Headlines of the Day

Indian telecom companies eye 5G services rollout with better profits

Indian telecom companies (telcos) are set to see a 40 per cent boost in their operating profits next fiscal, which will give them some room to invest in rolling out their 5G services. Operating profit is expected to surge to Rs 1 trillion from Rs 72,000 crore in the next fiscal, on the back of higher tariffs, better ARPU, and the government’s deferred payment option.

The recent 20-25 per cent tariff hikes announced by telcos and ongoing customer upgrades, led by continuous rise in data consumption will improve average revenue per user/month (ARPU) by 20 per cent to Rs 160-165 next fiscal year from Rs 135 in the previous fiscal year. ARPU growth will lead to non-linear growth in profitability due to the sector’s high operating leverage.

Moreover, the four-year moratorium on government dues announced by the Union Cabinet in September 2021 could provide annual cash-flow relief of Rs 32,000 crore to telcos that have opted for it.

Telecom is a capital-intensive sector requiring continuous technological upgradation. Key players had invested Rs Rs 5 lakh crore in 4G services between fiscals 2017 and 2021.

They will now need to make more investments to roll out 5G services. Higher operating profits and cash-flow relief will enable telcos to invest in rolling out 5G mobile services over the medium term.

Even prudent bidding at the 5G spectrum auction– likely next fiscal– would require investment of at least Rs 70,000 crore, assuming telcos will follow a calibrated approach initially and buy 5G spectrum only in metros and category A circles, where data consumption is high.

Besides this, moderate investment towards networks will continue.

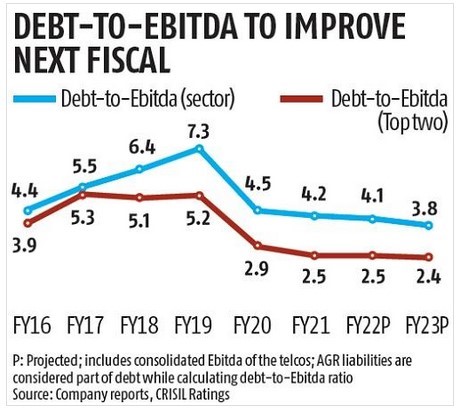

Debt in the telecom sector increased to Rs Rs 4 lakh crore as of March 31, 2021, from Rs Rs 3.3 lakh crore a year ago because of the large unpaid adjusted gross revenue dues. Debt is expected to rise to Rs Rs 4.6 lakh crore this fiscal because of additional liabilities pertaining to spectrum purchased in the March 2021 auction. That said, debt-to-Ebitda ratio should remain largely stable at 4.1 times. The ratio could improve to 3.8 times next fiscal and even fall below 2.5 times for the top two players, aided by full-year benefits of tariff hikes and equity infusion.

Having said that, any intense bidding for spectrum beyond the metros and category A circles, and more-than-expected investment in fiberisation for 5G, could have a bearing on credit profiles. Business Standard News

You must be logged in to post a comment Login