Headlines of the Day

Indus unlikely to benefit from VIL CapEx in the near term, ICICI Securities

Indus Towers’ stock price increased >20% post government reform in the telecom sector announced a few days ago, which has increased VIL’s going concern visibility. However, VIL still has a long way to go as it needs tariff hike and recouping of some market share. Even in a bull case where VIL incurs capex to catch up on 4G capacity gap compared to Bharti Airtel (Bharti), we don’t see material benefit to Indus. Our analysis shows VIL does not need much of cellsite addition, but it needs to expand 4G BTS which comes at marginal cost (loading charges). Further, tenancy expansion from 5G is at least 2-3 years away and visibility on other businesses such as fibre is limited. We have retained our estimates for Indus, but cut our WACC to 10.8% (from 12.8%) on VIL’s reduced going concern risk. Our revised DCF-based target price works out to Rs266 (earlier: Rs232). Maintain HOLD.

Government relief package increases visibility on VIL as a going concern

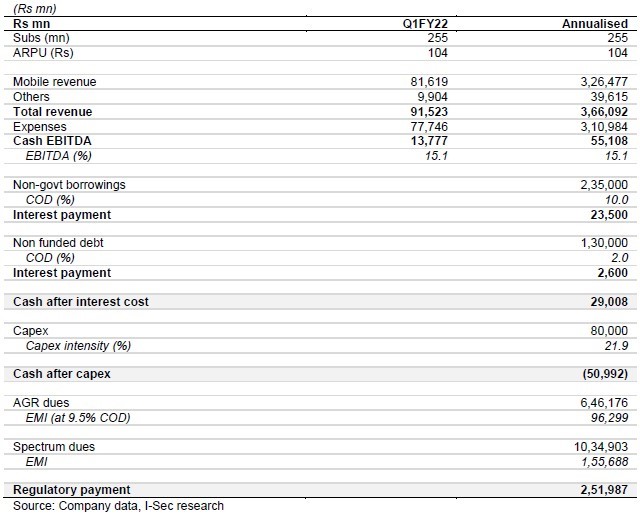

- The Indian government has announced the telecom relief package, which provides four years of moratorium on AGR and spectrum dues. This reduces the payment burden for Vodafone Idea (VIL) by a significant Rs252bn p.a. based on our calculations.

- Further, the government has the option to convert deferred dues and also annual interest on the deferred payment, into equities. In worst case, we believe this could pave the way for VIL to become majority-owned by the government, thus, increasing going concern visibility.

- We believe the worst case for Indus Towers has been averted with VIL remaining a going concern. However, VIL still needs equity infusion and significant tariff hike for catching up on capex, in our view.

VIL is expected to fight back, and capex investment is key…

- We expect VIL to fight back for a fair market share as cashflow issues have beenpostponed to FY26. News article (link) suggests promoters are looking to infuse cash, which should boost investor confidence and likely help raise external funding as well.

- We expect VIL to use capital to accelerate its capex in 4G where it lags peers in terms of data capacity though it always enjoyed a huge advantage on spectrum quantity.

