CT Stories

Indian telecom equipment procurement takes a major dip

The goal is crystal clear. India needs to be a USD 5 trillion economy. The government’s aspirations have been clearly spelled out, often enough. India is the third largest economy in terms of purchasing power parity. It wants to become the third largest in terms of current US dollar prices as well. The USD 5 trillion target will help achieve that. Bangladesh emerging as Asia’s new potential superpower is a reminder of the task ahead.

The positive externalities and multiplier effect of digital technologies will help India realize this vision. The Digital India platform with its focus on empowerment, inclusion, and digital transformation has its foundation on connectivity. Telecom is the bedrock of Digital India. The entire financial services-banking, capital markets and insurance sit atop the underlying architecture of telecom. Other crucial services like entertainment, e-governance, tele-medicine, online e-commerce, all of these depend on a robust telecom sector. It has the exalted status of a crucial utility, not unlike electricity or water. Indeed, in many countries, access to internet has been accorded the status of being an essential service.

For telecom to be a sustainable sector, there are some necessary conditions.

Out-of-the box government support. It is the private service providers that will play an increasingly important role in the digital disruption. With 5G services in the offing, the Indian government must provide the necessary support so that world class infrastructure and services continue to be possible. For instance, the Filipino government offered a very attractive 5G frequency structure. It reallocated unutilized frequencies and put together a frequency management policy. Philippines is one of the world’s largest archipelago nations with about 7,641 islands and an extremely varied topography making it already challenging from a geographical standpoint.

The private sector has stood the test of time, be it telecom service providers, internet service providers, or infrastructure providers and provided seamless connectivity during the COVID crisis to the citizens of this country. In the area of core connectivity, they have done an admirable job in all the three main dimensions that characterize universal access and universal service: availability, accessibility, and affordability. They seemed to have transformed, literally overnight, and scaled their operations in the face of so many challenges thrown at them by the lockdown and the pandemic.

Massive upgradation of cell sites with capacity has been done at population scale. Each industry player has responsibly invested huge amounts of money in creating capacity to drive the industry forward. Technologies like massive MIMO have a very large deployment, cloud based networking, SDN and NFV are an assumption; adopting open source standards and Open RAN are some of the technology interventions done to make sure that consumers in India get the best possible service at affordable prices. Each telco has invested adequately in analytics and big data.

The financial stress that the services sector is in is common knowledge. While the CapEx is very high compared to other countries, the ARPUs are the lowest in the world. The need is to create a digitally inclusive entity and yet create shareholder value at the same time.

Spectrum. Both licensers and regulators need to proactively and constructively work with the industry with a very light touch approach.

It is imperative to have a transparent and an unambiguous spectrum policy, with a clearly defined roadmap of available spectrum over a horizon of at least 4-5 years, at a fair price. The roadmap should indicate a clear allocation plan of each of the bands.

Spectrum in E&V band is very critical for 5G backhaul in India. The E&V band is not only a substitute to optical fibre, but also useful for its high bandwidth availability and the possibility of reuse at the different locations in the same area. It needs to be allocated on priority through a fair auction-based process.

A minimum of 100 MHz per operator in the 3.5 GHz band, at least 400 MHz in the millimeter wave bandwidth in 26-28 GHz, and a sufficient amount of backhaul in the E-band is critical in the first stage. It is critical because the entire network planning, equipment planning, availability, design, and architecture will depend on the spectrum that the operators will be able to buy.

Security. The government’s new directive for a list of trusted sources and trusted products that can be installed in telecom networks is similar to regulations which have been put in place across the US, UK, and EU to restrict Chinese gear makers. Worldwide, countries that account for over 60 percent of the world’s GDP have imposed restrictions, explicit or implicit, total or partial, against Chinese equipment manufacturers.

Interestingly, the largest buyer of Chinese equipment in India is state-owned BSNL. This equipment accounts for 40 per cent of its network. Both Bharti Airtel and Vodafone India also have networks from the Chinese.

Funding. India has the attention of investors, like never before. Jio Platforms, having raised ₹152,056 crore across thirteen investors in just eleven weeks, while the economies around the globe were battling the COVID-19 pandemic is a testimony that global investors find India an attractive investment destination.

Committed service providers backed by an equally strong infrastructure.

The Indian telcos are committed. Vodafone Idea’s tenacity is visible from the group’s discussion for USD 2 billion with a consortium comprising US-based GoldenTree Asset Management, Pacific Investment Management Co (PIMCO), and Oak Hill Advisors. Voda Idea still has more than ₹50,000 crore of adjusted gross revenue dues payable to the government over 10 annual instalments through March 31, 2031, despite the sword dangling (maybe no longer hanging, since the last date for filing appeal has just gone) that the Indian government might just challenge the international tribunal award in the ₹22000 crore tax case under the India-Netherlands BIPA.

Reliance Jio is keen to pioneer the 5G revolution in India by its indigenous-developed network, hardware, and technology components. In addition to an investment of ₹100,000 crore in its 4G network, the firm has invested around ₹40,000 crore in developing its 5G network, that comprises a 5G core and design of the new radios which work on 5G bands.

Bharti Airtel is the only company still standing since the telecom sector was privatised in 1995. The telco is making another large financial commitment. Bharti Global and the UK Government have acquired OneWeb, a Low Earth Orbit (LEO) satellite communications company, with a fleet of 648 LEO satellites, total in-orbit constellations being 110 satellites. Apart from its international operations, the company aims to offer high-speed internet in India by mid-2022. The company needs a total of USD 2 billion, out of which USD 1 billion has already been committed USD 500 million by the British government and USD 500 million by Bharti Global. The company is in dialogue with many investors, USD 50 million has been announced by Hughes, and USD 90 million by SoftBank, the balance USD 860 million will be raised in the coming months.

It is the USD 150 billion investment in world class infrastructure, sourced from manufacturers as Nokia, Ericsson, Huawei, and Samsung that has made seamless connectivity possible.

Encouragement to manufacturing. While initiatives like PLI, SPECS, duty drawback benefits, and EMC 2.0, are substantive in the support that they provide, are based on the production and investment benchmarks, and encourage larger firms to come and manufacture in India, issues as PMA demanded by local Indian telecom gear makers and equal market access by the international manufacturers with huge facilities in India must be speedily resolved, as must laying of the optical fibre cable and fiberization of towers and sites.

Increasing Demand. India today has the highest average traffic per smartphone user of 11-16 gigabits per month. The mobile consumption continues to increase, boosted by rapid adoption of 4G and people working from home during COVID-19.

The average time spent on mobile broadband has gone up by 2.2 hours per day in India during the pandemic, against the world average of 1 hour only. The positive trends of high consumption in India cannot be underscored.

The rural subscriber too has not disappointed. Rural connectivity does not mean erosion in profitability of a telco. While mobile broadband over the last five years, in urban population has moved by about 5x; in rural India it has moved by 25x, from 10 million mobile broadband connection in rural India to 250 million, out of the total 700 million internet connections.

India has more than 120 crore customers, wireless data usage of greater than 11 Gb per customer per month, a teledensity which is slightly more than 85 percent and is the fastest growing telecom market in the world.

Vision. 5G is the way forward. It has the capability of connecting roughly 1 million devices per sq km. 2021 is the year of 5G for the progressive world. 5G brings speed, latency, and a huge bandwidth. And as we move to Atmanirbhar Bharat, Industry 4.0, AI, and ML, it is a tremendous opportunity.

Why should India not be ahead in the race?

5G must be made successful in India. The key enabler of this technology is the large chunk of spectrum required in high band, propped by software defined network, massive MIMO and beaming formation, network slicing and service-based architecture, and fiberized base stations.

5G is a game changer technology, and there are sufficient India specific use cases, providing viable and affordable business models. The seeds of 5G use cases have already been sown. For instance, remote diagnostics will soon lead to remote surgeries. Similar collaborations will come up in healthcare, fitness, education, business health, and even security services.

There are huge big possibilities which India is opening up to, as it starts moving in its journey toward 5G. For the first time, India is developing its own technologies for 5G. And several Indian players have created parts and subsystems, components and technologies, which will comprise of nearly 10-20 percent of the overall technologies required in the 5G ecosystem. It is time to take India’s ability to build affordable technology not just within this vast country, but make it happen in South Africa, Middle East, and North Africa, these are parts of the world that should see India as a leader.

And who knows, by the time 6G comes, India could be a significant player in the technology arena for communication.

THE INDIAN TELECOM EQUIPMENT INDUSTRY

The four leading Indian telecom equipment companies saw a combined 25.83 percent decline in their revenues in 2019-20, as against 2018-19. Nokia was steady at around a 37 percent share. Samsung received around USD 1 billion orders from Reliance Jio for its 4G LTE network, its only customer for telecom infrastructure equipment. Ericsson’s revenue increased from ₹6566.68 crore in 2018-19 to ₹6910.97 crore in 2019-20, a 5.24 percent increase. Huawei lost out majorly in 2020. From a revenue of ₹12725 crore in 2018-19, the vendor’s revenue in 2019-20 dropped to ₹6658.9, a 47.67 percent decline. ZTE, has not been included here, since it has not filed its financial results with the Ministry of Corporate Affairs for the year, 2019-20 yet. Its revenue was ₹1210 crore in 2018-19 and ₹1200 crore in 2017-18.

