Trends

IT companies look set for strongest quarter in years, say analysts

India’s biggest software services players are expected to put up their strongest performance in the past few quarters, or even years, in the fourth quarter of FY21, say analysts.

Growth for the quarter will be driven by acceleration in digital technologies, improved demand in the aftermath of Covid, ramp-up in deal wins, and migration to Cloud.

With improvement in banking, financial services, and insurance or BFSI, as well as retail, manufacturing, and health care, analysts peg sequential revenue growth in Q4 at 2-5 per cent, with many upbeat that year-on-year (YoY) growth will be in double digits.

Cross-currency headwinds, which, analysts say, could add to gains ranging from 10-70 basis points (bps), is another factor. Analysts also say that with demand improving, large vendors will continue to benefit from scale and diversification.

“We expect Tier-I companies to report growth of 2.5-3.4 per cent quarter-on-quarter in constant currency terms — their strongest Q4 in five years. Early indicators like fresh high-order bookings from peer Accenture, in its February 2021 earnings, also point to an unprecedented demand for tech services — expected to reflect in deal momentum,” said Ankur Garg and Anmol Garg, research analysts at Motilal Oswal.

Global IT spending is projected to total $3.9 trillion in 2021, an increase of 6.2 per cent from 2020, according to the Gartner’s latest forecast. The same had declined 3.2 per cent in 2020 as CIOs prioritised spending on technology and services deemed “mission-critical”.

Gartner stated that through 2024, businesses will be forced to accelerate digital business transformation plans by at least five year, given the rising adoption of remote work and digital touchpoints. It forecasts global IT spending related to remote work to touch $332.9 billion in 2021, a 4.9-per-cent rise from 2020.

On similar lines, a survey by Nasscom stated that Indian tech CEOs demonstrated the highest-ever confidence regarding tech spending growth in 2021.

Close to 71 per cent of the CEOs expect global spending to grow in excess of 4 per cent. The figure is significantly higher than in 2020 and 2019, when 59 per cent and 41 per cent CEOs expected the year to be better, respectively.

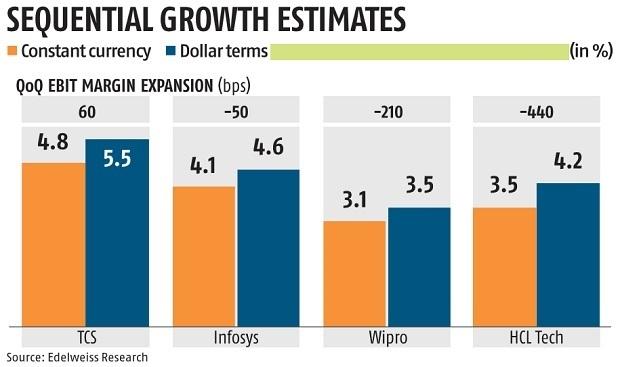

Sandip Agarwal of Edelweiss Research wrote in his report that IT companies will continue their trailblazing journey into Q4.

“The Street will, hence, be forced into ‘trailing conviction’ — much like over the past three quarters. Growth for IT companies began with robust results reported by FAANG (Facebook, Amazon, Apple, Netflix and Google) last April, followed by Accenture’s Q3FY20 results. Accenture’s Q4FY20 and Q1FY21 results did an encore of better-than-expected performance,” said Agarwal.

Tata Consultancy Services (TCS) and Infosys are expected to lead the pack among the top tier-1 players in revenue growth. The street will look at Infosys for guidance and demand for FY22 and at Wipro for guidance into Q1FY22.

Besides the demand outlook, the Street will also look for commentary on region-specific growth, keeping in mind hiring plans in India and overseas, and also with Europe increasing reliance on IT players.

With TCS already announcing salary hikes for employees, many will wait to see what peers say, and the resultant impact on margins. Many have already factored in an impact of 140-150 bps on earnings before interest and taxes, owing to wage hikes.

HDFC Securities in its report Onwards & Upwards stated that based on its Tech Investor forum, the commentary across companies/experts indicating continuation of multi-year industry tailwinds (Cloud acceleration) and optimism on hitting and sustaining double-digit growth, was validated.

“We expect sector revenue to grow at 14.4/10.8 per cent (in $ terms) for FY22/23E, with mid-tier IT growth coming in at 15.1/12.5 per cent. We expect margin expansion of 55 bps over FY21-23E (10/45 bps expansion in FY22/23E), following a 220-bp expansion in FY21, leading to Rs 17 per cent EPS CAGR over FY21-23E,” said Apurva Prasad and Amit Chandra of the brokerage.

The only tailwind that may act as a spoiler is skills or attrition. TCS’ announcement of a second hike in six months is a clear indication of impending attrition.

Accenture, too, reported a 300-bp sequential rise in attrition. The concern is valid despite higher acceptance of global delivery models, and seamless progression into virtual frameworks of sales and knowledge transfer. Business Standard News

You must be logged in to post a comment Login