Trends

Indonesia’s Q3 2022 smartphone shipments down 21% YoY on macro concerns

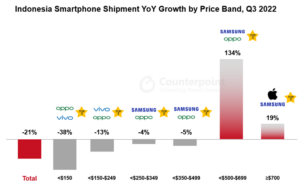

With macroeconomic conditions showing no signs of improvement, Indonesia’s smartphone shipments declined 21% YoY in Q3 2022, according to Counterpoint’s Monthly Indonesia Smartphone Channel Share Tracker. High smartphone demand in Q3 2021 after the lifting of COVID-19 lockdowns resulted in higher shipments which made this quarter look even worse.

OPPO managed to regain the top spot in Q3 2022 driven by its A16 model family, A57 series and Reno series. Aggressive marketing and models spread across price bands also contributed to the good show.

Major OEMs cut their shipments as inventory piled up. In the $150-$249 band, Samsung’s dominance weakened, thereby placing vivo and OPPO as the main OEMs with a combined share of 51%. The <$150 price band was led by OPPO and vivo with a 34% share. Infinix has increased its presence in this segment by introducing the Hot 12 series.

Smartphones priced ≥$500 are unlikely to be affected by macroeconomic headwinds due to the consumer group’s capacity for discretionary expenditure. Therefore, OEMs have increased the options for this price band. OPPO with its Reno series once held the crown in the $500-$699 segment. In Q3 2022, Samsung and OPPO led the segment with a share of 63%.

Commenting on the price range dynamics, Senior Analyst Febriman Abdillah said, “The $500-$699 price segment can be an attractive market given its high growth in economically turbulent times. In Indonesia, OEMs are offering specifications like 8-12GB RAM, 256 ROM, 4000-6000mAh battery capacity and 5G capability. These in-demand specs can help in better targeting of consumers.” The OPPO Reno 8’s Portrait Expert mode claims enhancements in photography technology. realme’s GT Neo series has come up with a “speed” differentiator that improves smartphone gaming. Samsung’s Galaxy A73 5G was one of the top mid-range phones.

Smartphone online channels grew 8% YoY in Q3 2022 to reach 22% of overall shipments. Product availability is one of the key drivers that motivate consumers to visit online platforms. Aside from price promotions, cashbacks, free shipping and bonus points from e-finance providers, the opportunity to get the latest products through pre-order schemes is another attraction of the online channel. Among e-commerce players, Shopee maintained its top spot followed by Akulaku, Lazada, Tokopedia and Blibli.

In addition to marketplaces, OEMs have improved their own online channels, such as Xiaomi, OPPO, realme and Samsung’s online stores. Virtual shopping stores like Samsung Experience Store could be a leap in the application of technology in connecting products with consumers. Here, 5G-ready phones can provide a better virtual experience.

5G smartphone share reached 25% in Q3 2022, which is a bit slower than Indonesia’s Southeast Asian neighbors. 5G smartphone shipments grew 42% YoY. This growth mostly came from the $250-$349 price band as most smartphones in the higher price band were already 5G-ready. In the $250-$349 band, Samsung and vivo led the 5G growth with the Galaxy A33 series, M33 series and vivo Y75.

CT Bureau

You must be logged in to post a comment Login