Some large orders placed in 2020

Ericsson

Bharti Airtel renewed its agreement with Ericsson in July 2020 to manage pan-India network operations. Ericsson is managing Airtel’s network operations centre and field maintenance activities across India. Ericsson will deploy the latest automation, machine learning, and artificial intelligence (AI) technologies to enhance Airtel’s mobile network performance and customer experience. The company will also provide Network Optimization Services, combining multi-vendor networks expertise with its state-of-the-art machine learning/AI-enabled Cognitive Software Suite.

In October 2020, Bharti Airtel also renewed its 4G network expansion contract for eight telecom circles in the country, a move which will help the telecom operator prepare for deployment of 5G technology in the next few years. Under the multi-year contract, to be renewed in 2022, Ericsson will supply and deploy 5G-ready radio and transport solutions to the telco.

And in November 2020 Bharti Airtel has replaced Huawei in Rajasthan and parts of Tamil Nadu with Ericsson. Huawei now works with Airtel in Karnataka and UP (West).

Nokia

Nokia

Nokia secured over 100 deals in India this calendar year aided by new telecom deals from Indian telecom operators and internet service providers that kept doing network expansion and modernisation throughout the year. A 15-20 percent increase in traffic, as a result of the shift to working from home is now forcing Indian telcos to expand network both in terms of coverage and capacity.

In February 2020, Bharti Airtel and Nokia partnered to offer private LTE based Industry 4.0 solution to enterprises. The partnership addresses the emerging requirements of enterprises across banking, financial services, and insurance (BFSI), information technology enabled services (ITES), media and services, manufacturing and distribution with technologies such as cloud, IoT, artificial intelligence and machine learning, and edge computing concepts.

In April 2020, Nokia secured a USD 1 billion (nearly ₹7,636 crore) deal with Airtel to supply its Single Radio Access Network (SRAN) solution across nine geographic regions in India. In a process that is expected to be completed by 2022, Nokia will deploy 300,000 radio units across several of the carrier’s spectrum bands. In addition, Nokia will provide its RAN equipment, including its AirScale Radio Access, AirScale BaseBand, and NetAct OSS solution. National regulators have divided India into 22 geographic circles for purposes of telecom maps; Nokia’s equipment will be used in nine of those circles.

In July 2020, Nokia announced that its CloudBand-based software products are powering Airtel’s Voice over LTE (VoLTE) network in India. The network supports over 110 million customers, making it the largest cloud-based VoLTE network in India and the largest Nokia-run VoLTE in the world.

In November 2020, Bharti Airtel had invited bids from equipment suppliers for Punjab and narrowed its selection to Nokia of Finland. The contract will soon be finalized with Nokia.

Huawei

Huawei gets most of its telecom revenue in India from the 4G network equipment segment, with Bharti Airtel and Vodafone Idea, as its clients. “Huawei, over the last 10 or 12 years, has become extremely good with their products to a point where I can safely today say their products at least in 3G, 4G that we have experienced is significantly superior to Ericsson and Nokia without a doubt. And I use all three of them,” Sunil Mittal had said in a panel discussion at the India Economic Summit organized by the World Economic Forum (WEF) on October 3, 2019.

In its 2019 annual report, Huawei had pointed out its bullish deployments in India. The vendor’s government cloud and network solutions have served the municipal services of India.

Huawei Enterprise’s OpenLab Delhi project has collaborated with 10-plus local partners to provide scenario solutions in smart-city and safe-city areas including smart campus, urban Internet of Things (smart lighting smart building converged command control, and intelligent video surveillance). These include Infosys, Tech Mahindra, Wipro, Tata and LEO among others.

The company has deployed its all-optical campus networks for airports, universities, and hotels. It also points to WAN interconnection routers which have seen large-scale commercial deployment in the country.

All had been going well for Huawei in India till June 2020, when there was a violent India-China clash at the LAC. In 2020, the company also faced an adverse US lobby that its wireless networking equipment could contain backdoors enabling surveillance by the Chinese government. Amid the pandemic, Huawei India also saw a change of guard in its top leadership. Jay Chen, was moved to an Asia-Pacific role after a 13 year stint here. With the pandemic sinking in along with LAC standoff, the new CEO David Li’s job has only got tougher.

Although officially Huawei has not been banned by the Indian authorities, and operators can decide who to select, the message is clear. The DoT in June 2020 directed state-owned BSNL and MTNL to exclude Chinese gear makers from supplying telecom equipment any further. The immediate impact was on the tender the PSUs had invited for planning, engineering, supply, installation, testing, commissioning, and annual maintenance of 4G mobile network in North, East, West, and South zones of BSNL and MTNL, Delhi and Mumbai on turnkey basis. The value of the order is estimated at ₹8700 crore.

Having said that, with the majority of its equipment in the Indian set-up being Chinese, India Huawei decoupling won’t be easy, and it will come at a cost, 30 percent more, that the industry will have to bear.

ZTE caters to Airtel and Vodafone Idea but its major success in India has been with BSNL, the vendor has built 40 percent of BSNL’s 3G network. As cross-border tensions between India and China raged, BSNL has been looking within the country for solutions as the government had moved to bar its use of Chinese equipment vendors. ZTE along with Nokia, had originally been chosen for the upgradation and expansion of its 2G and 3G network to 4G.

BSNL will not find it easy to replace ZTE, and neither is the PSU too excited by the idea. The system integrators as HCL, TCS, Infosys, and Tech Mahindra will be able to supply the software-centric core, and develop any software required for the network. The development of RAN equipment is more complex. Indian companies as Tejas Networks, Vihaan Networks, and Lekha Wireless have expertise in this area, but not exactly what BSNL needs for a 4G network. These companies have BTS with transmission capacities of 5-10 watts, whereas BSNL requires BTS with 40 watts transmission power. And then there is the added caveat of being the lowest bidder on price and massive delays in payments, which these companies may be able to ill- afford.

2021 will be a decisive year for the Chinese vendors in India.

Samsung

In 2020, Samsung completed building the vast Jio 400 million subscriber network, its first outside its home country. Its expectation for 2021 from the Indian market is in the vicinity of ₹3500 crore, as it continues to provide support, new software, and addition of new capacity to Jio. The vendor had an eight-year exclusive contract with the Reliance service provider. This arm of its business had received a contribution of around USD 1 billion for each of the last three years. This is in strong contrast to the share Samsung has in the global telecom equipment market in 2019, a mere 3 percent. Samsung also received an order for 100,000 miniature base stations in 2019 from Jio.

In the backdrop of the hostility being faced by the Chinese vendors, Samsung has been making an aggressive pitch for BSNL’s 4G LTE network and had been in dialogue with Airtel too. It is placing its bets on getting some part of the 5G business from Jio.

However, Samsung has two major hurdles in its pursuit of other telcos. One, all operators—barring Jio—require single RAN technology, where the same base station could be used for 2G, 3G, 4G, and even 5G. All established traditional vendors, Nokia, Ericsson, Huawei, and ZTE offer single RAN. Samsung doesn’t. This means that its telco clients would need other vendors in addition to Samsung for their 2G and 3G needs. This is why Samsung’s executives were keen to convince BSNL that it should focus solely on 4G.

Once the spectrum auction is held, then either through hardware and software expansion or refarming of the spectrum, a stream of orders are expected to be placed.

Handset manufacturing

The growing domestic handset manufacturing market and supportive policies by the government have ensured that India steadily builds on its device manufacturing capabilities.

As per a KPMG analysis, considering the estimated ₹14 lakh crore (USD 184.79 billion) market size for handsets by 2025, the addressable market for original equipment manufacturers (OEMs) is expected to be about ₹10 lakh crore and for components manufacturers, after deducting the conversions cost, handling charges, and margins, at ₹7 lakh crore by 2025.

By any stretch, this is a large and attractive market, and India offers an enviable opportunity for handset and components manufacturers to establish the manufacturing units in India. India can leverage this and capitalise on several existing strengths as well, the shifting, post COVID-19 geo-political sentiment to become a global leader in the handset, components, and electronics manufacturing industry.

With India continuously improving its ease of doing business and the launch of several attractive government initiatives such as the Production Linked Incentives (PLI), export incentives, Phased Manufacturing Program (PMP), M-SIPS, Make in India, and Digital India, alongside the National Digital Communications Policy (NDCP), FDI into the electronics manufacturing is sure to rise.

India has the second largest smartphone market globally, with the number of users expected to increase to 829 million by 2022. The annual production of mobile phones in India has increased to an estimated 320 million units valued at ₹2,25,000 crore in FY20. A turnover of USD 400 billion in electronic manufacturing in India by 2025 is envisaged and the production of one billion mobile handsets valued at USD 190 billion by 2025, out of which 600 million handsets valued at USD 100 billion could be exported.

India, a potential manufacturing powerhouse that has yet to realize its promise

Developing globally competitive manufacturing hubs represents one of the biggest opportunities for India to spur economic growth and job creation this decade. Their potential comes from several factors. First, this sector is well positioned to capitalize on India’s advantages in raw materials, manufacturing skill, and entrepreneurship. Second, they can tap into four market opportunities: export growth, import localization, domestic demand, and contract manufacturing.

