Daily News

Indian Telecoms To Drop CapEx Significantly In Two Years

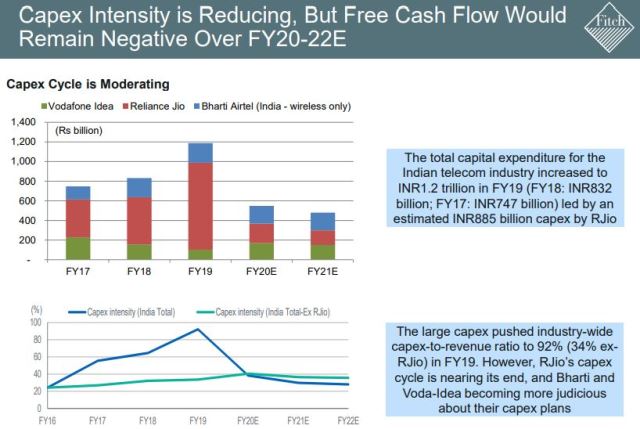

The capital expenditure (Capex) of Reliance Jio, Vodafone Idea and Bharti Airtel will drop to nearly INR 600 billion in fiscal 2020 and less than INR 500 billion in fiscal 2021, according to India Ratings and Research (Fitch Group).

The Capex for the Indian telecom industry increased to INR 1200 billion in fiscal 2019 from INR 832 billion in fiscal 2018 and INR 747 billion in fiscal 2017 — led by an estimated INR 885 billion Capex by Reliance Jio.

The Capex of Reliance Jio, Vodafone Idea and Bharti Airtel will be almost equal during the fiscal 2020 and 2021.

Reliance Jio Chairman Mukesh Ambani said its Capex cycle is nearing its end. Airtel CEO Gopal Vittal earlier said the company would cut down its Capex during the current fiscal.

Vodafone Idea, according to Goldman Sachs report, may down size its operations due to cash crisis. Vodafone Idea just appointed a new CEO to revive its dwindling revenue market share in India.

The large Capex of INR 1200 billion pushed the industry-wide Capex-to-revenue ratio to 92 percent in fiscal 2019, India Ratings and Research said. The Capex-to-revenue ratio of Airtel and Vodafone Idea was 34 percent.

The gross debt of Vodafone Idea, Airtel India business and Reliance Jio at end-FY19 stood at INR 3.9 trillion, implying gross leverage of over 8x for the Indian telecom sector.

The proportion of data subscribers in total subscribers for Airtel and Vodafone Idea increased rapidly to 41-44 percent in 4QFY19 from 28-33 percent in 1QFY19.

The share of broadband (3G+4G) also increased to 31-33 percent in 4QFY19 from 17-22 percent in 1QFY19.

Airtel has been a reporting steady growth in data traffic, and with average monthly usage of 11 GB/user, overtaking Jio in data consumption.

Reliance Jio is expected to deliver 30-35 percent annual revenue growth as against flattish revenue for Vodafone Idea / Airtel India business. Reliance Jio’s revenue growth will be aided by increase in subscriber base and growth in ARPU.

Jio will report superior EBITDA margins, whereas margin profile of Vodafone Idea and Airel will recover over next 2-3 years.

Competitive intensity in the telecom industry has elevated with Reliance Jio’s data tariffs that are 25 percent-30 percent lower than those of Airtel and Vodafone Idea.

Reliance Jio’s market share is expected to increase to 40-45 percent by FYE22 from around 30 percent in FYE19. Airtel / Vodafone Idea’s joint market share will drop to 25-27 percent each from 30-33 percent.―Telecom Lead

You must be logged in to post a comment Login