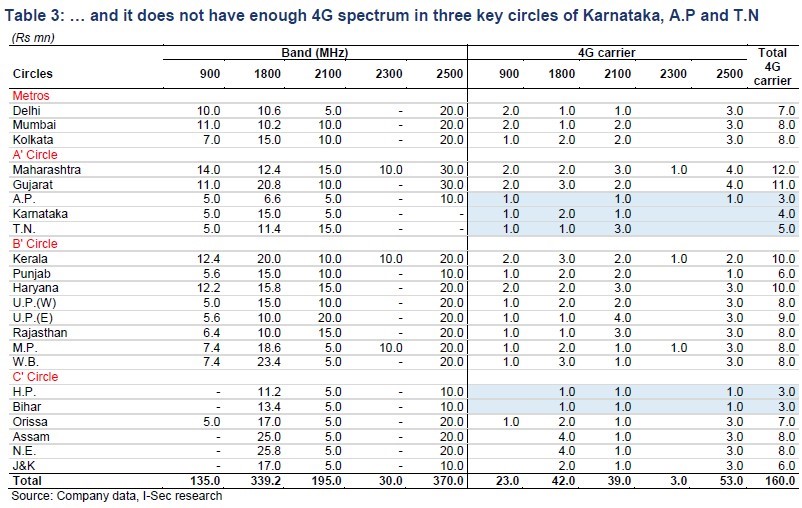

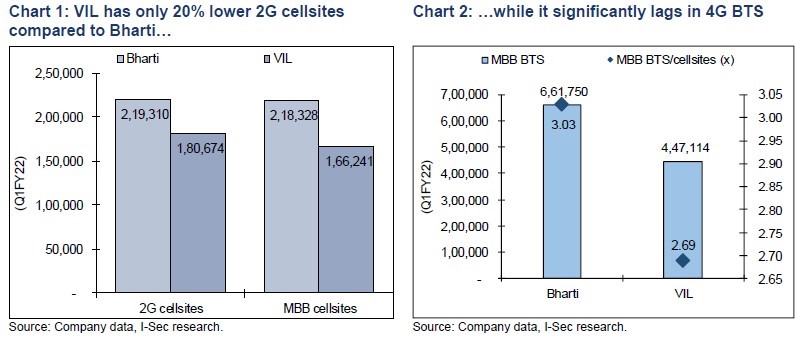

- As of Q1FY22, VIL had 21% lower 2G cellsites compared to Bharti, 31% lower mobile broadband (MBB) cellsites and 48% lower MBB BTS. Thus, VIL has much to catch up on 4G investment.

…but we don’t see any near-term benefit to Indus from VIL capex spend

- We don’t see acceleration in VIL’s capex to benefit Indus immediately. VIL’s capex will predominantly be in form of loading (4G BTS) where it has significant gap vs

- VIL has only 21% gap vs Bharti on 2G cellsites, growth in which drives tenancy expansion for Indus. We don’t expect VIL to significantly expand 2G cellsites, the reasons being:

- VIL is not a pan-India 4G player. It has to restrict its presence to 16 circles based on our AGR market share and quantity of 4G spectrum analysis. VIL has very low AGR market share (<10%) in six C-circles, Delhi and Karnataka. It has less than or equal to five 4G carriers in five circles – A.P, Karnataka, T.N, H.P and Bihar, where it has to incur significantly higher capex for capacity. It can pursue in these circles only if it has sufficient market share to justify higher capex.

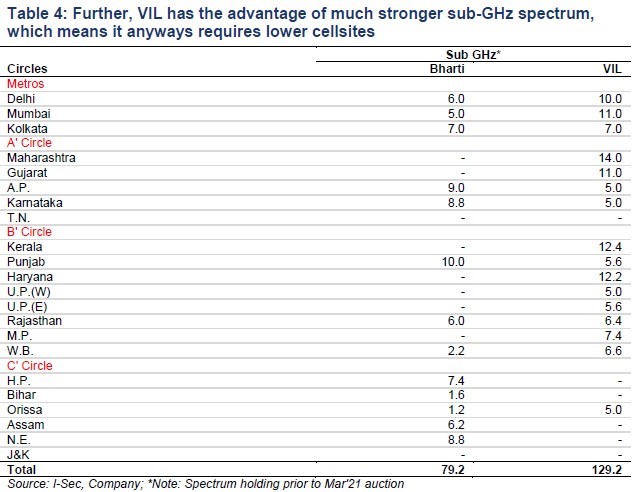

- VIL has much better sub-GHz spectrum footprint, which provides better network coverage vs Bharti. The latter had sub-GHz spectrum only in 13 circles before the Mar’21 auctions. This was the reason for Bharti to expand 2G cellsites in some of the circles such as Maharashtra, Gujarat, UP east, UP west among others.

- VIL already has >1bn population coverage in 4G and >1.2bn in 2G. This is strong footprint in our view.

- VIL basically requires higher data capacity, which can be created by using its entire spectrum holding for 4G, and

- VIL has to balance revenue and cost inflation. Tenancy expansion will put pressure on costs while cost of loading is marginal.