Several conditions help explain why Indian manufacturers tend to create limited value. Some have to do with the costs of infrastructure and key inputs. Poor logistics causes delays and raises inventory costs; high prices for power and credit inflate operating expenses. Other conditions are inherent to the value chains. The small, fragmented companies that make up some value chains cannot operate productively, let alone at peak efficiency; cannot innovate quickly enough to keep up with competitors; and cannot command price premiums because they lack strong brands.

At the same time, many of India’s manufacturing value chains enjoy important advantages that could help power them to rapid growth. India’s natural resources and low-cost labor are a boon to the makers. The country’s large numbers of well-trained workers lend strength to skill-intensive value chains. And many manufacturing value chains in India operate in close proximity to strong domestic markets. The makers of fast-selling technology products, for example, enjoy ready access to millions of Indian consumers.

McKinsey has identified 11 manufacturing value chains, including electronics and semiconductors. The company has sought three sets of policy interventions that could—if enacted in conjunction with actions that manufacturing companies themselves can take—accelerate the growth of manufacturing value chains specifically.

Raising productivity. To become globally competitive, India’s manufacturing value chains must lift their productivity—in gross value added (GVA) output per full-time-equivalent worker—closer to global standards. They have a long way to go in this regard, their labor productivity and capital productivity are both low. Compared with India, manufacturing productivity in Indonesia is twice as high; in China and South Korea, productivity is four times higher. (Especially wide disparities can be seen in certain sectors.

For example, South Korea’s electronics manufacturing sector is 18 times more productive than India’s.) While other developing economies such as China have managed to catch up with advanced economies in capital productivity, India’s capital is only about two-thirds as productive as China’s.

Securing know-how and technology. While India’s established manufacturing value chains possess the technology and know-how, they need to compete with overseas peers, the less-developed value chains do not. To be sure, manufacturers themselves must source technology through acquisitions and alliances.

Accessing capital. The availability of capital will be the single-biggest obstacle to increasing India’s manufacturing GDP. With an incremental capital-to-output ratio between 4.5 to 6.0 (which could become more favorable with productivity gains), India’s manufacturing sector would need investments totalling USD1.0 trillion to USD1.5 trillion over the next seven years to double its GDP in the same timeframe, provided that India also raises its GVA capture in these value chains by 25 percent.

India has an opportunity to raise its manufacturing competitiveness and become a supplier of choice not only for its large consuming class but also for global markets.

GLOBAL TELECOM EQUIPMENT INDUSTRY SCENARIO

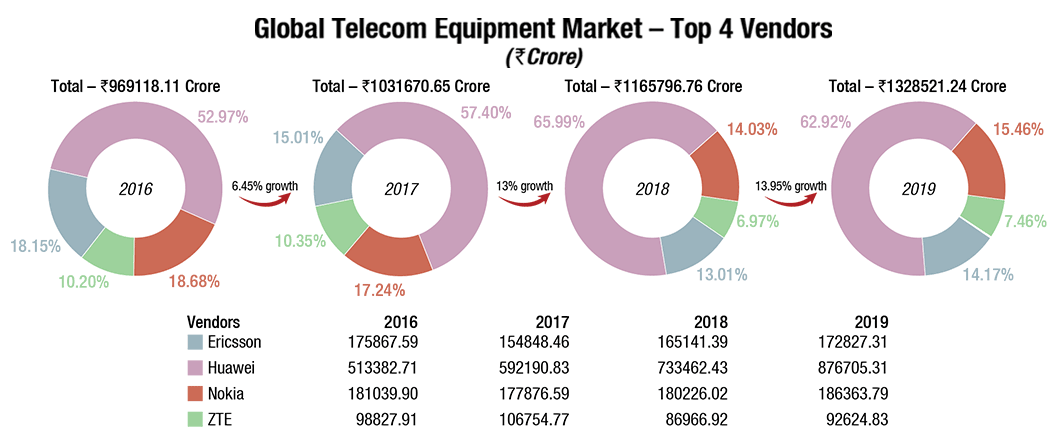

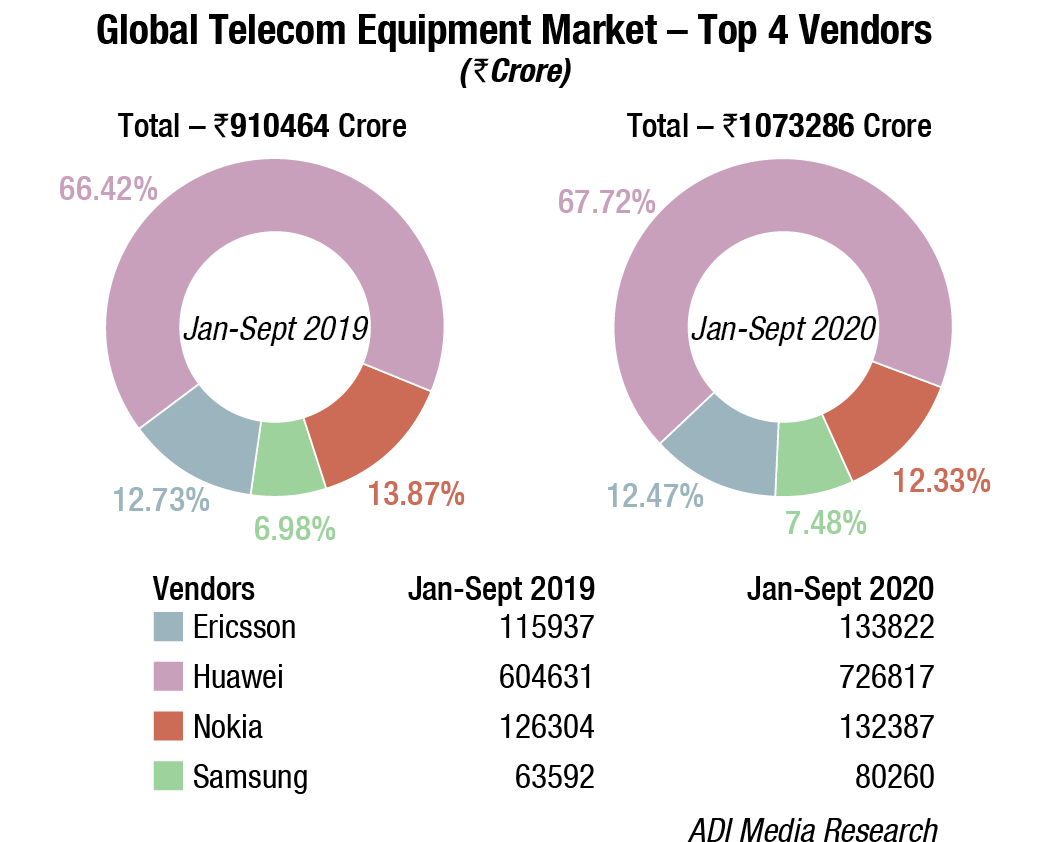

The annual results of the four leading global telecom companies, Huawei, Nokia, Ericsson, and ZTE indicate a combined revenue increase of 13.95 percent in 2019, from ₹1,165,796.76 crore in 2018 to ₹1,328,521.24 crore in 2019.

This trend was maintained. The combined revenues for the four companies for first three quarters in 2020, 1Q2020 to 3Q2020 show a 17.88 percent increase over the same period in 2019, from ₹901,464 crore in 1Q-3Q2019 to ₹1,073,286 crore in 1Q-3Q2020.

