Headlines of the Day

India’s smartphone market records steepest Q1 decline of 19%

India’s smartphone shipments declined 19% YoY in Q1 2023 (January-March) to reach over 31 million units, according to the latest research from Counterpoint’s Market Monitor service. This was the highest ever Q1 decline seen by India’s smartphone market, besides being the third consecutive quarterly decline. Sluggish demand, high inventory build-up carried over from 2022, growing consumer preference for refurbished phones and pessimistic channel view of the market contributed to this decline.

Commenting on the market dynamics, Senior Research Analyst Shilpi Jain said, “We are observing a change in consumer behaviour – demand is now concentrated around promotional periods. The beginning of the quarter saw a surge in demand across channels around the Republic Day sales period. However, demand dropped significantly after the sales period. Channel players are now focussing on getting rid of existing inventory instead of creating a fresh inventory of new models. It is crucial for OEMs to align their strategies with changed consumer and market dynamics. The quarter’s silver lining came from 5G smartphones, whose contribution (43%) crossed 40% for the first time, registering 23% YoY growth as consumers kept upgrading to 5G devices. We believe these situations will remain similar in Q2 2023 as well with growth coming back in the second half of the year owing to faster 5G upgrades, easing macroeconomic pressure and festive season.”

Commenting on the competitive landscape and price band analysis, Senior Research Analyst Prachir Singh said, “Premiumization trend is becoming stronger with each passing quarter. The premium segment’s share almost doubled in Q1 2023 compared to Q1 2022. Affordability is the key here as we saw more financial schemes being launched, like Apple’s ‘No-cost EMI with zero down payment’ through HDB Financial Services, offers on latest premium segment launches, increase in trade-in offers and push from retailers. The premium segment’s growth is reducing the mid-tier share as consumers are upgrading to higher-priced smartphones. The sub-INR 10,000 price band continued to decline in Q1 2023, with its shipments falling 9% YoY. This segment is suffering declining demand due to an elongated replacement period, declining feature phone-to-smartphone migration and lower presence of hero models.”

Market Summary:

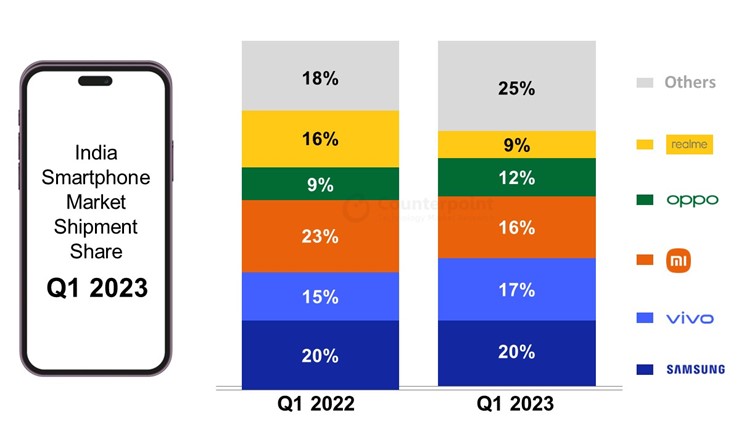

- Samsung maintained its top position in the Indian smartphone market for the second consecutive quarter with a 20% share in Q1 2023. It also remained the leading brand for 5G shipments, accounting for a 24% share. The new 5G-capable A series performed well in the offline market, contributing 50% of the shipments. Samsung’s ultra-premium segment (>INR 45,000, ~$550) grew 247% YoY in Q1 2023 driven by the successful launch of the S23 series and financing options.

- vivo also maintained its second position in Q1 2023 with a 17% market share. Although there was a 3% YoY decline, the company’s robust omnichannel presence and cost-effective pricing helped the OEM in maintaining its position. vivo was the leading brand in the affordable premium segment (INR 30,000-INR 45,000, ~$370-$550) with a 40% share driven by the V series.

- Xiaomi experienced a significant drop from Q1 2022, falling to the third spot during Q1 2023 with a 16% share. It suffered a 44% YoY decline, which is the largest the brand has ever recorded. The decline was due to weak demand in the sub-INR 10,000 (~$245) segment, more dependence on online channels even when demand is higher in offline channels, and a confusing portfolio. The Redmi Note 12 series received a positive response from consumers, contributing to over 14% of Xiaomi’s total shipments.

- OPPO took the fourth position in India’s smartphone market, recording 9% YoY growth with a 12% share. The brand has been consistently expanding its shipments in the high-tier segments, with a particular focus on the upper mid-tier range (INR 20,000-INR 30,000), where it saw the highest growth among all brands, registering 144% YoY growth driven by the F series.

- realme saw a 52% YoY decline in Q1 2023, resulting in the brand slipping to fifth place with a 9% share. realme continued to face challenges such as inventory build-up and unfavourable market conditions in the sub-INR 10,000 segment. It is now focusing on offline retail to expand consumer base. The brand also launched the C55 series, which did well during the quarter, accounting for 11% of its shipments.

- Transsion Group brands itel, Infinix and TECNO accounted for 16% of India’s handset market and secured the first spot there in Q1 2023 with 19% YoY growth. itel captured 3rd spot in India handset market registering 23% YoY growth. TECNO captured the fourth spot in the sub-INR 10,000 smartphone segment driven by strong demand for the Spark Go 2023. Infinix was the fourth fastest-growing brand with 27% YoY growth.

- OnePlus was the fastest growing brand with 72% YoY growth in Q1 2023 driven by the strong demand for its OnePlus Nord CE 2 Lite and newly launched OnePlus 11 series. OnePlus’ Nord CE 2 Lite 5G was the best-selling model in Q1 2023. It captured the second spot in the premium segment (INR 30,000-INR 45,000 or ~$370-$550) with a 30% share. Furthermore, the brand has been actively expanding its offline presence by opening experience stores in various cities.

- Apple grew 50% YoY and grabbed a 6% share in Q1 2023. The brand maintained its lead in the overall premium segment (>INR 30,000) as well as in the ultra-premium segment (>INR 45,000, ~$550) with 36% and 62% shares respectively. Its new financing scheme with HDB and promotions on the latest iPhone 14 series fueled the growth in offline channels. The recent opening of its own retail stores in the country will further strengthen Apple’s brand image and lead to better growth avenues not just for iPhones but for the whole Apple ecosystem.

- Among local brands, Lava did well with its refreshed portfolio in the sub-INR 10,000 segment. Lava continues to offer the cheapest 5G smartphone (Blaze 5G). It was also the third fastest-growing brand in Q1 2023 with 29% YoY growth.

CT Bureau

You must be logged in to post a comment Login