pressure and large-scale projects from market share gains in Networks, as well as an impact from initial 5G Core deployment costs in Cloud Software and Services, partly offset by retroactive IPR licensing revenues.

EBITA amounted to SEK 29.1 billion with an EBITA margin of 10.7 percent. EBITA was negatively impacted by previously announced charges in 2022 of SEK −5.5 billion, partly compensated by increased IPR licensing revenues. Net income in 2022 was SEK 19.1 billion, as compared to SEK 23 billion in 2021.

Ericsson has 90 percent plus of sales from telcos worldwide. The vendor continue to focus on its business of selling to communications service providers along with adding to its enterprise offerings, while making smaller acquisitions, thus compensating for slower, or even negative, growth in its CSP business. The vendor has seen overall margins erode as growth now mainly comes from fiercely price competitive markets such as India and its once big China market has slowed to a trickle.

CIENA reported revenue of USD 3.63 billion for fiscal year 2022, ending October 2022, as compared to USD 3.62 billion for fiscal year 2021. Products constituted 81 percent of the revenue, balance being from services.

Gary Smith

President and CEO,

Ciena

“Our strong fiscal Q4 financial results were better than expected as we benefited from some favorable supply chain developments in the second half of the quarter. Looking ahead, we expect to deliver outsized revenue growth in fiscal 2023 given our significant backlog and continued signs of gradual supply improvement. And, we remain confident that the durability of secular demand drivers and our strategic investments to expand our addressable market position us to deliver strong revenue growth over the next several years.”

The vendor reported an adjusted non-GAAP gross profit margin of 43.6 percent in 2022, from 47.9 percent in 2021.

Ciena has announced its results for Q1 2023 recently. The vendor posted record revenue in its fiscal Q1 2023 (ended January 28, 2023), as easing supply chain conditions allowed it to get more product out the door. As it hustles through the remainder of the year, executives said the company will continue working to trim its bulging backlog, which stood at USD 4.2 billion at the end of Ciena’s fiscal 2022 and remained elevated in FQ1.

Speaking on an earnings call, CEO Gary Smith noted a smaller backlog will actually be a good thing. While he did not provide an updated backlog number, he said of its inflated backlog more generally “We do not think this level of backlog is sustainable or frankly desirable. Customers want equipment. They do not want it sitting on our backlog.”

Smith added that even with its best efforts, Ciena expects to “go into 2024 with a bigger backlog than we would normally take into any fiscal year” and he isn’t sure when or if things will return to normal or what a “new normal” backlog level might look like.

In terms of what it was able to get out the door in FQ1, Smith said the quarter was its biggest modem shipment quarter ever. It has now shipped more than 60,000 Wavelogic 5e modems. That compares to more than 50,000 in the previous quarter, nearly 25,000 in FQ4 2021 and 35,000 in FQ2 2022.

Revenue jumped year on year from USD 844 million to USD 1.06 billion, with profit rising from USD 45.8 million to USD 76.2 million. Networking platforms accounted for USD 855.1 million in revenue, with USD 735.6 million of that coming from Ciena’s Converged Packet Optical business and USD 119.5 million from its Routing and Switching unit.

Sales increased across geographic segments, with the majority (72.4 percent) coming from the Americas. But Asia-Pacific revenue jumped 41 percent to account for 13.1 percent in FQ1, thanks in part to strength in India.

By vertical, 60 percent of Ciena’s revenue came from telcos, 24 percent from webscale, 9 percent from government and enterprise and 7 percent from cable.

In 2022, India has been a promising market for both Nokia and Ericsson. And in March 2023, Ciena reported that in Q3, India’s revenues were up 150 percent on YoY to USD 64 million. A lot of innovation and development comes out of India, which the vendors market globally. It seems to be one of the fastest growing market right now.

You must be logged in to post a comment Login