Telecom equipment market

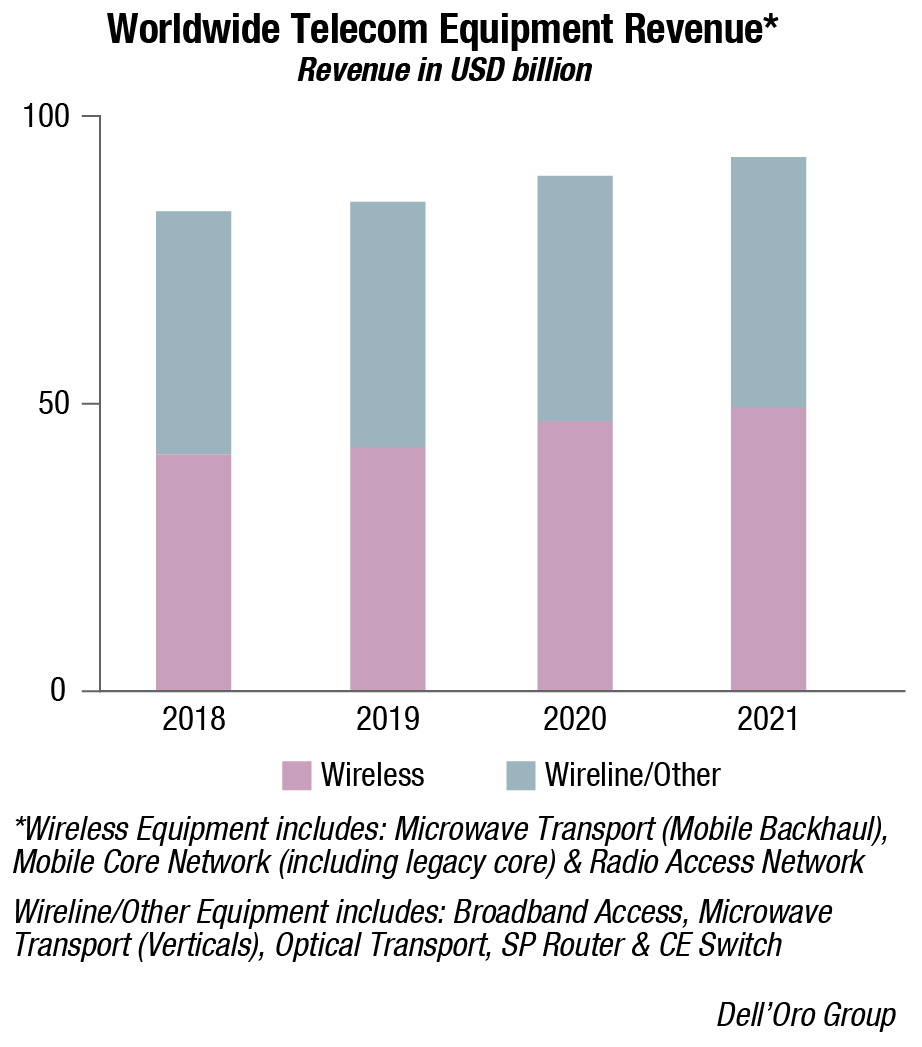

The overall telecom equipment market advanced 9 percent yoy during 3Q20 and 5 percent yoy for the 1Q20-3Q20 period. That market includes broadband access, microwave & optical transport, mobile core & radio access, SP router & carrier ethernet switch, reveal preliminary estimates by the Dell’Oro Group.

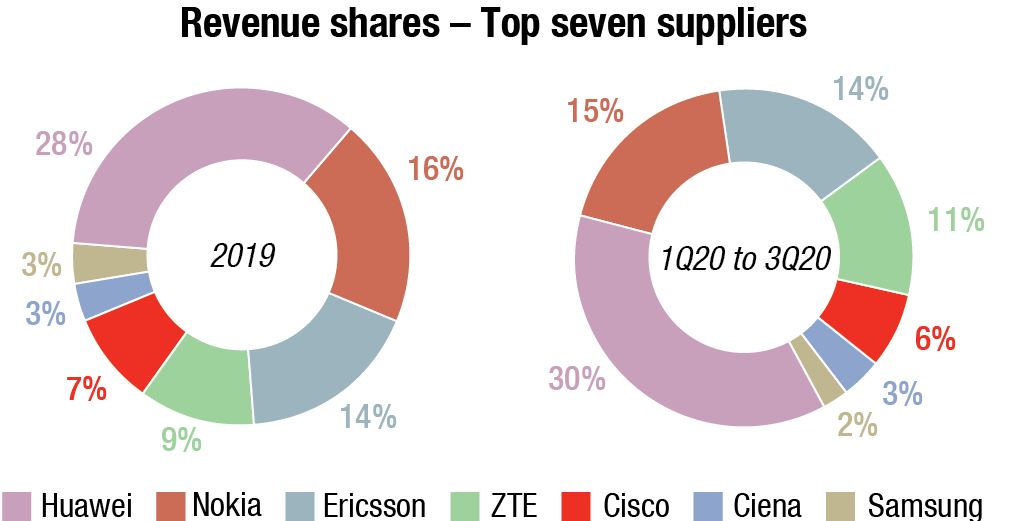

Revenue rankings remained stable between 2019 and 1Q20-3Q20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for more than 80 percent of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets.

Some global trends. Following the 4 percent yoy decline during 1Q20, the positive trends that characterized the second quarter extended into the third quarter, underpinned by strong growth in optical transport and multiple wireless segments including 5G RAN, 5G core, and microwave mobile backhaul. Technology segments that were impacted more materially by COVID-19 and the lockdowns during 1Q20 continued to stabilize in the quarter.

Preliminary estimates indicate increasing mobile infrastructure and optical transport revenues offset declining investments in microwave rransport and SP routers & CES for the 1Q20-3Q20 period.

The overall telecom equipment market continued to appear disconnected from the underlying economy. While the on-going transition from 4G to 5G is helping to offset reduced CapEx in slower-to-adopt mobile broadband markets, the disconnect may be attributed to the growing importance of connectivity and the nature of this recession being different than in other downturns improving the visibility for the operators.

With investments in China outpacing the overall market, Huawei and ZTE collectively are estimated to have gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40 percent of the global telecom equipment market.

The total telecom equipment market is projected to advance 5 percent to 6 percent in 2020 and 3 percent to 4 percent in 2021. Total telecom equipment revenues are projected to approach USD 90 billion to USD 95 billion in 2021.

Where are we heading?

The world is breaking apart, literally and metaphorically. And the telecom industry is witnessing its own breakup after a long period of globalization that culminated in the development of a single, international 5G standard. Despite fears that some countries or companies would fork these efforts in pursuit of commercial advantage, network operators in all regions can today invest in the same underlying technology, even if attempts to harmonize spectrum allocation have proven less successful. Such coordination never happened in the 2G, 3G and 4G eras, and it promises benefits for the owners and users of mobile technology. But the system that produced it has recently taken a pounding.

The trade war against China initiated by Donald Trump is the main culprit. That pits the world’s two technological superpowers against each other and features Huawei, the world’s biggest 5G vendor, as a protagonist. Succumbing to US pressure, the UK and many other countries have banned Huawei from the core part of its 5G networks and severely curtailed its presence in other areas, leading the industry to fracture along geopolitical fault lines. Huawei would become even more dominant in China as well as friendly African and Asian countries, leaving US allies to Western rivals such as Ericsson and Nokia. This could presage a return to the old days of different regional standards, as vendors pursue development in isolation.

It remains unlikely in 5G. The first 5G standard is already live in different parts of the world and the industry has a clear 5G destination in view. A fork at this stage would mean wasting billions of dollars in research and development costs. It would risk derailing telco plans and could drive up equipment prices. Few in the industry are seriously worried that 5G will fragment.

The real danger is to what comes after 5G. While standards bodies have yet to lay out any firm parameters for 6G, research institutions and 5G stakeholders are already at work on technologies that could one day fall under the 6G umbrella.

Trade wars and security concerns are not the only threat to future standardization. They could also be weakened by the recent proliferation of new groups trying to solve old problems in a less regimented way. The gravitation of service providers toward open source and more software-based technologies – as they try to break the stranglehold of several giant vendors – explains many of the recent initiatives.

The world has had several competing standards before, but not amid the levels of hostility, protectionism, and security-related anxiety that exist today. Political leaders have bought into the idea that 5G is the most important technology of the 21st century, raising the stakes even higher for 6G. India and Russia are determined to nurture their own equipment makers, while the UK says Huawei could face tougher restrictions as the market diversifies. Desperate to avoid Chinese technology, even Vietnam wants to build its own mobile networks. A 6G arms race could be the telecom story that defines the decade, aptly sums up Iain Morris, News Editor, Light Reading.

Nokia: Creating the technology to connect the world

Nokia Solutions and Networks India Private Limited

April 1, 2019-March 31, 2020. Total income of Nokia India for the year ended March 31, 2020 stood at ₹12,140.34 crore and net profit for the year at ₹663.24 crore. The company is engaged in the business of supplying telecommunication equipment and providing services in the nature of installation, commissioning, erection and maintenance, and managing telecommunications network of service providers. The company undertakes software development activities relating to the networks business, the costs of which are recharged to the parent company, in accordance with the underlying agreements. Similarly, the company provides remote network management and other related services in the nature of technical and operational support, the cost of which is also recharged to the parent company and other fellow subsidiaries in accordance with underlying agreements.

During March 2020, the coronavirus (COVID-19) outbreak became a global pandemic and it has had a significant negative effect on the global economy and financial markets as many countries imposed travel restrictions and quarantine measures as well as ordered non-essential businesses to temporarily close in an effort to slow down the spread of the virus. The virus as well as the measures taken to combat the virus together increased the risks related to supply chain operations, demand for products and services, access to financing as well as health and well-being of employees. The operating model of the company remains unchanged. To date the company has not seen, nor expects to see in the near future, a major impact on its operations by the coronavirus

Nokia Corporation

January-September 2020. Nokia net sales decreased 7 percent, primarily driven by lower net sales of Mobile Access services within Networks. The services-related declines in the first nine months of 2020 were primarily driven by lower levels of network deployment services. On a constant currency basis, Nokia net sales decreased 6 percent, compared to the same period in 2019. Excluding one-time Nokia Technologies net sales of approximately EUR 20 million in the first nine months of 2020 and EUR 60 million in the first nine months of 2019, Nokia net sales decreased 7 percent.

Additionally, the first nine months of 2020 net sales were impacted by unique dynamics in China and COVID-19. In China, a high level of competitive intensity had a particularly negative impact on Networks, due to prudent approach toward deal-making. In the first nine months of 2020, the company estimated that factory closures related to COVID-19 had an approximately EUR 200 million negative net impact on net sales; with the majority of these net sales expected to be shifted to future periods, rather than being lost.

