Trends

MEA smartphone shipments decline 7.8% YoY in Q2 2022

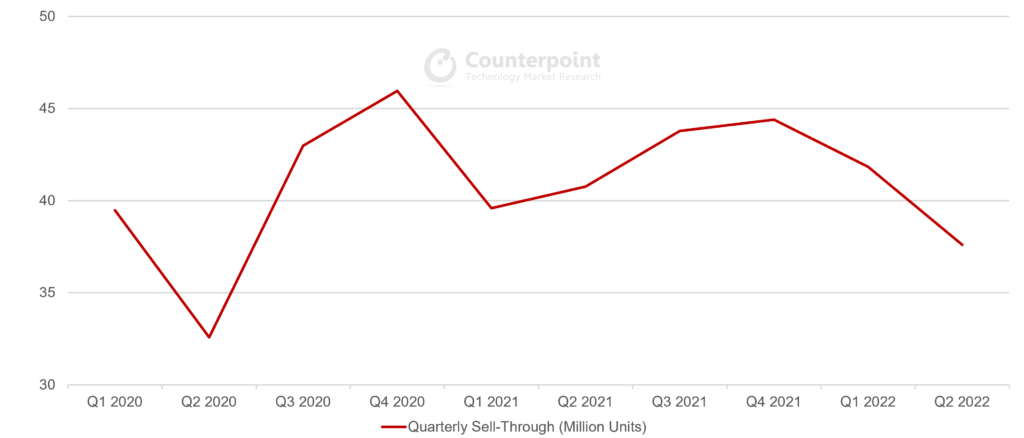

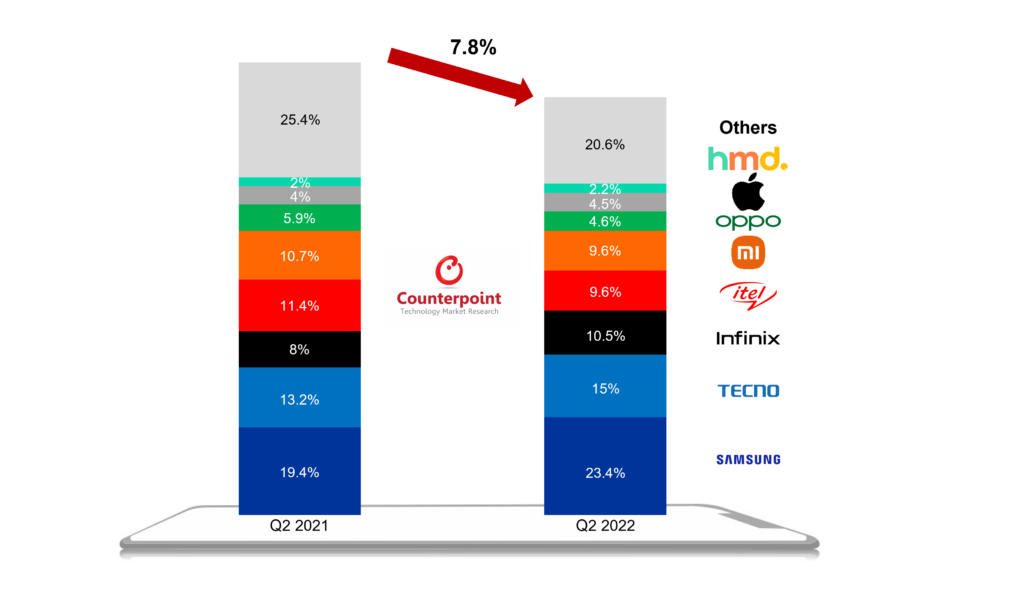

Smartphone shipments in the Middle East and Africa (MEA) region fell 7.8% YoY and 10% QoQ to 38 million units in Q2 2022, according to the latest research from Counterpoint’s Market Monitor Service. Worsening macro headwinds on the economic and geopolitical fronts undermined consumer demand as well as brands’ enthusiasm to expand their footprint across the region.

Commenting on the market’s performance, Senior Analyst Yang Wang said, “The biggest drag on the market was, unsurprisingly, macro issues. Inflation induced by food and fuel shortages dampened consumer demand while declining domestic currencies against the US dollar reduced the purchasing power of consumers.”

There were also secondary macro factors that impacted the market. For example, some governments imposed food export bans or ‘non-essential’ goods import bans to stem the outflow of foreign currency reserves. Taxes on electronics products were also increased, adding more hurdles to the market’s smooth operation.

Given the pessimistic global macro sentiment, we also saw some brands becoming cautious about activities in the region. Difficulties elsewhere meant that brands were under pressure to streamline budgets and activities, which were redirected to more strategic markets and regions. This meant that incentives to push brand penetration in MEA were scaled back, which in turn forced distributors and resellers to raise prices to defend their margins. These headwinds led to declining shipments for many OEMs.

The market leader, Samsung, grew YoY from a relatively low base in Q2 2021 when it faced COVID-19 disruptions at its Vietnam production facilities. The new and revamped Galaxy A-series devices have performed well and were among the best-selling devices during Q2. Samsung’s shipments are expected to grow in H2 with the upcoming launch of its new generation of foldables and as end-of-year sales approach.

Transsion Group’s brands continued to take the biggest share of smartphone shipments in the MEA region. Commenting on the performance of Transsion brands, Research Associate Ravyansh Yadav said, “Transsion Group brands’ shipment share grew YoY, largely driven by a strong performance of Infinix and TECNO devices. Multiple stylish and feature-rich new launches, like Infinix’s Hot series and TECNO’s Pova and Spark series, helped the brands weather adverse market forces. On the other hand, as the asymmetric impact of inflationary pressures on the low and entry tiers mounted during the quarter, itel’s smartphone shipments declined 23% YoY in Q2. itel is in a tough spot with regard to rising component prices, an underwhelming product portfolio revamp and customers migrating to the more upmarket TECNO and Infinix devices.”

Apple’s shipments also grew 2% YoY, largely due to better distribution and product availability in GCC countries. The iPhone 13 series has the best-selling premium devices in the region since its launch. OPPO, realme, vivo and Xiaomi saw steep YoY declines in their Q2 shipments. The OEMs continue to struggle in establishing a foothold in the region, as weak distributor incentives and supply issues have plagued the brands throughout H1 2022. Furthermore, stiff competition from regional stalwarts Samsung and Transsion Group’s TECNO and Infinix has curtailed market share for the challenger brands. However, the ramping up of local production in Pakistan, specifically for OPPO, vivo and Xiaomi, could help ease supply issues in the region. But it is unlikely to have any substantial effect in 2022.

Despite the underwhelming market performance in the first half of the year, there are some reasons to be cautiously optimistic about the rest of the year. Though inflation has reached double digits in many countries across MEA, it is not a new phenomenon and most customers have experienced these episodes in the recent past. This has brought them the ability to adapt quickly to the new economic realities. Also, we noticed that the average selling prices (ASP) of smartphones are continuing to trend up in the region, suggesting increasing digitization and customers’ need for more sophisticated handsets. The easing of the global semiconductor shortage, which led to severe product availability issues for MEA in 2021, is also expected to help the market find a stronger footing once the economic issues subside.

CT Bureau

You must be logged in to post a comment Login