Trends

MEA smartphone market drops 4% YoY in Q1 2022

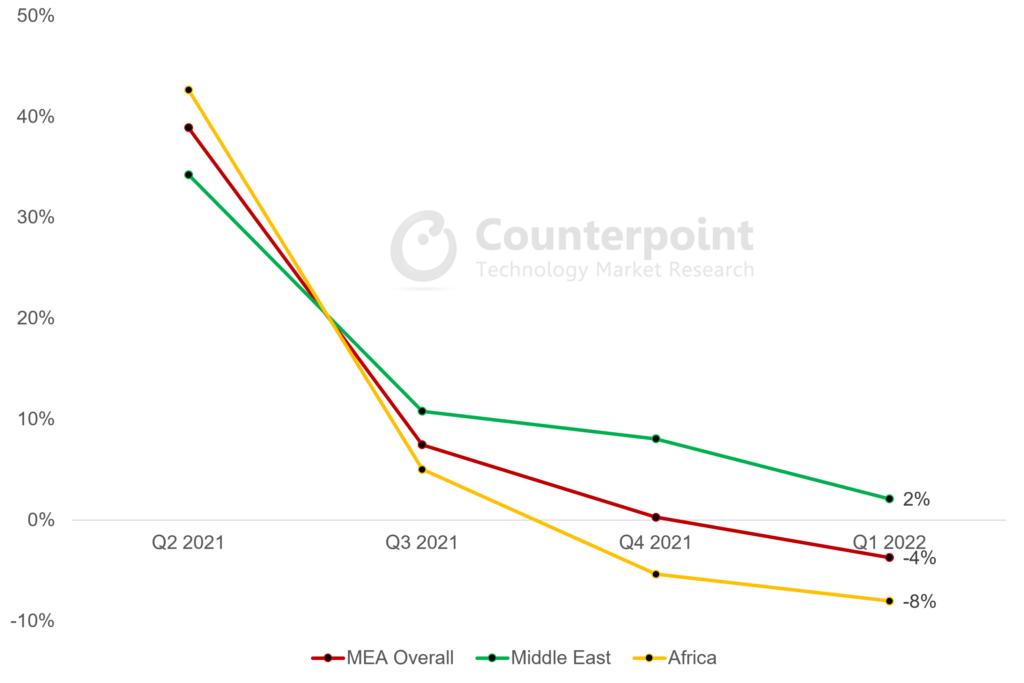

Smartphone sales in the MEA (Middle East and Africa) region fell 3.7% YoY in Q1 2022, according to the latest research from Counterpoint’s Market Pulse Service. Sales were expected to drop during Q1, which is typically a soft quarter, but demand was also dented by geopolitical worries elsewhere and increasing pressure on consumers due to commodity and food price increases.

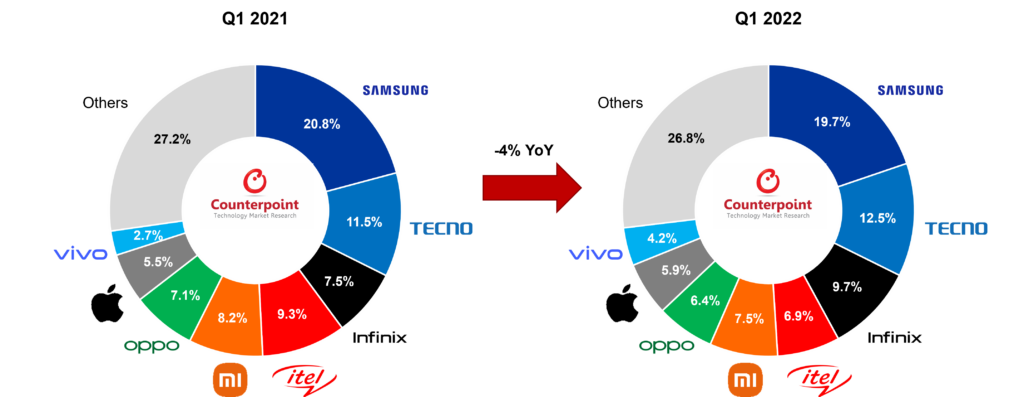

Commenting on the performance of OEMs, Senior Research Analyst Yang Wang said, “Most key OEMs saw sales drop YoY, but this needs to be interpreted in the context of economic reopening in Q1 2021, which led to pent-up demand that manifested in an unusually high base effect. MEA leader Samsung saw sales and market share losses in Q1 2022, but this was a much more optimistic performance than what the numbers suggest. Despite lingering supply issues, Samsung’s new affordable A-series models proved to be popular in the region. Compared to other OEMs, the brand is best positioned in terms of supply chain and product mix, and we expect to see Samsung taking more market share from rivals in the next few quarters.”

“Transsion brands saw their market share increase from 28% to 29% in Q1 2022, but they also saw a sales drop of 7.5% YoY during the quarter, their first sales drop since the beginning of the COVID-19 pandemic. This was mainly due to the weakness seen by itel, the brand that is skewed heavily towards entry-level, lower-income African customers. On the other hand, Infinix continued to grow strongly on the back of impressive performance of its mass-market models in the Hot and Smart series. Looking ahead, customer demand in Transsion’s home market Africa is a reason for worry. Local currency depreciation may also put Transsion’s price competitiveness under pressure.”

“Xiaomi and OPPO went through a tumultuous H2 2021 and are evidently still influenced by supply chain issues. But despite macro concerns, the two brands performed resiliently in Q1 2022. We expect their market share retreat to bottom out during the middle of the year.”

While growth has inevitably flattened across the MEA market in recent quarters, it is important to emphasize the regional differences within. In Q1 2022, the Middle East market managed to grow despite the economic headwinds. On the other hand, Africa is becoming a point of concern, having underperformed since H2 2021.

Since the start of the Russia-Ukraine war, markets across the world have been pegged back by inflationary and foreign currency pressure. But the Middle East is an exception, with Gulf Cooperation Council (GCC) countries benefiting from increased oil revenues. The IMF has revised upwards its 2022 and 2023 GDP forecasts for the region by 1%. With the resumption of tourism, migrant population movements and business travel, the region’s smartphone market is poised to be the outperformer for the rest of 2022.

Weakness in Africa may persist throughout the year, as food price increases will force consumers to pause spending on big-ticket items like smartphones. At the same time, high levels of inflation are not foreign to most consumers in Africa. Consumer sentiment will certainly be hit, but drastic lifestyle changes are unlikely. And given the trend of urbanization, digitization and smartphone adoption across the continent, we can expect the African market to resume growth after the current situation eases.

Counterpoint Research’s market-leading Market Pulse and Model Sales services for mobile handsets are available for subscribing clients.

CT Bureau

You must be logged in to post a comment Login