Nokia Solutions and Networks India Private Limited Financial highlights |

|

Particulars |

(₹Crore) Particulars Year ended Mar 31, 2020 |

| Total income | 6658.9 |

| Revenue | |

| Revenue from operations | 12140.34 |

| Other income | 320.11 |

| Total income | 12460.45 |

| Total expenses | 11369.63 |

| Profit/before tax | 1090.82 |

| Net profit after tax | 663.24 |

| Total comprehensive income | 635.33 |

Segment revenue |

|

| Software development | 1313.27 |

| Networks business | 9417.73 |

| Remote network management and other support | |

| services | 1282.92 |

| Other ancillary support services | 126.42 |

| EPS (₹) | 31.59 |

| *Alcatel Lucent financials not included. Those are reported separately in India as that’s a separate legal entity. | |

In Nokia Enterprise, the company continued to make great progress and delivered 18 percent growth in net sales. The strong growth in net sales to enterprise customers was primarily driven by increased demand for mission-critical networking solutions in industries including utilities and the public sector, with continued momentum in private wireless solutions. Net sales also benefitted from the timing of completions and acceptances of certain projects.

Importantly, Nokia continued to deliver improvements in gross margin and operating margin. In Networks, gross profit and operating profit increased, driven primarily by improved performance in Mobile Access, where the company continued to drive improvements in portfolio by strengthening roadmaps, reducing product costs and improving product performance.

In the first nine months of 2020, the company generated an operating profit, compared to an operating loss in first nine months of 2019. The improvement was primarily driven by lower operating expenses and a higher gross profit, partially offset by a net negative fluctuation in other operating income and expenses. The lower operating expenses were primarily due to lower amortization of acquired intangible assets, continued progress related to Nokia’s cost savings program and lower travel and personnel related expenses due to COVID-19, partially offset by higher investments in 5G R&D to accelerate product roadmaps and cost competitiveness in Mobile Access. The net negative fluctuation in other operating income and expenses was primarily due to Nokia’s venture fund investments, a lower gain on defined benefit plan amendment and loss allowances for trade receivables, partially offset by lower restructuring and associated charges.

Nokia Corporation Financial highlights (Unaudited) (EUR million) |

|||

| Particulars | Year ended Dec 31, 2019 | Q1-Q3’20 | Q1-Q3’19 |

| Net sales | 23315 | 15299 | 16412 |

| Operating profit/(loss) | 485 | 444 | (318) |

| Operating margin % | 2.1% | 2.9% | (1.9)% |

| EPS | 0.22 | 0.11 | 0.07 |

NET SALES |

|||

| By Segment | |||

| Networks | 18209 | 11825 | 12770 |

| Nokia Software | 2767 | 1795 | 1898 |

| Nokia Technologies | 1487 | 1020 | 1112 |

| Group Common and Other | 952 | 691 | 720 |

| By Region | |||

| Asia-Pacific | 4556 | 2740 | 3173 |

| Europe | 6620 | 4721 | 4725 |

| Greater China | 1843 | 955 | 1374 |

| Middle East & Africa | 1876 | 1333 | 1257 |

| North America | 6948 | 4830 | 4877 |

| By Customer | |||

| Communication service providers | 12561 | 13742 | |

| Enterprise | 1070 | 910 | |

| Licensees | 1020 | 1112 | |

In the first nine months of 2020, Nokia generated a profit of EUR 187 million, compared to a loss of EUR 545 million in the first nine months of 2019. The improvement was primarily due to generating an operating profit, compared to generating an operating loss in the year-ago period, and a net positive fluctuation in financial income and expenses, partially offset by a net negative fluctuation in income taxes.

January-December 2019. While Nokia’s financial performance in 2019 was below expectations, driven by challenges in mobile access and cash generation, Nokia ended the year with a solid quarter and a plan in place. Rajeev Suri was President and CEO then.

Net sales in 2019 were EUR 23315 million, an increase of EUR 752 million, or 3 percent, compared to EUR 22563 million in 2018. The increase in net sales was primarily due to an increase in Networks net sales, and, to a lesser extent, Nokia Software net sales. This was partially offset by a decrease in Group Common and Other and Nokia Technologies net sales.

Gross profit in 2019 was EUR 8326 million, a decrease of EUR 120 million, or 1 percent, compared to EUR 8446 million in 2018. The decrease in gross profit was primarily due to lower gross profit in Networks, Group Common and Other and Nokia Technologies, partially offset by lower product portfolio integration-related costs and higher gross profit in Nokia Software. Gross margin in 2019 was 35.7 percent, compared to 37.4 percent in 2018. In 2019, gross profit included product portfolio integration-related costs of EUR 123 million, compared to EUR 548 million in 2018.

Operating expenses. Research and development expenses in 2019 were EUR 4411 million, a decrease of EUR 209 million, or 5 percent, compared to EUR 4620 million in 2018. Research and development expenses represented 18.9 percent of our net sales in 2019 compared to 20.5 percent in 2018. Selling, general, and administrative expenses in 2019 were EUR 3101 million, a decrease of EUR 362 million, or 10 percent, compared to EUR 3463 million in 2018. Selling, general, and administrative expenses represented 13.3 percent of the net sales in 2019 compared to 15.3 percent in 2018. Selling, general and administrative expenses included transaction and integration-related costs of EUR 50 million, compared to EUR 207 million in 2018.

Other operating income and expenses in 2019 was a net expense of EUR 329 million, a decrease of EUR 93 million, compared to a net expense of EUR 422 million in 2018. Other operating income and expenses included restructuring and associated charges of EUR 435 million in 2019 compared to EUR 319 million in 2018. In 2019, the company recorded a non-cash impairment charge to other operating income and expenses of EUR 29 million, compared to EUR 48 million in 2018.

Operating profit in 2019 was EUR 485 million, a change of EUR 544 million, compared to an operating loss of EUR 59 million in 2018. The operating margin in 2019 was 2.1 percent, compared to approximately breakeven in 2018. Financial income and expenses was a net expense of EUR 341 million in 2019, an increase of EUR 28 million, or 9 percent, compared to a net expense of EUR 313 million in 2018. Profit before tax in 2019 was EUR 156 million, an increase of EUR 516 million compared to a loss of EUR 360 million in 2018. Income taxes was a net expense of EUR 138 million in 2019, a decrease of EUR 51 million compared to a net expense of EUR 189 million in 2018.

Nokia Networks

Net sales. Networks net sales in 2019 were EUR 18209 million, an increase of EUR 805 million, or 5 percent, compared to EUR 17404 million in 2018. Mobile Access net sales were EUR 11655 million in 2019, an increase of EUR 382 million, or 3 percent, compared to EUR 11273 million in 2018. IP Routing net sales were EUR 2921 million in 2019, an increase of EUR 376 million, or 15 percent, compared to EUR 2545 million in 2018. Optical Networks net sales were EUR 1752 million in 2019, an increase of EUR 146 million, or 9 percent, compared to EUR 1606 million in 2018. Fixed Access net sales were EUR 1881 million in 2019, a decrease of EUR 99 million, or 5 percent, compared to EUR 1980 million in 2018.

Gross profit. Networks gross profit in 2019 was EUR 5577 million, a decrease of EUR 458 million, or 8 percent, compared to EUR 6035 million in 2018. Networks gross margin in 2019 was 30.6 percent, compared to 34.7 percent in 2018.

Operating profit. Networks operating profit was EUR 665 million in 2019, a decrease of EUR 108 million, or 14 percent, compared to EUR 773 million in 2018. Networks operating margin in 2019 was 3.7 percent compared to 4.4 percent in 2018.

Nokia Technologies

Net sales. Nokia Technologies net sales in 2019 were EUR 1487 million, a decrease of EUR 14 million, or 1 percent, compared to EUR 1501 million in 2018. In 2019, the EUR 1487 million of net sales related entirely to patent and brand licensing. In 2018, EUR 1476 million of net sales related to patent and brand licensing and EUR 25 million of net sales related to digital health and digital media.

Gross profit. Nokia Technologies gross profit in 2019 was EUR 1459 million, a decrease of EUR 20 million, and operating loss was EUR 490 million in 2019.

Group Common and Other

Net sales. Group Common and Other net sales in 2019 were EUR 952 million, a decrease of EUR 73 million, or 7 percent, compared to EUR 1025 million in 2018.

Gross profit. Group Common and Other gross profit in 2019 was EUR 34 million, a decrease of EUR 120 million, or 78 percent, compared to EUR 154 million in 2018. Group Common and Other gross margin in 2019 was 3.6 percent compared to 15.0 percent in 2018.

Outlook

Cloud and network services creates value for both service providers and enterprise customers as demand for critical networks accelerates, leading the transition to cloud-native software and as-a-service delivery models. It is expected to deliver comparable operating margin in the mid-single digit range in 2021, and significant improvement over the longer term.

Nokia’s outlook for 2020 and 2021 remains unchanged. In connection with its 3Q20 results, Nokia expects comparable operating margin of 7-10 percent in 2021.

Mobile Networks’ immediate focus will be on executing its turnaround and regaining 5G leadership. It will focus on leadership in ORAN and vRAN, maintaining scale with CSP customers and growing its enterprise-dedicated Private Wireless Networks business. It is expected to deliver comparable operating margin of around zero percent in 2021, and significant improvement over the longer term.

