Trends

‘Made in India’ smartphone shipments decline 8% YoY in Q3 2022

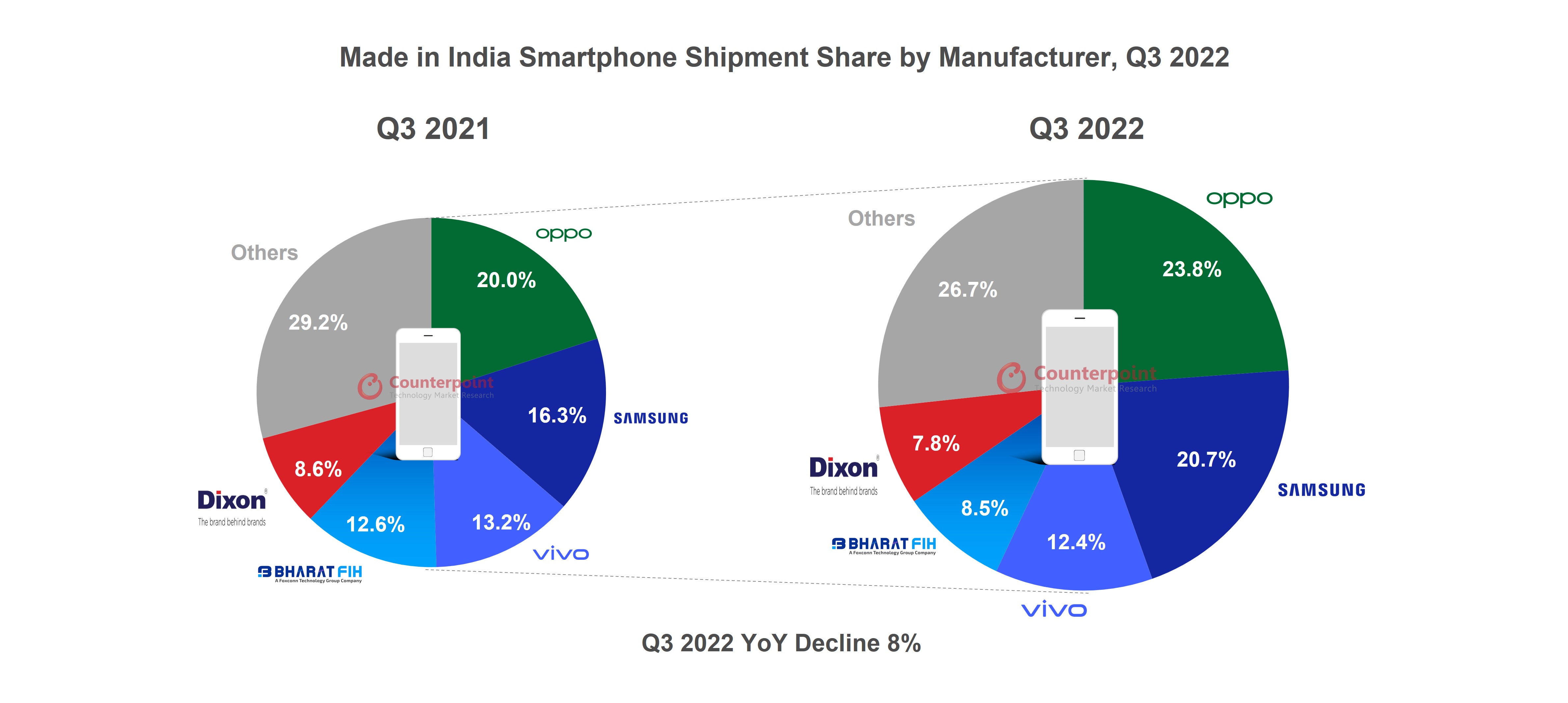

‘Made in India’ smartphone shipments declined 8% YoY in Q3 2022 (July-September) to reach over 52 million units, according to the latest research from Counterpoint’s Made in India service. This is the first decline reported this year. Economic headwinds that led to a decline in consumer demand, and market uncertainties due to geopolitics were the prime reasons for the contraction.

Commenting on the local manufacturing ecosystem, Senior Research Analyst Prachir Singh said, “The Made in India smartphone shipments declined in Q3 2022 as compared to Q3 2021. Two major forces impacted the growth of such smartphone shipments. First, the decline in consumer demand, especially in the entry-level segment, due to the negative macroeconomic indicators. Second, the high channel inventory at the start of the quarter also impacted the manufacturing during the quarter. The country’s smartphone manufacturing ecosystem continues to grow with almost 63% of such shipments coming from in-house manufacturers and 37% from third-party EMS players. OPPO led the Made in India smartphone shipments in Q3 with a 24% share, followed by Samsung and vivo. BYD and Lava were the fastest-growing manufacturers in terms of smartphone shipments. Further, we will continue to see PLI disbursements in subsequent quarters, which will add to the local manufacturing landscape. Overall, the manufacturing trend is witnessing an upward trajectory with multiple partnerships happening in recent months, like the ones between Tata Group and Wistron and between Foxconn and Vedanta.”

On the Indian government’s focus, Research Analyst Priya Joseph said, “On the regulatory front, despite the adverse global climate, the Indian smartphone market has remained resilient. The government’s efforts to bring about a supply chain shift and make India a manufacturing hub with constant policy interventions in the form of PLI schemes has helped the country to attract major global players across the value chain. Further, the government is actively pursuing the target of expanding the local value addition from the present 17-18% to 25% in the near future.”

Looking ahead, we believe that the manufacturing volumes will grow with an increasing focus of the OEMs to export to other countries. Increasing local value addition and exports have been the main focus points of the government under the ‘Make in India’ scheme.

CT Bureau

You must be logged in to post a comment Login