Face-to-Face (Blockchain)

Interview with Dr Owen Vaughan, Lead Scientific Architect, BSV

Dr Satya N Gupta in a series of exclusive interviews with business leaders inviting their comments on blockchain technology and its impact on business

As lead scientist of the largest Blockchain protocol, please elucidate on the salient features of BSV and how can it be adopted by society at large?

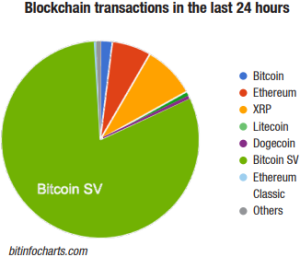

I lead a team of research scientists, who push the boundaries of what is possible using Blockchain technology. We value working on problems that are relevant and have real-world impact, which is why we need to focus on Bitcoin SV. It is the public Blockchain with most ambitious scaling targets and highest current daily usage. At the time of writing, there were over 10 m transactions in the last 24 hours on Bitcoin SV, which is five-fold more than Ripple, Ethereum, and BTC combined1. These impressive statistics are not driven by traders speculating on digital assets, but by real-world use-cases using the Blockchain to enhance their products and efficiencies. For example, applications in IoT, social media, compliance, cyber-security, and iGaming comprise the top five transaction senders of the 10 m transactions mentioned above2. The average transaction fee on Bitcoin SV is less than USD 0.00001. This makes it an attractive platform for application developers, who wish to leverage the key benefits of public Blockchain technology, such as transparency, immutability, availability, and a native payment system. The low transaction fees encourage digital inclusion and open up new business models. Where Bitcoin SV stands out from the others is in its very large block size – 4 GB at the time of writing – with the goal of being completely unbounded and governed purely by market forces in the near future. This means that nodes strive to acquire as many transactions as possible and are rewarded for doing so with transaction fees. The more individuals use Bitcoin SV, the more cost-effective it becomes. This is due to economies of scale and a consensus mechanism that encourages open competition between nodes. This is in contrast with other blockchains that either have high fees due to limited block space, or have artificially low fees with a centrally managed node network.

The Bitcoin SV community believes that just like we have one internet, we will eventually have just one Blockchain that is used universally by everyone. This is because transparency of data ownership and usage – the greatest benefits of Blockchain – cannot be fully realized with multiplicity of ledgers. A single, universal public ledger will enable us to construct the internet of the future, which some call Web3, where data security will be of primary importance. But the benefits of Blockchain will filter down to our institutions of finance, government, healthcare, and many others. Nevertheless, this technology will largely go unnoticed by the average citizen, and will act as the plumbing in the infrastructure layer of our digital society. From an end user’s perspective, they will experience an increase in choice and transparency of their personal data usage. They will no longer live in a world where big companies can exploit their attention as a commodity. Instead, a new paradigm will emerge where users have the option to pay a small fee – a nano-transaction – for a service of higher-quality, greater privacy, and free of advertisements. Incidentally, as you have been quoting, it gels with India’s G20 vision of One World-One Family-One Future extended to include One Blockchain as well.

There is an urgent need to bridge the gap between policy makers, industry, and technology. Please comment.

It is important that policy makers are not awed by the complexity of the latest technology, and not to be beholden to software developers who do not share their values. Extended timeframes to develop and enforce new rules can stifle innovation and economic impact for society.

In fact, most of the existing financial regulations can be translated immediately to the Blockchain space. An example is the travel rule, whereby transactions over a certain threshold (e.g. USD 500) must be recorded along with the identities of the people involved. These records must be kept for a set period of time and produced to examiners on demand. The origins of the travel rule date back to the Bank Secrecy Act of 1970, well before blockchain was invented. It is straightforward for blockchain payment processors to comply with the travel rule if they have the appetite to do so. On the other hand, some newer regulations, such as GDPR right to be forgotten, are more complex to apply due to the Blockchain’s immutability and decentralized architecture. However, even these obstacles can be overcome by appealing to new advances in technology, such as zero-knowledge proofs. For other types of rules, it is simply that the regulators themselves need a stronger will to impose their authority. An example is the ability for courts to seize and confiscate digital assets such as Bitcoin.

Although the ability to seize such assets is not currently written into the code, it is a relatively a simple procedure to do so – a simple software patch is required. In fact, this has recently been implemented for Bitcoin SV3, the only public Blockchain to do so. The same software can be run on BTC immediately, which would help recover lost or stolen assets and prevent ransom demands. These types of compliance tools could significantly discourage criminal activity on the Blockchain.

What is in store for the future architecture and protocol?

We believe that the Bitcoin SV protocol should not change and is set in stone forever as stated by Satoshi himself. In fact, Bitcoin SV stands for Satoshi Vision, because it follows the principles outlined by Satoshi in his white paper, code, and early writings. It is a vision for a Blockchain of unbounded scaling capability and fixed protocol. The latter point is important because it means that application developers can build (and businesses can invest) on top of a protocol they know will not change in six months’ time. This fixed protocol is analogous to John von Neumann’s 1945 computer architecture design, which has remained largely unchanged to this day. Nevertheless, application advances are happening all the time. Bitcoin SV’s fixed protocol is in contrast with Blockchains, such as Ethereum that embrace experimentation and incremental development, as demonstrated by a fundamental redesign of their consensus mechanism in 2022.

The high transaction volume of Bitcoin SV is facilitated by a simple first seen rule applied to node transaction processing. This means that if a node sees a first transaction spending a particular coin, then they will not instead accept a second transaction spending the same coin (a.k.a. double spend). This contrasts with Blockchains, such as BTC, which have a replace-by-fee rule, or Ethereum with a complex and opaque gas fee-market. Bitcoin SV’s simple ruleset means it is possible to gain instant transaction confirmation from a node, meaning that one does not need to wait until blocks are produced to be assured that their transaction is accepted. An important enabling technology is Miner ID. This allows nodes to electively identify themselves, and for users to communicate with them directly. This opens up new revenue streams for nodes and improves user experience.

What advice do you have for regulators and young talent?

Emerging markets, such as India, have an enormous opportunity to learn from the mistakes of others and adopt the highest quality digital infrastructure and technical standards from the beginning. In two areas they are leading the way. First, in terms of IPv6 adoption, India is ranked second in the world. This technology is critical for ensuring secure, private, and direct communication. Second, in terms of digital payments, India has seen widespread adoption with its UPI payment-processing service, along with a recent CBDC pilot of the eRupee. This means that India is in a very good position to leverage the advantages of Blockchain technology for nano-payments and data services. In terms of regulation, it is important for regulators to make their position as clear as possible in order to attract investment, as regulatory risk is one of the key blockers for enterprise development. The success of areas, such as the cryptovalley in Switzerland, have shown the benefits of getting regulation right.

To young talent in India, I would highlight that there is a massive global skills shortage in Blockchain and Web3 technology. After Covid, many companies are warming to the idea of remote workforces that are globally distributed. At the same time, it is more accessible than ever to get accredited with qualifications that will be recognized globally. For example, they can look at an excellent set of open introductory courses provided by the Bitcoin SV Academy4. There can be a wonderful opportunity to train themselves up and become the engineers of the next generation of the internet.

References

- bitinfocharts.com

- bsvdata.com

- bitcoinsv.com/digital-asset-recovery

- bitcoinsv.academy

You must be logged in to post a comment Login