Network Infrastructure (previously IP and fixed networks) will focus on the building blocks and essential solutions of critical networks, using its technology leadership in IP networks, optical networks, fixed networks, and Alcatel submarine networks to drive digitalization across all industries. It is expected to deliver comparable operating margin in the high single digit range in 2021, and gradual improvement over the longer term.

Nokia Technologies will continue to monetize and grow the value of Nokia’s intellectual property and licensing revenue by investing in innovation and its world-leading patent portfolio as well as pursuing other licensing opportunities. It is expected to deliver a slight improvement in comparable operating profit in 2021, relative to 2020, and stable performance over the longer term.

Group Common and Other, which predominately consists of corporate costs, is expected to be run in a lean manner, with costs directly embedded into the business groups whenever possible.

Group Common and Other is expected to deliver a comparable operating loss of approximately EUR 200 million in 2021.

Pekka landmark

Pekka landmark“We are positioning Nokia to lead in a changing world. The world faces big problems: environmental issues, resource scarcity, inequality and stalling productivity. Technology will be an essential part of the solution. As a result, we will see an increase in critical networks, which will extend to all corners of society.Critical networks are advanced networks that run mission-critical services for companies and societies. They are becoming increasingly important and extending to all corners of society. This means that Nokia’s addressable market for critical networks with CSPs, webscales, and enterprises is also extending.Customers are using a best-of-breed approach to build these networks, selecting network elements from multiple individual vendors who are able to offer the best performance per total cost of ownership. Nokia is aiming to be the technology leader in the areas it chooses to play in. We are well positioned to be a trusted partner for critical networks. We are experienced in creating both carrier-grade performance networks and working with the world’s most demanding webscales. We have a strong position in technologies that are important for critical networks, such as open and virtualized radio access networks and we are on course for a 100 percent cloud-native software portfolio.Nokia also sees a market evolution where value in critical networks will gradually shift from monolithic systems toward silicon, software and services; where the importance of cloud-native and open solutions will increase; and where value will be captured through different business models.We are one of the leading network equipment providers to evolve monolithic core networks to virtualized core networks that are fully cloud-native. One of our focus areas will be to continue building out our capabilities in this area to ensure technology and market leadership. We are well positioned to pivot to new business models as our customers’ needs evolve and require more as-a-service solutions.Continuing to strengthen Nokia’s long-term research and global patent portfolio is a key element in securing technology leadership. Nokia’s ambition is to lead in all domains including innovation, products, standardization and patents. Committing to long-term investment in research and innovation will allow us to anticipate and capitalize on industry changes and position us at the front of the pack when new technology windows open.””The spokesperson is President and CEO, Nokia Corporation, October 2020.”

Ericsson: Building a stronger company long term

Ericsson has been at the forefront of innovation for more than 140 years and as the market continues to transform and user demands continue to change – so does Ericsson.

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help its customers go digital, increase efficiency, and find new revenue streams. The company’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world.

Ericsson India Private Limited

January-December 2019. The company revenue touched ₹6910.97 crore in 2019 as compared with ₹6563.94 crore in the previous year. Ericsson India’s revenue contribution was again stable at 4 percent.

Ericsson

January-September 2020. Gross margin increased to 40.2 percent (37.5%) driven by improvements primarily in Networks and Digital Services, mainly due to business mix and a higher share of software sales. Sales increased by 1 percent. Sales adjusted for comparable units and currency increased by 2 percent.

Operating income increased YoY to SEK 16.8 (4.4) billion. The operating income was impacted by increased restructuring charges of SEK -1.3 (-0.5) billion. 3Q19 was negatively impacted by a provision of SEK -11.5 billion for the settlement with SEC and DOJ and positively by a refund of social security costs of SEK 0.9 billion. In addition, operating income 1Q19 was positively impacted by capital gains (SEK 0.8 billion) related to the media businesses, and a reversal of a provision for impairment of trade receivables (SEK 0.7 billion) following customer payment.

Net income year to date improved to SEK 10.4 (-2.6) billion.

Networks grew organically by 13 percent and reported a gross margin of 46.7 percent. This reflects high activity levels in North East Asia and North America. Underlying business fundamentals remain strong in North America driven by consolidation in the US operator market, pending spectrum auctions, and increased demand for 5G. The 5G contracts in Mainland China have developed according to plan, contributing positively to profits in 3Q and are expected to improve further.

Business in Europe grew based on several footprint gains. While the pandemic has hurt revenues for several of company’s customers, and in some cases, this has led to a reduction of CapEx, the company has not seen any negative impact on business, largely due to footprint gains. However, the pandemic negatively impacted sales in Latin America and Africa.

| Ericsson Financial statement Jan-Sept

SEK million |

||

| Particulars | 2020 | 2019 |

| Net Sales | 162.8 | 160.8 |

| Gross income | 65.5 | 60.4 |

| Gross margin (%) | 40.2 | 37.5 |

| Operating Income (Loss) | 16.8 | 4.4 |

| Operating Margin (%) | 10.3 | 2.8 |

| Net Income (Loss) | 10.4 | -2.6 |

| EPS Diluted, SEK | 3.00 | -0.67 |

| Gross margin Excluding Restructuring Charges (%) | 40.7 | 37.6 |

| Operating Income Excluding Restructuring Charges | 18.1 | 13.9 |

| Operating Margin Excluding Restructuring Charges (%) | 11.1 | 8.6 |

Operating income increased to SEK 9.2 (7.2) billion. YoY, with an increase in operating margin to 22 percent (18.4%). Operating margin excluding restructuring charges increased to 22.7 percent (18.4%). Operating expenses increased by SEK -1.1 billion to SEK -10.3 billion due to increased restructuring charges, accelerated R&D investments in 5G and in a broader portfolio of antenna and site solutions as well as an increase in SG&A expenses driven by the increased Group investments in digitalization and compliance. Operating income increased by SEK 3.9 billion QoQ while operating income excluding restructuring charges increased by SEK 3.8 billion supported by seasonally higher sales, improved gross margin and seasonally lower operating expenses.

Net sales rolling four quarters were SEK 161.1 billion and operating margin excluding restructuring charges was 17 percent.

Digital Services continued to make good progress on the execution of the turnaround plan, transforming the business and increasing software sales. The gross margin improved to 43.5 percent, supported by increased software sales and improvements in the underlying business. Cloud-native 5G core portfolio shows very positive momentum with a high win-ratio and a significant number of new customer contracts. The company is selectively increasing R&D investments to accelerate its growth portfolio to capture market opportunities. However, sales in legacy portfolio is declining faster than earlier predicted. In the short term, this shortfall will not be compensated by the growth in new offerings and therefore sales volume is lower than expected. With weaker sales in combination with higher R&D investments, there is a risk of further delay in reaching the 2020 operating margin target for Digital Services.

| Ericsson Financial statement

SEK million |

|

| Particulars | Year ended Dec 31, 2019 |

| Income | |

| Net sales | 227,216 |

| Cost of sales | -142,392 |

| Gross income | 84,824 |

| Other income | 2,350 |

| Expense | -64,215 |

| Operating income (loss)/profit | 10,564 |

| Financial income and expenses | -1802 |

| Income after financial items | 8,762 |

| Taxes | -6,922 |

| Net income (loss)/profit | 1,840 |

| EPS (SEK) | 0.67 |

| Balance Sheet | |

| Current assets | 153,914 |

| Non-current assets | 122,469 |

| Total assets | 276,383 |

| Total equity | 81,878 |

| Total liabilities | 194,505 |

| Total equity and liabilities | 276,383 |

Reported operating income (loss) was SEK -0.6 (-0.7) billion. Operating income (loss) excluding restructuring charges was SEK -0.5 (-0.5) billion. Operating expenses excluding restructuring charges remained flat YoY. While rationalization of the legacy portfolio continues, R&D investments are made in the growth portfolio of 5G and cloud-native products.

Operating income as well as operating income excluding restructuring charges improved QoQ, supported by seasonally higher sales and lower operating expenses.

Net sales rolling four quarters were SEK 37.8 billion and operating margin excluding restructuring charges was -7 percent.

Managed Services delivered a gross margin of 20.1 percent. Reported gross margin increased to 19.9 percent from 17.1 percent QoQ. Gross margin excluding restructuring charges increased to 20.1 percent from 17.2 percent QoQ, mainly due to higher variable sales, efficiency gains, and timing of costs. Sales declined by 14 percent YoY. Sales adjusted for comparable units and currency decreased by 9 percent YoY, mainly due to reduced variable sales in a large contract in North America, post the merger between two large operators, and transfer of a contract from Ericsson to an associated company. Sales in Managed Services IT showed growth mainly in market areas North America and in South East Asia, Oceania, and India.

Operating income was SEK 0.5 (0.6) billion. Operating income excluding restructuring charges was SEK 0.5 (0.6) billion. The decline was mainly due to lower sales. Operating income increased to SEK 0.5 billion from SEK 0.3 billion QoQ driven by higher gross margin.

Net sales rolling four quarters were SEK 23.8 billion. Operating margin excluding restructuring charges rolling four quarters was 7.4 percent.