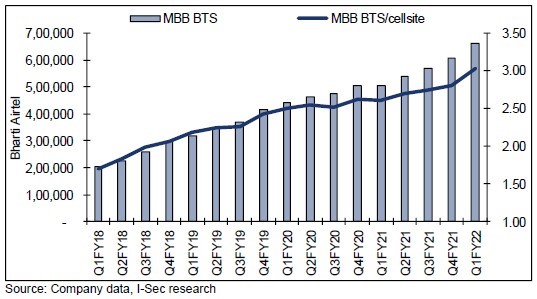

Case study: Bharti expanded significant data capacity through the loading route. We have studied Bharti’s 4G expansion to understand VIL’s capex spend. Our observations are

- Bharti’s 2G cellsites expanded by 35% since FY18 to 216k in Q1FY22, on low base of 162k. This was also aimed to improving its coverage in traditional non sub-GHz circles such as Maharashtra, Gujarat and others. It was seeing opportunity from a weakening VIL position and expecting to capitalise on it. Refer news article for Bharti’s network expansion plan (link).

- However, during the same period, Bharti expanded its MBB BTS by 225% while 4G BTS addition was much higher as it converted >100k 3G BTS into 4G as part of 3G refarming.

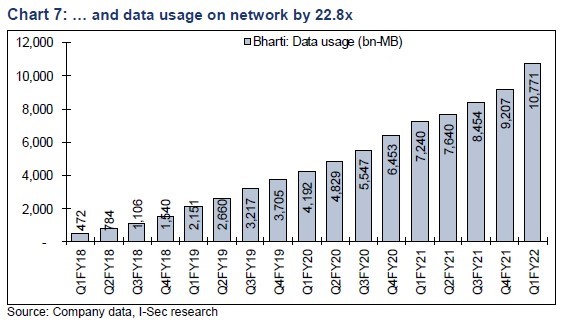

- The capacity created by loading helped Bharti to expand its 4G subs by 3.8x and data usage on network by an impressive 22.8x.

- This was achieved with networking operating cost increase of only 25% (CAGR of 7.8%) in FY21 over FY18.

5G and other opportunities are at least 2-3 years away, if not more.

- 5G commercial launch should happen in next 12-18 months if spectrum auctions conclude as planned by the government before Mar’22. Government indicated, as part of telecom reform, to conduct the auctions with fixed calendar in February or March every year.

- However, we believe initial rollout will be through the loading route to keep costs under control with limited subscriber base. Further, 5G is aimed at creating capacity and, initially, operators may not have blanket coverage like in 4G.

- Thus, tenancy expansion from 5G looks unlikely in the near term and benefits may start showing only in next 2-3 years.

- There is no visibility on scale-up of other businesses such as fibre, EV charging stations, etc.

VIL’s cash crunch will be much less for next four years. This should help the company repair and fill the network gap

Case study: Bharti capex was focused on capacity creation

Chart 5: Bulk of the capex was to create 4G data capacity via loading, or 4G BTS

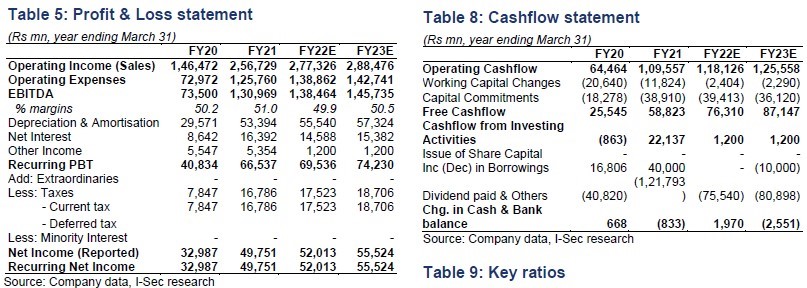

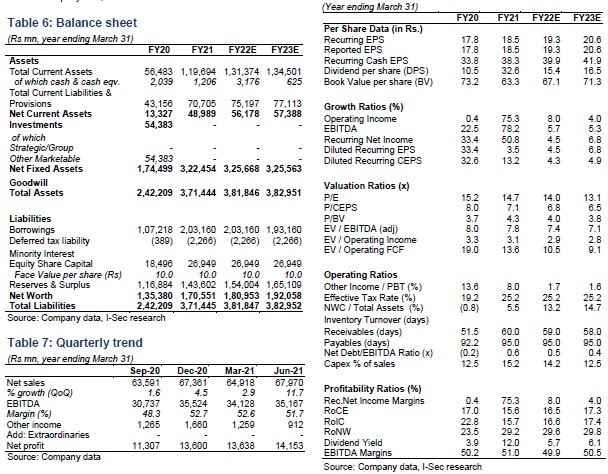

Financial summary

CT Bureau

CT Bureau

You must be logged in to post a comment Login