Trends

LATAM smartphone shipments fall 14% YoY

LATAM smartphone shipments declined 14.2% YoY in Q4 2022 to mark the region’s worst Q4 since 2013, according to the latest data from Counterpoint Research’s Market Monitor service. Shipments fell despite the comparatively slow market in Q4 2021, which was constrained by supply chain issues.

Commenting on the market dynamics, Principal Analyst Tina Lu said, “There were a few factors that fueled the fall in shipments in Q4 2022. First, many channels ended Q3 2022 with very high inventory. Second, operators and retailers were very conservative in their sourcing as consumer demand was expected to remain weak in Q4 2022. Last but not least, the FIFA World Cup in 2022. The tournament usually takes place in June or July, but this time it was held in November. Consumers traditionally upgrade TVs during the FIFA World Cup season and smartphone sales usually decline. 2022 was no different. However, smartphone sales in Q4 2022 did not decline too much as OEMs and operators offered many promotions on Black Friday and Christmas that stimulated consumer demand, and as most channels were sitting on high inventories. The inventory issue in the region has improved but has not been completely resolved.”

Lu added, “LATAM smartphone shipments decreased 5.5% YoY in FY 2022 as consumer demand declined due to high inflation, regional political instability, and weak regional currency. On top of that, smartphone prices increased in most local currencies. All these are slowing down smartphone replacement. 5G technology is slowly picking up as many operators are driving its growth, and it is not just in the premium price band. However, 5G smartphones only captured 17% of the regional smartphone market in 2022.”

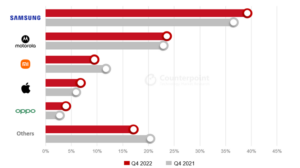

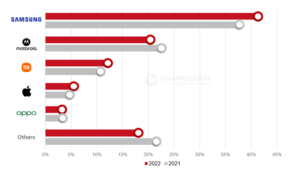

Commenting on the performance of OEMs in the region, Research Analyst Andres Silva said, “During 2022, Samsung widened its lead in the LATAM market, as its share was more than double that of the next competitor. There has been a significant increase in brand concentration in the region. During 2021, the top five brands represented more than 82% of the market, a 3.5% increase YoY. Three of the top five OEMs gained market share during this period. As the market contracts, big brands that have deeper pockets for promotion and more brand recognition will leave fewer opportunities for smaller brands.”

Market Summary

- Samsung, with a 41.6% share, remained the absolute leader in the regional market. Its leadership is based on its number one rank in every market in the region and its strong supply of entry-level models in the region.

- It was also the brand with the highest inventory buildup in LATAM.

- Samsung’s volume grew in 2022 compared with the previous year, when it had a sales issue with Mexico’s biggest operator Telcel.

- Motorola’s market share was less than half that of Samsung, but it was the firm runner-up in the LATAM region. Brazil, Mexico, and Argentina drove the brand’s volume.

- Its shipment volume and share declined as the brand’s entry-level models were in short supply.

- Xiaomi’s market share and volume declined YoY in 2022. The brand marked its lowest volume since Q1 2021. Xiaomi has been losing its growth momentum in the region, partially affected by Mexico’s premium price band and its inventory buildup.

- Apple’s market share in the region increased YoY in Q4 2022 and FY 2022, driven by the iPhone 11. The OEM keeps pumping the 2019 model into the region. It has been Apple’s bestselling model in the region.

- OPPO entered the region’s top five brands list in 2022 with Mexico driving the company’s growth. In terms of shipments, OPPO ranked third in the country in Q4 2022. However, the brand is still lagging in the rest of the region.

- OPPO was the only brand that also grew in volume during Q4 2022.

- ZTE performed weakly throughout 2022. Its sales increased slightly by the end of the year, but it was still a significant drop YoY.

- Although HONOR increased YoY in 2022, its growth is flattening. So far, the brand has utilized its good relationship with the carriers to promote its offerings. But now, it needs to build branding to continue growing.

CT Bureau

You must be logged in to post a comment Login