Emerging Business and Other reported a gross margin of 30.5 percent. IoT platform sales grew by more than 40 percent despite an impact on demand from COVID-19. In the quarter the company announced plans to acquire Cradlepoint, which will strengthen its ability to grow in the 5G enterprise market alongside existing dedicated networks and IoT portfolio. Cradlepoint will drive revenues for customers as wireless WAN gains further penetration. Cradlepoint will operate as a standalone subsidiary within Ericsson.

Reported operating income (loss) was SEK -0.4 (-11.3) billion. Operating income (loss) excluding restructuring charges and items affecting comparability was SEK -0.5 (-0.8) billion.

Media Solutions reported operating income was SEK -0.2 (-0.3) billion including Ericsson’s 49 percent share in earnings of the MediaKind business.

Red Bee Media’s operating income improved and reached break even and iconectiv delivered solid profitability.

Net sales rolling four quarters were SEK 6.5 billion.

Patent licensing continues to perform well based on strong IPR portfolio, even though revenues decreased in the third quarter as one of company’s licensees experienced lower sales volumes. The company is approaching several important contract renewals. Ericsson is confident in the value of broad patent portfolio, including a strong position in 5G and will seek to maximize the net present value of patent estate that has been built over time through large R&D investments. Depending on timing of the agreement renewals, company may see gaps in IPR revenues in 2021 and 2022.

The company has increased its footprint in China through 5G contract awards from all three major operators in China.

Ericsson currently has 108 commercial 5G agreements and contracts with unique communications service providers, of which 58 are publicly announced 5G deals, including 60 live commercial 5G networks.

Ericsson’s contracts span Radio Access Network (RAN) and Core network deployments, enabled by products and solutions from the Ericsson Radio System and Ericsson Cloud Core network portfolios. Ericsson 5G deployments include 5G non-standalone, 5G standalone, and Ericsson Spectrum Sharing technology. They also include cloud native capabilities with 5G Core.

January-December 2019. In 2019, sales increased by 8 percent driven by sales growth in Networks. Gross margin improved to 37.3 percent (32.3%) with improved gross margins in Networks, Digital Services, and Managed Services. Operating income was SEK 10.6 (1.2) billion. Operating income was SEK 22.1 billion (9.7 percent operating margin) excluding restructuring charges of SEK –0.8 billion and costs of SEK –10.7 billion related to a resolution with the US SEC and DOJ.

Networks represented 68 percent (66%) of Group net sales in 2019. The segment solutions support all radio-access technologies and offer hardware, software and related services for both radio access and transport. Sales increased by 12 percent in 2019 to SEK 155.0 (138.6) billion. Sales adjusted for comparable units and currency increased by 6 percent. The sales increase was primarily in the US, South Korea, Italy, Germany and Saudi Arabia, driven by operator investments in LTE and 5G networks. The Networks share of IPR licensing revenues was SEK 7.9 (6.5) billion.

Digital Services represented 18 percent (18%) of Group net sales in 2019. Sales increased by 5 percent in 2019 driven by growth in North America. Services sales increased driven by customer support. Sales in the new portfolio grew by 7 percent driven by customer investments in 4G and 5G, while sales in legacy products declined. Sales adjusted for comparable units and currency decreased by 1 percent.

Managed Services represented 11 percent (12%) of Group net sales in 2019. Sales decreased by 1 percent. Sales adjusted for comparable units and currency decreased by 4 percent, mainly as a result of customer contract exits.

Emerging Business and Other segment represented 3 percent (4%) of Group net sales in 2019. Sales decreased by 19 percent in 2019 due to the 51 percent divestment of MediaKind in February 2019. Sales adjusted for comparable units and currency increased by 14 percent driven by growth in the iconectiv business through a multi-year number portability contract in the US.

Outlook

Ericsson continues to closely monitor the COVID-19 situation and the Global Crisis Management Council and task forces in each market area have been activated since January. The global RAN equipment market is estimated to grow by 8 percent (previously: 4% growth) for full-year 2020. China is expected to grow by 33 percent and the global RAN market without China is expected to be flat in 2020. The global RAN equipment market is estimated to be flat at 0 percent CAGR for 2019-2024. The momentum in North America remains strong and the market is estimated to grow by 4 percent in 2020.

The year to date (YTD) results are expected to strengthen the company’s confidence in delivering on the Group targets for 2020. With the weaker sales in Digital Services, in combination with higher R&D investments, the company foresees a risk of further delay in reaching the 2020 operating margin target in this segment. The 2022 operating margin target for Digital Services of 10-12 percent remains.

In terms of net sales, 3-year average reported sales seasonality between 3Q and 4Q is +17 percent. The revenues from current IPR licensing contracts are expected to reach approximately SEK 10 billion for 2020. During 2021 and 2022 the company may see temporarily lower IPR licensing revenues as important agreements are up for renewal.

Borje Ekholm

Borje Ekholm“Amid the continuing global COVID-19 pandemic and with more than 80 percent of our people working from home, we keep on executing on our focused strategy. We continue to win footprint in several markets leveraging our competitive 5G portfolio. The gross margin improved in all segments in the third quarter and reached 43.2 percent, the highest since 2006. With the acquisition of Cradlepoint, expected to close in 4Q, we are making further progress in our strategy to build an enterprise business. COVID-19 has so far had limited impact on our business, but we are closely monitoring any signs of a change in the situation. The year-to-date results strengthen our confidence in delivering on the 2020 Group target.We are committed to continue improving our Ethics and Compliance program. Through driving stronger management ownership and accountability for compliance, we are also reinforcing our commitment to responsible business practices and a stronger corporate culture. Our people should always be able to speak up and we expect Ericsson leaders to operate with integrity at all times.

Open RAN is a hot topic in our industry today and Ericsson is a strong supporter of openness and actively engages in alliances, such as 3GPP, ONAP, and the O-RAN alliance. In the years to come, networks will gradually evolve, as will the current open standards. At the same time 5G is ready and happening now so focus must be on providing early access to 5G networks to enable the broader ecosystem to innovate at scale.We remain positive on the longer-term outlook for the industry and Ericsson. The year-to-date results strengthen our confidence in delivering on the 2020 Group target.Stay healthy and well.”The author is President and CEO, Ericsson, October 2020.

Huawei: Building a Fully Connected, Intelligent World

Huawei Telecommunications India Pvt. Ltd.

The company recorded a total income of ₹6658.9 crore in 2019-20, as against ₹12884.1 crore in 2018-19. The total expenditure was ₹6192.7 crore in 2019-20, as against ₹11940.3 crore in 2018-19, and net profit ₹249.5 crore in 2019-20, as against ₹623.3 crore in 2018-19. These are the latest results available for the Indian arm.

There were media reports that Huawei Technologies Co had cut its India revenue target for 2020 by up to 50 percent and was laying off more than half of its staff in the country, end-July 2020. And that the company was targeting USD 350-500 million in revenue for 2020, compared with roughly USD 700-800 million it was aiming for earlier in India.

Feng Tian and Xianli Cao were appointed as additional directors of the company with effect from April 6, 2020. Jinge Li and Qiuen Peng had resigned from the board on April 6, 2020. Xinongwei Li was appointed as additional director and Mingjie Chen resigned with effect from May 18, 2020.

Huawei Investment & Holding Co. Limited

January-September 2020. The company, on October 23, 2020 announced its business results for the first three quarters of 2020. During this period, Huawei generated CNY 671.3 billion in revenue, an increase of 9.9 percent over the same period last year. The company’s net profit margin in this period was 8 percent. Throughout the first three quarters of 2020, Huawei’s business results basically met expectations.

As the world grappled with COVID-19, Huawei’s global supply chain was being put under intense pressure and its production and operations face significant challenges. The company continued to do its best to find solutions, survive and forge forward, and fulfill its obligations to customers and suppliers.

Moving forward, Huawei’s strategy is to leverage its strengths in ICT technologies such as AI, cloud, 5G, and computing to provide scenario-based solutions, develop industry applications, and unleash the value of 5G networks along with its partners. Its stated goal is to help enterprises grow their business and help governments boost domestic industry, benefit constituents, and improve overall governance.

ICT has become a cornerstone of modern society and the main driver behind sustainable social, economic, and environmental development. Huawei believes that rapid and healthy development within the ICT industry will rely on open collaboration and mutual trust across the global industry, so it will continue working closely with its global partners and using its innovative ICT technologies to create greater value for customers despite the complex situation it is currently facing. The company will continue contributing to pandemic responses, economic growth, and social progress.

January-September 2019. On October 16, 2019 Huawei had announced its third-quarter results of 2019 showing a growing business with 24.4 percent year on year (YOY) growth on the face of the US trade ban.

Huawei’s revenue has rose to 610.8 billion yuan ($86.2 billion) with a net profit margin of 8.7 during the timeline.

The revenue figure was generated by a combined force of ICT, Carrier, Cloud, Consumer Busines, and other Enterprise solution businesses.

Its smartphone business had grown steadily and shipment in the first three quarters of 2019 exceeded 185 million units, representing a year-on-year increase of 26 percent.

The company also saw rapid growth in other new businesses like PCs, tablets, wearables, and smart audio products.

This was the second earning report coming under the shadow of US trade ban, which was imposed on Huawei in May due to allegation of security threat by its equipment. Huawei had repeatedly responded that the claims made by the US are completely false.

Huawei Telecommunications India Pvt. Ltd. |

|

| Standalone Financial Results (2019-20) | |

Particulars |

₹Crore |

| Total income | 6658.9 |

| Total expenditure | 6192.7 |

| Profit before tax | 466.2 |

| Net profit | 249.5 |

Total comprehensive |

|

| Income of the year | 248.4 |

| Revenue from operations | 6581.3 |

| Other income | 77.6 |

Assets |

|

| Total non-current assets | 1536.8 |

| Total current assets | 2364.7 |

| Total assets | 3901.5 |

Equity and liabilities |

|

| Total equity | 1541.7 |

| Total liabilities | 2359.8 |

| Total equity and liabilities | 3901.5 |

| EPS (₹) | 415.86 |

| Ministry of Corporate Affairs, Govt. of India | |

This company had estimated about USD 10 billion loss in annual revenue under the trade restrictions.

January to December 2019. Revenue in 2019 totaled CNY 858,833 million, representing an increase of 19.1 percent year-on-year (YoY). Net profit grew by 5.6 percent year-on-year to CNY 62,656 million.

- As the consumer business grew rapidly and contributed a larger share to total revenue in 2019, the company’s gross profit margin dropped by 1 percentage point from 2018.

- While the company increased its investment in future-oriented research and innovation, branding, and sales channel development, Huawei continued with its management transformation to increase efficiency. As a result, there was a slight increase in the total operating expenses as a percentage of revenue, up 0.1 percentage points compared with 2018.

- As interest expenses related to financing activities increased and net finance income decreased sharply, net finance income contributed less to our net profit.

In 2019, Huawei continued to increase its investment in research and development, such as in 5G, cloud, artificial intelligence, and smart devices, as well as in its business continuity plan. The company’s R&D expenses as a percentage of revenue increased by 1.2 percentage points year-on-year.

5G core network. Huawei had maintained its global leadership by signing the world’s first commercial 5G SA core network contract in the Middle East; and providing voice services to 2G, 3G, 4G, 5G, and fixed subscribers with Single Voice Core solution to help carriers lay the foundation for 5G voice services. The company has put more than 100 VoLTE networks into commercial use, which serve over 600 million users.

In May 2019, Huawei proposed 5G Deterministic Networking, aiming to help carriers deliver a deterministic networking experience that can be defined, orchestrated, and managed to their customers from different industries.

Huawei partnered with Haier and China Mobile to launch the world’s first AI+5G interconnected factory.

Ken Hu

October 2020. In accordance with Huawei’s Rotating Chairman system, Ken Hu assumed the position of Rotating and Acting Chairman of Huawei from October 1, 2020 to March 31, 2021. During his term, Hu serves in the company’s top leadership position and head the Board of Directors and its Executive Committee.

In the 11th annual Huawei Global Mobile Broadband Forum (MBBF) 2020, held from November 12-13, 2020 in Shanghai, China, Huawei’s Rotating Chairman, Ken Hu, China said that “Now Huawei has over 600K 5G sites deployed across over 300 cities across China. The Chinese operators are now collectively connecting over 160 subscribers on their 5G networks. These statistics represent a massive expansion of 5G network coverage and capacity as well as connection growth in less than a year since the first Chinese operator launched its 5G services.”

Huawei in China is approaching year two since the first commercial 5G deployments. The company is now focusing on accelerating operator value by making deployments easier and faster, and fostering new-breeds of applications that will enable digital transformation across industries.

The company seems to have a holistic mindset and integrated approach toward supporting the telco operator’s digital transformation. Huawei recognizes that as operators transform into digital service providers, they will need to provide more than connectivity in order to deliver the idea of “good” to their customers both consumer and industrial. As Yang Chaobin, President of Huawei Wireless Network Solution, puts it, “To embrace the approaching golden decade of 5G, we need to evolve our networks toward 5G with full spectrum and build on high-bandwidth simplified target networks that ensure ubiquitous connectivity with an on-demand overlay of ‘N’ capabilities.”

This “1+N” perspective is further expounded upon in Chairman Hu’s overview of “5G ToB” which outlines what Huawei considers the life cycle that will foster 5G innovation and benefit across industries. Connectivity is just one of the many capabilities that enterprises will need for their digital transformation. Huawei sees cloud services and development tools and platforms as additional capability layers needed to deliver the industry applications that will express 5G value.

Huawei is uniquely positioned to provide the entire stack of converged IT/CT technologies and solutions as well as the frameworks and tools to help carriers implement their 5G infrastructure and offer cloud-based platforms that enterprises can use to develop new breeds of intelligent industrial applications.

While the deployments and uptake of 5G over the last two years have exceeded expectations, the hype has begun to subside as inflated consumer expectations have hit the wall of reality. Operators in China have struggled to deliver gigabit speeds with any meaningful coverage and quality of service. With a few exceptions such as LG U+, operators have not broadly experienced the highly anticipated 5G ARPU uplift. Whether the industry realizes it or not, 5G is just entering the trough of disillusionment.

As Ryan Ding, President of Huawei’s Carrier BG, stated at 2020 Global Mobile Broadband Forum held on November 12, 2020, “5G will be the major mobile communications technology until 2030 and will likely be in service until 2040.”.

This year’s Huawei MBBF event carried a refreshingly practical tone and a sense of urgency to address the problems that lie along the path to the 5G promise land.

Huawei seems to be taking important steps forward with its customers toward surfacing critical problems and developing industrial solutions that will make 5G the catalyst for industry digital transformation we hope it will be.

David Wang, Huawei’s Executive Director, MBBF at the forum presented what Huawei dubs “5.5G”. He unveiled the 5.5G Hexagram which represents Huawei’s vision for the next stages of 5G’s evolution that focus on industry applications and digital transformation. It builds upon the familiar ITU-T 5G/IMT 2020 usage scenario triangle by introducing three well conceived scenarios:

- Uplink Centric Broadband Communications (UCBC) – Important for HD video uploading, and high-speed transfer of data from endpoint devices at the edge to the cloud data center.

- Harmonized Communications and Sensing (HCS) – Important for precision positioning, V2X (vehicle-to-everything) and contextual computing.

- Real-Time Broadband Communications (RTBC) – Important for immersive media and communications such as XR (extended reality) and holographic applications as well as the fabled remote surgery.

This is important as it represents a mindset shift toward the practical and an evolved lens for perceiving the capability gaps that 3GPP release 17 and beyond will need to address. It is also a simple representation of how the industry needs to extend its thinking about 5G and its relevance to industries. It also highlights the need to consider the new classes of technology challenges that must be addressed over the next few years of 5G’s evolution.

The 5.5G Hexagram feels more enterprise and industry oriented rather than operator oriented. It is a solid attempt at framing new categories of industry-specific requirements for 5G. The new 5.5G usage scenarios seem informed and defined by the real challenges and the deficiencies in the current state of technology that Huawei and its customers have experienced applying cellular technologies across a wide range of industrial use cases.

5.5G gives the impression that 5G will continue to become more complex but outlines an expanded field of possibilities for creating new societal and industry value. It also suggests that new threads of innovation and invention are needed to realize the broadening promise of 5G.

Huawei has not ignored the IoT opportunity that their carrier customers are prospecting after. Chairman Ken Hu articulated Huawei’s distillation of the real, practical needs for industrial scenarios which are:

- Remote control;

- Machine vision;

- Video backhaul; and

- Real-time positioning.

With 5G, operators are well positioned to provide the distributed intelligence that can bring the benefits of autonomous operations across industries.

However, Chairman Hu stated that it behooves the operator to identify the “practical scenarios” to invest in first. He recommended that operators use four criteria to prioritize the 5G IoT opportunities they pursue across vertical markets:

- Technical relevance of 5G: Is 5G the right technology? Will it make a difference and have impact?

- Business potential of 5G enabled solutions: Can you replicate a solution and the business model? Can you scale the solution?

- Value chain maturity: Are devices available and easy to integrate? Is there sufficient openness to garner interoperability?

- Standardization: Are there sufficient industry standards that make it easy to adopt 5G?

According to Chairman Hu, operators need to press their role in providing the end-to-end solutions that their industrial and enterprise customers are looking for to enable their digital transformations. These solutions will transverse the IT, CT and OT domain requiring operators to come to the table with more than connectivity to situate themselves close to where the industry value is realized.

The key metric for 5G has been download speed. It is effectively the sole performance measure by which all networks are judged since 3G. No doubt, 5G is about much more than download speeds but the industry is still fixated on the smartphone and the ability for a consumer to download a 4K movie in seconds to their mobile device.

It turns out that metrics for latency and reliability are not as marketable at the moment though these attributes are arguably as if not more important than download speeds as we look to take 5G to the enterprise and position it as a catalyst and enabler of the next industrial revolution.

In many ways, China is becoming a crucible of 5G innovation. China’s operators have a great opportunity to define what it means to be a digital service provider. It is very evident that Huawei is important partner for the Chinese operator in their journey of reinvention.

As China’s operators set their sights on the nascent enterprise and industrial 5G opportunities, it is apparent that Huawei is looking forward beyond the current state of the technology. In a sense, they are leading the conversation for where 5G will be going next as operators seek new revenue opportunities while carving out a more compelling niche for themselves in a very rapidly changing ICT landscape.

ZTE

ZTE Corporation